Did you file a tax extension with another tax provider but now want to finish filing your tax return with TaxAct®? Good news — you’re not locked in! TaxAct makes it easy to switch, so you can confidently tackle your income tax return and (more importantly) avoid any last-minute tax deadline stress.

Let’s clear up the confusion about switching providers after filing a tax extension, walk through what you need to do, and help you cross the filing finish line before this year’s Oct. 15 due date.

Can I file my tax return with a different company than the one I used to file my extension?

Yes! If you used a different company (or even irs.gov) to submit your application for automatic extension of time to file, you can absolutely still use TaxAct to e-file your final federal tax return or business tax return. You aren’t required to finish your tax filing with the same provider that filed your federal extension form.

Whether you filed Form 4868 (for individuals) or Form 7004 (for businesses), the Internal Revenue Service (IRS) doesn’t require you to use the same software for both your extension and your final return. The only thing that matters is that you submit your completed tax forms and any tax payment owed before the filing deadline. This year, that’s Oct. 15, 2025.

Will the new provider know I filed an extension?

Not automatically, but that’s okay. The IRS keeps track of all filing extensions tied to your tax identification number (like your SSN or EIN), so the agency will know you’ve requested an extension.

When you file taxes with TaxAct, we will prompt you to provide us with the amount of estimated tax you may have paid when submitting your extension request (found on your Form 4868). This way, you’ll get a credit for the amount you already paid.

When are taxes due with extensions?

For most filers, the due date of the return after requesting a federal extension is Oct. 15. If Oct. 15 falls on a weekend or holiday, the next business day becomes the filing deadline.

If your area was affected by a natural disaster, you might have a different extended filing deadline. Check out our list of extended tax deadlines due to natural disasters.

What do you need to file your return with TaxAct?

Completing the filing process with us is easy, but you’ll want to have these on hand just in case:

A copy of your extension form (Form 4868)

Any confirmation from your previous provider or irs.gov acknowledging your extension request

Records of any tax payment made with your extension of time (also found on Form 4868)

All your usual tax documents for the tax year (like W-2s, 1099s, receipts, etc.)

Your taxpayer identification number (SSN or ITIN)

Try using our tax preparation checklist to make sure you have everything you need. If you’re a small business or self-employed, remember to gather all your business income tax records too.

How to finish your tax return in TaxAct after filing an extension elsewhere

Ready to wrap up your taxes? Here’s what you need to do:

Sign in or create a TaxAct account.

Start a new tax return for the current tax year and proceed through the Q&A process.

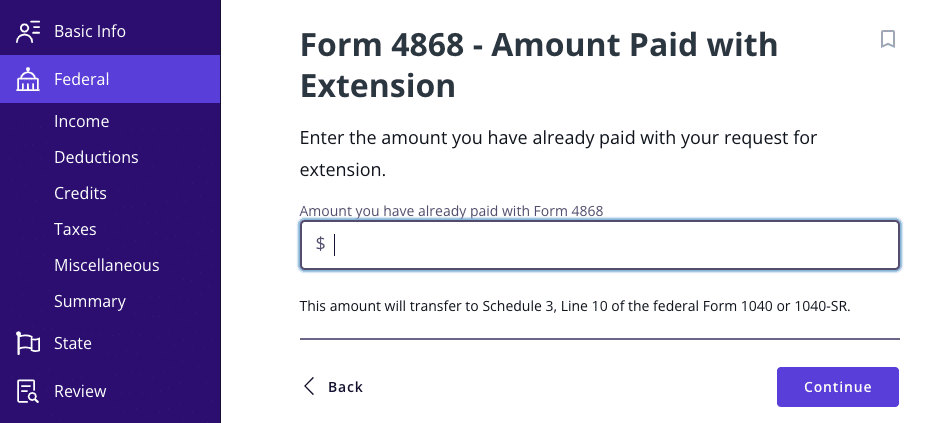

To indicate you previously filed an extension request, you will need to enter the amount of tax you paid when you requested an extension. You can easily review this by clicking Federal, then selecting Credits, followed by Amount paid with extension, as shown below.

You can then enter the amount you have already paid, as shown below. This will ensure you get a tax credit for that amount. (If you didn’t pay anything when you requested an extension, just enter 0).

Continue with the interview process to complete your income tax return as usual.

Review your return, pay any remaining tax liability, or set up a payment plan for unpaid tax if needed.

E-file your return or print and mail a paper form (but e-filing is faster!).

Keep a copy of your filed return and confirmation for your records.

FAQs

The bottom line

You don’t have to stick with the company you originally used to file your tax extension — TaxAct can help you finish your tax return easily and on time. Just make sure you file by the extended due date and tell us how much tax you already paid, and we’ll handle the rest. Our tax software is ready when you are.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.