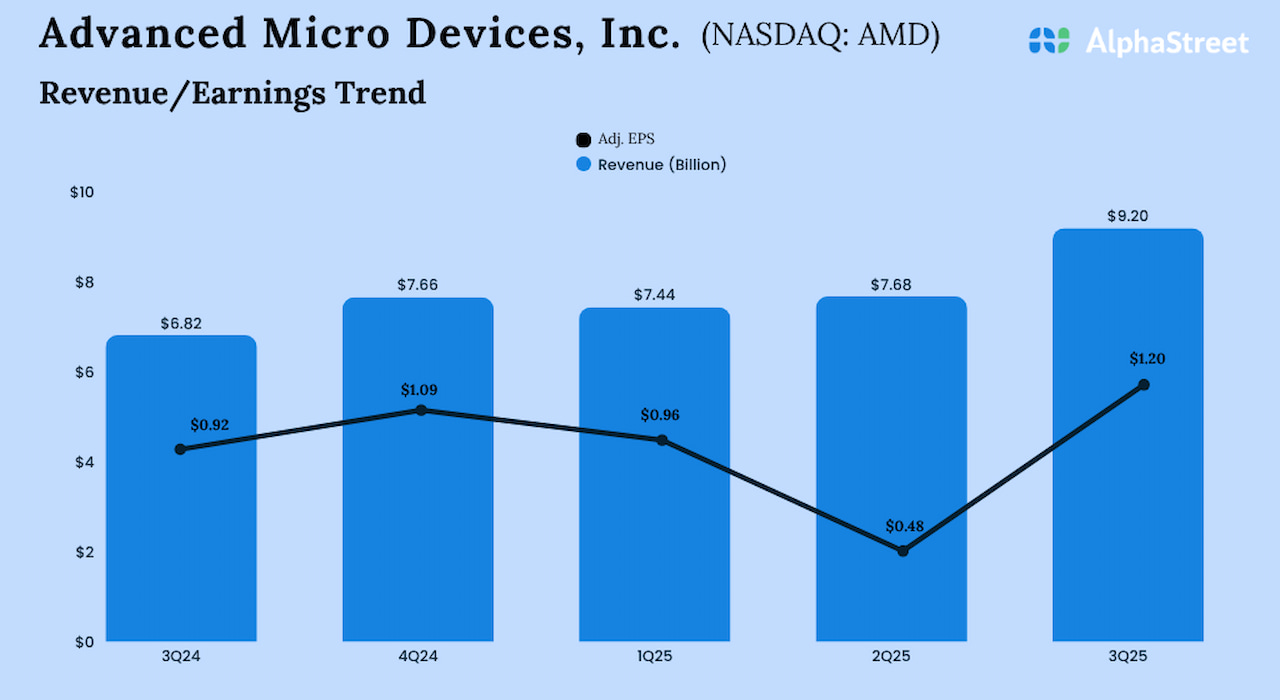

Shah also says metals are poised for a significant rally. Experts predict the metals index will reach 10,500. Top-tier metal producers, especially in steel and non-ferrous sectors, are favoured. Jindal Group stocks are particularly attractive. These leading stocks could see gains between 15% and 30%. Investors should focus on quality large-caps to navigate global volatility.

Everybody wants the gold price to come down. When will gold come down?Gautam Shah: Yes, I am sure the gold has actually done the unthinkable. I remember 18 months back at various conferences, it was trading at levels of $1800 and nobody had the visibility that it could actually cross $3000. But in charts it gave you some sense that a mega trend was coming. For now, the trend is done with, $3450-3500 is a short-term top. It needs multiple weeks of consolidation before it can do bigger things. The longer term is intact. Stay invested in gold but do not be a buyer at these prices. You will get a little more dip closer to levels of $2900-3000. But the bigger trade for the next one year which again we have been saying for a while now is silver. Silver seems to be consolidating and what gold has done over the last one-and-a-half years, silver can do over the next 12 to 18 months. So once the metal gets past, you are going to see a mega trend there.

You rightly mentioned about metals, what about IT because that has been one oversold sector. A lot of global uncertainty is clearing off. Can it get back to its heyday?Gautam Shah: I do not think it can get back to its heyday, but it will not go down too much, that itself is a win for the IT index. Remember, many of these stocks are very richly valued. Many of these stocks have a lot to do with foreign soil. And in today’s complex and volatile world, it might not be easy for IT stocks to get into a structural uptrend.

So, while they might see a pullback from time to time, I do not think they are going to take leadership anytime soon. In the next leg of the market moving towards lifetime highs, new leaders will emerge. Maybe financial services will do better. Metals will do well. Real estate will do well. The entire PSU basket will do well where the valuations are very comfortable. So, while we like it, we are not recommending it as a structural trade for the rest of the year.

If we ask you to make one happy trade before you go for your summer holiday and then come back only after your winter holiday, what will be that trade?Gautam Shah: It would be metals. Last summer that same trade was financial services and Bajaj Finance and some of these top stocks worked out quite well because they stood out while the entire mess was getting cleaned and cleared. Now the metals index after yesterday’s big move on charts, tells me that there is something brewing behind the scene that fundamentally could trigger a big move. So, chartically, I am very convinced that the metals index is heading towards 10,500. Give us your top stock as well over there within metals.Gautam Shah: I am sticking to top quality everywhere, in each of these sectors of the market I am looking at the big boys because they can create alpha and in this complex global world, you do not want to be very picky with midcaps and smallcaps where the trend is very shallow. Any volatility and midcaps and small caps tend to fall. But the top steel producers are the ones which we really like. In fact, even in the non-ferrous metal stocks, we like the top three or four names. The entire Jindal Group of stocks we like. In this basket, all the top five or six stocks can appreciate anywhere between 15% and 30%.