Amish people and communities are unique in many ways. To most outsiders, they’re known mostly as soft-spoken people who live a simple life, don’t use electricity, and don’t drive cars. They’ve also had just enough bad press to make some people wary. No matter what your opinion of their beliefs, the traditional Amish community and lifestyle offers some financial advantages that anyone might consider adopting.

Obviously, some adjustments involve sacrifices and commitments that not everyone is going to want to make, but the principles can still help you find ways to save. Here are some lessons we can learn from this community.

1. Sometimes “Need” Really Means “Want”

Most people cultivate a sense of need for things they could live without. Since most aren’t driven by a culture that abhors amenities, it can take a financial crisis to help a person realize what he or she can give up. How many times have you said, or heard something like, “a person has to have some comforts.” to justify a second television, a luxury car, or something similar? If saving money is your goal, take a look around and figure out what the real necessities are.

2. Simple is Good

In many ways, the things we spend extra money on either complicate our lives or end up costing more in the long run. A self-propelled lawnmower doesn’t cut grass any better; it’s just easier and has more moving parts to replace. A brisk hike in the fresh air is just as effective as that 30-minute stroll on an expensive treadmill, and you’ll enjoy it more. Manual hedge clippers are half as expensive as electric, less noisy and give your arms some exercise.

3. Grow Your Own

I know, not everyone can raise livestock or big crops, but most of us can grow a few vegetables or herbs, even if they’re of the miniature, indoor variety. You’ll save some money and get better tasting, healthier produce, too. In fact, according to the Mayo Clinic, being an active gardener improves your physical fitness, diet, mental health and lowers your stress level. You can find that article here.

4. Many Hands Make Light Work – and Less Expense

When big projects arise in an Amish community, family and neighbors pitch in to get it done. Granted, if you live in the city, a barn raising is pretty much out of the question, but that doesn’t mean that family and friends can’t pitch in to mend that back fence or build a deck. Building codes in most cities will allow a homeowner to make home improvements and “employ” someone to help. You’ll need a permit for most work, and there will be inspections, but if you can’t afford a contractor, some free meals and maybe a case of beer might go a long way toward paying your friends.

5. Craftsmanship Isn’t About Expensive Tools

The reputation of Amish woodworkers is based on attention to detail, patience and secrets handed down through generations. Many of their tools are hand-made. You’re probably wondering what that has to do with saving money. It’s simple. Photographers can create awesome images without the top-of-the-line DSLR. Web developers can create great sites without owning the latest computer or software. Whatever you do, don’t get caught up in needing the biggest and best. Be the master of the tools you own and save some money.

6. Take Care of Your Tools

Keeping the tools of your trade longer doesn’t mean letting them fall apart. Any skilled craftsman knows that without proper maintenance, tools fail. Keeping your equipment in shape means it will perform better, longer. Having to replace them because of premature failure isn’t cost-effective.

7. Quality is Worth the Investment

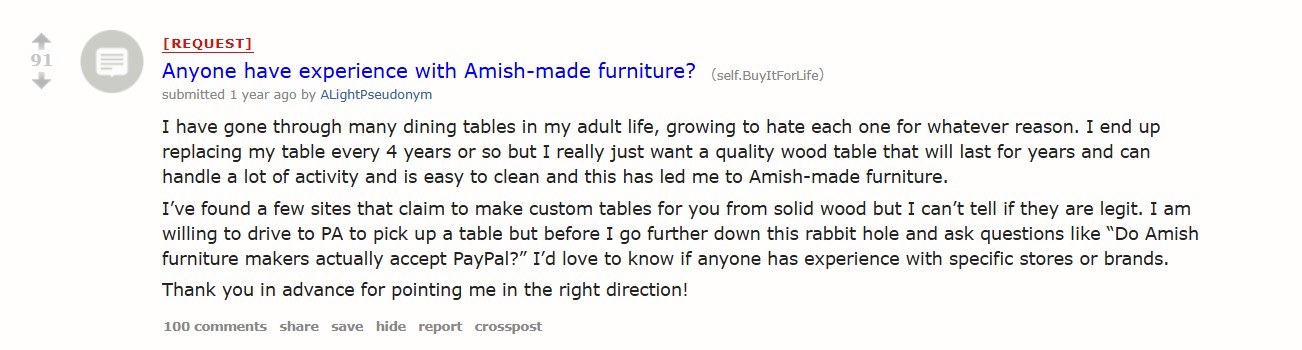

One of the reasons Amish furniture is in such high demand is that it lasts. Because of the meticulous construction methods and hand-selected materials, many Amish pieces become heirlooms. Sometimes saving money means paying a little more for something that you’re not going to be throwing away soon. Naturally, this applies to much more than furniture.

For example, Reddit user ALightPseudonym posted on the r/BuyItForLife subreddit:

8. Make the Most of Resources

To an Amish farmer, a cow is a source of dairy products and fertilizer. A grove of trees can provide building materials, but needs to be managed well, because it also produces game for the dinner table, as well as other natural foods. Crops are rotated carefully to optimize soil condition and help control crop disease. Careful resource management helps Amish communities sustain themselves with little help from the outside. We can all save money by learning to manage, recycle and repurpose what we have.

9. Get the Most Out of What You Have

Those horse-drawn prams the Amish are so well known for are also handed down, and repaired or reconditioned many times over. So it is with their other possessions. The basic principle is that if something serves its purpose, it doesn’t need to be replaced. Imagine how much money you can save by keeping your car a few years after it’s paid off. How about refinishing the dining table instead of replacing it? Make what you own last a little longer and you’ll save.

10. Gifts Don’t Have to Break the Bank

Traditional Amish gifts for birthdays, etc. are simple, practical items and usually singular. A tool or an item of clothing is typical. While there’s no need to adjust your gift giving quite that radically, it wouldn’t hurt to consider buying one very thoughtful gift instead of a dozen expensive ones.

The Amish Are In Fact, Often Wealthy

The Amish are often quite successful in business, but since their expenses are very low, they’re often able to accumulate significant wealth (BI.com). A 2010 report by the Houston Chronicle also suggests that Amish businesses often have low debt levels and treat wealth as a means to an end, rather than an end in and of itself (chron.com). So, their frugal and religious oriented lifestyle has brought results to the Amish community. They’re well worth a look.

When it comes to surviving hard times, the Amish have sustained their culture and communities in North America for centuries, while relying mostly on themselves. What better example for those of us trying to provide for ourselves and our families in today’s economy?

(Photo courtesy of puliarf)

What lessons do you think we can learn from the Amish community? Share with us in the comments below.

You Might Also Enjoy…

Reasons to be Frugal Besides Saving Money

Stop Hoarding These Ten Items And Let Them Go Already

17 Bills Worth More Than Face Value In Your Wallet

Strange, But True Stuff Worth More Than You Can Imagine