When Meta Platforms, Inc. (NASDAQ: META) reports its third-quarter results, investors will be looking for updates on the trajectory of the social media behemoth’s AI-focused growth strategy. The company has delivered an impressive performance in the first half, capitalizing on continued momentum in ad monetization and solid platform engagement.

Bullish View

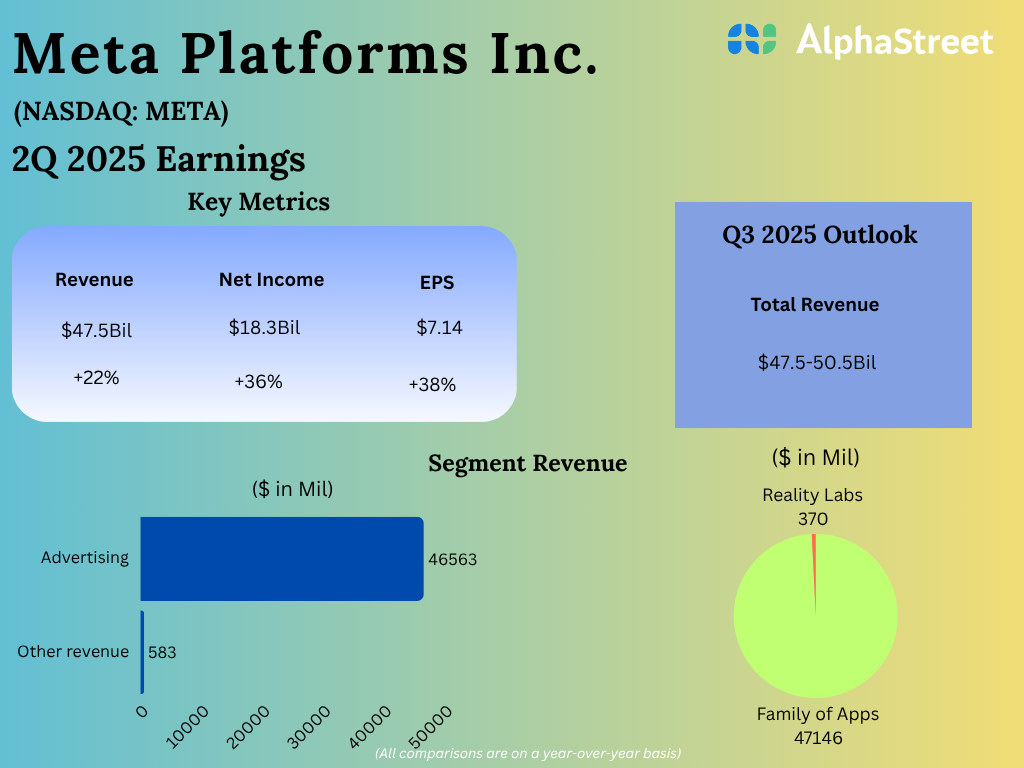

As the third-quarter report approaches, market watchers remain bullish on the tech giant’s financial performance – the consensus revenue estimate is $49.39 billion, representing a 22% year-over-year growth. Analysts see the positive topline performance translating into an 11% increase in Q3 earnings to $6.72 per share. The report is slated for release on Wednesday, October 29, at 4:05 pm ET. Notably, Meta’s quarterly revenue and profit have regularly beaten estimates for nearly three years.

A few weeks ago, the Meta leadership said it expects third-quarter revenue to be in the range of $47.5 billion to $50.5 billion. The guidance assumes foreign currency tailwinds of around 1% to revenue growth. For the fourth quarter, it expects the revenue growth rate to be slower than in the third quarter.

In early August, Meta shares reached a new high of $789.47, after growing steadily for over four months. Since then, the stock stabilized and has traded mostly sideways. If analysts’ upbeat outlook is any indication, META has room for more gains, with the potential to grow by a fifth in the next 12 months.

Strong Engagement

In the June quarter, revenue jumped 22% from the prior-year period to $47.52 billion. As a result, Q2 net income increased 36% to $18.3 billion, and earnings per share rose 38% to $7.14, compared to last year. Both revenues and earnings topped Wall Street’s expectations. Family daily active people, which refers to the average number of unique users who engage with the company’s family of apps on a given day, was 3.48 billion, up 6% from last year.

“While we’re still very early in planning for next year, there are a few factors we expect will provide meaningful upward pressure on our 2026 total expense growth rate. The largest single driver of growth will be infrastructure costs, driven by a sharp acceleration in depreciation expense growth and higher operating costs as we continue to scale up our infrastructure fleet. Aside from infrastructure, we expect the second largest driver of growth to be employee compensation as we add technical talent in priority areas and recognize a full year of compensation expenses for employees hired throughout 2025.” Meta’s CFO, Susan Li, said in the Q2 earnings call.

Updates

While making heavy investments in its AI efforts, Meta is reportedly planning layoffs in that division, raising concerns about the sustainability of its AI strategy. This week, the company entered into a joint venture partnership with funds managed by asset management firm Blue Owl. As per the agreement, they will develop and own the Hyperion data center campus, with Meta providing construction management and property management services for the project.

The average price of Meta’s stock for the past twelve months is $658.98. The stock, which has grown around 26% since the beginning of 2025, traded slightly higher on Friday afternoon.

The post Meta Platforms to report Q3 earnings on October 29. Here’s what to expect first appeared on AlphaStreet.