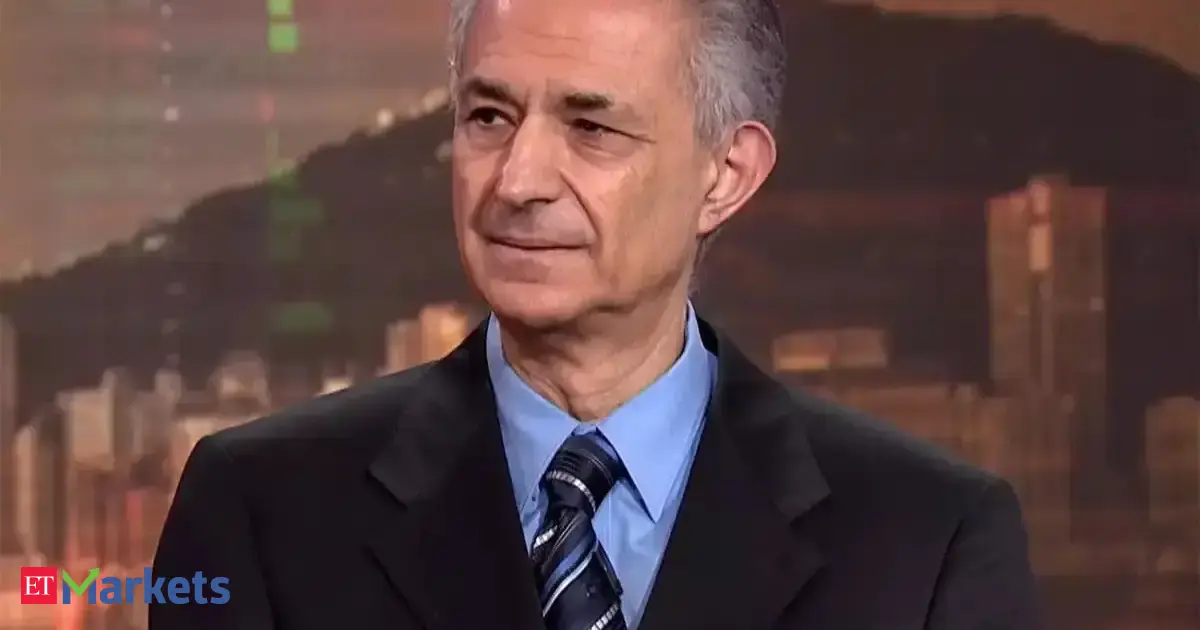

ET Now asked Andrew Freris, CEO, Ecognosis Advisory about the prospects of a trade deal between India and the United States.

Freris responded candidly: “Three things here. First, nothing that Trump ever negotiates is balanced, lasts for more than about five minutes and it is mostly blah, blah and hot air till you actually sit on the table. Remember, as far as we are concerned, India is facing a 50% increase in tariffs overall. The extra 25 coming because of its trade with Russian oil. And although Trump claims that India is trading much less Russian oil than before, I have not heard anything from India saying that this is the case. So, this is totally premature to think that just because Trump said that it is going to be a very good deal for everybody, that is going to be a good deal for India.”

He further noted, “India’s GDP is not dependent on exports and exports to the United States is a very small percentage of overall Indian exports in total and therefore as part of GDP in particular. So, I much prefer to look at what is happening to inflation in India rather than whether a trade deal with Trump is going to be there, is going to last, and is going to have any particularly strong impact. So, I am afraid I look at it with benign indifference.”

Turning to the US, ET Now asked about the impact of a potential end to the government shutdown and possible interest rate cuts on American equities.

Freris remained cautious: “Well, there are several mixed things here. First, there is no guarantee that we are going to have any rate cuts until and when we have two months’ worth of economic data and numbers, particularly labour market, particularly inflation. Also, Trump claims that inflation has been coming down continuously. Inflation has been going up in the last six months. It has been going up both CPI, core CPI and PCE. I really do not know where the man got his numbers. At least I get mine from Bloomberg. So, cuts in interest rates there is absolutely no guarantee until we have numbers and we would not have numbers till the relevant sectors of the government that produce those open up.” He added, “On the contrary, there is great significant doubts whether the deal that has been stricken is going to pass from the Senate to the House of Representatives. There are two separate hurdles to do that. I am not saying that this is not going to happen but to jump that everything is fine, everything is not fine as it is.” Freris also highlighted the performance of US markets relative to global peers: “Look, S&P year to date is 16%. If I was to put half my money on Hong Kong year to date, it would have been 32%. So, it is insane. People are obsessed investing in the States where they can get much higher returns. For example, the Euro Stoxx, the FTSE, the Nikkei, the Hang Seng Index, the CAC, the Shanghai, all of them are in their 20s and over as opposed to the S&P which is a 16. So, if I was to turn to my clients and tell them we would have been making a lot more money if we had not stuck on American, of course, they are going to kill me. And given also that the increases in the S&P are driven totally by a very small number, I understand something like eight are driving something like 40% of the increase. This is completely insane. That is the reason why I am so careful about United States. It is not that I do not like the States.”