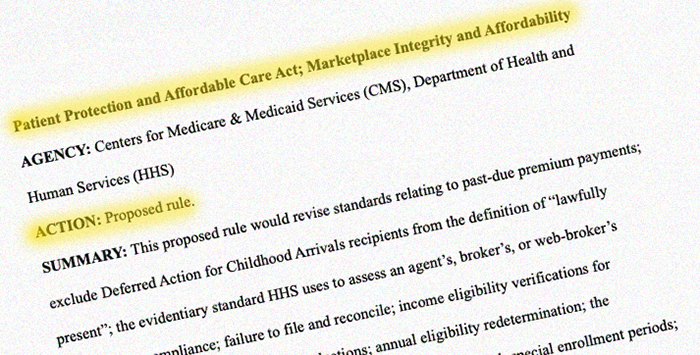

A proposed federal rule issued this week would, if finalized, bring wide-ranging changes for the Affordable Care Act’s health insurance Marketplace, including a shorter open enrollment period in all states.

The Centers for Medicare & Medicaid Services (CMS) issued the proposed rule on March 10. A final rule would modify numerous regulations affecting consumers’ access to Marketplace coverage and financial assistance.

CMS projects that the proposed rule changes will result in between 750,000 and 2 million fewer Marketplace enrollees in 2026, compared to enrollment projections under existing Marketplace rules. This is separate from the reduced enrollment that was already expected in 2026 due to the expiration of the American Rescue Plan’s subsidy enhancements at the end of 2025.

Let’s take a look at some of the rule changes that could affect consumers’ costs and access to Marketplace coverage.

Open enrollment period would be shortened in all states

CMS has proposed that open enrollment should run from Nov. 1 through Dec. 15. in all states. The dates of open enrollment have varied over the years, but have most recently been set at Nov. 1 through Jan. 15 in most states.

In the past, HHS has given state-run exchanges the option to offer longer open enrollment periods. But the new proposal calls for the December 15 end date to apply to all exchanges.

As is already the case, the open enrollment period would apply both on-exchange and off-exchange.

In the 31 states that use HealthCare.gov, more than 17.1 million people enrolled in Marketplace coverage during the open enrollment period for 2025 coverage. Of those, 16.6 million had completed their enrollments by Dec. 15. So the majority of enrollees do sign up by mid-December, in time to get full-year coverage for the coming year. Only about 529,000 people enrolled via HealthCare.gov between Dec. 16, 2024 and Jan. 15, 2025, accounting for about 3% of total enrollment.

But if open enrollment ends on Dec. 15, absent a special enrollment period, an applicant or enrollee will no longer have an opportunity to pick a different plan after the start of the calendar year. This will make it particularly important for enrollees to pay close attention to communications they get from their plan and the Marketplace before and during open enrollment, to ensure that there are no unwelcome surprises regarding their coverage or premiums in January.

Rule would eliminate the low-income special enrollment period

For the last few years, there has been a year-round enrollment opportunity in most states in the form of a special enrollment period for people who are subsidy-eligible and have a household income that isn’t more than 150% of the federal poverty level (FPL). For a single adult in the continental United States, that’s an income of $22,590 in 2025.

The proposed rule would end this year-round enrollment opportunity. This change would apply nationwide, including in states that run their own exchanges.

Many other provisions of the proposed rule are slated to take effect for the 2026 or 2027 plan year. But the proposed rule calls for the low-income SEP to end almost immediately, on the effective date of the final rule.

In justifying the proposed rule, CMS noted that the year-round SEP for low-income enrollees was “one of the primary mechanisms” that contributed to the unauthorized enrollments that made headlines in 2024.

Rule would eliminate enrollees’ ability to auto-renew $0-premium coverage

Under current rules, if a Marketplace enrollee lets their plan auto-renew and is eligible for a subsidy that covers their entire premium, their after-subsidy premium can continue to be $0 in the coming year. (This isn’t always the case, as it also depends on how subsidy amounts change based on the cost of the second-lowest-cost Silver plan.)

Under the proposed rules, the Marketplace would have to reduce the person’s subsidy amount by $5/month, resulting in a $5/month after-subsidy premium for the enrollee. This premium would be imposed until the enrollee updates their information with the Marketplace so that an updated eligibility determination can be made.

This proposed rule would apply starting with the 2026 plan year in states that use HealthCare.gov, and starting with the 2027 plan year in states that run their own Marketplace platforms.

As a result of this proposed rule, people with fully subsidized plans who rely on auto-renewal and don’t update their Marketplace account by Dec. 15 would continue to have coverage as of January, but with an after-subsidy premium of $5/month.

(If and when the enrollee updates their eligibility with the Marketplace, they would qualify for the full amount of the subsidy based on their updated information. And if they would have qualified for a full subsidy, the $5/month could be recouped when they reconcile their premium tax credit on their tax return – as is always the case when an enrollee is owed additional premium tax credits).

CMS is also soliciting comments on whether the amount should be higher than $5, as well as whether auto-renewal should even continue to be possible for fully subsidized enrollees.

Previous analyses have found that when net premiums increase from zero to even a dollar or two per month, the result is a drop in enrollment.

Maximum out-of-pocket limits would increase for 2026 plans

Under current rules, 2026 Marketplace health plans would have maximum out-of-pocket (MOOP) limits as high as $10,150 for a single individual, and $20,300 for a family. Under the proposed rule, those limits would increase to $10,600 and $21,200, respectively.

This would also result in higher MOOPs for Silver plans with integrated cost-sharing reductions, as those values are based on reducing the standard MOOP by a set percentage.

The change would stem from a new methodology for indexing these amounts, reverting to a methodology that was briefly used under the first Trump administration.

If finalized, the MOOP for a single individual will rise from $9,200 in 2025 to $10,600 in 2026 – a 15% increase.

Rule would require additional documentation for enrollment and subsidy eligibility

HHS has proposed several rule changes that would require more documentation and verification to enroll in Marketplace coverage and qualify for financial assistance. They include:

Verification of SEP eligibility

Since 2023, the federally run Marketplace has only required pre-enrollment proof of SEP eligibility if the qualifying life event is the loss of other coverage. The proposed rule would remove that limitation and allow pre-enrollment eligibility verification for any SEP.

Further, it calls for all exchanges – including HealthCare.gov and state-run exchanges – to verify eligibility for at least 75% of new enrollees utilizing SEPs. The proposed rule notes that most exchanges would only need to require eligibility verification for their two most-used SEPs to meet this target.

Additional income verification

The new proposed rule would require more documentation to verify that some enrollees are eligible for Marketplace subsidies. If the Marketplace’s trusted data sources (IRS data, for example) indicate that an applicant’s household income is below the FPL but the person attests to an income of at least the FPL, the new proposed rule would require the Marketplace to generate a data matching inconsistency. These must be resolved for the person to qualify for Marketplace subsidies.

CMS has also proposed that if the Marketplace requests income data from the IRS and is told that it’s not available, the Marketplace cannot just rely on the applicant’s attested income. Instead, the Marketplace will need to use other trusted data sources to verify the applicant’s income, or the applicant will need to submit proof of income.

Shorter window to provide income documentation

The ACA provides applicants with a 90-day window to provide requested income verification documentation, and subsequent rules added an automatic 60-day extension, without the enrollee needing to request it. HHS has proposed removing that automatic extension.

Additional rule changes

The proposed rule calls for various other provisions, including:

Allowing insurers to require people to pay past-due premiums before they can re-enroll in new coverage. This was previously required under rules that were finalized in 2017, but a rule finalized in 2022 prohibited insurers from doing this.

Prohibiting DACA recipients from enrolling in Marketplace coverage nationwide, or receiving federal premium subsidies or cost-sharing reductions. (DACA recipients are already blocked from enrolling in Marketplace coverage in 19 states.)

Cutting off an enrollee’s eligibility for advance premium tax credit (APTC) if they fail to reconcile the prior year’s APTC on their tax return. Current rules cut off APTC only after the person has failed to reconcile APTC for two consecutive years.

Repealing the current auto-renewal protocol that allows the exchange to move an enrollee (who is eligible for cost-sharing reductions) from a Bronze plan to a Silver plan if one is available with the same provider network and product type, and with equal or lesser premiums after the premium subsidy is applied.

Prohibiting individual and small group plans from covering “sex-trait modification” (gender-affirming care) as an essential health benefit (EHB). If a state mandates coverage of gender-affirming care, the state would have to defray the cost of that coverage. And if an insurer were to voluntarily cover gender-affirming care, it could not be as part of an EHB. This would ensure federal premium subsidies could not be used to offset the cost of that portion of the coverage.

Once the proposed rule is published in the Federal Register, there will be a 30-day window during which the public can submit comments, which will be taken into consideration before the rule is finalized.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.