For families locked into highly appreciated stock that could bring a big tax hit from the capital gains on any sale of the holdings, a so-called upstream gift could offer a solution.

But the potential door to a step-up in basis that avoids capital gains taxes is only open if the person receiving the stock keeps it until death, updates estate-planning documents for a new beneficiary to receive the holdings and lives at least one year from the date they received the equity, said Ben Rizzuto, a director and wealth strategist with Janus Henderson Investors’ Specialist Consulting Group. In a blog post last month, the company used the example of a father who saved $1.5 million in possible taxes on the Apple stock he had held for more than 40 years by gifting it to his father, rather than his son.

“The idea of upstream gifting has been around since the tax code was written. The thing that I have found is that people don’t think about it from that direction,” Rizzuto said in an interview. “At any point in time, someone can have or hold an asset that has a low cost basis and a big unrealized gain, and we need to think about, are there ways that we can help them not incur that tax liability?”

While taxes on a gift of more than $19,000 in a single year would not apply to the strategy, the transfer does affect the two estates’ values, Rizzuto noted. But the exemptions from estate taxes are high enough (and staying that way, thanks to the One Big Beautiful Bill Act) that the appreciated stock wouldn’t pose an impact on most households’ plans.

READ MORE: Advisors clamor for estate planning tools as attorneys wave red flags

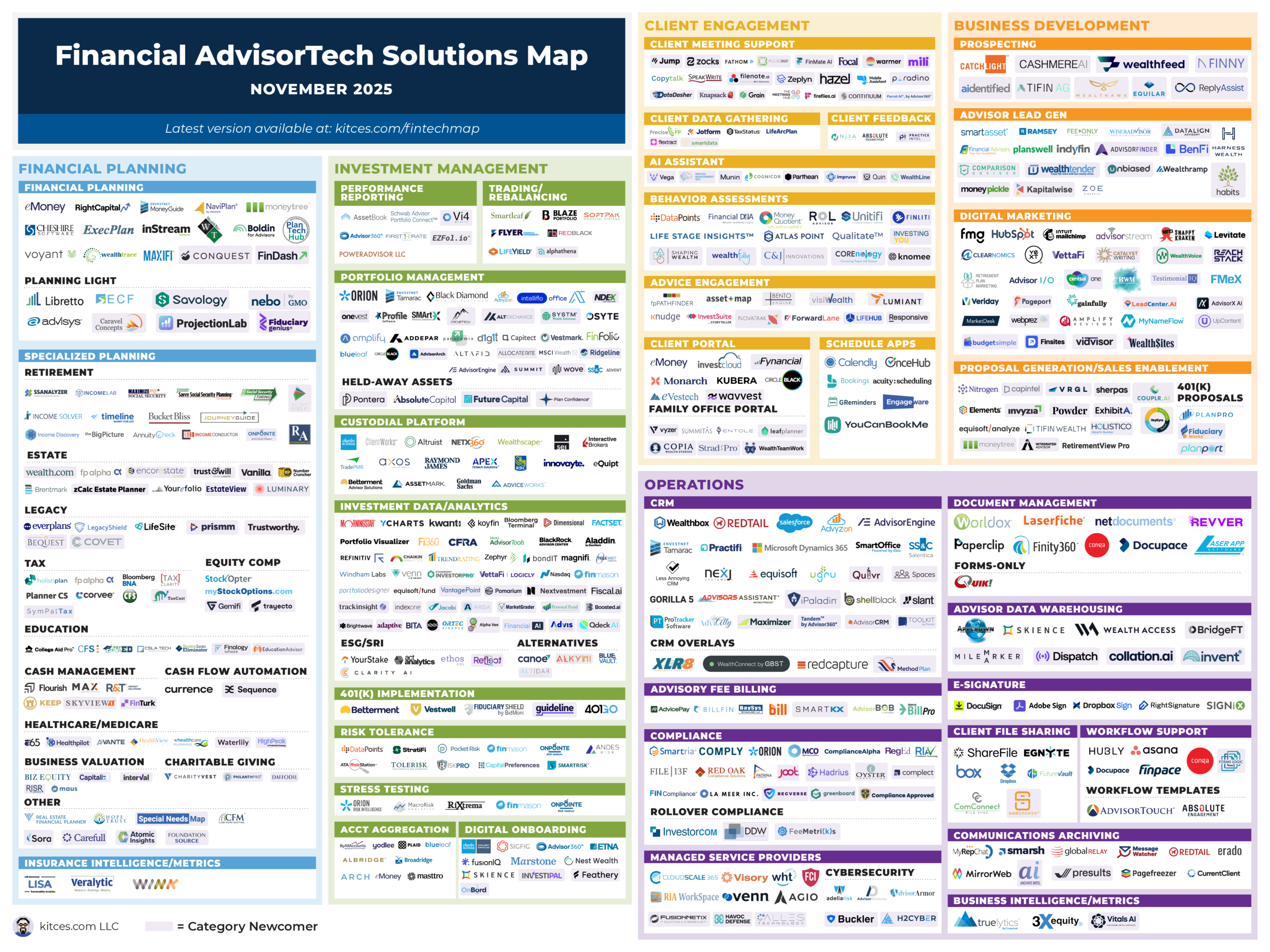

Besides the tax implications, large longtime holdings of the same stock sometimes come with emotional baggage tied to keeping them in the family. The upstream gifting of assets adds to other available strategies for highly concentrated or appreciated holdings, such as charitable giving, Section 351 conversions or variable prepaid forwards. Financial advisors and their clients cannot use the upstream gifting strategy for inherited individual retirement accounts, but it could prove beneficial in a number of other situations, according to a 2023 guide by the advisor lead generation and client matchmaking service SmartAsset.

“Upstream gifting is a strategy for expediting the transfer of highly appreciated assets to children, while limiting the taxes that will be owed on the inheritance,” it read. “Instead of giving assets directly to your children while you’re still alive or including them in your will, you can transfer the property to a living parent or grandparent. In turn, they leave those assets to your children when they die, preserving the step-up in basis and saving your children on taxes.”

The Janus Henderson blog explained the concept through the 10,000 shares of Apple stock that an investor had bought for $800 in December 1983 and held onto as it gained $4,999,200 in value. If the investor simply passes the holdings to the next heir in line, the accumulated capital gains just transfer to the next generation. That beneficiary could get the step-up in basis — meaning that the value for the stock would count for tax purposes on that of the day the heir inherited the position — but only if the investor had died.

Instead, the investor shifts the stock up one generation. So when that recipient passes the holdings back down at death, the original investor can get the stock back at the stepped-up basis and avoid the capital gains taxes.

“Of course, this strategy requires planning and communication between all parties involved,” the Janus Henderson blog said. “And as simple as it is, the strategy is not without risk. What if Grandpa incurs large medical bills or meets the second love of his life? What if he does not live for another year? What if the law changes to eliminate the step-up in basis at death? All these risks — and more — must be weighed before engaging in this strategy. It is essential for investors to retain the advice of their tax preparer or accountant and their attorney before implementing this technique.”

READ MORE: Using tax-aware long-short vehicles to track down alpha

The fact that people are living longer signals the need for more often-difficult conversations about how to transfer assets with the greatest tax efficiency, Rizzuto said. When using the upstream gifting approach, families may even decide to send the assets to “another trusted individual” who isn’t a relative, he noted. The important part is planning it out in advance.

“I can’t just go out on the street and find an older person and say, ‘Hey, I’ve got this idea. Can you help me out?” Rizzuto said. “There has to be some planning and communication that goes on here.”