In an interview with Scott Melker on August 3, veteran macro analyst Jim Bianco leveled a stark critique of Bitcoin’s trajectory, arguing that the asset has been “co-opted” by the very institutions it was created to resist. According to Bianco, Wall Street’s embrace of Bitcoin through vehicles like ETFs and corporate treasuries has shifted the network’s purpose from disruptive innovation to speculative asset chasing.

Has Wall Street Co-Opted Bitcoin?

“Bitcoin is amazing,” Melker said, reflecting on his own controversial tweet that sparked backlash from Bitcoin maximalists. “But it’s obviously been co-opted to some degree by the very people that it was created to [hedge] against. Many of the most ardent early whales have seen their faith shaken and have been selling at these prices.” Bianco responded without hesitation: “Yeah, it does,” aligning himself with the view that Bitcoin’s original ethos has been undermined.

“I have been a big fan of these products as a disruptive force for the financial market,” Bianco said, referring to early crypto projects. “The financial market and the banking system is in desperate need of change and disruption. And I saw these [crypto assets] as vehicles that could do that.” But that vision, he argues, has been eclipsed by FOMO and “number go up” culture driven by ETFs, institutional endorsements, and speculative hype cycles.

The institutionalization of Bitcoin—via BlackRock’s ETF, corporate treasuries like MicroStrategy, and the wider TradFi pivot into digital assets—has created what Bianco calls a “disincentive to innovation.” Rather than pushing for payment infrastructure reform or financial sovereignty, the focus has become price action. “I’m just here for number go up,” he said mockingly, summing up the prevailing mindset. “I’m not here to understand where this will fit in, how this will make us a better financial system.”

Bianco contrasted Bitcoin’s current role with Ethereum’s evolving utility, expressing a preference for platforms that aim to “become a new version of a financial system.” While acknowledging that this view may provoke Bitcoin maximalists, Bianco emphasized Ethereum’s potential to enable structural reform—despite being heavily influenced in recent months by regulatory tailwinds like the Genius Act and figures such as Tom Lee.

Still, his criticism extended beyond Bitcoin. He argued that the broader crypto space is repeating past mistakes, especially in regard to stablecoins. “This whole conversation we’re having about stablecoins sounds a lot like the exact conversation we were having in 2021,” he said, cautioning that overhyped narratives often ignore the technological and regulatory challenges still unresolved.

And Solana?

He expressed particular concern that stablecoin infrastructure is veering toward centralization, with projects like JPMorgan Coin and potential Fed-backed instruments masquerading as stablecoins. “That’s a CBDC,” Bianco said bluntly, warning that this trend could gut the decentralized promise of crypto. “There will not be an investable opportunity there for the average person.”

According to Bianco, even Solana—once touted as an institutional-grade blockchain—has strayed from its mission. “It had the promise of being that competitor to JP Morgan and the Federal Reserve,” he said. “And it kind of got lost in this memecoin mania.” He noted that Solana’s price action now appears to be “the metric of memecoins,” and that its identity has been eclipsed by speculative euphoria—an observation reinforced by the network hosting over 10 million memecoins, many of which never trade.

Ultimately, Bianco’s critique centered on the disconnection between crypto’s stated goals and its market behavior. “The Maxis’ argument that everything’s going to zero and you have to have your money in Bitcoin is demonstrably wrong because everything’s at an all-time high right now,” he said. Bitcoin, in his view, now behaves like “a levered risk asset,” moving in tandem with equity markets rather than serving as a true hedge or alternative.

For Bianco, the signal of peak complacency is clear. “This is some of the best investing I’ve ever seen—right up until the moment you’re killed,” he said, likening the market’s current posture to the infamous Top Gun quote. In an environment of frothy valuations, political rate-cut pressure, and inflationary fiscal dominance, the original vision of Bitcoin as an antidote to centralized monetary abuse, he suggests, may be slipping further from reach.

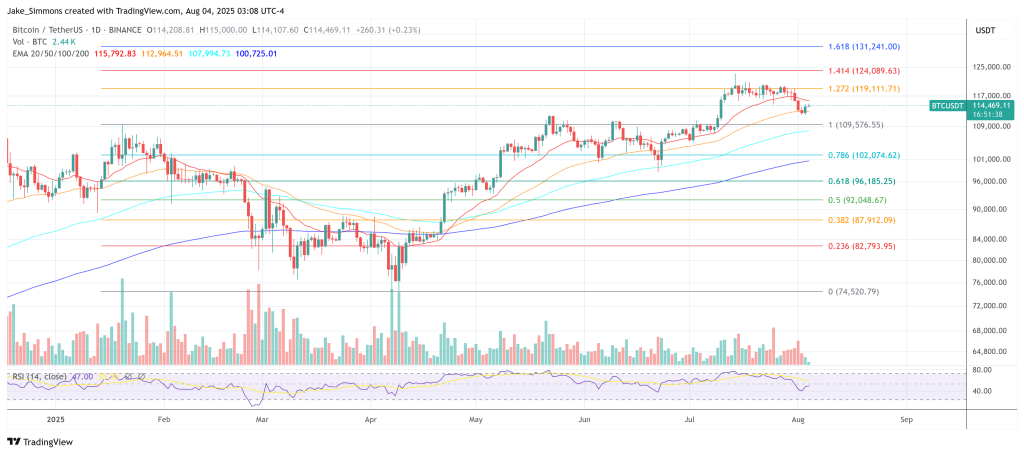

At press time, BTC traded at $114,469.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.