Identifying these companies early in their journey requires vision and patience, as their paths are often marked by volatility.

Here are three buy-and-hold disruptive tech stocks that are transforming their sectors and are worth considering for long-term portfolios.

Looking for actionable trade ideas? Subscribe now to unlock access to InvestingPro’s AI-selected stock winners for up 50% off!

In the rapidly evolving landscape of technology, certain companies stand out for their disruptive capabilities and potential for long-term growth. SoFi Technologies (NASDAQ:), Reddit (NYSE:), and Upstart Holdings (NASDAQ:) exemplify such pioneers, each transforming their respective sectors with innovative solutions.

These companies not only promise substantial growth opportunities but also represent compelling buy-and-hold options for investors focusing on the future of technology.

Below, we explore how each is transforming its industry and why they make compelling long-term investments.

1. SoFi Technologies: The Future of Banking

Year-To-Date Performance: +69.1%

Market Cap: $30.8 Billion

SoFi is a fintech disruptor, challenging traditional banks by offering a one-stop platform for student loan refinancing, personal loans, mortgages, investing, and banking services. Founded in 2011, the company is well-positioned to capture market share in the $13 trillion U.S. financial services industry, making it a compelling long-term investment.

As of mid-2025, SoFi reports over 10 million members, with accelerating revenue from its diversified segments, including a growing lending portfolio and technology platform services for other institutions.

Analysts project sustained membership growth and profitability improvements, with the company achieving its first full-year profit in 2024. Despite market volatility, SoFi’s focus on underserved markets—like gig economy workers and young professionals—positions it for compounding returns. With a forward P/E ratio that’s reasonable for a high-growth fintech, SOFI is ideal for investors seeking exposure to the U.S. banking disruption without the legacy baggage of incumbents.

Source: InvestingPro

SoFi comes in with a mid-pack 2.77 health score and a ‘GOOD’ performance grade, signaling solid fundamentals but also some caution due to recent profitability pressures. Analysts set SoFi’s mean price target at $20.78, with a high of $30.00. The current price, $26.01, is above the mean, indicating that much of the near-term optimism may already be priced in, but long-term growth prospects still attract bullish calls.

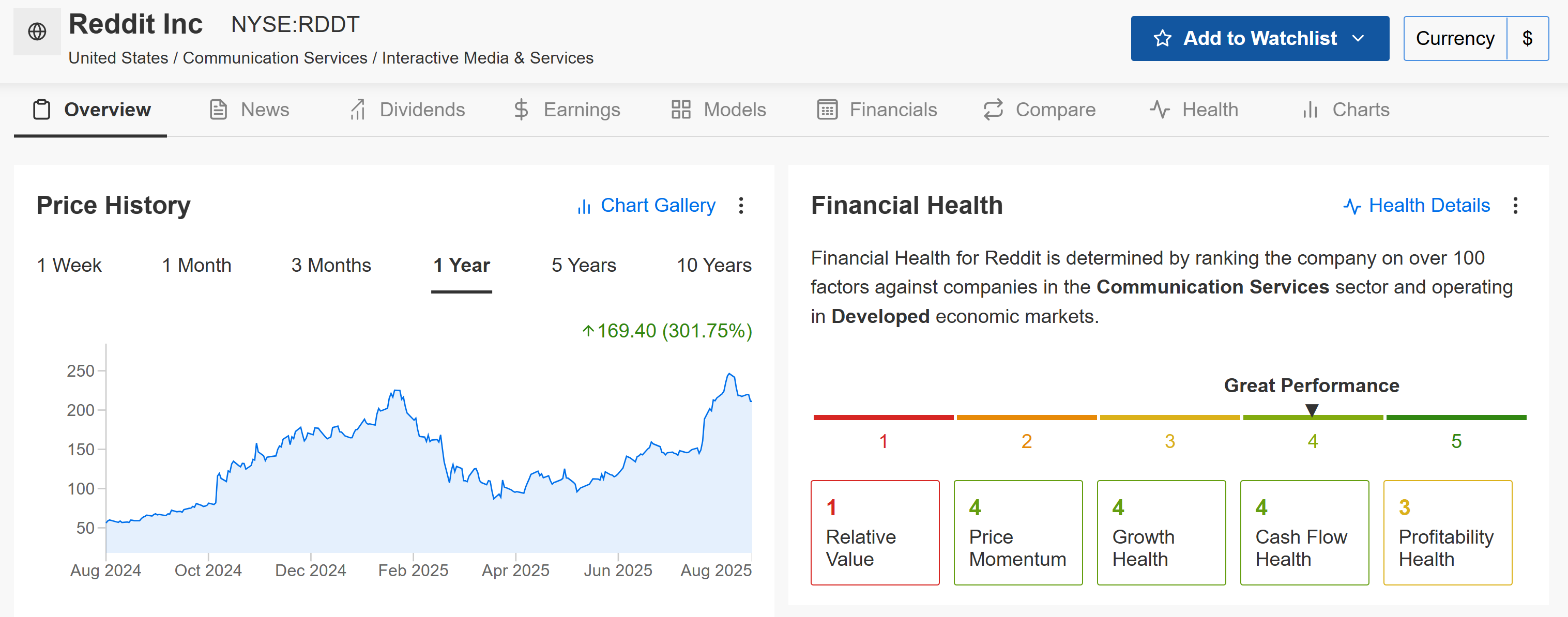

2. Reddit: The Data Goldmine of the AI Era

Year-To-Date Performance: +38%

Market Cap: $42.2 Billion

Reddit, often called the “front page of the internet,” is a unique social media platform where users create and engage in communities (subreddits) around shared interests. This model challenges giants like Meta and TikTok by emphasizing organic conversations, anonymity, and community moderation, fostering deeper engagement and trust.

However, its most significant disruption is just beginning to unfold: monetizing its vast, 19-year archive of human-to-human conversation as a training ground for AI models. Its recent data licensing deals, including a reported $60 million annual contract with Google, are just the tip of the iceberg. This creates a new, high-margin revenue stream that is largely untapped by its social media peers.

Beyond AI, Reddit’s advertising platform is still in its early innings and has significant room for growth as it improves its targeting and ad formats. With over 500 million monthly active users and untapped monetization potential, Reddit– which went public in March 2024– is poised to become a major player in social media and digital advertising.

Source: InvestingPro

Reddit stands out with a robust 3.10 score and a ‘GREAT’ performance, reflecting analysts’ recognition of its strong balance sheet and operational resilience. The consensus mean price target for Reddit stands at $197.31, with a high estimate of $235.00 and a low of $110.00—showing a wide but bullish range as the stock currently trades at $223.13.

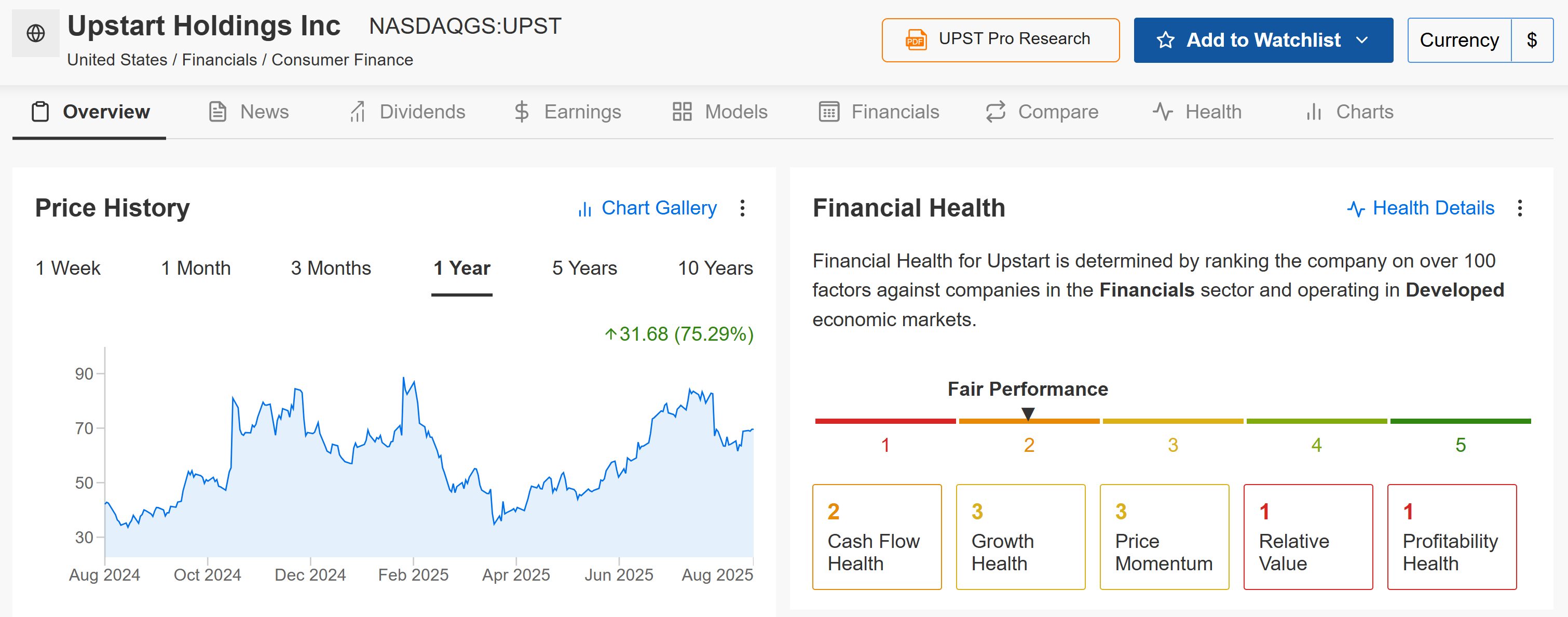

3. Upstart: Disrupting Credit with AI

Year-To-Date Performance: +19.8%

Market Cap: $7.1 Billion

Upstart is an AI-driven lending platform that uses machine learning to assess credit risk, enabling lenders to approve more borrowers at lower rates. This approach challenges legacy credit bureaus like FICO, which rely on outdated metrics that exclude millions from fair lending opportunities.

Its disruption is quantified by superior performance: Upstart reports loan approval rates 27% higher than traditional models, with 75% lower losses during economic stress. With a scalable platform that can expand globally, UPST’s valuation offers an attractive entry point for long-term growth, potentially delivering multibagger returns as AI adoption permeates banking.

Founded in 2012, the company is now expanding beyond personal loans into auto loans, small business loans, and even mortgages, addressing a massive market opportunity.

Source: InvestingPro

Upstart’s Financial Health score comes in at 1.97 with a ‘FAIR’ performance grade, highlighting the risks that come with high-growth, high-volatility fintech disruptors. Yet, the analyst mean target is $80.85 (high: $105.00), and with shares at $73.27, the Street sees significant upside potential for those willing to weather the volatility.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now and save up to 50% on all Pro plans and instantly unlock access to several market-beating features, including:

AI-managed stock market strategies re-evaluated monthly

10 years of historical financial data for thousands of global stocks

A database of investor, billionaire, and hedge fund positions

And many other tools that help tens of thousands of investors outperform the market every day!

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.