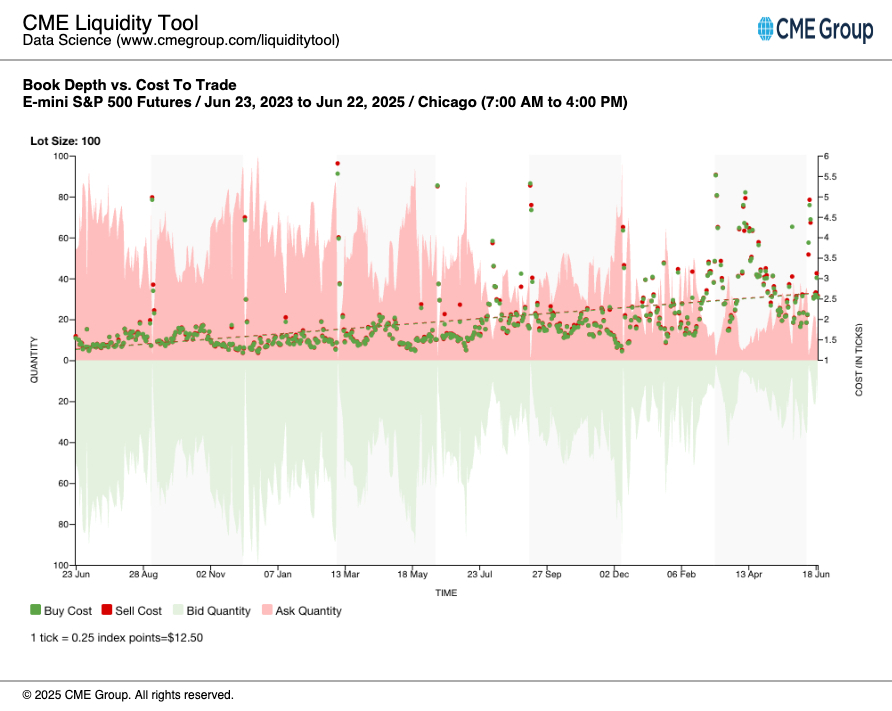

Poor liquidity and low volume are exaggerating intraday market moves, as yesterday’s trading action demonstrated.

Volatility dropped sharply as geopolitical tensions eased, causing traders to close hedges, supporting an afternoon rally in equities.

EUR/USD and USD/JPY saw sharp intraday reversals, suggesting persistent ranges.

The 10-year Treasury yield held key support at 4.35%, signaling limited downside potential despite geopolitical tensions.

Yesterday was an odd day for markets: fell the night before, rallied in the morning, gave back all the gains, then rallied again. Let’s face facts—Tesla (NASDAQ:) was largely responsible for yesterday’s advance, gaining nearly 9% and driving the market-cap-weighted higher by roughly 95 bps, while the equal-weight gained only about 50 bps.

For some reason, I felt compelled to check the -to-RSP ratio yesterday. Surprisingly, it stood at 3.36. This ratio previously reached similar levels on July 10, 2024, December 26, 2024, and February 18, 2024, and is now at the same level. I’ve overlaid the S&P 500 ETF chart to illustrate this clearly. Perhaps it means something—perhaps not. But it is clear what happened each time.

Unfortunately, market liquidity remains very poor. Eventually, the top-of-book liquidity will improve, reducing trading costs, but that day isn’t here yet. Until then, market moves can be exaggerated.

Yesterday’s S&P 500 futures volume wasn’t impressive, and when you combine low volume, wide spreads, and weak liquidity, you tend to see exaggerated moves. The past 24 hours illustrate this clearly.

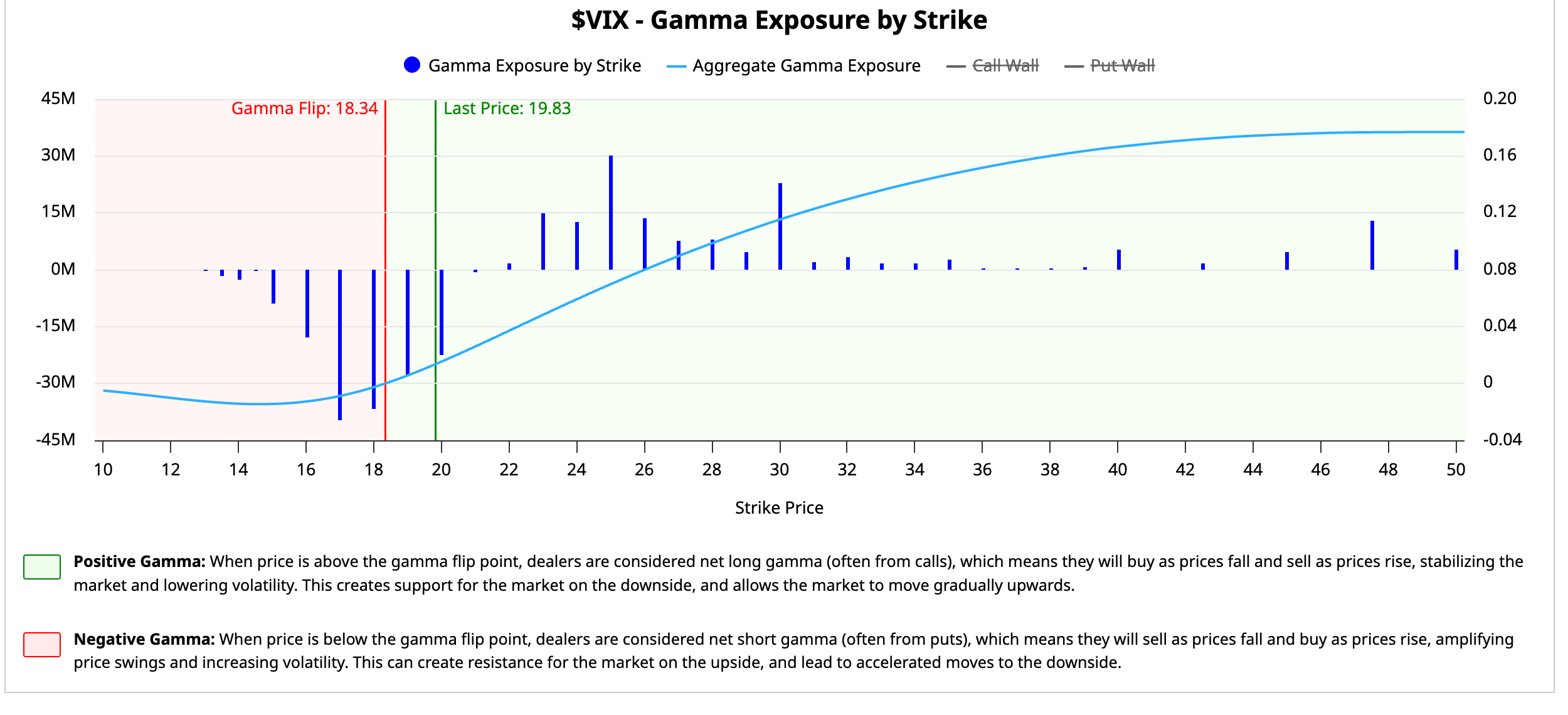

Additionally, with some tensions in the Middle East easing this afternoon, the dropped sharply. This volatility crush likely fueled the afternoon rally in the S&P 500, as traders probably closed out put positions—and perhaps also covered short call positions from the morning.

However, the VIX likely doesn’t have much room left to decline, as substantial gamma support sits in the 17–20 range.

(BARCHARTS)

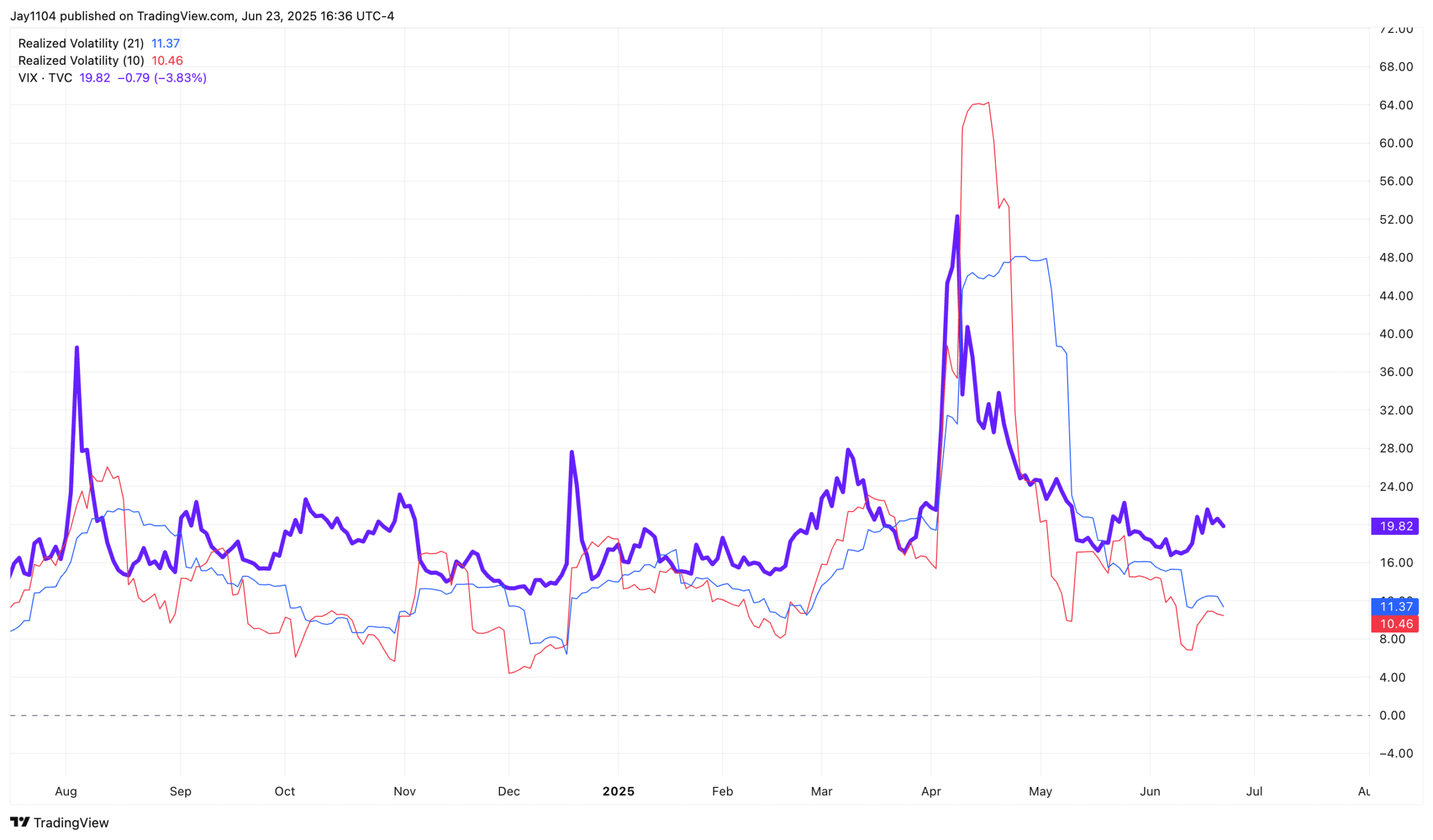

Meanwhile, realized volatility has remained relatively flat, suggesting limited room for further declines.

Just when it seemed the might finally break down, it decided otherwise. The trendline held firm, the RSI turned higher, and suddenly, a tired EUR/USD pair looks re-energized. The next logical step would be a break above the 1.1630 high, setting the stage for a return toward 1.19.

You could say the same about , which traded up to 148 intraday before sharply reversing lower to around 146.20. The pair has essentially been stuck in neutral for weeks, and right now, there’s little reason to expect a break from the current sideways price action.

The also traded in a wide range yesterday, looking poised to break below the critical 4.35% region.

But as cratered midday, yields quickly snapped higher, closing comfortably above support. It’s rather interesting—if geopolitical tensions and the threat of war aren’t enough to push the 10-year yield sustainably below 4.35%, it’s hard to imagine what could.

Original Post