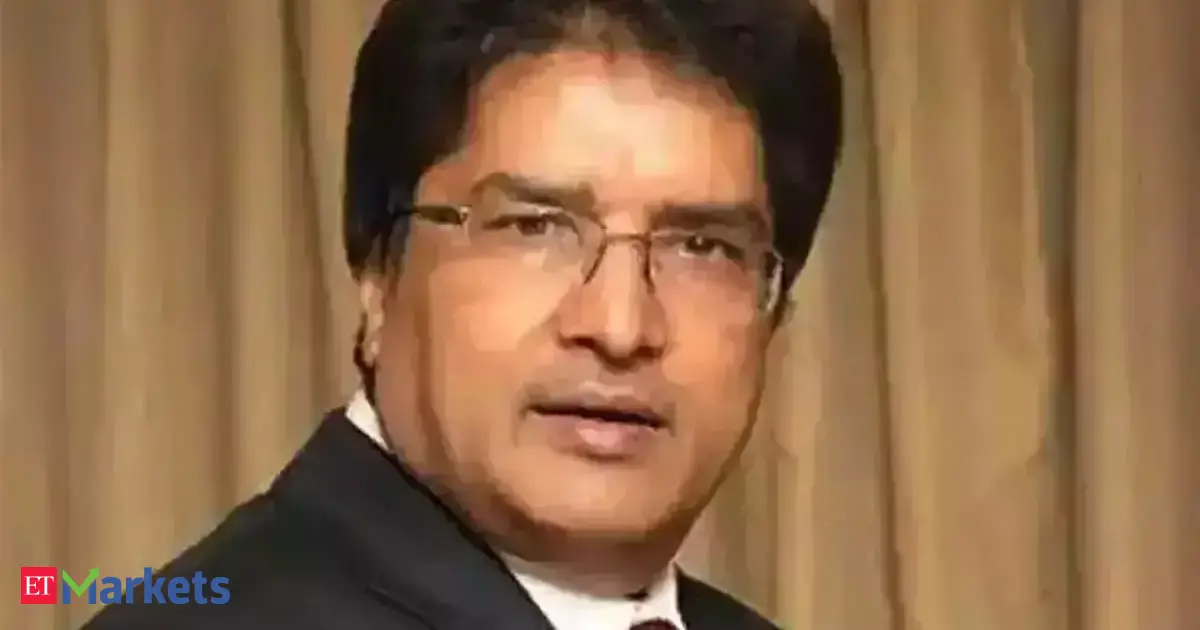

The party will continue for the longer run, but in the near-term, after the RBI bazooka, one would have thought corporate performance is going to give it a leg up and demand will come back swiftly. But it has not been witnessed in Q1 earnings so far. Is that a concern for you because that is also going to have a bearing on the speed at which the market moves.Raamdeo Agrawal: That is a major concern because markets are very richly valued. We need to support good earnings growth and wherever earnings growth is there, despite rich valuations, the market is giving salami (saluting it). We started tightening credit flow in the economy sometime last year after Q1 24-25 and the full impact of that is visible now. Now we are seeing the credit flow in single digit; housing loan growth is about 2.5%, 3%; automotive growth is literally flat; now gross direct tax collections are up only 3-4%.

So, multiple high frequency data are showing that the economy is slowing down and all the authorities are aware of it and that is why we see very determined efforts by monetary authorities as well as fiscal guys to loosen the purse. But it takes two-three quarters. I would think that by the busy season in September, October, November when all the credit flow is in place and lower credit cost is also passed on to the consumers, the demand will start picking up.

Low oil price, low inflation, everything is falling in place, but two-three quarters are needed for the party to start again. Nobody knows when the party will start, but the probability is much higher that the second half of the year should be picking up in the economy. Up until then, you think it is going to be a very range-bound move?Raamdeo Agrawal: Yes, the foreigners in any case have other options to go to America, to go to some other emerging market, to Europe as defence spending is happening there. So, there are a lot of options and that is why their entry-exit is very muted in the sense that they are not committed to coming to India. They love the Indian story, but since the valuation does not justify the current low earnings growth rate, the multiples are still fine if you are able to deliver about 15-17% aggregate corporate earnings growth in the second half. So far, what is your analysis? Where are the positive surprises, if at all, in earnings? Maybe not this quarter, maybe next?Raamdeo Agrawal: It will start with the financial sector because the banking sector is the biggest. They count for almost 30% of the corporate profits. The banks are in a very healthy shape. Just that they are growing at 10-12% or 8% to 10% they are not growing at 15%, 20%, 25%, so that gap on this large size like you might have seen the profits of say icici Bank was very good. HDFC Bank was also reasonably good but then their numbers are like Rs 16,000 crore, 18,000 crore for the quarter. These are the giants. When the credit growth starts at about 15-17%, each of these banks will not only have topline growth a little faster but also the operating leverage will come to play and their profits growth will also be very good, more like 20%, 22% and that gives a push to the aggregate earnings and along that even consumer companies like whether it is a QSR, whether it is a Nestle, whether it is a Lever, all sorts of consumer companies.How can you have an economy growing for five, seven, eight years at about 6.5% and 7% and yet none of the consumer companies are doing well broadly whether durable or non-durable. I think there is some kind of a disconnect, I do not understand why it is happening so. But authorities must also be thinking about how to go about it. My view is higher interest rates, lower petrol-diesel prices – they need to cut petroleum prices reflecting the $65 to $70 crude oil prices – and that will give multiple relief to the consumers so that they will have a little more purchasing power than earlier time.