Shares of The Campbell’s Company (NASDAQ: CPB) were up 6% on Wednesday, after the company reported its earnings results for the fourth quarter of 2025. The results were mixed, as earnings beat expectations while revenue fell short. The soup giant anticipates a dynamic operating environment in fiscal year 2026.

Mixed results

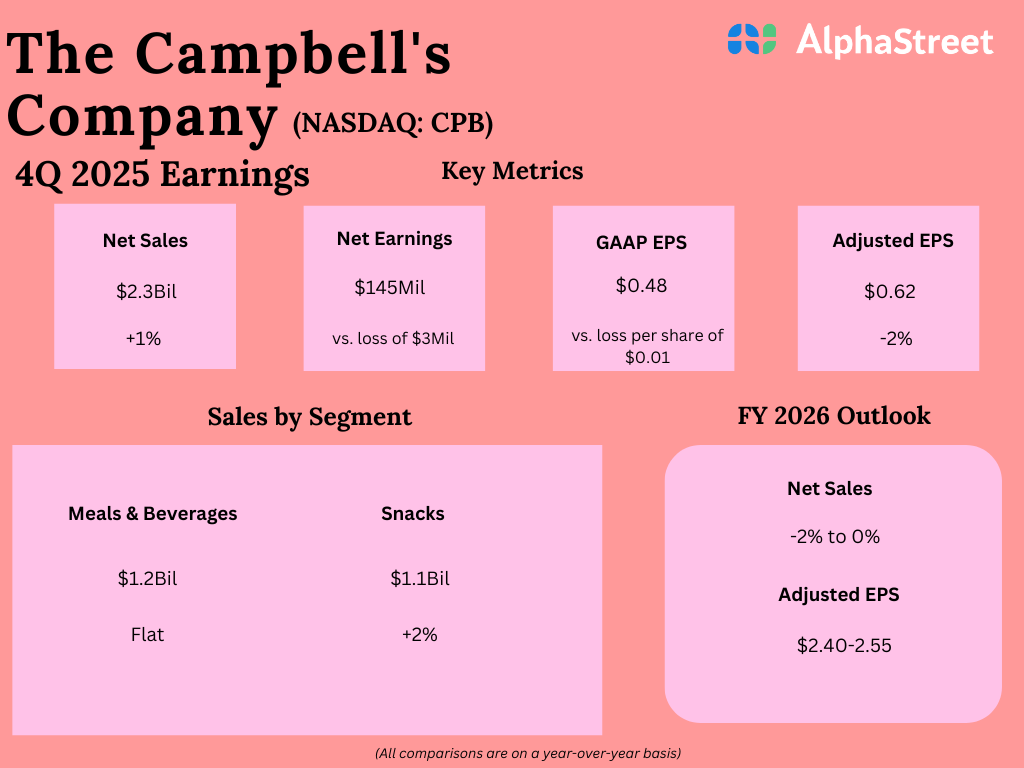

Campbell’s net sales inched up 1% year-over-year to $2.32 billion in Q4 2025, narrowly missing estimates of $2.33 billion. Organic sales, which exclude impacts from the additional week in the quarter and divestitures, was down 3%. Earnings per share, on an adjusted basis, fell 2% to $0.62 but surpassed projections of $0.57.

Business performance

Campbell’s has seen consumers remain budget-conscious and seek value, and also stay health-conscious. They prefer to cook at home and look for healthy options, a trend that is benefiting the Meals & Beverages segment. At the same time, they remain intentional in their spending, which has led to softness in the Snacks segment.

In Q4, sales in the Meals & Beverages division remained flat compared to the year-ago period. Organic sales fell 3%, driven by declines in Rao’s pasta sauces and US soup. This segment benefited from growth in broth and condensed cooking soups. The Ready-to-Serve portfolio benefited from gains in the Chunky, Pacific and Rao’s brands.

Sales in the Snacks segment increased 2% in Q4. Organic sales, which exclude the additional week and the impact of the Pop Secret divestiture, decreased 2%. Snacking categories remained pressured in the fourth quarter but the company saw gains in brands like Kettle, Late July and Goldfish.

Outlook

Looking ahead to fiscal year 2026, Campbell’s expects to benefit from the ongoing trend of consumers focusing on health and wellness and cooking at home. However, input cost pressures, caused by a dynamic operating environment, in particular tariffs, are expected to weigh on its profits.

The company expects net sales for FY2026 to be down 2% to flat versus FY2025. Organic net sales are expected to be down 1% to up 1%, reflecting continued momentum in Meals & Beverages and stabilization in Snacks in the second half of the year at the midpoint of the range. Adjusted EPS is expected to range between $2.40-2.55, representing a decline of 18% to 12% versus the previous year.