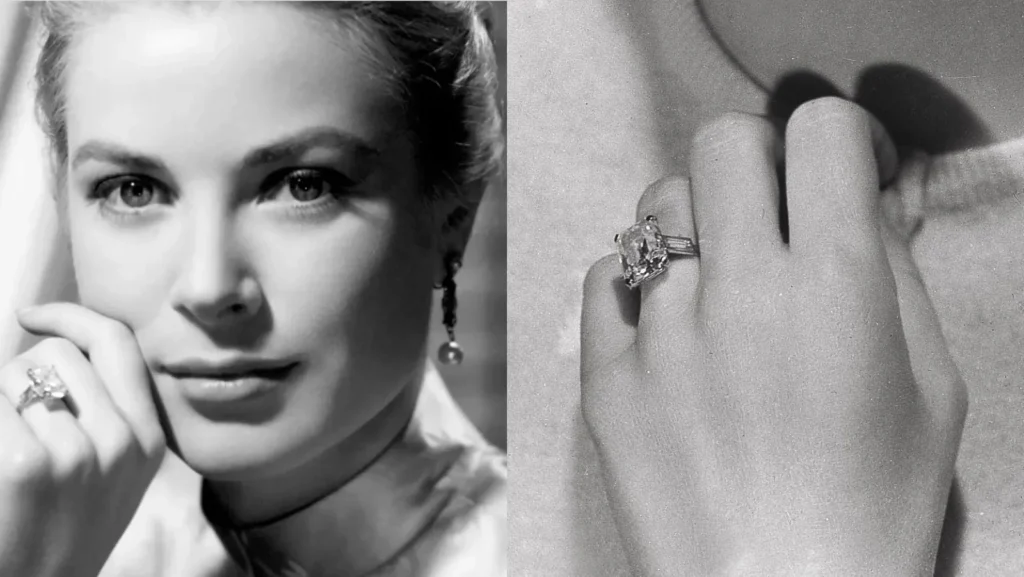

Grace Kelly’s Cartier diamond. Mariah Carey’s 35-carat sparkler. Kim Kardashian’s flawless cushion-cut stone.

These aren’t just engagement rings—they’re symbols of jaw-dropping wealth. Grace Kelly’s ring alone is valued at nearly $39 million.

And lately, celebrity rings have been all over the headlines again. Taylor Swift’s engagement ring sparked massive buzz this year, and Georgina Rodríguez’s giant diamond from Cristiano Ronaldo also made waves. But here’s the thing: while stunning, both rings are actually far less expensive than the record-breakers on our list. Taylor’s is estimated at around $550,000, and Georgina’s at about $5 million—impressive, but nowhere near Grace Kelly’s historic $39 million Cartier masterpiece.

That’s why we decided to run this fun thought experiment: If you’re 30 years old today and want to build enough wealth by 65 to afford one of these iconic rings—or anything else on your dream list, like a house, a trip around the world, or even a yacht—how much would you need to invest each month?

Sounds crazy—but it’s actually the perfect way to understand how much consistent investing can build over time.

Step 1: Why We Assume 7%

We’re assuming a 7% annual return—slightly below the stock market’s long-term average of 10%—to account for inflation and taxes. Financial planners often use this number when running long-term projections.

That’s what we’ll use here.

Step 2: The Power of Compounding

Compounding is what happens when your money earns returns, and then those returns themselves start earning returns.

Think of it like a snowball rolling down a hill: it starts small, but the longer it rolls, the bigger it gets.

By investing monthly, you’re giving your money the maximum chance to compound over decades.

Step 3: Dollar-Cost Averaging (Why Monthly Beats “Perfect Timing”)

If you invest a fixed amount every month, you naturally buy more when prices are low and less when prices are high. This is called dollar-cost averaging, and it protects you from the impossible task of trying to “time the market.”

Consistency beats perfection.

The Celebrity Ring Price Tags 💍

Before we dive into the numbers, keep in mind: the exact price of these rings is impossible to know. The values below are based on estimates from jewelers and media reports. Celebrity diamonds aren’t traded on the open market—so treat these as the best guesses from experts.

And yes, a picture is worth a thousand carats—so here are the icons themselves:

Grace Kelly – $38.8M (10.47-carat Cartier diamond)

2. Mariah Carey – $10M (35-carat emerald-cut diamond)

3. Elizabeth Taylor – $8.8M (33.19-carat Krupp diamond)

4. Kim Kardashian – $8M (20-carat cushion-cut from Kanye West)

5. Beyoncé – $5M (18-carat emerald-cut flawless diamond from Jay-Z)

Honorable Mentions: Jennifer Lopez ($5–7M), Georgina Rodríguez ($5M), Taylor Swift (around $550K).

How Much You’d Need to Invest Monthly (Starting at 30)

With 35 years of compounding at 7%:

Step 4: The Real Lesson

Of course, the point here isn’t to plan your retirement around buying Grace Kelly’s Cartier diamond. The real takeaway is understanding what consistent investing can do for your future goals.

Here’s what this exercise teaches us:

Time is your best friend. At 30, you still have 35 years to grow your money. That’s plenty of time for compounding to work its magic. Even if you feel “late,” starting now makes a huge difference.

Consistency beats perfection. You don’t need to wait for the “perfect” market moment. Investing monthly—through market ups and downs—adds up over decades.

Small steps still count. Maybe you can’t set aside thousands per month, but even $200–$300 a month could grow into hundreds of thousands by retirement. That could mean financial freedom, travel, or helping your kids with college.

Your goals don’t have to be flashy. For us, the rings are just a metaphor. Replace “diamond” with “dream home,” “early retirement,” or “world travel fund.” The same math applies.

The earlier you start, the easier it is. Someone who begins at 25 could contribute much less each month and still reach the same totals as someone starting at 35 or 40. But if you’re starting at 30—good news—it’s not too late.

It’s about freedom, not things. The real reward isn’t a diamond—it’s the freedom to say yes to the life you want without financial stress.

Final Word

Celebrity engagement rings are fun to gawk at—but they’re also a reminder of just how powerful consistent investing can be. At 30, you might feel like you’ve already missed the boat. You haven’t. The truth is:

Start now. Be consistent. Let compounding work.

Who knows—by 65, you may not have Grace Kelly’s Cartier masterpiece on your finger, but you’ll have something even better: the financial freedom to say yes to the life you want.

New to the stock market? Wall Street Survivor gives you $100,000 in virtual money to practice trading in our real-time investing simulator. Plus, our free stock market courses will help you start investing the right way.

And if you’re ready to explore further, check out our newsletter rankings below to see which service can guide your next steps.

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks as of August 16, 2025

We are paid subscribers to dozens of stock and option newsletters. We actively track every recommendation from all of these services, calculate performance, and share our results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is “Return vs SP500” which is their return above that of the S&P500. So, based on August 16, 2025 prices:

Best Stock Newsletters

RankStock NewsletterPicksReturnReturnvs SP500Picksw ProfitMax %ReturnCurrent Promotion

1.

Alpha Picks74.7%51.1%78%969%Sept, 2025 Promotion:Save $50

Alpha Picks74.7%51.1%78%969%Sept, 2025 Promotion:Save $50

Summary: 2 picks/month based on Seeking Alpha’s Quant Rating; Retail Price is $499/yr. See complete details and analysis in our Alpha Picks Review.

2.

Moby.co52.5%18.1%73%2,406%Sept, 2025 Promotion:Next pick free!

Moby.co52.5%18.1%73%2,406%Sept, 2025 Promotion:Next pick free!

Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review.

3.

Zacks Top 1033.0%15.1%73%170%Sept, 2025 Promotion:$1, then $495/yr

Zacks Top 1033.0%15.1%73%170%Sept, 2025 Promotion:$1, then $495/yr

Summary: 10-25 stock picks per year based on Zacks’ Quant Rating; Retail Price is $495/yr. Read our Zacks Review.

4.

TipRanks SmartInvestor18.6%7.6%65%386%Current Promotion:Save $180

TipRanks SmartInvestor18.6%7.6%65%386%Current Promotion:Save $180

Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500’s 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review.

5.

Stock Advisor41.7%6.1%76%299%Sept, 2025 Promotion:Get $100 Off

Stock Advisor41.7%6.1%76%299%Sept, 2025 Promotion:Get $100 Off

Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr. Read our Motley Fool Review.

6.

Action Alerts Plus25.9%4.9%65%210%Current Promotion:None

Action Alerts Plus25.9%4.9%65%210%Current Promotion:None

Summary: 100-150 trades per year, lots of buying and selling and short-term trades. Read our Jim Cramer Review.

7.

Rule Breakers35.6%1.2%78%273%Current Promotion:Save $200

Rule Breakers35.6%1.2%78%273%Current Promotion:Save $200

Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500’s 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review.

8.

Zacks Home Run Investor3.5%-1.3%44%200%Sept, 2025 Promotion:$1, then $495/yr

Zacks Home Run Investor3.5%-1.3%44%200%Sept, 2025 Promotion:$1, then $495/yr

Summary: 40-50 stock picks per year based on Zacks’ Quant Rating; Retail Price is $495/yr. Read our Zacks Review.

9.IBD Leaderboard ETF11.4%-1.8%n/an/aSept, 2025 Promotion:Save $129/yr

Summary: Maintains top 50 stocks to invest in based on IBD algorithm; Retail Price is $495/yr. Read our Investors Business Daily.

10.

Stock Advisor Canada23.5%-4.6%69%378%Sept, 2025 Promotion: Save $100

Stock Advisor Canada23.5%-4.6%69%378%Sept, 2025 Promotion: Save $100

Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review.

Top Ranking Stock Newsletters based on their 2024, 2023, 2022 stock picks’ performance as compared to S&P500. S&P500’s return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF. Performance as of August 16, 2025.

–>