The Federal Reserve’s Federal Open Market Committee (FOMC) meets this week and is expected to keep its target policy interest rate (the federal funds rate) unchanged at 4.5 percent.

This is unlikely to please Donald Trump who has repeatedly pushed Fed Chairman Jerome Powell and the FOMC to adopt a lower target interest rate and further force down interest rates on federal debt. Moreover, Trump has signaled that he wants the US central bank to be more like the European Central Bank which has been more aggressively forcing down interest rates in recent months.

Trump Wants More Easy Money from the Fed

Last week, Trump met with Powell and called Powell a “numbskull” for not forcing down interest rates enough to suit Trump’s personal whims. But the messaging this time was a little different. In the past, Trump has tended to demand lower interest rates for purposes of monetary stimulus. This time, Trump is openly admitting that he wants lower interest rates to make federal debt cheaper. NBC reported last week:

President Donald Trump ripped Federal Reserve Chair Jerome Powell as a “numbskull” on Thursday as he turned up the heat on the central bank chief to lower interest rates.

Trump claimed at the White House that lowering rates by 2 percentage points would save the U.S. $600 billion per year, “but we can’t get this guy to do it.”

“We’re going to spend $600 billion a year, $600 billion because of one numbskull that sits here [and says] ‘I don’t see enough reason to cut the rates now,’” Trump said.

Trump added that he was OK with the Fed raising rates if inflation was going up.

“But it’s down,” he said, “and I may have to force something.”

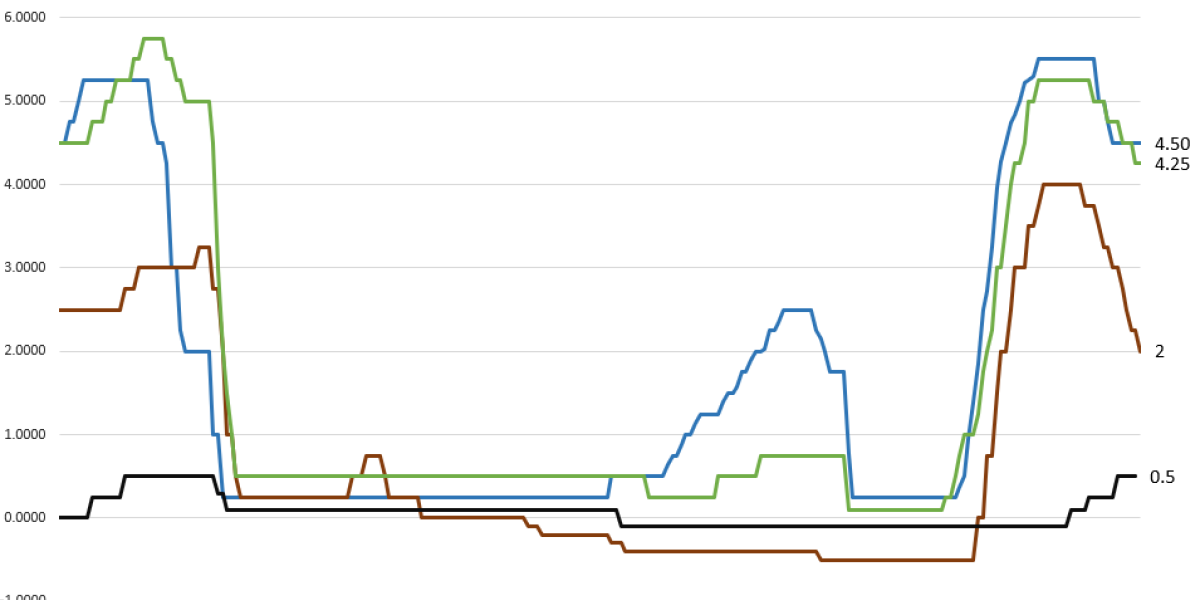

Here Trump states that his primary purpose for demanding lower interest rates is to bring down borrowing costs. Naturally, Trump, who continues to push for ever larger multi-trillion-dollar deficits, wants to be able to borrow more cheaply, thus freeing up federal dollars so Trump can reward key interest groups with taxpayer money. It’s easy to see why Trump is concerned about this. The Federal government’s interest expenses have ballooned in recent years as the federal debt has soared and as the average interest rate on the debt has nearly doubled since 2021. 2025’s fiscal year will likely be another year in which the US pays more than a trillion dollars just in debt service:

Source: FiscalData.Treasury.gov.

Trump, however, fails to mention that the process of bringing down interest rates on federal debt usually requires the fed to purchase Treasurys with newly created money. What Trump is really saying is “I want more devaluation of the dollar so I can have bigger deficits.”

Trump then wrongly claims that inflation “is down.” In this, Trump is either lying or is bad at basic arithmetic. “Inflation”—by which he presumably means price inflation—is not down. In fact, it’s still higher than the Fed’s arbitrary two-percent target. Moreover, the consumer price index is up by 24 percent since early 2020. And, of course, monetary inflation is up by about 35 percent in that time. Nowhere—except, apparently, in Donald Trump’s mind—is inflation “down.” Unfortunately, Trump shows no interest in pursuing the solution to inflation, which is deflation. Indeed, what the economy needs is price deflation—fueled by monetary deflation. But, this will be quite impossible under Trump’s regime on runaway fiscal deficits and ongoing monetary inflation.

Trump, however, is pretending that inflation is “down” in order to push for the FOMC putting more downward pressure on interest rates.

Comparing US Target Interest Rate to Other Central Banks

On April 17, Trump again took to social media to call for more easy-money policy from the Fed, complaining that Powell is “always TOO LATE AND WRONG,” and he insisted the Fed chairman’s “termination cannot come fast enough!” Trump even held up the highly inflationist European Central Bank as a sort of model, claiming that the Fed should be more like the ECB.

So, should the Fed be more like the ECB?

Trump is right insofar as the ECB has indeed aggressively pushed down its target interest rate since 2024, lowering the target rate by 200 basis points from 4 percent to 2 percent in that time. During that same period, the US lowered its target interest rate by 100 basis points, pushing it down from 5.5 percent to 4.5 percent.

But why assume that this is the “correct” thing to do? Trump appears here to be working from the assumption that if some other central bank lowers its target policy rate, then the US’s central bank should do the same. It is difficult to fathom why or how Trump came to this conclusion. Does Trump, the self-styled “master negotiator” think that he is somehow “winning at monetary policy” if his country’s central bank lowers its target rate below that of other central banks?

We may never know.

In any case, it’s difficult to imagine on what data he might be basing this assumption since there is no correlation between low-interest-rate policy and improvements in the standard of living for ordinary people.

If anything, the ECB’s commitment to low interest rates is an example of Europe eating its seed corn. One apparent effect of the European Central Bank’s race to lower interest rates is the euro’s continued slide in terms of global demand. Last week gold surpassed the euro as the second-largest global reserve asset, behind the dollar. Meanwhile, the euro is still down five percent against the dollar, compared to where it was in 2020 when central banks in both Europe and the USA began frantically printing money to prop up their locked-down economies.

Given that the Trump administration has made a big deal about keeping the dollar as the number one global currency, it’s difficult to see why Trump thinks that the US’s central bank should follow Europe in terms of monetary policy.

One the other hand, from the point of view of conventional central banking, the ECB has more room to lower its target rate. Specifically, price inflation is lower in the euro area. In May, the euro area’s CPI growth was 1.9 percent, year over year. That’s below the ECB’s two-percent target. In the United States, meanwhile, the CPI increase was 2.4 percent. This is likely due to Europe’s slowing and stagnating economy, which is putting a damper on price growth beyond that which is now seen in the US.

But perhaps the US should imitate UK or Japanese monetary policy? Well, both the UK and Japan have recently reported shrinking economies, in spite of the fact that both countries have lower target interest rates than the United States.

All of this together gives us good reason to believe that Trump’s demand that US monetary policy parrot European policy is misguided at best.

Why Isn’t Powell lowering Rates More?

Now, I should be clear that I’m not trying to defend Jerome Powell here. Powell is a politician and a technocrat just as much as any other power broker or member of the Washington ruling class.

Yet, the fact that Powell isn’t doing the bidding of Donald Trump is not a good reason to attack him. Powell has his own political agenda, no doubt, but whatever his motivation, his current policy of doing very little with the Fed’s target interest rate is relatively harmless compared to Trump’s calls for ever higher levels of inflation. Ideally, of course, the Fed would allow all interest rates to be determined by the market, and the Fed would not intervene in buying of Treasurys—as it recently did—to suppress interest on federal debt. Nor would the Fed meddle in the economy to stimulate more consumer spending, as Trump has repeatedly demanded it do.

Rather, the Fed should do nothing at all. Powell’s relative lack of action on this front in recent months gives the market some room to breathe. What Trump apparently wants, however, is for the Fed to be more active in its efforts at centrally planning the economy.

This would hardly be an improvement. Alas, long gone are the days when Trump was pledging—probably cynically and disingenuously—to audit the Fed and force a count of all the gold in the US gold reserve. That’s all been long forgotten at the White House, and Trump apparently wants a return to what would have been business as usual under Bernanke or Yellen in the days of quantitative easing massive asset price inflation.