Published on May 14th, 2025 by Bob Ciura

We have only one sell rule in the Sure Passive Income Newsletter.

That one rule is to sell when a stock breaks its streak of consecutive annual dividend increases. This occurs when a stock does any of the following:

Fails to increase its dividend (flat year-over-year-dividends)

Reduces its dividend (declining year-over-year dividends)

Eliminates its dividend

This means dividend policy entirely dictates when we sell.

The ultimate goal of the Sure Passive Income Newsletter, and dividend growth investing in general, is to realize dividend growth over time (as the name implies).

So long as dividends are increasing, we want to buy and hold forever. Having additional selling criteria can interfere with the long-term dividend compounding of any previous buy.

For this reason, we recommend dividend growth investors focus on stocks with long histories of increasing dividends each year.

A prime example is the Dividend Aristocrats, a select group of 69 S&P 500 stocks with 25+ years of consecutive dividend increases.

There are currently 69 Dividend Aristocrats. You can download an Excel spreadsheet of all 69 Dividend Aristocrats (with metrics that matter such as dividend yields and price-to-earnings ratios) by clicking the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

But when a stock fails to generate dividend growth, it isn’t doing what we purchased it for.

For a dividend growth investor, selling a stock that isn’t growing its dividend is a lot like disposing of a refrigerator that doesn’t keep food cold – in either case, the reason you bought is no longer valid.

This article will discuss 10 dividend stocks that may have attractive yields, but do not have dividend growth–meaning investors focused solely on rising income should consider selling.

The list is sorted by current yield, from lowest to highest.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

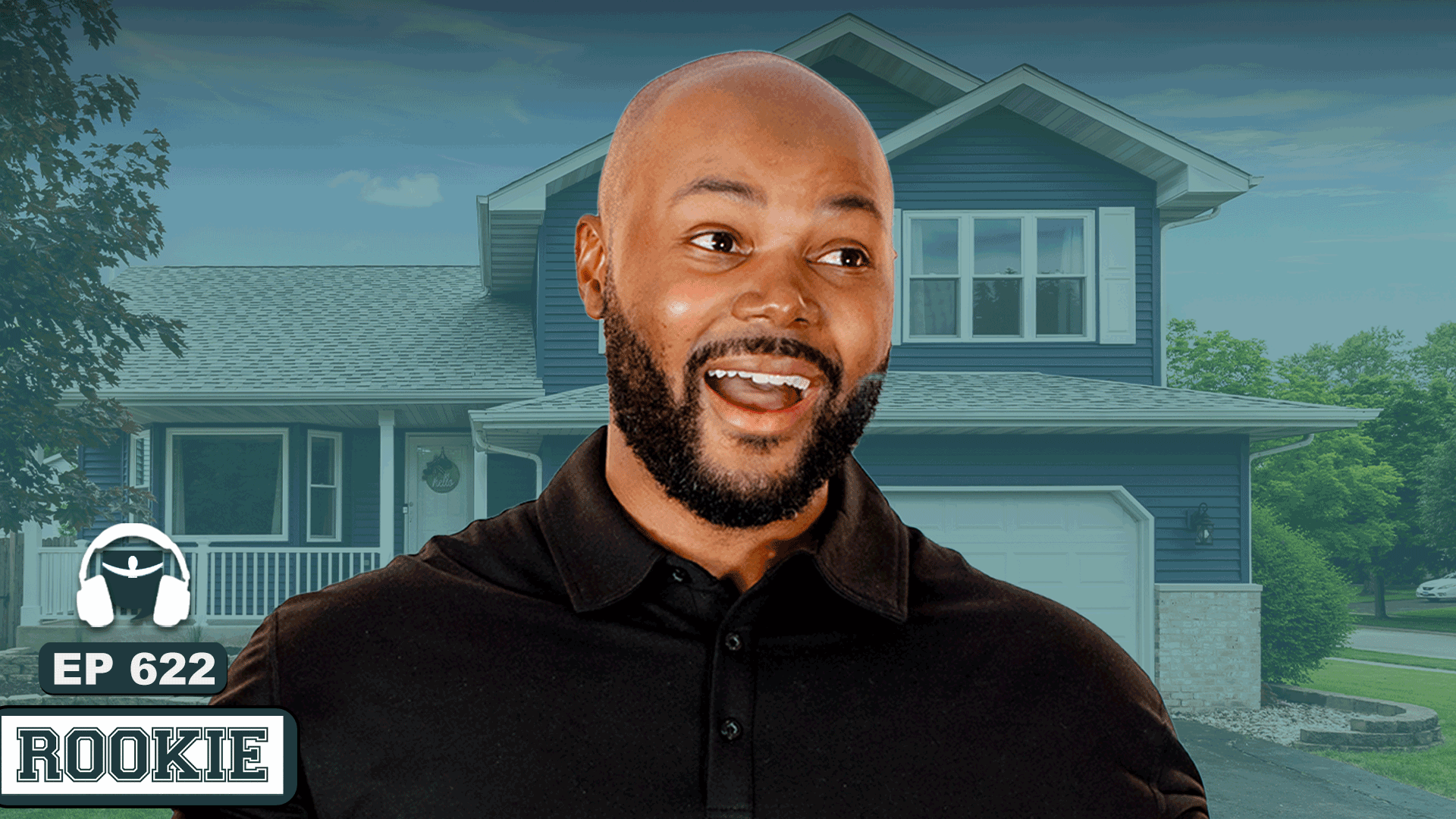

High Dividend Stock To Consider Selling #10: Oxford Square Capital (OXSQ)

Oxford Square Capital Corp. is a BDC (Business Development Company) specializing in financing early- and middle-stage businesses through loans and investments in collateralized loan obligations.

At the end of last quarter, the total fair value of Oxford Square’s investment portfolio stood at about $243.2 million across 61 positions, allocated approximately 61% in secured debt (48% first-lien, 13% second-lien), 38% in CLO equity, and about 1% in equity or other investments. Last year, the BDC generated roughly $42.7 million in total investment income.

On April 25th, 2025, Oxford Square Capital reported its first-quarter 2025 results for the period ending March 31st, 2025. The company generated about $10.2 million in total investment income, down slightly from $10.7 million in Q1 2024, mainly due to lower interest income from debt investments.

The weighted average yield on debt investments fell to 14.3%, down from 15.8% at year-end. The BDC’s effective yield on CLO equity investments rose slightly to 9.0%, while the cash distribution yield on cash-generating CLO equity declined marginally to 16.0%. Total expenses were $4.1 million, roughly flat compared to $4.2 million in Q1 2024.

Click here to download our most recent Sure Analysis report on OXSQ (preview of page 1 of 3 shown below):

High Dividend Stock To Consider Selling #9: Xerox Corporation (XRX)

Xerox Corporation traces its lineage back to 1906 when The Haloid Photographic Company began manufacturing photographic paper and equipment. Through a series of mergers and spinoffs, the Xerox we know today was formed.

Xerox spun off its business processing unit in 2017 (now called Conduent) and now focuses on design, development, and sales of document management systems.

In February, the company cut its quarterly dividend by 50%.

Xerox reported first quarter financial results on May 1st. Quarterly revenue of $1.46 billion missed estimates by $60 million. Adjusted earnings-per-share of -$0.06 per share missed analyst estimates by $0.03 per share.

Click here to download our most recent Sure Analysis report on XRX (preview of page 1 of 3 shown below):

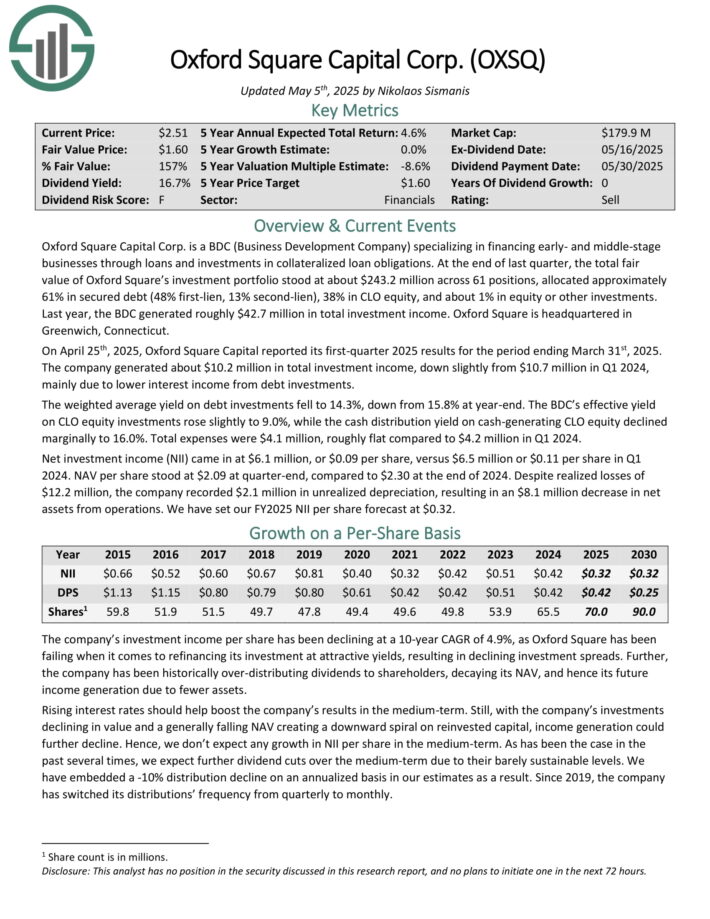

High Dividend Stock To Consider Selling #8: BCE Inc. (BCE)

BCE Inc. is a telecommunications and media company that provides communications services in the following business units: Bell Communication and Technology Services (“CTS”), which includes Wireless and Wireline, and Bell Media.

BCE addresses residential customers as well as small- and medium-sized businesses and large enterprise customers. BCE was founded in 1970, is headquartered in Verdun, Canada. Shares are listed on the NYSE and on the TSX in Toronto.

BCE reported its Q4 and full-year 2024 results on 2/6/2025. For the quarter, its operating revenues fell 0.8% year over year (“YOY”) to C$6.4 billion, its adjusted net earnings rose 4.1% to C$719 million, while its adjusted EBITDA (a cash flow proxy) rose 1.5% to C$2.6 billion.

Adjusted earnings-per-share (“EPS”) rose 3.9% to C$0.79 versus the same quarter a year ago. It also generated cash flows from operating activities of C$1.9 billion (down 21%) and free cash flow (“FCF”) of C$874 million, down 32% YOY.

For 2024, operating revenue was C$24.4 billion, down 1.1% YOY. Adjusted EBITDA climbed 1.7% to C$10.6 billion with the margin expanding 1.2% to 43.4%. Adjusted EPS declined 5.3%.

In May, BCE cut its dividend by 56%.

Click here to download our most recent Sure Analysis report on BCE (preview of page 1 of 3 shown below):

High Dividend Stock To Consider Selling #7: Prospect Capital (PSEC)

Prospect Capital Corporation is a Business Development Company, or BDC, that provides private debt and private equity to middle–market companies in the U.S.

The company focuses on direct lending to owner–operated companies, as well as sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional equity investments.

Prospect posted second quarter earnings on February 10th, 2025, and results were somewhat weak. Net investment income per-share acme to 20 cents, while total investment income fell from $211 million to $185 million year-over-year.

NII per-share fell from 21 cents in Q1, and 24 cents from the year-ago period. Total interest income was $169 million for the quarter, down from $185 million in the prior quarter, and $195 million a year ago. It also missed estimates by about $2 million.

Total originations were $135 million, down sharply from $291 million in the previous quarter. Total payments and sales were $383 million, up from $282 million in Q1.

Click here to download our most recent Sure Analysis report on PSEC (preview of page 1 of 3 shown below):

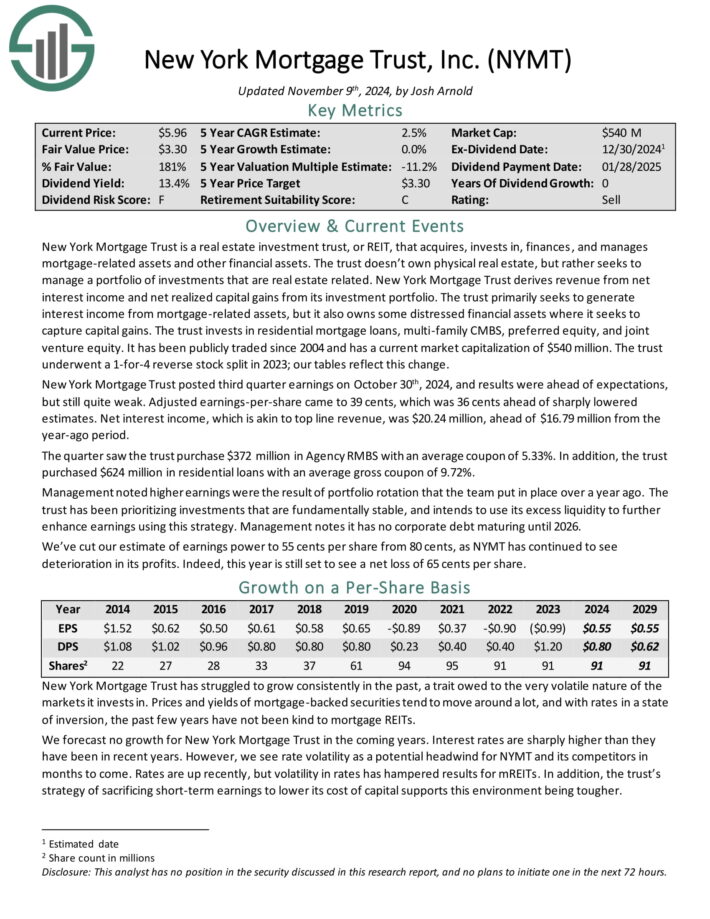

High Dividend Stock To Consider Selling #6: New York Mortgage Trust (NYMT)

New York Mortgage Trust acquires, invests in, finances, and manages mortgage-related assets and other financial assets. The trust doesn’t own physical real estate, but rather seeks to manage a portfolio of investments that are real estate related.

The trust invests in residential mortgage loans, multi family CMBS, preferred equity, and joint venture equity.

New York Mortgage Trust posted third quarter earnings on October 30th, 2024, and results were ahead of expectations, but still quite weak.

Adjusted earnings-per-share came to 39 cents, which was 36 cents ahead of sharply lowered estimates. Net interest income, which is akin to top line revenue, was $20.24 million, ahead of $16.79 million from the year-ago period.

The quarter saw the trust purchase $372 million in Agency RMBS with an average coupon of 5.33%. In addition, the trust purchased $624 million in residential loans with an average gross coupon of 9.72%.

Click here to download our most recent Sure Analysis report on NYMT (preview of page 1 of 3 shown below):

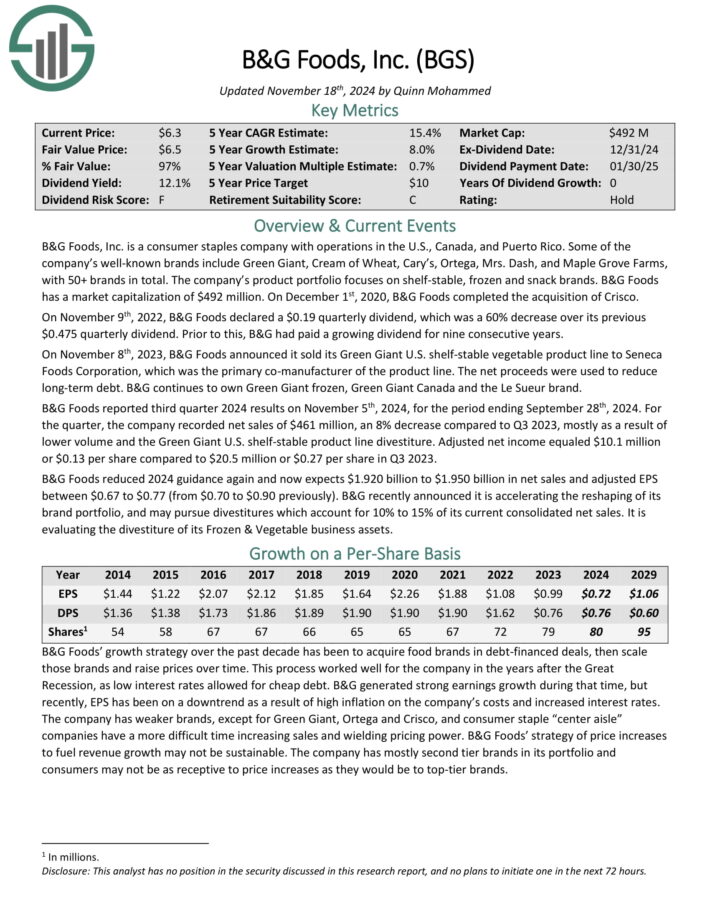

High Dividend Stock To Consider Selling #5: B&G Foods, Inc. (BGS)

B&G Foods, Inc. is a consumer staples company with operations in the U.S., Canada, and Puerto Rico. Some of the company’s well-known brands include Green Giant, Cream of Wheat, Cary’s, Ortega, Mrs. Dash, and Maple Grove Farms, with 50+ brands in total.

It product portfolio focuses on shelf-stable, frozen and snack brands. On December 1st, 2020, B&G Foods completed the acquisition of Crisco.

B&G Foods reported first-quarter financial results on May 7th. For the quarter, the company recorded net sales of $425 million, which missed analyst estimates by $10.4 million. Adjusted earnings-per-share of $0.04 missed estimates, which called for $0.08 per share.

The company revised full-year guidance, now expecting 2025 revenue of $1.86 billion to $1.91 billion.

Click here to download our most recent Sure Analysis report on BGS (preview of page 1 of 3 shown below):

High Dividend Stock To Consider Selling #4: ARMOUR Residential REIT (ARR)

ARMOUR Residential invests in residential mortgage-backed securities that include U.S. Government-sponsored entities (GSE) such as Fannie Mae and Freddie Mac.

It also includes Ginnie Mae, the Government National Mortgage Administration’s issued or guaranteed securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate home loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, money market instruments, and non-GSE or government agency-backed securities are examples of other types of investments.

In the fourth quarter of 2024, ARMOUR Residential REIT, Inc. reported a GAAP net loss of $49.4 million, or $0.83 per common share. Despite this, the company achieved distributable earnings of $46.5 million, equating to $0.78 per common share, which fell short of the anticipated $0.97. Net interest income for the quarter was $12.7 million.

During this period, ARMOUR raised approximately $136.2 million through the issuance of about 7.2 million shares via an at the market offering program. The company maintained its monthly common stock dividend at $0.24 per share, totaling $0.72 for the quarter.

Click here to download our most recent Sure Analysis report on ARMOUR Residential REIT Inc (ARR) (preview of page 1 of 3 shown below):

High Dividend Stock To Consider Selling #3: Kohl’s Corporation (KSS)

Kohl’s traces its roots back to a single store: Kohl’s Department Store in 1962. Since then, it has grown into a leader in the space – offering women’s, men’s and children’s apparel, housewares, accessories, and footwear in more than 1,100 stores in 49 states. The company should generate roughly $16 billion in sales this year.

From 2007 through 2018, Kohl’s was able to grow earnings-per-share by about 4.7% annually. However, it should be noted that this was driven by the company’s extensive share repurchase program. Over that period the share count was nearly halved, a reduction rate of -5.6% per year.

With the share repurchase program having been paused, we don’t see that as a tailwind for the time being. Fears of struggling margins have proven to be right, as the past few years have seen declining profitability. We note that 2021’s earnings has the potential to be the top for some time.

In March, Kohl’s cut its quarterly dividend by 75%.

Click here to download our most recent Sure Analysis report on KSS (preview of page 1 of 3 shown below):

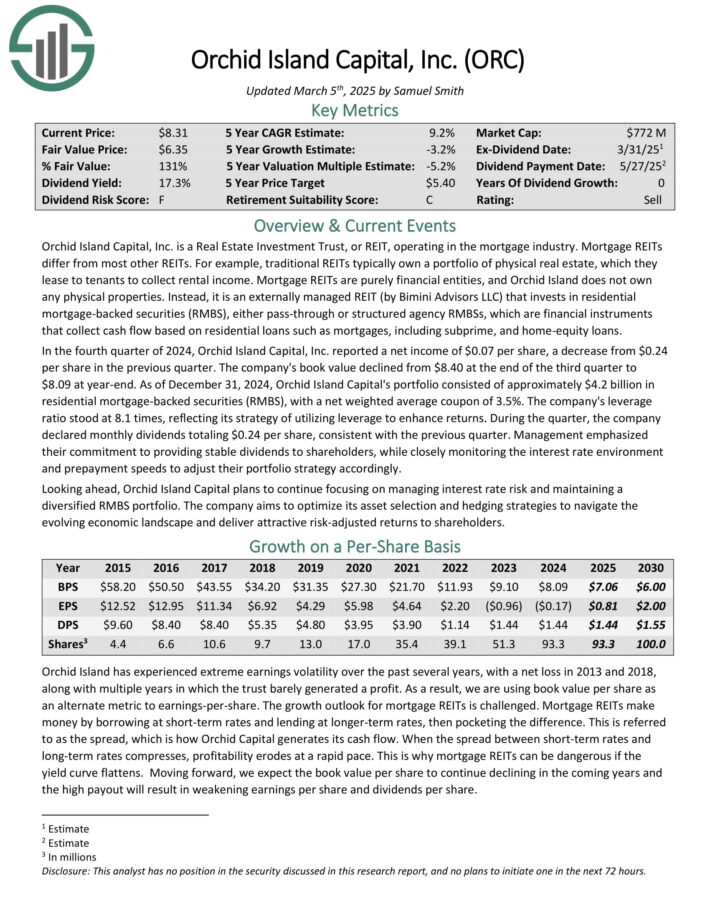

High Dividend Stock To Consider Selling #2: Orchid Island Capital (ORC)

Orchid Island Capital is a mortgage REIT that is externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), including pass-through and structured agency RMBSs.

These financial instruments generate cash flow based on residential loans such as mortgages, subprime, and home-equity loans.

In the fourth quarter of 2024, Orchid Island Capital, Inc. reported a net income of $0.07 per share, a decrease from $0.24 per share in the previous quarter. The company’s book value declined from $8.40 at the end of the third quarter to $8.09 at year-end.

As of December 31, 2024, Orchid Island Capital’s portfolio consisted of approximately $4.2 billion in residential mortgage-backed securities (RMBS), with a net weighted average coupon of 3.5%. The company’s leverage ratio stood at 8.1 times, reflecting its strategy of utilizing leverage to enhance returns.

Click here to download our most recent Sure Analysis report on Orchid Island Capital, Inc. (ORC) (preview of page 1 of 3 shown below):

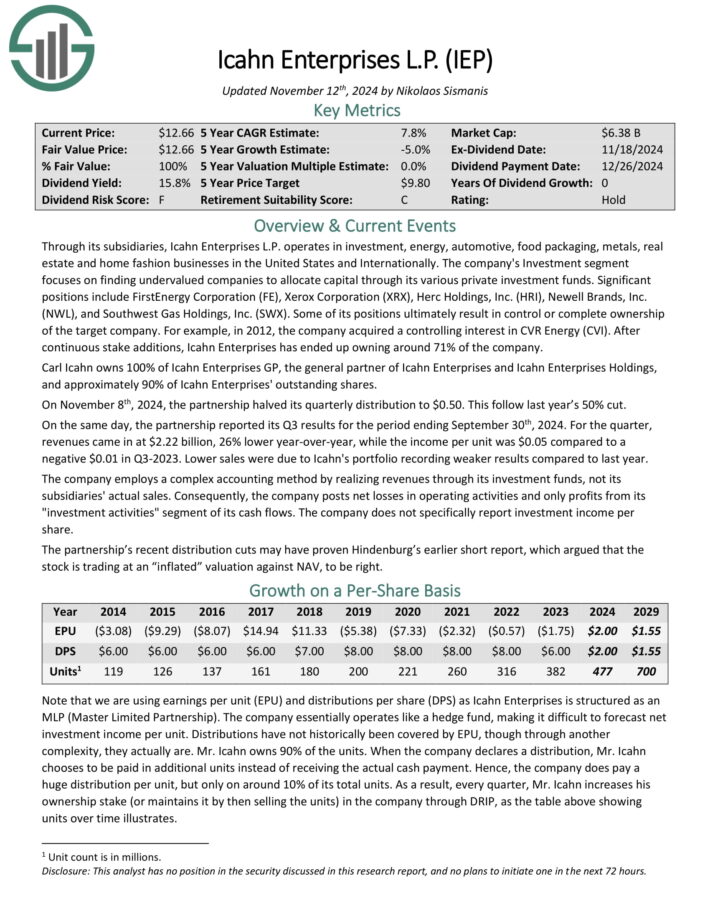

High Dividend Stock To Consider Selling #1: Icahn Enterprises LP (IEP)

Through its subsidiaries, Icahn Enterprises L.P. operates in investment, energy, automotive, food packaging, metals, real estate and home fashion businesses in the United States and Internationally.

The company’s Investment segment focuses on finding undervalued companies to allocate capital through its various private investment funds.

Significant positions include FirstEnergy Corporation (FE), Xerox Corporation (XRX), Herc Holdings, Inc. (HRI), Newell Brands, Inc. (NWL), and Southwest Gas Holdings, Inc. (SWX).

On November 8th, 2024, the partnership halved its quarterly distribution to $0.50. This follow last year’s 50% cut. On the same day, the partnership reported its Q3 results for the period ending September 30th, 2024.

For the quarter, revenues came in at $2.22 billion, 26% lower year-over-year, while the income per unit was $0.05 compared to a negative $0.01 in Q3-2023. Lower sales were due to Icahn’s portfolio recording weaker results compared to last year.

Click here to download our most recent Sure Analysis report on IEP (preview of page 1 of 3 shown below):

Final Thoughts & Additional Reading

High dividend stocks are naturally appealing on the surface, due to their high dividend yields.

But income investors need to make sure they do not fall into a dividend ‘trap’, meaning purchasing a stock solely due to its high yield, only to see the company cut or eliminate the dividend payout.

Income investors looking for growth should consider selling the 10 dividend stocks in this article, because they have not displayed any dividend growth. In many cases, these stocks have already cut their dividends, violating one of the three rules of the Sure Passive Income newsletter.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].