Money is personal but it’s also relational. Whether you’re managing finances with siblings, parents, adult children, or a partner, understanding how to communicate about money can make or break your financial harmony. Here’s how to approach these conversations thoughtfully, strategically, and without stress.

The Family Finance Meeting

Talking money with family can feel awkward but avoiding it can create bigger headaches later aligning on financial values. Sharing plans for 401(k) contributions, IRAs, and long-term investments ensures everyone is on the same page. Especially when planning for inheritances or supporting aging parents.

Tips for a productive discussion:

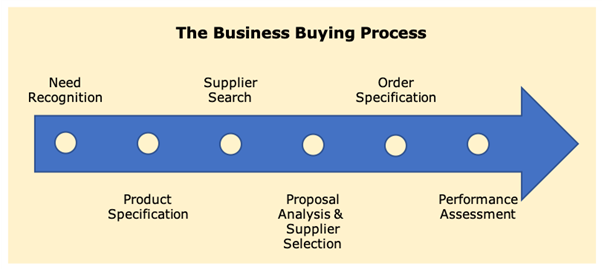

Start with a “Why”: Instead of a rigid agenda, kick off by explaining the purpose. Are you coordinating retirement goals, planning for a family gift, or just getting on the same page? Framing it around a shared “why” makes the conversation feel meaningful, not like a chore. Pick a Comfortable Setting (Not a Battle Zone): You don’t need a boardroom. A cozy living room, a quiet coffee shop, or even a Zoom call with good vibes works best. Comfort helps people open up instead of getting defensive. Keep the Conversation Curious, Not Combative: Ask questions before giving advice. “How do you see your 401(k) goals?” or “What’s been challenging with saving?” fosters collaboration. Listening > lecturing. Use a Visual Roadmap: Sometimes numbers on paper don’t click. Pull up a spreadsheet, app, or even a simple whiteboard to map goals, retirement timelines, debt payoff, or savings targets. Seeing it makes abstract plans concrete. End with Actionable Next Steps: Instead of “we’ll talk again later,” assign small, clear actions. “I’ll check my IRA contribution options,” or “Let’s each draft a monthly budget by next week.” Concrete steps prevent conversations from dying in the ether. Forget Perfect and Aim for Progress: You don’t need everyone to agree 100% or solve all problems in one sitting. Clarity, understanding, and small aligned steps are what matter most.

Read more about designating beneficiaries for your 401(k).

What’s Your Money ‘Love Language’?

Just like people express love differently, everyone has a unique way of approaching money. Understanding your partner’s or family member’s financial personality can influence how you approach retirement savings together. Are they a saver focused on a Roth IRA, or more of a spender who needs encouragement to increase 401(k) contributions? Recognizing these differences helps bridge gaps and set realistic retirement targets.

Try this approach:

Figure Out Your Own Money Style: Are you the saver who hides cash like a squirrel, the gifter who loves surprising others, the spender who splurges for joy, or the investor who thinks long-term? Knowing your habits helps you understand why you make the choices you do. Ask About Their Style (Without Rolling Your Eyes): Your partner’s approach might feel totally foreign. Maybe they love “retail therapy” while you’re tracking every penny. Instead of judging, ask questions: “What’s your favorite way to spend or save?” or “How do you feel about our retirement accounts?” Find the Overlap (And Respect the Gaps): Not every style has to match. If you’re a saver and they’re a gifter, agree on boundaries: maybe a small monthly gift fund while keeping your retirement contributions on track. Look for ways your habits can complement each other instead of collide. Turn Money into a Team Sport: Once you understand each other, money stops being a battleground and becomes a tool for connection. You can plan trips, retirement, or just manage bills without constant tension. Think of it as teamwork for your future.

The Debt Disclosure

Nobody enjoys confessing past money mistakes, sharing your debt history, or a shaky credit score. But being open about debt or financial missteps can bring you closer if you handle it right. Think of it as building trust, not delivering a confession.

How to approach it:

Keep It Real, Not Overwhelming: You don’t need to recite every late payment or old mistake. Just share the essentials like current balances, credit score, or major debt. Skip the shame. Lead With a Game Plan: Debt disclosure is about solutions, not guilt. Show your partner or family how you’re tackling it. Maybe it’s a payoff strategy, budgeting tweaks, or an updated retirement contribution plan. Action > anxiety. Make It a Team Effort: Frame it as “how we solve this together,” not “here’s my mess.” Collaborative discussions turn financial challenges into a shared project, strengthening trust and communication. Transparency Builds Momentum: Once the initial awkwardness is over, openness about money sets the stage for all kinds of financial teamwork. This includes saving for retirement, managing bills, or planning for future goals.

Joint Accounts vs. Separate Accounts

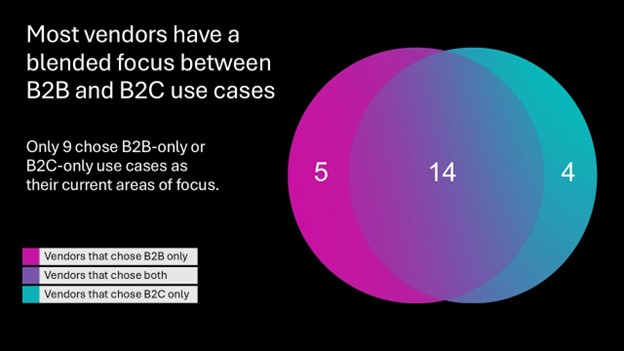

There’s no universal “right” answer when it comes to combining finances. The best approach depends on your relationship, goals, and comfort level. Frame the discussion around shared goals rather than individual preferences.

Be honest about boundaries: Some people feel anxious when all money is pooled, while others find it stressful to manage separate accounts. Discuss comfort levels and compromise where needed Joint Accounts – Teamwork Made Easy: A shared account can simplify bills, savings, and retirement contributions like 401(k)s or IRAs. It makes long-term planning transparent and collaborative, but it requires some trade-off in privacy. Discuss how much openness feels comfortable for both of you. Separate Accounts – Autonomy and Flexibility: Keeping accounts separate lets each person maintain independence and control over spending. You can make experimenting with retirement strategies easier and reduce conflict. Stay coordinated on shared goals so that your household and retirement plans don’t drift apart. The Hybrid Approach: Many couples find hybrid approaches work best one joint account for shared expenses and separate accounts for personal spending. This balance allows you to respect each other’s money style while keeping your long-term goals aligned for 401(k) growth, IRA funding, and debt repayment. Regular check-ins help ensure the system continues to work as circumstances change.

Money isn’t Just About the Numbers

Money talks can feel intimidating, but they’re essential for building wealth, reducing stress, and strengthening relationships.

Whether it’s a family meeting or discussing debt, the key is openness, clarity, and respect.

At Slavic401k, we know financial planning isn’t just numbers, it’s an art. Thoughtful conversation can transform your finances and relationships. Start the conversation today and watch how it transforms your financial future.