Yes, it is. With bank-level encryption, multi-factor authentication, and read-only access to your accounts, Monarch Money ensures your data and finances are secure. This article delves into the safety measures, privacy policies, user reviews, and compliance standards to thoroughly assess Monarch Money’s security.

Key Takeaways

Monarch Money prioritizes user security and privacy with bank-level encryption, multi-factor authentication, and read-only access to accounts.

The app operates on a subscription model, offering a robust ad-free experience for managing finances with features like goal tracking and cash flow forecasting.

User feedback is overwhelmingly positive, praising Monarch Money’s intuitive design and comprehensive budgeting tools, despite minor concerns about pricing and syncing issues.

What Is Monarch Money?

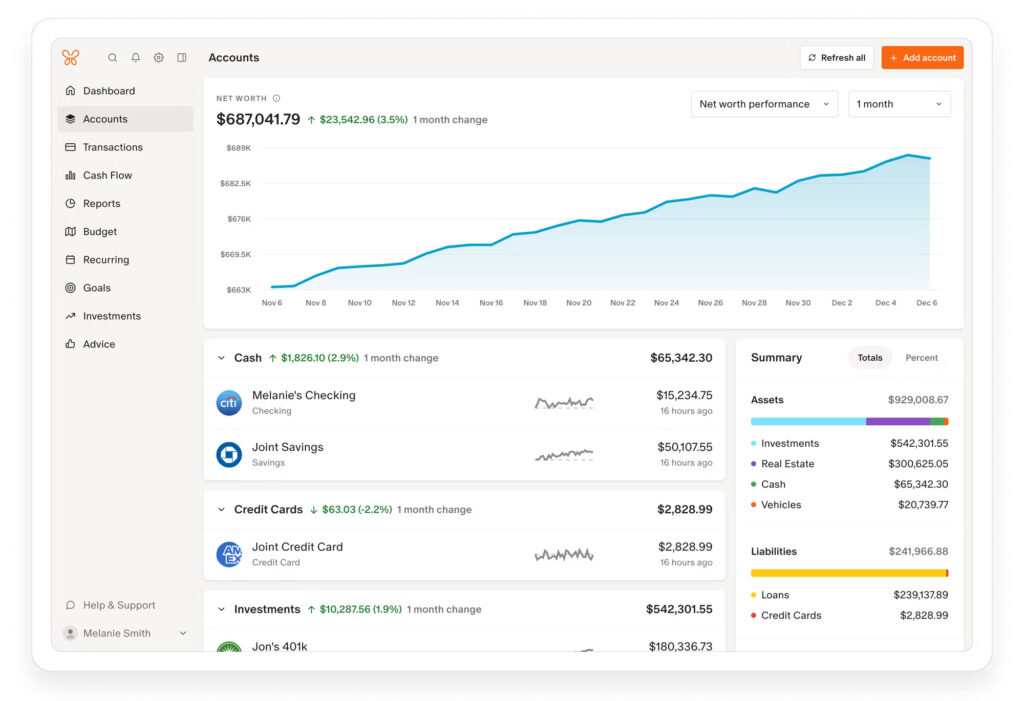

Monarch Money helps users organize, track, and plan their finances in one central dashboard. Founded in 2020 by former Mint and Microsoft employees, Monarch focuses on visual clarity, customization, and collaboration for both individuals and couples. Its intuitive design and robust features make it a contender among the best budgeting apps available today.

The platform offers the following features:

Allows users to connect accounts securely through Plaid’s read-only API, ensuring it can view but never move funds.

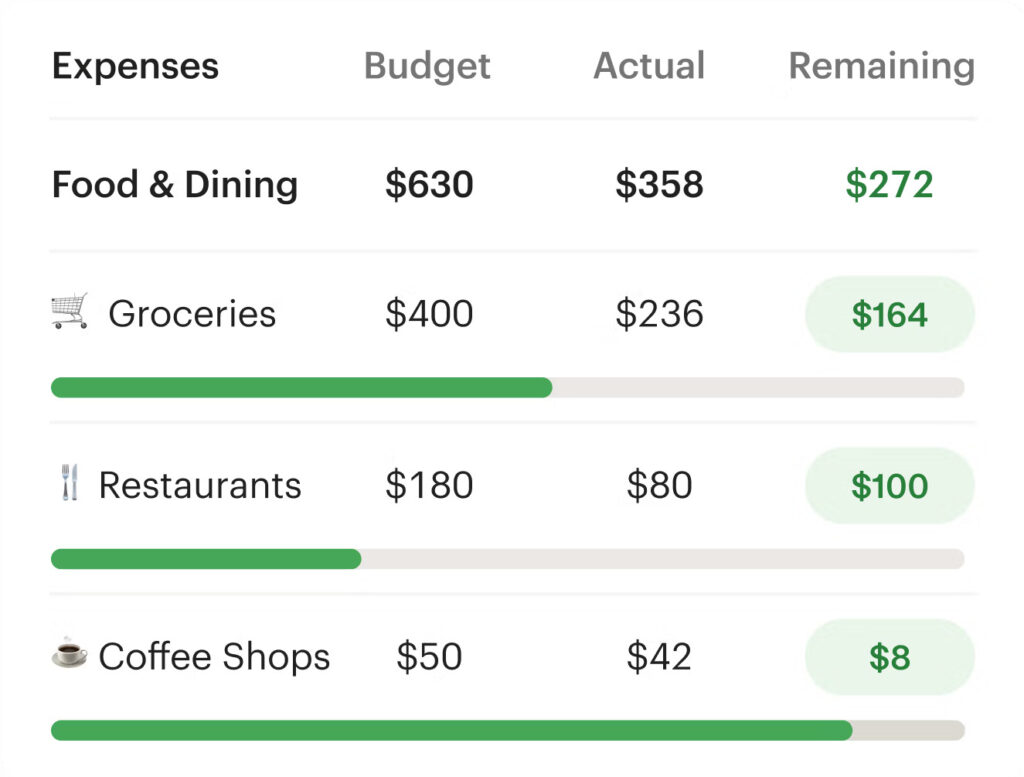

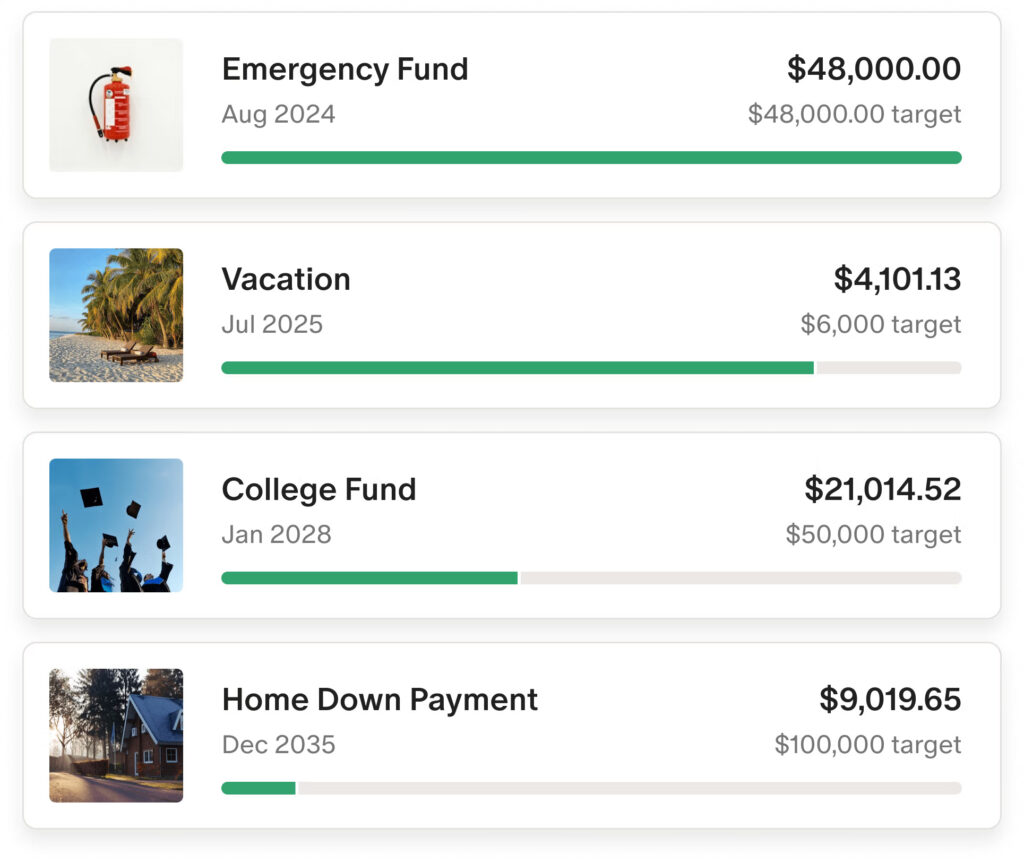

Provides goal tracking, cash flow forecasting, and subscription management tools for recurring transactions, offering actionable insights into one’s financial health.

Offers web and mobile platforms that ensure real-time syncing across devices, prioritizing simplicity and privacy.

Unlike many free apps that rely on advertisements or selling user data, Monarch Money operates on a subscription model. Users pay a monthly or annual fee to ensure a private, ad-free experience. This model underlines Monarch’s commitment to privacy and a seamless user experience. Aimed at families, couples, and professionals, Monarch offers a clean, privacy-focused alternative to apps like Mint, YNAB, and Rocket Money.

To learn more, check out our Monarch Money review.

Ready to see how Monarch can simplify your finances? Start your free trial today — and use code WSS50 to get 50% off your first year of Monarch Money.

Monarch Money’s Security Measures

Security is non-negotiable in finance management. Monarch Money uses bank-level encryption to protect user data from unauthorized access. This level of encryption is similar to what banks use, providing peace of mind to users connecting multiple bank accounts, credit cards, and savings accounts. A money safe with bank level security is a crucial aspect of this protection.

Monarch Money also employs multi-factor authentication and identity access management controls to enhance security. These measures add an extra layer of protection, making unauthorized access difficult. Regular penetration testing identifies and rectifies potential security vulnerabilities on Monarch’s platform.

A standout feature is the read-only access when users link their accounts, meaning Monarch Money can view but not move funds. These security measures make Monarch Money a reliable choice for managing finances securely.

Data Privacy at Monarch Money

Data privacy is a critical concern for users of any financial app. Monarch Money ensures it does not sell user data to third parties. This commitment to privacy is reinforced by their adherence to industry best practices for data protection. Financial information is handled with the utmost care and confidentiality.

Monarch Money maintains individual privacy even when shared features are used. When sharing account information with a partner, it is done through read-only access to ensure sensitive data is not compromised. Data for Monarch Money’s AI tools is not shared publicly or used for training models, safeguarding user privacy.

Monarch Money follows industry best practices to ensure user data remains protected and private at all times. This focus on privacy makes Monarch Money a trustworthy choice for managing your finances and keeping your money safe.

User Reviews on Safety

User reviews provide valuable insight into an app’s safety and functionality. Monarch Money holds impressive ratings across various platforms, with a 4.7 rating on Google Play, 4.8 for iOS, and 4.6 for Android. These high ratings reflect users’ satisfaction with the app’s visual design, functionality, and intuitive layout.

Users consistently praise Monarch Money for its forecasting tools, flexibility, and ability to provide a comprehensive financial overview. However, some common complaints include the app’s price tag and occasional syncing issues, particularly with its investment tracking feature. Despite these minor drawbacks, the overall user sentiment is overwhelmingly positive. In conclusion, these are my final thoughts on the app.

How Monarch Money Compares to Competitors

Monarch Money compares to competitors like Empower, YNAB, and Rocket Money in the following ways:

Offers a middle ground between beginner and advanced budgeting tools.

Provides a more intuitive experience than YNAB’s complex interface.

Delivers an overall snapshot of finances.

Gives custom advice to help users achieve better financial health.

Monarch Money excels in day-to-day financial management compared to Empower by offering:

More robust budgeting features

Detailed charts

Better collaboration options without the hassle of sales calls

Tracking of recurring expenses

Alerts before payment due dates to help users stay on top of their finances

Requiring less work than YNAB, Monarch Money is a more convenient option for users looking for a comprehensive money management platform. By providing a total financial management solution, Monarch Money stands out as a versatile and user-friendly choice.

Take control of your financial data without sacrificing privacy. With bank-level encryption and a commitment to zero data sharing, Monarch Money is built for your security.Use code WSS50 for 50% off your first year and start budgeting safely today.

Monarch Money’s Compliance with Financial Regulations

A legitimate service, Monarch Money has been an established money management app since 2021. The platform emphasizes that it never sells users’ financial data, reinforcing its commitment to user privacy and trust.

Compliance with financial regulations ensures users can rely on Monarch Money for a complete financial overview, knowing their data is handled according to industry standards. Such compliance is crucial for maintaining trust and credibility in the financial sector.

Transparency in Monarch Money’s Practices

Transparency is fundamental to Monarch Money’s practices. By not displaying advertisements, the platform enhances user privacy and ensures a distraction-free experience. Monarch Money collects only the necessary personal data to provide and customize their services, maintaining a high level of transparency.

Customer service is available through email or request submission via app settings or the help center, though there is no phone line for direct support. Paying options include a monthly or annual fee, ensuring users have access to a private, ad-free experience with a free trial and no hidden costs.

Monarch Money does not recommend or sell products to users, focusing solely on providing a reliable financial management tool. This approach underscores Monarch Money’s dedication to user privacy and trust.

Real-Life Experience Using Monarch Money

After using Monarch Money for two years, I confidently say it’s the best budgeting software I’ve experienced. The initial setup was quick and user-friendly, offering immediate insights into my finances. Its robust features automate budgeting processes and track spending effectively across various categories.

A standout feature is the ability to collaborate on managing shared finances and financial goals. Whether it’s shared goal tracking or detailed reports, Monarch Money makes it easy to stay on the same page with your partner. The clean, ad-free experience further enhances overall satisfaction.

Monarch Money offers a detailed view of investments alongside budgeting, which I find particularly beneficial. Managing multiple bank accounts and credit cards has never been easier, aligning my finances efficiently. Overall, my experience with Monarch Money has been highly positive, reaffirming its value as a comprehensive financial management tool. I also use monarch money to enhance my financial planning. The monarch money cost is justified by the features it provides, highlighting the monarch money pros. This monarch money review showcases its effectiveness in managing finances.

Is Monarch Money Worth Your Trust?

Trust is crucial for managing financial health with a budgeting app. Monarch Money does not provide professional advice and disclaims liability for actions taken based on its information. Users appreciate the sleek design and comprehensive budgeting tool, which effectively manage finances. The best budgeting app helps users stay on top of their budget. Additionally, budget apps can enhance the overall budgeting experience.

User data utilized for AI functionalities is protected and not shared publicly, emphasizing Monarch Money’s commitment to privacy. This dedication to safeguarding user data, combined with robust budgeting tools, makes Monarch Money a trustworthy choice for users.

Monarch Money’s focus on security, privacy, and user experience positions it as a reliable and effective financial management tool. Its comprehensive features and commitment to user trust make it valuable for anyone looking to take control of their finances.

Monarch Money makes secure, private budgeting simple. Join thousands who’ve made the switch — and save 50% on your first year with code WSS50 at checkout!

Summary

Monarch Money stands out in the crowded field of budgeting apps with its robust security measures, commitment to data privacy, and user-friendly features. Users consistently praise its intuitive design and comprehensive financial management tools, which make it a reliable choice for managing money.

In summary, Monarch Money is a trustworthy financial management tool that prioritizes user privacy and security. For those looking to take control of their finances, Monarch Money offers a secure, ad-free, and comprehensive solution. Dive in and experience the peace of mind that comes with a well-managed financial life.

Frequently Asked Questions

Monarch Money does not sell your financial data. They prioritize your privacy and maintain a read-only platform that ensures your information is secure.

Monarch Money is not FDIC insured because it is not a bank; it functions as a financial aggregator. It’s important to keep this in mind when managing your finances with this platform.

Monarch Money cannot access or transfer your money; it only offers read-only access to your accounts. This means it can view your financial information but cannot move any funds.

Monarch Money is owned by its founders, who are former employees of Mint and Microsoft, having established the company in 2020.

Monarch Money provides a balanced and user-friendly financial management solution, making it a strong alternative to both Mint and YNAB. Its comprehensive features cater to a wider range of financial needs.

Top U.S. Brokers of 2025

★ ★ ★ ★ ★

★ ★ ★ ★ ★Features:

✅ U.S. stocks, ETFs, options, and cryptos✅ Now 23 million users✅ Cash mgt account and credit card

Sign-up Bonus:

Free stock up to $200 with new account, plus up to $1,500 more in free stock from referrals

Get Free Stock

★ ★ ★ ★ ★

★ ★ ★ ★ ★Features:

✅ Free Level 2 Nasdaq quotes✅ Access to U.S. and Hong Kong markets✅ Educational tools

Sign-up Bonus:

Deposit $100, get $20 in NVDA stock; Deposit $2,000, get $50 in NVDA stock; Deposit $10,000, get $300 in NVDA stock; Deposit $50,000, get $1,000 in NVDA stock

Get Free Shares

★ ★ ★ ★ ☆

★ ★ ★ ★ ☆Features:

✅ Access 150+ global stock exchanges✅ IBKR Lite & Pro tiers for all✅ SmartRouting™ and deep analytics

View Full List

★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆