Wondering if Monarch Money is the right budgeting app for you? This Monarch Money review explores its features, benefits, and drawbacks to help you decide. Find out if it can simplify your financial management and achieve your financial goals.

Key Takeaways

Monarch Money centralizes all financial accounts, offering a comprehensive view and simplifying the budgeting process for individuals and couples.

The app provides flexible budgeting methods, allowing users to create personalized budgets and track various financial goals with ease.

Monarch Money prioritizes security, employing bank-level protection and offering a seven-day free trial, making it a reliable choice for effective financial management.

What is Monarch Money?

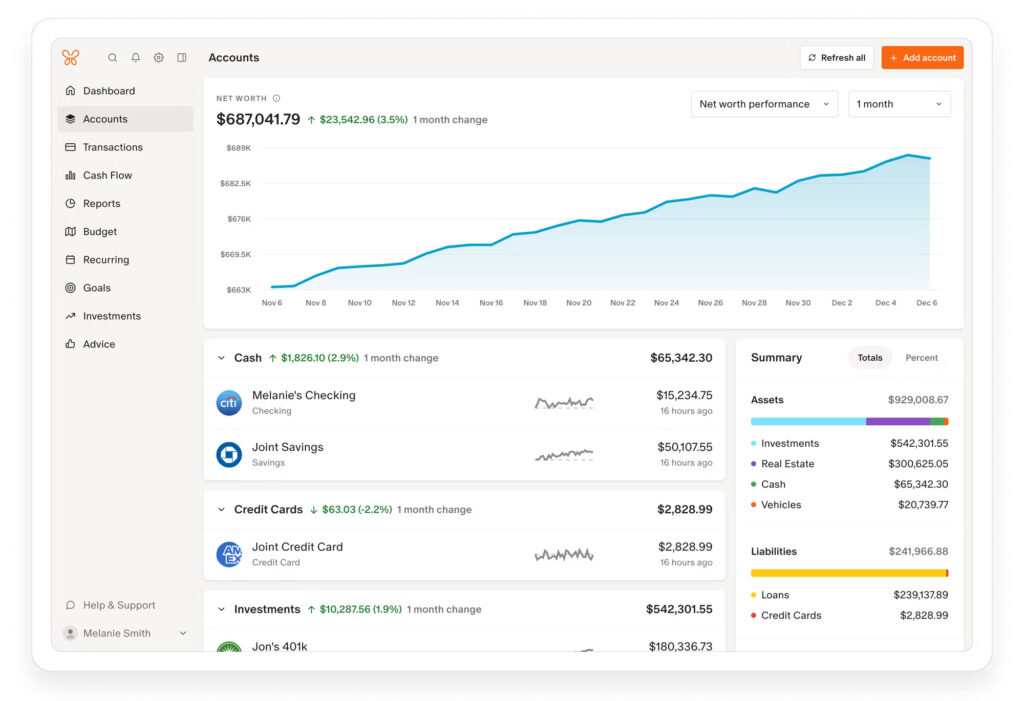

Monarch Money is designed for individuals and couples who want to manage their finances effectively. It helps users know exactly where their money is, enabling them to achieve their financial goals faster and with more clarity. Monarch Money categorizes finances, tracks spending, and sets financial goals, providing a sense of control over one’s financial situation.

One of the key benefits of Monarch Money is its ability to bring all financial accounts together in one place, simplifying financial management. Other advantages include:

Users can set targets, track their progress, and stay motivated towards achieving their financial goals.

The app allows for collaboration with partners or advisors at no extra cost.

It is a legitimate and highly rated financial management solution.

How Does Monarch Money Work?

Monarch Money works by integrating all your accounts into a single interface, making it easier to manage your finances. It consolidates various account types into one view, including:

Bank accounts

Credit cards

Loans

Investments

Bank websites This provides a comprehensive overview of your financial situation. This integration helps users make informed decisions and stay on top of their financial goals.

The app offers multiple budgeting methods, including flexible budgeting and category budgeting, allowing users to choose the one that best fits their lifestyle. Monarch Money also tracks your finances by scanning transaction history to identify spending and saving patterns, automatically assigning categories to transactions, or prompting users to label them if unrecognized.

Key Features of Monarch Money

Monarch Money boasts several key features that set it apart from other budgeting apps. Users can link over 13,000 financial accounts seamlessly, providing a clear view of their entire household’s financial situation through a comprehensive dashboard. This feature makes it easier to manage and monitor multiple accounts without hassle.

The app offers several key features:

Allows users to create an unlimited number of savings goals

Provides a collaborative platform for couples or an advisor to manage finances together

Visualizes expenditures to help users focus on their spending habits and save make necessary adjustments.

Sign up for Monarch Money today to get 30% off your first year!

Setting Up Monarch Money

Setting up Monarch Money is an easy way to breeze through your financial management. Upon initial login, users are prompted to connect an account to begin using the platform. The setup process is quick and straightforward, allowing users to gain insights within minutes. It is recommended to connect multiple accounts, starting with the most frequently used banking and credit card accounts, for a more comprehensive financial overview.

Customization is key with Monarch Money. Users can:

Create new custom categories and organize them according to personal preferences.

Edit account names, types, and subtypes within the Institutions Settings page for easier identification.

Collaborate on financial matters, allowing partners to view and manage shared finances together.

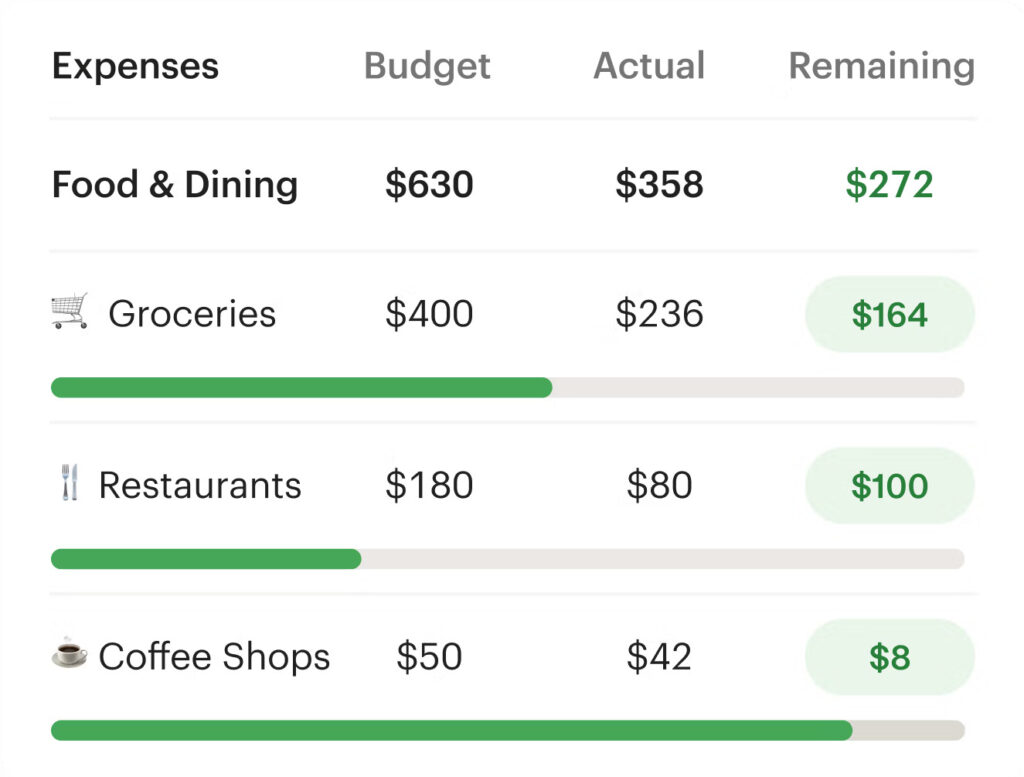

Budgeting with Monarch Money

Monarch Money supports two budgeting methods: category budgeting and flex budgeting. This flexibility allows users to create customizable budgets that adapt to their needs rather than forcing them into a rigid structure. The app provides visual tools to help users understand how their spending aligns with their budget, making financial management more intuitive.

Users can set up personalized budgets tailored to their specific needs, tracking a wide range of financial goals and motivating savings. Specific shared financial objectives, like saving for a vacation or an emergency fund, can be set with designated dates and amounts, hoping to achieve them. The app also provides a rollover feature for budgets to carry over surplus or deficit amounts into the next month, ensuring continuous progress. This plan helps users stay on track with their financial goals that they have spent time developing.

Another powerful aspect of Monarch Money is its ability to adjust budgets throughout the month to reflect changes in one’s financial situation. Users can allocate spending limits to different categories based on their preferences, ensuring they stay on track with their financial goals.

Tracking Spending and Income

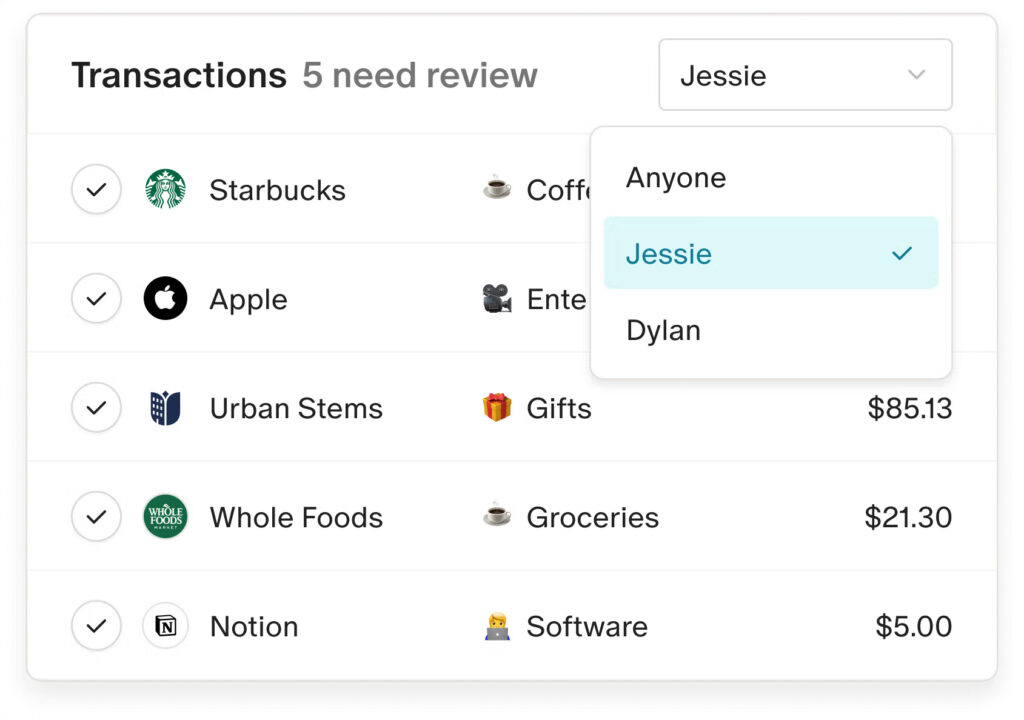

Monarch Money excels in tracking spending and income by:

Providing a comprehensive list of transactions that can be filtered and reviewed easily

Compiling all transactions into a single, easily searchable list

Making it simple for users to review their expenses and stay on top of their finances.

The app generates monthly reports detailing spending categories, cash flow trends, and net worth changes. These reports turn raw data into actionable insights and feedback, helping users understand their financial life habits and make informed decisions to improve their financial life health in the past.

Managing Recurring Bills and Subscriptions

Monarch Money makes managing recurring bills and subscriptions effortless. The app automatically detects and categorizes recurring subscriptions, helping users keep track of their spending and avoid forgotten charges. This feature is particularly useful for managing monthly subscriptions and memberships.

Additionally, Monarch Money provides a calendar view that organizes and displays upcoming recurring expenses, allowing users to stay on top of their financial obligations. Notifications of recurring charges enable users to identify and manage unwanted subscriptions easily, ensuring they only pay for services they truly use.

Visualizing Financial Data

One of Monarch Money’s standout featured features is its ability to visualize financial data through customizable charts and reports, providing a visual breakdown for users. Users can:

Create different visual formats to analyze their financial data

Track progress toward their goals more easily

Use visual tools to understand their financial flow

Identify spending patterns

Customizable reports can track progress towards specific financial goals, enhancing user engagement with their finances. Graphs and charts illustrate various aspects of financial performance, such as income changes and expenditure, providing a clear picture of one’s financial health with an investment tracker.

Start your free 7-day trial with Monarch Money and see how easy budgeting can be when all your accounts live in one place.

Security and Privacy

Security and privacy are top priorities for Monarch Money. The app employs bank-level security measures to protect user data and transactions, ensuring that financial information is safe. Encryption technology and multifactor authentication are utilized to secure user accounts against unauthorized access.

Monarch Money guarantees that users’ financial information is not sold or shared with third parties, maintaining their privacy. This commitment to security and privacy gives users peace of mind, knowing their financial data is protected.

Cost and Subscription Plans

Monarch Money offers a monthly subscription model with a monthly cost of $14.99 or an annual cost of $99.99, which breaks down to approximately $8.33 per month. New users can take advantage of a seven-day free trial to test the service. Additionally, promotional discounts of 30% off the first year are available for new users signing up on the website.

However, there is no free version available, which may be a drawback for budget-conscious users. Despite the relatively high subscription costs, many users find the features and benefits of Monarch Money justify the price.

Pros and Cons of Monarch Money

Monarch Money’s features and modern interface make it a reliable and valuable option compared to free alternatives. Users appreciate the comprehensive financial insights and the ability to manage finances collaboratively. However, some users find the subscription cost to be a drawback, especially when compared to free alternatives.

One notable disadvantage is that Monarch does not sync the savings buckets from joint accounts, which can be a limitation for users who rely on this feature for joint financial management.

Alternatives to Monarch Money

There are several alternatives to Monarch Money, including Rocket Money. Rocket Money offers robust budgeting tools that allow users to track their spending and monthly bills effectively. While Rocket Money provides a different array of features than Monarch Money, users often appreciate both for their unique offerings.

Monarch Money is perceived as a solid middle-ground between basic and advanced budgeting tools compared to alternatives like Rocket Money. This makes it a suitable choice for users looking for a comprehensive yet user-friendly budgeting app.

User Reviews and Testimonials

Overall, users report an awesome positive experience with Monarch Money, praising:

Its intuitive interface

Robust features

The app’s ability to automate budgeting, providing ease and convenience in financial management

Comprehensive financial insights that help them understand their spending habits better

However, some users express frustration with occasional syncing issues and the subscription cost. Despite these drawbacks, many find the benefits of Monarch Money to outweigh the negatives, making it a worthwhile investment for budgeting.

Monarch Money helps you build flexible budgets, track goals, and manage spending in real time—all from one dashboard. Sign up today for 30% off your first year!

Summary

Monarch Money stands out as a powerful budgeting app with a range of features designed to simplify financial management. From integrating multiple accounts to providing detailed visual reports, Monarch Money helps users achieve their financial goals with ease. While the subscription cost may be a concern for some, the app’s benefits make it a valuable tool for anyone serious about managing their finances.

In conclusion, Monarch Money offers a comprehensive solution for financial management, making it worth considering for those looking to take control of their financial life. Start your journey towards better financial health today with Monarch Money.

FAQs

Setting up Monarch Money is a breeze! Just connect your banking and credit card accounts during your first login and you’re ready to start managing your finances effectively.

Monarch Money offers a monthly subscription for $14.99 or an annual plan for $99.99, and you can enjoy a seven-day free trial to explore its features!

Monarch Money offers strong security measures like bank-level encryption and multifactor authentication, ensuring your data and transactions are well-protected. You can feel confident about your financial information while using their services!

Absolutely, you can use Monarch Money with your partner to manage finances together effectively and collaboratively. It’s a great tool for shared financial management!

Top U.S. Brokers of 2025

★ ★ ★ ★ ★

★ ★ ★ ★ ★Features:

✅ U.S. stocks, ETFs, options, and cryptos✅ Now 23 million users✅ Cash mgt account and credit card

Sign-up Bonus:

Free stock up to $200 with new account, plus up to $1,500 more in free stock from referrals

Learn more

★ ★ ★ ★ ★

★ ★ ★ ★ ★Features:

✅ Free Level 2 Nasdaq quotes✅ Access to U.S. and Hong Kong markets✅ Educational tools

Sign-up Bonus:

Deposit $100, get $20 in NVDA stock; Deposit $2,000, get $50 in NVDA stock; Deposit $10,000, get $300 in NVDA stock; Deposit $50,000, get $1,000 in NVDA stock

Learn more

★ ★ ★ ★ ☆

★ ★ ★ ★ ☆Features:

✅ Access 150+ global stock exchanges✅ IBKR Lite & Pro tiers for all✅ SmartRouting™ and deep analytics

Sign-up Bonus:

Refer a Friend and Get $200

Learn more

View Full List

★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆