Financial institutions face mounting pressure as regulatory requirements intensify and financial crime grows more sophisticated, with the financial crime compliance operations market now valued at $155B annually. Banks struggle with manual, error-prone processes that create backlogs, increase risk, and explode costs while compliance teams are overwhelmed by alert volumes that can bury operations. WorkFusion addresses these critical challenges by delivering AI Agents specifically designed for financial crime compliance, offering pre-built digital workers that automate Level 1 analyst functions across sanctions screening, transaction monitoring, KYC, and adverse media monitoring. The company’s AI Agents currently process over 1 million alert hits daily and save customers approximately 40,000 hours of manual work per day, serving 10 of the top 20 banks and leading financial institutions worldwide. After pivoting in 2022 to focus exclusively on financial crime compliance, WorkFusion has achieved 60% year-over-year growth in its AI Agent solutions while expanding its global footprint.

AlleyWatch sat down with WorkFusion CEO and Founder Adam Famularo to learn more about the business, its future plans, recent funding round, and much, much more…

Who were your investors and how much did you raise?

We just closed a $45M growth round led by Georgian, with participation from Serengeti Asset Management; Nokia Growth Partners III; Teralys Capital; Hawk Equity; Chubb INA Holdings; Declaration Partners; WorkFusion CEO Adam Famularo and other members of the leadership team; SVB Innovation Credit Fund VIII, L.P.; Konrad Investments LLC; and George John.

Tell us about the product or service that WorkFusion offers.

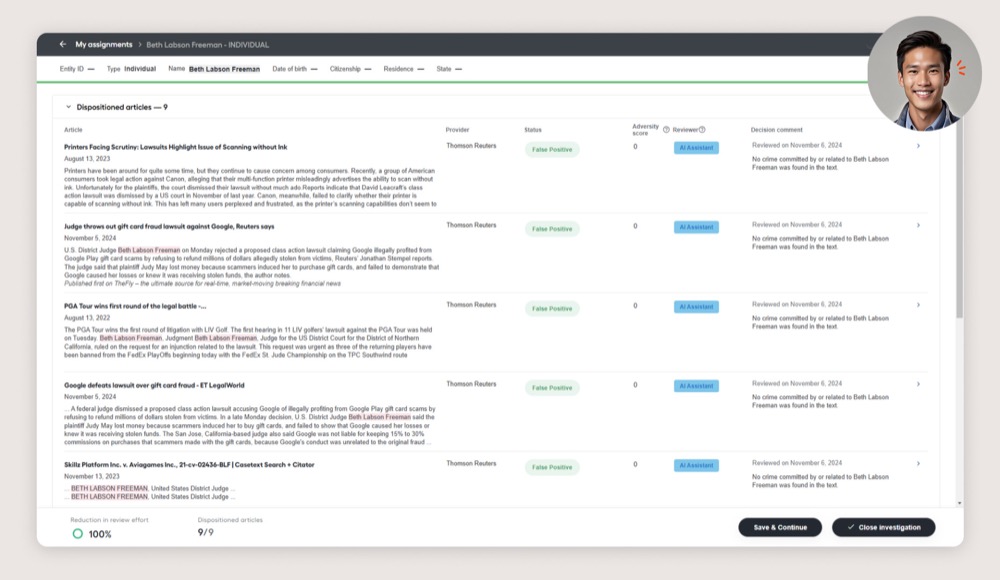

WorkFusion builds AI Agents to fight financial crime compliance (FCC). These are purpose-built digital workers trained to take on critical compliance analyst functions at banks, such as sanctions screening, KYC refresh, transaction monitoring, fraud review, and adverse media monitoring. Our AI Agents come “out of the box” with years of job-specific training, making them easy to hire, configure, and scale.

What inspired the start of WorkFusion?

WorkFusion was originally founded out of MIT Labs in 2010 with the vision of using automation to transform work. In the early days, we tried to automate anything for anybody. But by 2021, after surveying our customers, it became clear that our most successful use cases were in fighting financial crime. That’s when we made the decision to focus entirely on building AI Agents for FCC, and in February 2022, we relaunched the company with this new strategy.

How is WorkFusion different?

Unlike general-purpose automation or AI tools, WorkFusion delivers pre-built, job-specific AI Agents that financial institutions can hire like they would an analyst. They come trained with years of domain expertise, integrate quickly, and deliver work at a level of consistency and scale that humans simply can’t. In short, our customers don’t need to spend years building their own AI capabilities because they can put our agents to work immediately.

What market does WorkFusion target and how big is it?

We target the financial crime compliance operations market, primarily at banks and financial institutions, which is valued at around $155B. It’s one of the fastest-growing, most resource-constrained areas in financial services. We’re already working with 10 of the top 20 banks in the U.S. plus other leading financial institutions globally.

What’s your business model?

We operate on an on-prem and SaaS model, licensing AI Agents to banks and financial institutions. Customers can scale usage up or down depending on their workload, which gives them flexibility while avoiding the costs of hiring or outsourcing.

How are you preparing for a potential economic slowdown?

Economic slowdowns often put more pressure on compliance teams, since fraud and financial crime tend to rise in uncertain markets. Banks are also under pressure to do more with less. That’s where our AI Agents shine because they reduce manual work, scale capacity 3–5X, and save thousands of man hours a day for our customers. In many ways, we’re positioned as a cost-saving and risk-reducing solution when financial institutions need it most.

What was the funding process like?

We were fortunate that many of our existing investors doubled down and new investors came in, which speaks to both the strength of our traction and the urgency of the market problem we’re solving. It was a collaborative process focused on how we scale responsibly into the next phase of growth.

What are the biggest challenges that you faced while raising capital?

The biggest challenge was focus. AI is everywhere right now, and investors see thousands of AI pitches. We had to clearly differentiate how Agentic AI for FCC is not just another AI story, but a proven, revenue-generating product with a specific, massive market.

What factors about your business led your investors to write the check?

Several things:

We’re already working with 25 major financial institutions, including 10 of the top 20 U.S. banks and leading financial institutions around the world.

Our AI Agents save customers 40,000 hours of manual work a day, which is transformative for compliance teams.

Our pivot in 2022 has shown we can adapt quickly to meet market needs and build needed technology.

We are seeing 60% year-over-year growth in our AI Agent solutions.

What are the milestones you plan to achieve in the next six months?

We’ll be expanding our customer base in North America and Europe while opening up new opportunities in the Middle East. On the product side, we’re continuing to enhance our agents’ capabilities and scaling our team.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

I would say it’s to focus relentlessly on your customers’ biggest problems and solve them better than anyone else. That’s what carried WorkFusion through our pivot in 2022, by identifying where we could have the most impact, doubling down, and letting customer traction drive investor interest.

Where do you see the company going now over the near term?

In the near term, we see ourselves becoming the standard for delivering AI agents for FCC operations across global banks. The demand is enormous, the need is urgent, and our technology is already proven at scale.

What’s your favorite fall destination in and around the city?

It is always fun to walk around Central Park in the Fall. We also enjoy traveling out to Montauk and the Hamptons in the Fall. Quieter and fun atmosphere.