Goldman Sachs Warns: Tech ‘Superstars’ Could Lose Their Shine

Goldman Sachs strategists are sounding cautious about the market’s biggest winners, warning that the “superstar” tech stocks powering recent gains may not stay invincible forever.

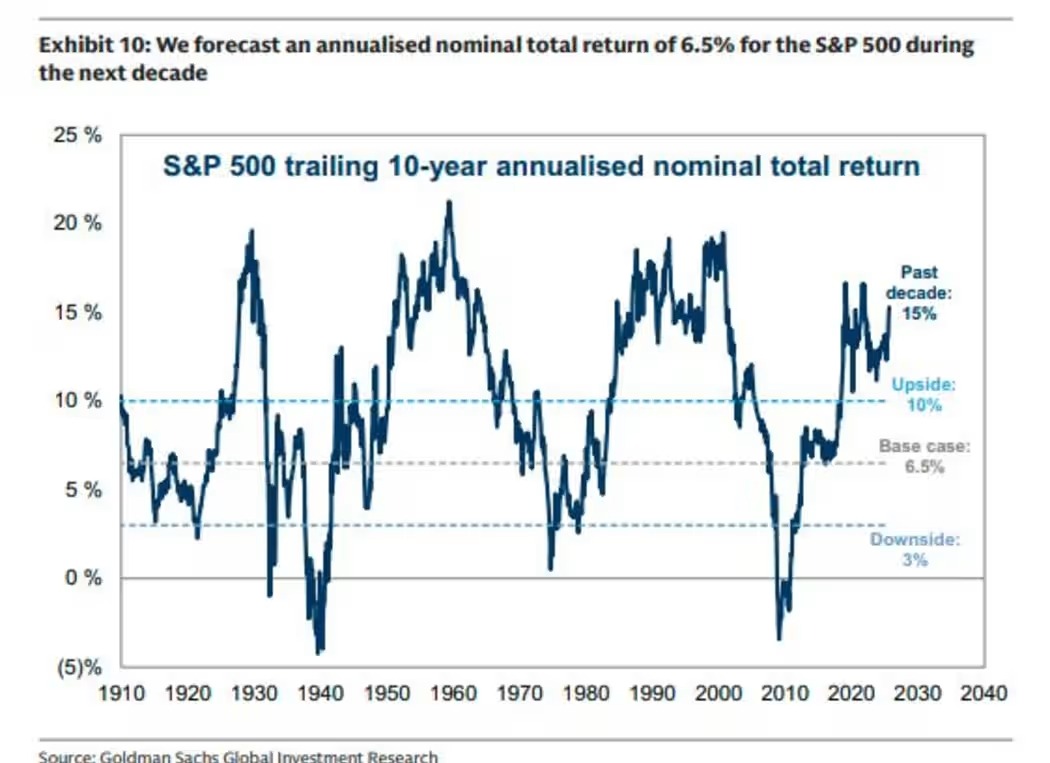

As one of the first Wall Street banks to publish forecasts for next year, Goldman expects the S&P 500 to reach 7,600 by the end of 2026 — an 11% gain from current levels. Looking further ahead, chief global equity strategist Peter Oppenheimer and his team project the index will deliver a 6.5% annualized return over the next decade, slightly below their 7.7% forecast for global equities. Historically, that sits at just the 27th percentile of returns since 1990.

Goldman’s 10-year outlook includes both bullish and bearish scenarios, ranging from 3% to 10% annualized returns.

The 6.5% base case assumes 6% earnings-per-share growth, offset by a 1% valuation decline and a 1.4% dividend yield. The projection also reflects revenue growth in line with nominal GDP and a modest boost from a weaker U.S. dollar.

The firm notes that corporate profit margins are near record highs at 13%, up from 5% in 1990, thanks to globalization, lower interest rates, and falling corporate taxes — advantages that may fade in the coming decade.

Goldman’s valuation model, which factors in long-term interest rate and inflation assumptions and a 4.5% nominal Treasury yield by 2035, suggests little change in corporate profitability ahead. That implies a forward P/E of 21 for the S&P 500 in 10 years — down roughly 10% from today’s multiple of 23.

“Without a sharp rise in interest rates or a major hit to corporate profits, U.S. equity valuations are likely to remain above long-term averages,” Oppenheimer’s team wrote.

However, the strategists flagged one key risk: extreme market concentration. The dominance of a handful of mega-cap tech firms has inflated both valuations and index returns. If those companies maintain their edge, market performance could continue to exceed expectations — but if they stumble, and no new leaders emerge, broad-market returns could take a hit.

On the flip side, AI remains a major upside risk. Stronger-than-expected adoption could lift profits and margins, driving EPS growth as high as 9%, versus the current 6% baseline.