How to Build a 401k Prospect Pipeline Process

ERISA is all about process, and what a better way to manage an ERISA prospect than through a consistent, systematic, 401k prospect pipeline process.

There are many ways you might get a new 401k prospect, such as from your website, a seminar or networking event, cold calling, referrals, or content marketing.

Once you have a lead, you should implement a process that provides a professional experience demonstrating your value, and that nurtures and converts them from a prospect to a new plan client.

Prospect Management Best Practices

Before we dive into what a new prospect pipeline process might look like, there are some best practices that you should follow whenever you get a new lead. These include:

Provide them with information about your firm that highlights the benefits you offer retirement plan clients and paints a Tclear picture of your expertise and service model.

Confirm any meeting both in writing (could be via email) and verbally (reminder call the day before).

Always have an agenda for any meeting and include both their objectives as well as your own.

Do your research. Use Google and LinkedIn (or another site where you can get 5500 data) to learn about your prospect and their organization prior to talking with them.

Do not assume that they will not be making a quick decision – but remember the typical lead cycle in the retirement industry is 9-24 months.

Approach any meeting with one goal – to get another meeting. This is how you can build a relationship, learn their value system, and have the opportunity to provide the services they’re looking for and need.

Building a 401k Prospect Pipeline Process

So, now that that’s out the way – what does a solid prospect pipeline process look like?

Here’s an example of how to structure your pipeline process with a lead who has agreed to meet with you…

Step One – Enter the prospect into your database as a new lead.

Step Two – Meeting Prep

EMAIL an appointment confirmation along with a link to your website and/or your brochure as an attachment (or information they requested or about your firm if it was an RFI only).

ALSO MAIL them an appointment confirmation letter. If possible, make it memorable by using a bright envelope, handwritten note, or send a memorable warm up (for example, a book or a magic 8-ball with the words “Do You Have a Successful Plan?” printed on it and mailed in a small box).

Step Three – Conduct the Meeting

Make sure you completed your due diligence on the prospect first.

Bring an agenda.

Bring a capabilities presentation or information about the services you offer and how you help clients.

Bring a discovery meeting questionnaire that allows you to gather data and discover their pain points.

If they do not sign the broker change form or engage you for something specific at your face to face meeting (rarely happens), then offer to help them understand and assess their plan. (Hero7 offers a Plan Governance Index Score that is a GREAT get-your-foot-in-the-door offering for situations just like this.)

Step Three and a Half 😉 – If they agree to a plan assessment or review, gather the necessary data (have any worksheets or a list of information needed ready to go over at this first meeting.)

Present your findings at a follow-up appointment. Explain any discoveries or concerns and let them know how you could help them have a more successful and compliant plan. Always have with you a generic finals presentation (they should all be pretty generic with some common items you find most plans need help with – after all, you’re selling YOU, not any specific provider).

Step Four – Add Prospect into Your Drip Program

If they’re not ready to engage you right away, (or not willing to schedule a next appointment yet), get them into your DRIP campaign so you stay in front of them and they continue to receive information from you on a regular basis.

Include information that is unique to your firm that will help you stick in their mind (article about your volunteer endeavors, award you recently won, case study of a client’s measured improvement, etc.).

Make an action item or task in your CRM system or an appointment on your schedule to call them again in 3 months (maximum) to schedule an appointment that moves them closer to their goals.

Benefits of a Drip Campaign

Why implement a drip campaign? According to figures from the National Sales Executive Association, and The Mind Capture Group:

48% of sales people never follow up with a prospect;

25% of sales people make a second contact and stop;

12% of sales people only make three contacts and stop;

Only 10% of sales people make more than three contacts.

HOWEVER…

2% of sales are made on the first contact;

3% of sales are made on the second contact;

5% of sales are made on the third contact;

10% of sales are made on the fourth contact;

80% of sales are made on the fifth to twelfth contact.

And yet still, we’ve all done it. We’ve let a warm prospect turn cold because of lack of follow-up. It’s not intentional, but it happens to the best of us. Some advisors have even paid thousands of dollars or spent hundreds of man hours to get those leads, only to waste them because of lack of follow-up.

Over the course of a year, a mid-size retirement office might spend upwards of $50k for retirement plan leads through various sources such as direct mail, outside calling firms, etc. And while some new clients might be gained, the majority of prospects are not ready to make any changes on the spot.

New in the prospect pipeline process, these prospects are considered “HOT” prospects. In order to take time out of their busy schedules to meet with you, there was some need or question or issue that they were willing to talk about. However, many (most) are not necessarily ready to move or do something immediately and not following up or following through or keeping in contact is the death of a hot prospect.

If you have a hot prospect and you lose contact with them, 3 months from now they are once again a cold prospect and you will be starting from scratch.

It’s common knowledge that the retirement industry has a long sales cycle and stopping short after the first or second contact or “NOT NOW” response really is flushing money down the drain.

That’s where having a solid “DRIP” campaign (or a system of communicating or reaching out to your prospect with regular information of value) comes in. It’s important to implement a process that allows you to stay in front of prospects if you want to increase your chances of converting them to clients.

Drip Delivery Methods

When it comes to building a drip program, you need a plan to reach them that incorporates multiple methods of delivery.

Many people are more technologically savvy today than they were 20, 10, or even just 5 years ago. Most people now read their news online, communicate via email, and many prefer zoom meetings over face to face. This means you have to be able to provide various methods of communication to accommodate those that fully embrace technology.

Here’s something else you should keep in mind as well… many people are NOT technologically savvy. They may survive online ;-), but deep down, they’d prefer the old fashioned face-to-face, let-me-hold-it-and-feel-it-in-my-hands method of communication. You must integrate more than just email and online touches into your drip campaign in order to reach all communication preferences and personality types on your prospect list.

A solid communications program should include various components as well – such as credibility-building emails, printed communications, follow-up phone calls, webinars or seminars, luncheons, and offer to meet face to face at least every 3 months.

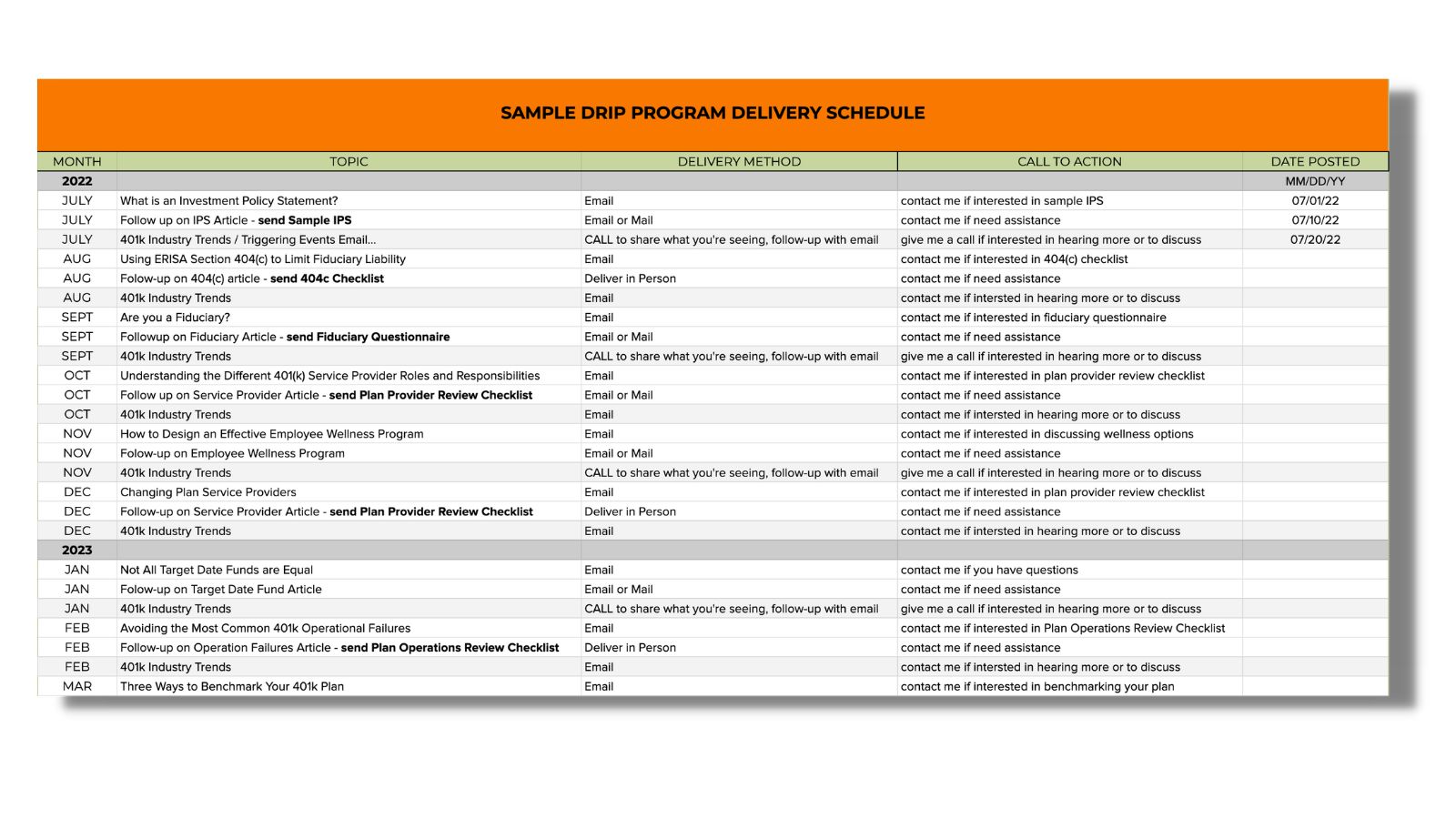

Sample Drip Campaign

Here’s an example of a drip campaign (from the Prospect Drip Content in a Box Kit).

This one has been laid out to send communications in a pattern of sending one monthly email on a specific topic, following it up with another email (or printed and mailed follow-up), calling every 2 months, and stopping by once a quarter. The drip schedule you determine should be appropriate for your business resources.

That being said, the content you send should always be educational in nature (such as the educational articles, fact sheets, white papers, etc.).

You should avoid trying to sell in your drip communications and strive to provide valuable content and information they can benefit from. Doing this, allows you to position yourself as an expert in the industry.

Persistence pays off and those that develop and implement solid drip campaigns to stay in front of prospects greatly increase your chances of closing more new business.

Drip Program Implementation

To implement a solid drip campaign, here’s what you must do:

Don’t let leads gather ANY dust. Create a solid PROCESS to keep in contact with them and your name in front of them.

Create a 12 month drip calendar and plan out what content you’ll send each month. You can leverage provider material, BD material, or create additional material in-house (or consider the done-for-you content found in the Prospect Drip Content in a Box found here). When possible, leverage material already developed and compliance approved.

Decide HOW often you want to contact your list.

Then decide what type of content you want to provide.

And finally, HOW (email, mail, webinar, etc).

Be prepared with a follow-up plan. Have material available to send as a successor on topics prospects express concern about or interest in. For example: they click the link or open the email you send about fees; follow-up with them by sending a fact sheet or whitepaper about fee disclosures or the importance of benchmarking, then call them to identify the real need and set an appointment.

The CONTENT should be interesting, relevant, timely, engaging, and/or get them to your website to capture their email address, answer a question, vote on something, or download something. (If you give them an interesting article to read with no ACTION to take, don’t expect them to do anything more with it than read it.)

Avoid These Common 401k Prospect Pipeline Process Mistakes

Some of the most common mistakes that you’ll want to avoid when implementing a drip campaign include:

Failure to Prepare: such as developing a schedule but failing to prepare ahead of the implementation date by not having the material on hand and compliance approved.

Inability to Implement: such as not having the right systems in place to implement an email campaign to multiple contacts, no website links or forms set up, etc.

Outdated Data on Your Prospect Lists: It’s important to make sure your mailing and email lists are current or you’ll end up wasting postage, getting bounced emails, and a campaign that’s never read by your intended audience.

Giving up Too Early: Ensure you give any communications program enough time; do not give up after just three or four emails. Think of your drip campaign as an ongoing credibility-building, expert-positioning strategy that is an ongoing initiative.

Avoid the common mistakes by planning ahead, being patient and persistent, tracking your clicks to identify who’s opening the emails, following-up when prospects express an interest in a topic you’ve sent out, and consider outsourcing if you’re unable to implement a consistent drip campaign in-house.

Effective 401k Prospecting Strategies

This article is part of a series covering effective 401k Prospecting Strategies. You can access the full series using the links below:

Listen to the Podcast episode of this topic here (coming soon).Or watch the video on YouTube here (coming soon).