401k Prospecting Strategies – Push vs. Pull

So you want to grow your 401k plan business, but you’re not sure the best strategies that will work for you…

In this recent article, I gave some examples of proven tactics that work in the 401k industry.

But I think it’s important to understand what the two main strategies are, and how to figure out which strategies – and which tactics – will work for you.

Strategy One – Outbound Marketing (Pushing Out Your Message)

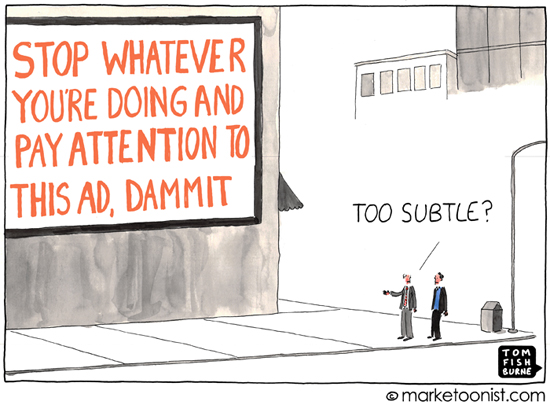

Outbound marketing is an approach where businesses advertise their products and services by presenting information to consumers even if they are not looking for those products or services. Think of outbound strategies as a hammer.

Seth Godin coined the term “Interruption Marketing” to describe outbound marketing, since they are basically tactics that work only if they interrupt you to get your attention. Think of the ads you’re forced to watch at the beginning of a YouTube or Facebook video.

(You can read the first four chapters of Seth’s book titled, Permission Marketing where he discusses this strategy in detail here.)

There are three outbound strategies advisors often use:

direct mail,

advertising,

and cold calling (also known as telemarketing).

Each of these methods pushes out a message both far and wide with the hope that the message will resonate with your target audience.

Strategy Two – Inbound Marketing (Pulling Prospects to You)

The opposite of Outbound marketing is what’s referred to as Inbound Marketing. Inbound marketing is any tactic that relies on earning people’s interest instead of buying it.

The idea of inbound marketing is that you target a core audience by providing useful and quality content to entice them into finding out more about your products or services.

So, in essence, you give them something in order to get them to come to you. TO PULL them to you. Think of inbound marketing them as a magnet that draws people to learn more about you through the valuable content you deliver.

The 3 common inbound strategies advisors often use include:

networking,

referral marketing,

and publishing (known as content marketing)..

Why is inbound marketing a more effective approach than outbound marketing?

(And in case I didn’t mention it – it is a more effective approach  – year after year my marketing effectiveness survey completed by 401k plan advisors shows that the most effective strategies are always inbound strategies. Not to say that outbound strategies don’t work – they just aren’t as effective for most people.)

– year after year my marketing effectiveness survey completed by 401k plan advisors shows that the most effective strategies are always inbound strategies. Not to say that outbound strategies don’t work – they just aren’t as effective for most people.)

For starters, it doesn’t interrupt what are clients are focused on that’s enjoyable. Instead, it gives them something valuable and enjoyable to focus on.

It’s also much more cost effective and can help you build authority and credibility when you offer so much value, that people seek you out rather than the other way around.

The Bee and the Flower Analogy

A great analogy I heard was from Brendon Burchard, speaker, author, and business coach at one of his live events I attended.

A great analogy I heard was from Brendon Burchard, speaker, author, and business coach at one of his live events I attended.

He told this great story about how you need to stop buzzing around from flower to flower trying to find and bring back pollen to make honey. You need to stop buzzing around like busy little bees and instead, be the flower that attracts the bees to you.

Think about the bee – frantically flying from one flower to the next, collecting the pollen for the hive. Every day it starts over frantically flying from one flower to the next gathering the pollen. Eventually, it wears itself out and dies.

With outbound marketing, you’re the bee – everyday starting over, going from prospect to prospect trying to gather enough pollen to make honey.

On the other hand, imagine you’re the flower. The flower doesn’t move from one place to another. It stays in one place. It’s bright and attractive, inviting bees to stop by and take a look. In order for the flower to grow and be productive, it must be pollinated by the bee. The bee is attracted to it by its scent and therefore the bee pollinates it when it moves from one flower to the next.

When a bee finds an attractive flower with a good supply of pollen, it flies back to the hive and tells the other bees by performing a sophisticated waggle dance communicating the distance and direction of the flower from the hive, the type of flower it is and the potential size of the discovery. It’s only going to do this of course if the pollen was good – so you have to provide a good customer experience.

The brighter and sweeter the scent of the flower, the more likely prospects are to find you (this equates to distinct branding and value) and the more pollen you provide (which equates to value and customer experience), the easier it is to attract referrals.

Learn to be the flower that attracts the bees. It’s a much wiser and efficient service model.

Which Marketing Strategies and Tactics Will Work For You?

While the Marketing Effectiveness Survey suggests that the inbound strategies are more effective in the 401k industry, the reality is, the only strategies that will work for you, according to David Newman of, Do It! Marketing, are the ones you find easy, enjoyable and effortless.

Think about it, the opposite of easy, enjoyable and effortless is hard, difficult and painful. And you don’t want marketing that is hard, difficult and painful.

You don’t need to throw spaghetti at the wall and try all strategies just because it’s what you think you should be doing or someone told you it worked for them. Doing LESS is actually a more effective strategy. Pick the strategies that have worked for you in the past, the ones that you enjoy doing, and do more of that!

I’ll say it again – identify your strengths and do more of what you know works!

Gary Vaynerchuk, author of the book, Jab, Jab, Jab, Right Hook, made a great point in his keynote speech at the INC 500 Seminar – he said, “Instead of working on your weaknesses, quadruple down on your strengths!”

And I quote, he said “I bet on my strengths, not my weaknesses. I don’t work on my weaknesses. I think it’s a waste of time. I think it’s going on the defense, I’m always on the offense. I know what I’m good at, and I triple, quadruple down on it.”

You need to do the same thing.

There’s a worksheet I created that you can download and complete – it’s called Identifying Your Marketing Money Makers. If you take time to complete this, it will help you identify the strategies that you should be working on that will be the most effective for you.

Earn the a Seat at the Table…

Regardless of which marketing method you ultimately decide to pursue for growing your 401k business, finding quality leads requires these 2 key things:

For you identify and only use those marketing methods that are most effective – for you,

And for you to understand that any method can work if you realize that there is no such thing as closing the sale – you must always be building and nurturing the relationship through the contribution of ongoing value.

David Newman said it best with this question you should ask yourself…

”What VALUE have I ADDED to my prospect’s world in order to EARN the RIGHT to INVITE them to a conversation and OFFER my solutions to their problems, headaches, heartaches, and challenges?”

Making Any Strategy Effective…

This article is part of a series covering effective 401k Prospecting Strategies.

In this next few articles, I want to help you understand how to make three specific strategies more effective since these are the ones around which I get a lot of questions from advisors.

The first one we’re going to cover is referral marketing which is by far the most effective strategy if you employ it correctly.

Second, we’ll go over content marketing since this is the trend, the internet publishing, the inbound, add-tremendous-value-without-a-lot-of-cost marketing, and it complements some of the strategies in referral marketing.

Finally, telemarketing is a strategy that almost everyone has tried and many are still using so I want to share some techniques that can make this work for you if it’s on your marketing money makers list.

You can access the full series using the links below:

Part 1 – 401k Prospecting Strategies – Push vs. Pull (this article)

Part 2 – How to Get Referrals the Right Way

Part 3 – How to Use Content Marketing to Grow Your 401k Plan Practice

Part 4 – Cold Calling 101 – Tips for Success

Part 5 – How to Build a 401k Prospect Pipeline Process

Part 6 – What I Learned from Jane Murphy That Can Help You Close More 401k Plan Business

Part 7 – Education-Based Marketing – An Effective 401k Business Growth Strategy

Part 8 – The 5 Success Principles for Closing More Business and Creating Raving Fans

Listen to the Podcast episode of this topic here (coming soon).

Or watch the video on YouTube here (coming soon).

Image Credits:

Cartoon – Marketoonist.com

Flower – Janosch Diggelmann

Affiliate Disclaimer: As an Amazon Affiliate, if you make a qualifying purchase on Amazon, I may receive a commission (at no extra cost to you). I only recommend books I’ve read and feel you can benefit from.