Advance Auto Parts, Inc. (NYSE: AAP) on Thursday announced financial results for the second quarter of fiscal 2025, reporting a decline in sales and earnings.

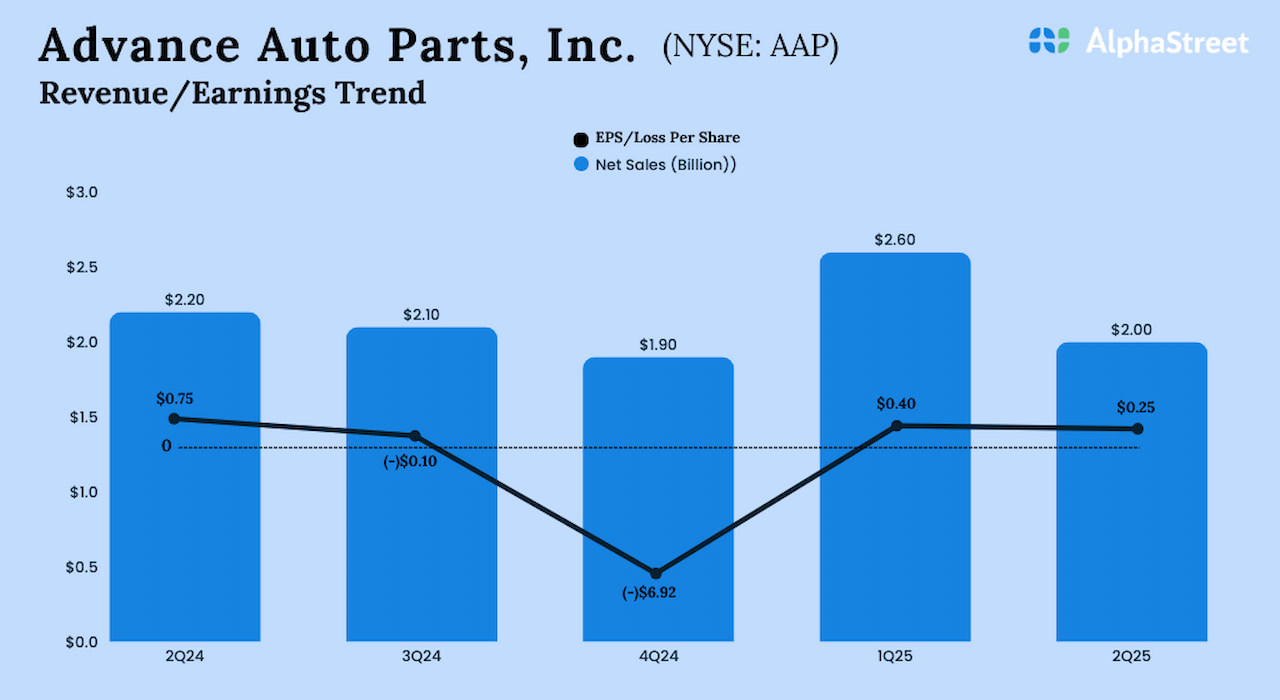

Net sales were $2.01 billion in the second quarter, compared to $2.18 billion in the prior-year period. Comparable store sales edged up 0.1% during the quarter.

Net income decreased to $15 million or $0.25 per share in the July quarter from $45 million or $0.75 per share in the corresponding quarter of fiscal 2024. Second-quarter gross profit was $0.9 billion, or 43.5% of net sales, compared to $1.0 billion, or 43.6% last year.

For fiscal 2025, the management expects net sales from continuing operations to be in the range of $8.4 billion to $8.6 billion and comparable store sales growth to be between 0.5% and 1.5%. Full-year adjusted EPS from continuing operations is expected to be $1.20-2.20.

“Our strategic plan is designed to establish a strong foundation for consistently delivering exceptional customer service, and I am pleased with the progress being made by the team. Q2 also marked an important milestone with Advance returning to profitability,” said Shane O’Kelly, the company’s chief executive officer.