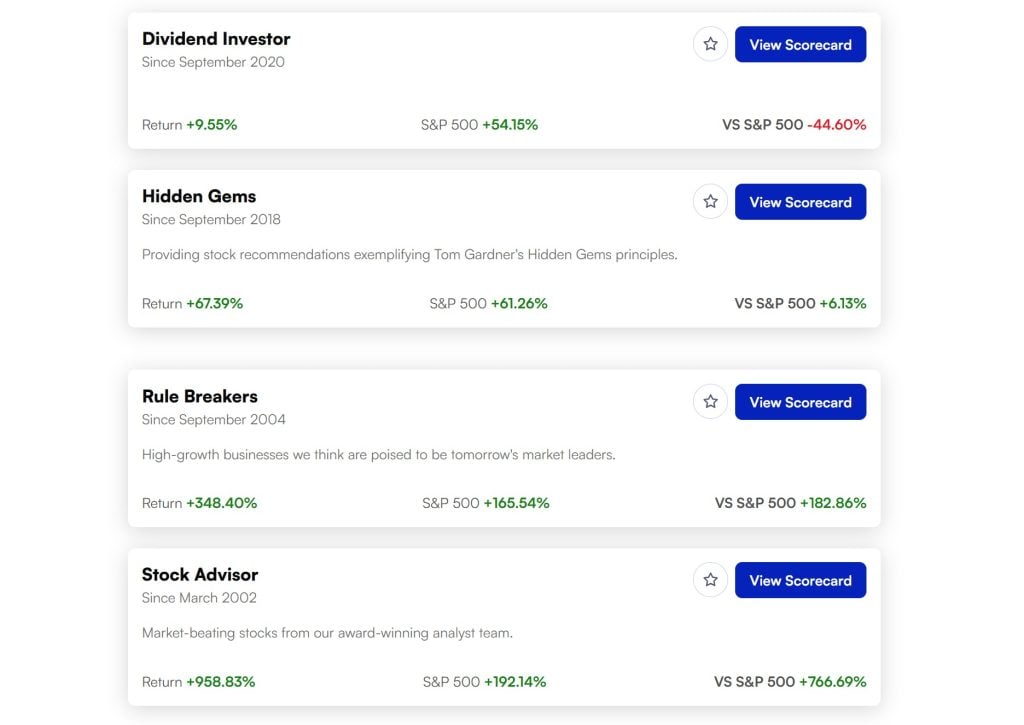

The Motley Fool is one of the most popular and successful investment research companies in the game t today. Its Stock Advisor service has beaten the S&P 500 952% to 193% since it launched in 2002 (as of December 2025). That’s a massive outperformance that few other services can match.

But there’s more to Motley Fool than just Stock Advisor. Motley Fool Epic is a bundle that includes Stock Advisor and three additional stock recommendation services: Rule Breakers, Hidden Gems, and Dividend Investor.

In this guide, I’ll take a closer look at both Epic and Stock Advisor to help you decide which service is right for you.

Stock Advisor

Let’s start off with Stock Advisor. This stock recommendation service has been around since 2002 and has beaten the S&P 500 by a more than 4x margin as of December 2025. I’ve tested a lot of stock recommendation services, and none of them have matched Stock Advisor’s consistency or overall performance.

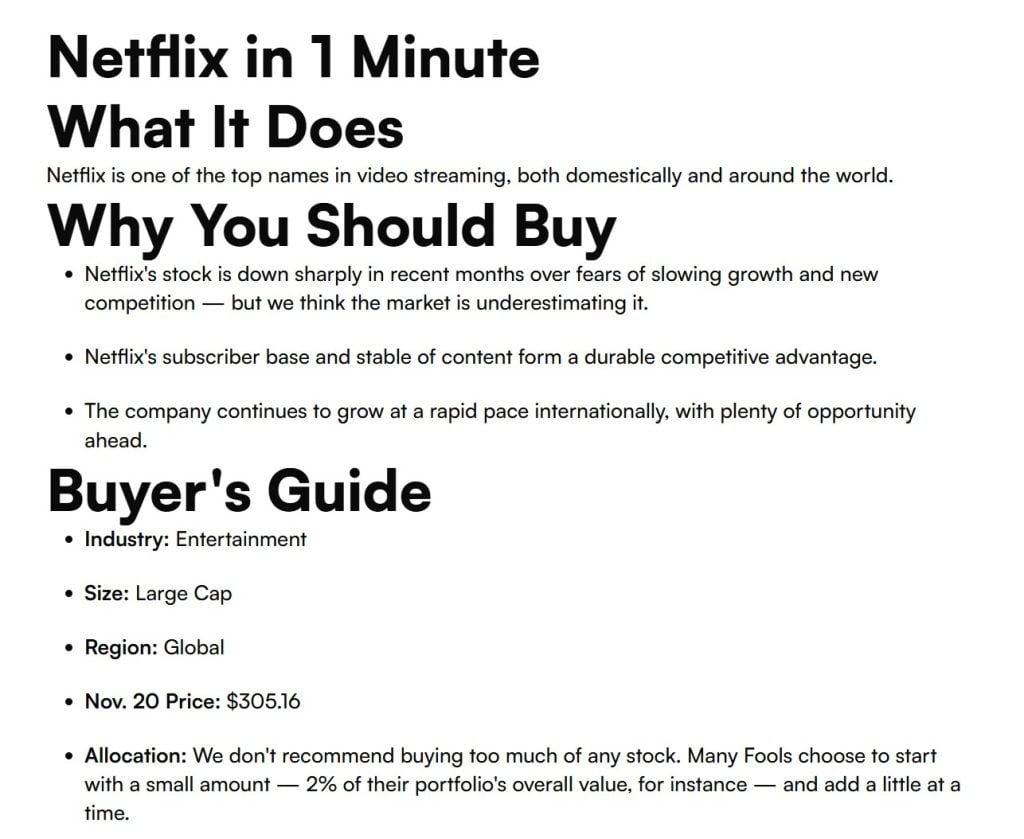

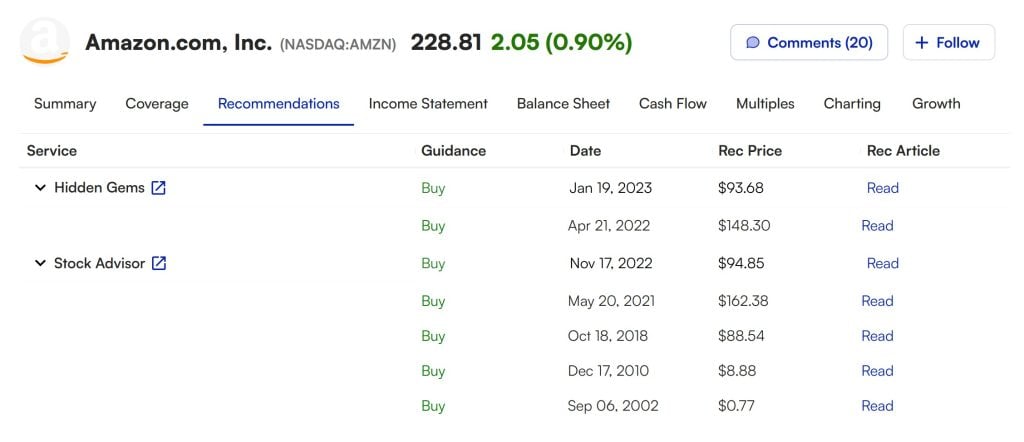

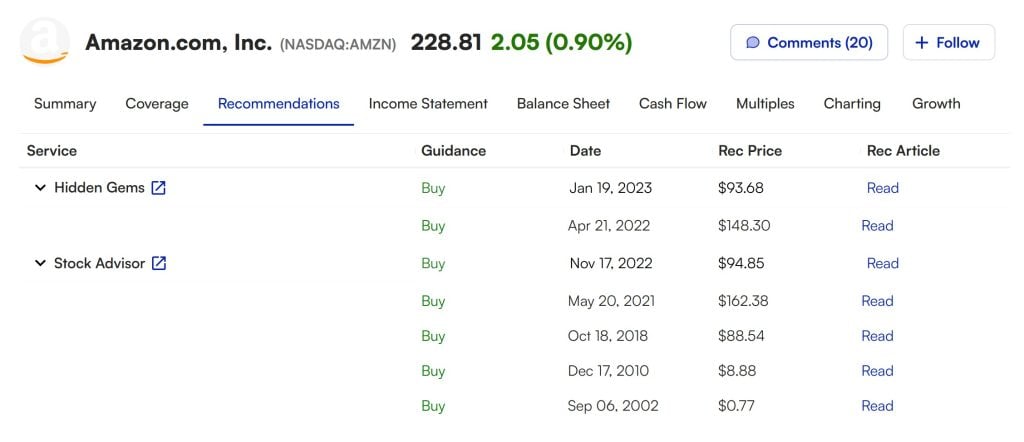

With Stock Advisor, you get two new stock recommendations every month. The portfolio is focused on long-term, potentially explosive growth stocks. It invested in Netflix back in 2003 and Nvidia in 2005. Importantly, you’re expected to hold onto recommended stocks for at least five years, and potentially a lot longer. Netflix and Nvidia are both still in the portfolio more than 20 years after Stock Advisor initially recommended them.

Each stock recommendation is accompanied by a research report that breaks down what the company does and what the Stock Advisor team sees in it. I like these reports a lot because they’re easy to read and focus more on long-term trends and market opportunities than on detailed financial data. The reports also highlight potential risks of each stock so you know exactly what you’re investing in.

The other thing you get with Stock Advisor is a pair of lists to help you invest in between new recommendations. The first list is Stock Advisor’s Foundational Stocks list. These are 10 high-conviction stocks that the Motley Fool team thinks every growth investor should own. These stocks are always recommended if you have extra cash to invest and they’re a great place to start if you’re new to Stock Advisor.

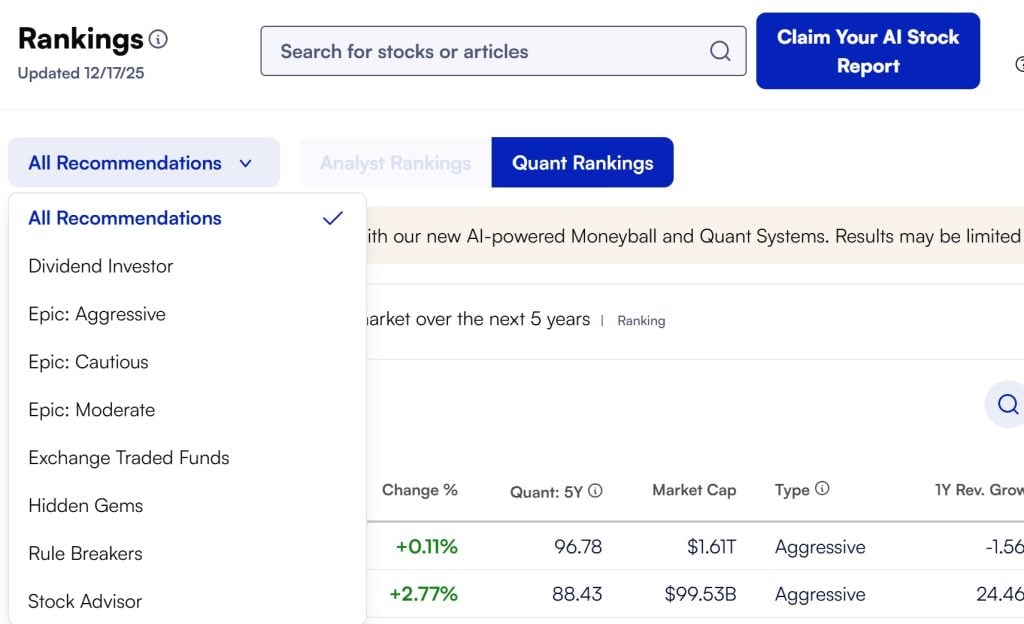

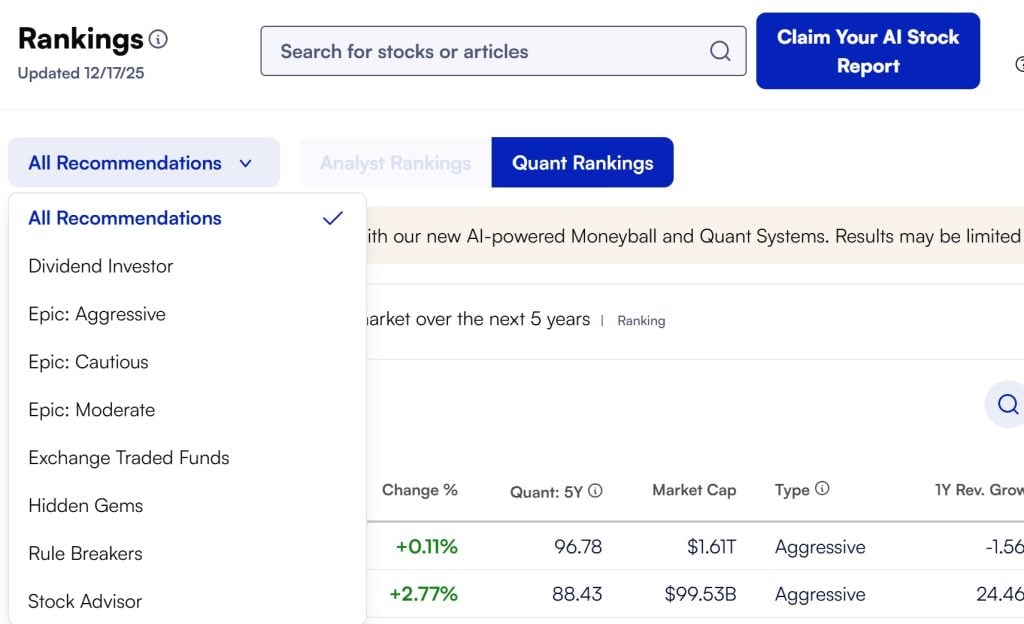

The second list is the Rankings list. This list covers 10 stocks already in the Stock Advisor portfolio that could be smart to re-invest in right now. The stocks in this list might be experiencing a pullback, coming off a strong earnings report, or be in a high-momentum sector. The list is updated every month, ensuring you always have access to timely ideas when you have extra cash to invest.

Overall, the Stock Advisor system is very easy to follow and doesn’t take much attention. You can just log in every two weeks to see the latest recommendation and use the research report to decide if it’s a good fit for your portfolio. If you want to be more involved, the Foundational Stocks and Rankings lists offer more ideas in between new recommendations.

Best of all, Stock Advisor is very inexpensive. You’ll pay $99 for your first year and $199 per year after that. It’s one of the most affordable stock recommendation services available.

New Member Special

Get Stock Advisor for Only $99 for Your First Year

(regularly $199)

Epic

Epic is a Motley Fool service that includes four distinct stock recommendation services: Stock Advisor, Rule Breakers, Hidden Gems, and Dividend Investor.

The format of each of these services is pretty similar to Stock Advisor. The biggest difference is that Rule Breakers, Hidden Gems, and Dividend Investor offer one new recommendation per month, for a total of five per month when you subscribe to Epic. All three services include research reports for each new recommendation and their own monthly Rankings lists, but only Rule Breakers has its own Foundational Stocks list.

So, what’s the difference between these services? For Stock Advisor, Rule Breakers, and Hidden Gems, the answer is not all that much.

Rule Breakers and Hidden Gems are run by different teams of analysts within Motley Fool, but they’re the same teams that contribute recs for Stock Advisor. All three services are focused on the same kind of long-term growth stocks and have the same five-year minimum investment horizon. There’s even some overlap in the specific stocks they recommend.

This can be helpful at times. For example, if you see the same stock recommended across multiple services or appear in multiple Rankings lists, that’s a strong sign of conviction in the company. On the other hand, the similar focus across services means there isn’t a ton of diversification in either strategy or the specific stocks you own.

Rule Breakers has been around since 2004 and has performed quite well, beating the S&P 500 342% to 166% as of December 2025. But Hidden Gems hasn’t been as impressive, beating the S&P 500 just 65% to 62% since it launched in 2018 as of December 2025.

Dividend Investors is a bit different from the other services because it does adopt a different strategy. Instead of focusing on high-growth stocks, this service looks for strong dividend-paying companies that have the potential to deliver a market-beating total return.

I really like the inclusion of Dividend Investors in Epic because it can go a long way towards diversifying your portfolio and generating some cash flow. The problem is that since the service launched in 2020, it’s underperformed the S&P 500 10% to 55% as of December 2025. I’m hopeful that Dividend Investor can turn things around since it’s just barely beyond five years since launch, but the service has a lot of catching up to do.

Importantly, while Epic includes a lot more recommendations and research than Stock Advisor alone, it’s also much more expensive. Epic costs $299 for your first year, then $499 per year after that.

Special Offer

Save $200 on Motley Fool Epic

Stock Advisor vs. Epic: When Should You Upgrade?

Is Epic worth the extra cost for you? That depends on a variety of factors, including your investing style, your portfolio size, and how involved you want to be with your portfolio.

Let’s talk about your investing style first. Stock Advisor and Epic both primarily focus on long-term growth stocks. This is great for growth investors, but it’s not the right approach for everyone. If you can’t commit to investing in recommended stocks for at least five years or prefer value investing, then neither Stock Advisor nor Epic will be a good fit for you. Dividend Investor, which is included with Epic, can be a nice bonus for investors interested in generating cash flow, but I wouldn’t recommend buying Epic just for this one service.

When it comes to portfolio size, I found it takes a minimum portfolio of between $1,000 and $2,000 to recoup Stock Advisor’s annual fee. the $199 annual subscription cost. In my opinion, a larger portfolio is better so you can invest in all the recommendations, so take this range as a minimum.

For Epic, you may need more capital to invest to recoup the service’s cost and to take advantage of all the additional stock recommendations. I recommend a minimum portfolio of at least $5,000, and ideally $10,000 or more. In my opinion, much larger portfolios could benefit from Epic since you get more recommendations along with a second Foundational Stocks list and more monthly Rankings list to help you to decide what to do with extra cash.

Ultimately, one of the biggest differences I’ve found between Stock Advisor and Epic is in how much effort the two services require. Stock Advisor is ridiculously easy—all you have to do is check out the new recommendation every two weeks, and you can quickly pull ideas from the Foundational Stocks or Rankings lists if you have extra money to invest.

Epic, on the other hand, gives you a lot more ideas and research to think about. Realistically, most people aren’t going to invest in five new recommendations per month, so you’re going to have to make choices about which recommendations to follow. I often look across the Stock Advisor, Rule Breakers, and Hidden Gems to find stocks that have been recommended by multiple services and appear on multiple Rankings lists. I also read multiple research reports on a single stock to see why different sets of analysts are recommending the same company.

This is all great for finding strong companies, but it takes a lot of time and a lot more thought compared to using Stock Advisor on its own—and not everyone wants to put this level of work into investing.

With all this in mind, I recommend most investors start out with Stock Advisor rather than jump straight to Epic. You can use Stock Advisor to get your portfolio off the ground, supplement your existing investment ideas, and generally get a feel for how the Motley Fool system works. If, after the first year, you find yourself wanting more investment recommendations, then consider upgrading to Epic. Since Motley Fool focuses on long-term investments with a minimum horizon of five years, you’re not going to miss much by taking a year to try out Stock Advisor first. Plus, you’ll already have a Motley Fool-inspired portfolio underway and have a clear understanding of how you can put Epic to work for you.

Conclusion: Epic vs. Stock Advisor

Stock Advisor and Epic are both excellent stock recommendation services with a lot of overlap, but also some important differences. I recommend most investors start out using Stock Advisor, then upgrade to Epic if you want more stock research and recommendations.

If you’re still on the fence about which one is right for you, check out my full Stock Advisor review and Epic review to learn more about everything these two services offer.