There are lots of digital trading platforms that claim to be commission free. Commissions are a type of fee, but not all fees are commission.

If you’re someone who’s considering Webull as a trading platform, you may be wondering the same thing many traders ask:

Does Webull charge fees?

The answer isn’t as simple or yes or no. Webull does offer commission-free trading, there are fees for some activities.

It’s for that reason that it’s so crucial to understand Webull’s fee structure if you’re a cost-conscious trader.

Webull charges fees for certain activities in your brokerage account, including some trading fees. There are also options trading fees, futures fees, and withdrawal charges.

In this overview of fees, we’ll explain exactly what they charge and when, so you’ll be able to make an informed decision about whether trading on Webull is right for you.

Webull Trading Fees: What You Need to Know

We’ll start with Webull trading fees. One of the mistakes that new traders make is assuming that when a platform doesn’t charge commissions it means there are no fees.

Is Webull Free?

There’s a difference between a commission-free platform and a free brokerage account. Webull doesn’t charge commissions for most trades, but it does charge fees.

Short answer: No, Webull is not free.

It is a low-cost trading platform. If you’re mostly trading stocks and ETFs, you can expect:

No commission

No trading fees

Regulatory and exchange fees

That last item is important to understand. Webull is a registered broker-dealer. That means it’s regulated by the Securities & Exchange Commission (SEC) and a member of FINRA. Both charge regulatory fees.

In addition, there may be fees charged by certain exchanges. Webull doesn’t charge a fee for stocks and ETFs traded on US-based exchanges.

How Much Does Webull Charge Per Trade?

You might be wondering how much Webull charges for stock and ETF trades. There are three regulatory fees you should be aware of.

You’ll notice that these fees are all quite low. For a $1,000 trade, you’d pay $0.0278 to the SEC, $0.166 to FINRA, and $0.04 to Webull for a total of just $0.2338. That’s less than a quarter for $1,000 worth of trades.

Webull Options Fees: Costs for Day Traders & Options Traders

Day trading and options are two of the more advanced trading features on Webull. Here’s what you need to know about the costs.

Does Webull Charge Fees for Day Trading?

Day trading stocks comes with some risks (read: WEBULL DAY TRADING), but it doesn’t come with higher fees on Webull. The same three fees we outlined in the previous section are charged on all day trades.

One thing that you’ll need to remember is that there are strict rules for day trading. You can day trade as much as you want with a cash account. If you use a margin account, you’ll need a minimum of $25,000 in your account, otherwise you may only execute three day trades in any rolling five-business-day period. This is known as the Pattern Day Trading (PDT) rule.

The other consideration is the difference between settled and unsettled funds. When you sell a stock, it may take several days for it to be settled by the SEC. If you make too many trades with unsettled funds, Webull may penalize you.

Breakdown of Webull Options Fees

Trading options on Webull is a more complex undertaking than trading stocks or ETFs. In addition to regulatory fees, you’ll also need to pay exercise/assignment fees. Here’s how Webull options fees break down.

As you can see, there are more fees and in some cases, they’re higher than they are for stocks. For example, the FINRA regulatory fee is higher and there’s no maximum.

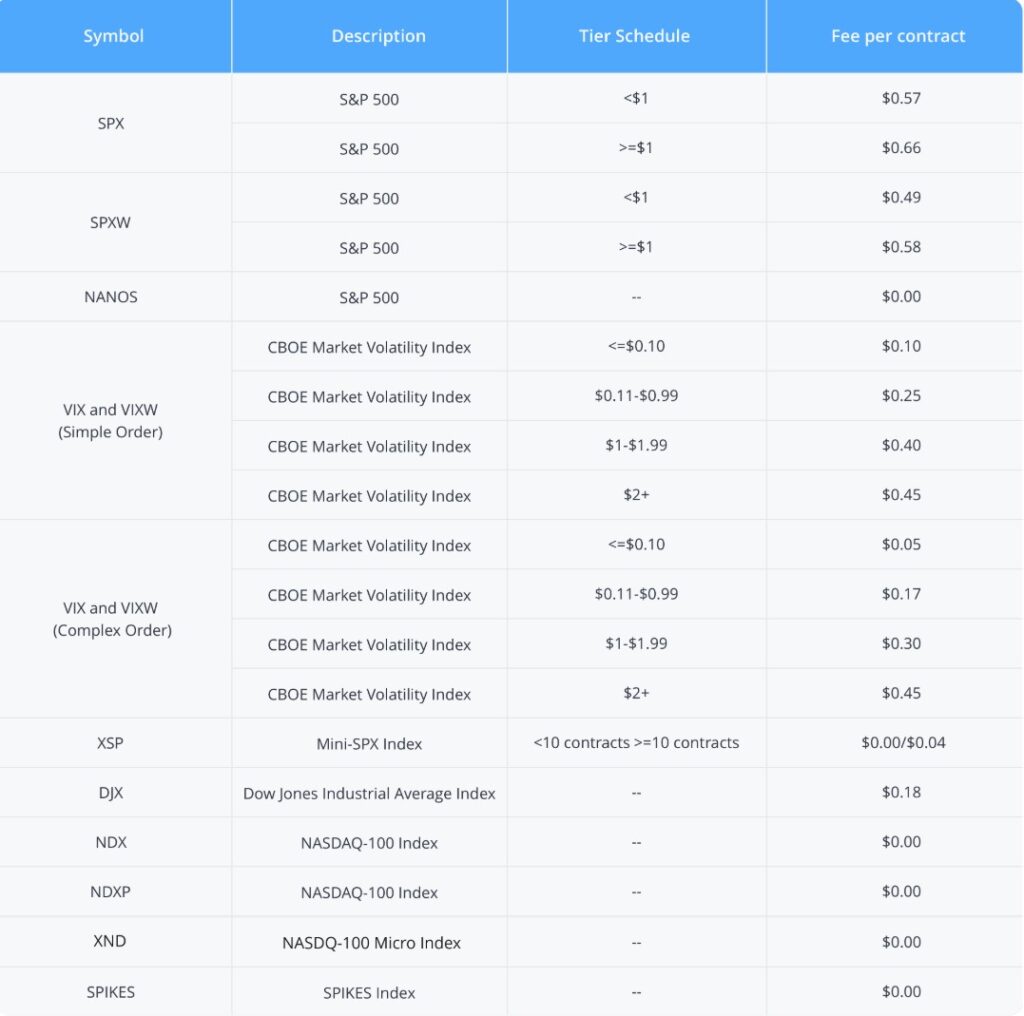

The fees for index options are far more complex. Webull may charge a fee of $0.55 per trade. Here’s a partial screenshot to show you how complex these fees can be.

If you want a full breakdown of Webull Options check out our original article: WEBULL OPTIONS REVIEW

You can view the complete table, which includes exchange fees and much more, on Webull’s pricing page.

Pro Tip:

Get 20 free fractional shares on Webull when you deposit $500 or more today!

Webull Futures Fees: What Futures Traders Should Expect

Webull offers its users access to futures trading through its exchange partners. Webull futures fees are broken down like this.

Additional fees may also apply, and this is where it can get confusing. Exchange, clearing, and regulatory fees are not included and Webull doesn’t specify them on their pricing page.

Webull Commission Fee: Where Costs May Apply

In addition to the fees we’ve already reviewed, there are a few other instances when you may pay a commission when trading on Webull.

Webull doesn’t always call these fees commission, but here’s a quick breakdown of what you can expect.

Short-selling fees: These mostly consist of hard-to-borrow or HTB fees. Calculating HTB rates includes making multiple calculations, including:

Per-share collateral amount: Previous Closing Price * Current Industry Convention Rate

Trade value: Per-Share Collateral Amount * Shares Sold

Annual HTB fee: Trade Value * Annual HTB Rate (currently 6%)

Daily HTB fee: Annual HTB Fee / 360

Margin trading fees: When you engage in margin on Webull, you’ll pay a percentage of your margin account as interest. That percentage starts at 8.74% for margin accounts with balances below $25,000. They tier down and may be as low as 4.74% for accounts with balances of $3 million or more.

Exchange fees for specialized markets: If you engage in trading on any specialized exchange, then be aware that there may be exchange fees that aren’t listed on Webull’s website.

Basically, when you engage in margin or short-selling, you are paying interest on either borrowed funds or borrowed shares.

Pro Tip:

Get 20 free fractional shares on Webull when you deposit $500 or more today!

Webull Withdrawal Fees & Transfer Fees: What to Expect

Any time you withdraw money from Webull or transfer your holdings from Webull to another broker, there are fees involved.

Webull Deposit and Withdrawal Fees

Asset Transfer Fees

The other type of transfer fee you’ll need to be aware of is the ACAT transfer fee, which will be charged in the event you decide to transfer assets out of Webull.

The ACAT fee is charged by Apex and is $75 per transfer. That’s the industry standard, so don’t go to another trading platform expecting a lower fee.

Pro Tip:

Get 20 free fractional shares on Webull when you deposit $500 or more today!

Hidden Fees and Regulatory Charges on Webull

We’ve already covered regulatory charges from SEC and FINRA, but here’s a little more information about what to expect and how these fees work.

SEC and FINRA fees are charged to Webull, and Webull passes those costs on to users. The fees are low, as we’ve already told you.

Margin interest rates are charged when you borrow funds to trade on margin. Margin fees are set by the lender and vary by amount. You can view Webull’s rate table here.

The same is true of short-selling fees, which are charged when you trade borrowed stocks.

Webull says its fees are fully transparent and disclosed. That said, they can be complicated and there are a few holes in the information on their website. For example, they don’t specify what the regulatory fees are for futures trading.

That means it’s not unusual for users to be surprised when they see the total they’re paying, especially when they’re trading on margin.

Our suggestion to you is that you always review the fees before completing a trade.

Is Webull Worth It? Final Thoughts on Webull Fees

Is Webull worth it? It’s an important question to ask because each platform has its own pros and cons.

Our take on Webull is that it’s one of the most cost-effective platforms for traders. If you’re just getting started on your investing journey, you may find that Webull’s fees make it possible for you to build a portfolio quickly and at a low cost.

Remember, Webull charges no commission on stocks, ETFs, or options. If you begin with stocks and ETFs within extended hours, you’ll pay only minimal regulatory fees. That means you keep more of your money in your portfolio, and that’s a good thing for you and your financial goals!

Keep in mind that there are regulatory fees, and if you decide to trade on margin, margin rates can translate to a significant percentage of each trade and total trading activity fee.

You should also remember the withdrawal costs to make sure you’re not surprised by those after you make a sale.

Conclusion & Next Steps

The bottom line about Webull fees is that this is a company that strives to keep trading fees low. They make their money on more complex trades, including margin trading and futures. If you stick to straightforward investment choices, then your fees will be low to the nearest dollar.

In other words, Webull’s fees are minimal when compared to other platforms, and that makes it a good choice for beginners and advanced traders alike.

.png)