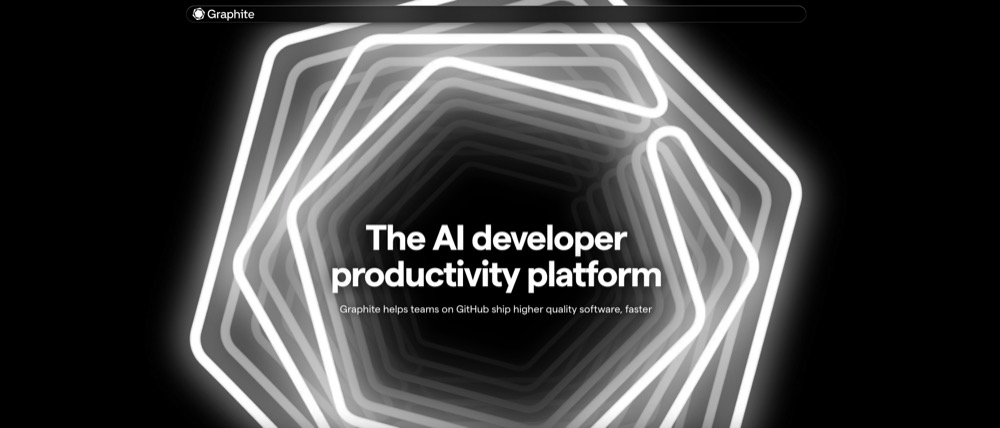

Below is a breakdown of the top NYC startup funding rounds for Q1 2025, compiled using data from CrunchBase. For each company, I’ve included critical details such as industry, company description, round type, and total equity funding raised to date, providing a window into the current state of venture capital activity in NYC and where investors directed their attention last quarter.

📈 Amplify Your Brand with AlleyWatch — connecting you to NYC’s most innovative minds and companies. Our platform offers premium opportunities to showcase your brand to key technology and business leaders throughout New York. Explore our advertising solutions today.

16. SeeQC

Round: Series A – $30.0MDescription: SeeQC is a semiconductor company developing commercially viable application-specific quantum computing systems for global businesses. Founded by John Levy, Matthew Hutchings, and Oleg Mukhanov in 2018, SeeQC has now raised a total of $59.2M in total equity funding and is backed by US Department of Energy, EQT Ventures, Innovate UK, Newlab, and BlueYard Capital.Investors in the round: Asset Management Ventures (AMV), BlueYard Capital, Booz Allen Ventures, EQT Ventures, FAM AB, M Ventures, NordicNinja VC, SIP Capital, Vertical PartnersMonth of Funding: JanuaryIndustry: Electronics, Infrastructure, Manufacturing, Quantum Computing, SemiconductorFounders: John Levy, Matthew Hutchings, Oleg MukhanovFounding year: 2018Total equity funding raised: $59.2M

16. Viam

Round: Series C – $30.0MDescription: Viam is a robotics company that lets users build, monitor, and manage their smart machines via cloud-based management.Investors in the round: Battery Ventures, Neurone, Union Square VenturesMonth of Funding: MarchIndustry: Machine Learning, Robotics, Software, Software EngineeringFounders: Eliot HorowitzFounding year: 2020Total equity funding raised: $117.0MAlleyWatch’s exclusive coverage of this round: Viam Raises $30M to Bridge AI and the Physical World With One Unified Platform

15. Hone Health

Round: Series A – $33.0MDescription: Hone Health provides an online clinic platform for men. Founded by Alba Mertira, Mohammed Saad Alam, Seth Franz, Stuart Blitz, and Zachary Kane in 2018, Hone Health has now raised a total of $38.0M in total equity funding and is backed by Saudi Arabia’s Public Investment Fund, Bossa Invest, Gaingels, Tribe Capital, and FJ Labs.Investors in the round: Agent Capital, Anthony Pompliano, Austin Rief, Christopher Petkas, Codie Sanchez, Fasha Mahjoor, FJ Labs, Gaingels, Hanwha, humbition, Looking Glass Capital, Matt Wan, Michael Rabil, Nikita Bier, Paul Rabil, Republic capital, Sam Parr, Saudi Arabia’s Public Investment Fund, Shaan Puri, Stephen Dukker, Tribe Capital, Vibe VCMonth of Funding: JanuaryIndustry: Health CareFounders: Alba Mertira, Mohammed Saad Alam, Seth Franz, Stuart Blitz, Zachary KaneFounding year: 2018Total equity funding raised: $38.0MAlleyWatch’s exclusive coverage of this round: Hone Health Raises $33M to Make Aging Optional

14. Air

Round: Series B – $35.0MDescription: Air is the Creative Operations System for marketing and creative teams. Find, organize, share, and collaborate on your images and videos. Founded by Shane Hegde and Tyler Strand in 2017, Air has now raised a total of $63.0M in total equity funding and is backed by Headline, Avenir, Tiger Global Management, Xfund, and Good Friends.Investors in the round: Avenir, Designer Fund, Good Friends, Headline, Lerer Hippeau, Slack Venture Capital, Tiger Global Management, WndrCo, XfundMonth of Funding: JanuaryIndustry: Cloud Storage, Collaboration, Content, Digital Media, Productivity ToolsFounders: Shane Hegde, Tyler StrandFounding year: 2017Total equity funding raised: $63.0MAlleyWatch’s exclusive coverage of this round: Creative Ops Platform Air Secures $35M to Scale Creative Workflow Automation

The AlleyWatch audience is driving progress and innovation on a global scale. With its regional media properties, AlleyWatch serves as the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including developing prominent brand placement, driving demand generation, and building thought leadership among the vast majority of key decision-makers in the New York business community and beyond. Learn more about advertising to NYC Tech at scale.

14. Inspiren

Round: Series A – $35.0MDescription: Inspiren is a healthcare tech company using AI to monitor patient care, track interactions, and improve clinical workflow management.Investors in the round: Avenir, Primary Venture Partners, Story Ventures, Studio VC, Third PrimeMonth of Funding: MarchIndustry: Analytics, Artificial Intelligence (AI), Health Care, Information Technology, Machine LearningFounders: Michael Wang, Paul Coyne, Vincent CocitoFounding year: 2016Total equity funding raised: $42.8M

13. Slingshot AI

Round: Series A – $40.0MDescription: Slingshot AI provides a cloud-based platform for easy training, deploying, and managing machine learning models. Founded by Daniel Cahn and Neil Parikh in 2022, Slingshot AI has now raised a total of $70.0M in total equity funding and is backed by Andreessen Horowitz, Felicis, BoxGroup, Alex Macdonald, and Arjun Sethi.Investors in the round: a16z Cultural Leadership Fund, Andreessen HorowitzMonth of Funding: JanuaryIndustry: Artificial Intelligence (AI), Cloud Data Services, Software, Web DevelopmentFounders: Neil ParikhFounding year: 2022Total equity funding raised: $70.0M

13. Clay

Round: Series B – $40.0MDescription: Clay offers creative tools for growth teams to enhance customer research. Founded by Kareem Amin, Nicolae Rusan, and Varun Anand in 2017, Clay has now raised a total of $102.0M in total equity funding and is backed by BoxGroup, Sequoia Capital, Builders VC, boldstart ventures, and CSC Upshot.Investors in the round: boldstart ventures, BoxGroup, First Round Capital, Meritech Capital Partners, Sequoia CapitalMonth of Funding: JanuaryIndustry: Artificial Intelligence (AI), Developer Tools, Information Technology, Productivity Tools, SoftwareFounders: Kareem Amin, Nicolae Rusan, Varun AnandFounding year: 2017Total equity funding raised: $102.0M

13. Recycle Track Systems

Round: Venture – $40.0MDescription: Recycle Track Systems provides waste management solutions for businesses and communities. Founded by Adam Pasquale and Gregory Lettieri in 2015, Recycle Track Systems has now raised a total of $151.7M in total equity funding and is backed by StepStone Capital Partners, Gaingels, Edison Partners, Partnership Fund for New York City, and Rosecliff Ventures.Investors in the round: Beth Birnbaum, Edison Partners, Robert Farrell, Shazi Visram, StepStone Capital Partners, Volition CapitalMonth of Funding: JanuaryIndustry: Environmental Engineering, Recycling, Sustainability, Waste ManagementFounders: Adam Pasquale, Gregory LettieriFounding year: 2015Total equity funding raised: $151.7M

Connect with NYC’s leading innovators and decision-makers through AlleyWatch. Our platform reaches the heart of New York’s tech ecosystem, offering unparalleled access to entrepreneurs, investors, and industry leaders. Explore advertising opportunities designed to elevate your brand in the NYC tech community.

12. Campus

Round: Series B – $46.0MDescription: Campus is an online college offering accredited associate degrees with live classes, flexible schedules, and personalized support.Investors in the round: 137 Ventures, 8VC, Akshay Kothari, Bloomberg Beta, Dylan Field, Emil Michael, Founders Fund, General Catalyst, Jason Citron, Max Altman, Rethink Education, Sam AltmanMonth of Funding: MarchIndustry: EdTech, Education, Higher EducationFounders: Tade OyerindeFounding year: 2016Total equity funding raised: $101.6M

11. Norm AI

Round: Series B – $48.0MDescription: Norm AI is a regulatory AI agent company that automates legal and compliance tasks.Investors in the round: Bain Capital, Blackstone Innovations Investments, Citi Ventures, Coatue, Craft Ventures, Marc Benioff, New York Life Ventures, TIAA, VanguardMonth of Funding: MarchIndustry: Artificial Intelligence (AI), Compliance, Legal TechFounders: John NayFounding year: 2023Total equity funding raised: $86.1M

10. Berry Street

Round: Series B – $50.0MDescription: Berry Street offers treatment for disordered eating, heart health, PCOD, liver disease, women’s health, sports nutrition, and diabetes. Founded by Jesse Rose and Noah Kotlove in 2023, Berry Street has now raised a total of $59.2M in total equity funding and is backed by Northzone, FJ Labs, Sofinnova Partners, TA Ventures, and ICLUB VC.Investors in the round: FJ Labs, ICLUB VC, Northzone, Sofinnova Partners, TA VenturesMonth of Funding: FebruaryIndustry: Fitness, Health Care, Nutrition, WellnessFounders: Jesse Rose, Noah KotloveFounding year: 2023Total equity funding raised: $59.2M

AlleyWatch delivers results for brands looking to connect with NYC’s tech innovators. Our targeted reach helps you build meaningful relationships with key decision-makers and thought leaders in New York’s dynamic business landscape. Ready to grow your influence? Discover effective advertising solutions tailored for the tech ecosystem.

9. Graphite

Round: Series B – $52.0MDescription: Graphite is an open source CLI and a code review dashboard.Investors in the round: Accel, Andreessen Horowitz, Figma Ventures, Menlo Ventures, Shopify Ventures, The General PartnershipMonth of Funding: MarchIndustry: Developer Tools, Internet, Security, Shipping, Software EngineeringFounders: Greg Foster, Merrill Lutsky, Tomas ReimersFounding year: 2020Total equity funding raised: $72.0M

8. Taktile

Round: Series B – $54.0MDescription: Taktile is a software platform that helps users create automated risk management decisions. Founded by Dr. Maximilian Eber and Maik Taro Wehmeyer in 2020, Taktile has now raised a total of $78.7M in total equity funding and is backed by Y Combinator, Plug and Play, Index Ventures, Tiger Global Management, and Prosus Ventures.Investors in the round: Balderton Capital, Index Ventures, Lawrence H. Summers, Prosus Ventures, Tiger Global Management, Visionaries Club, Y CombinatorMonth of Funding: FebruaryIndustry: Financial Services, FinTech, Insurance, Lending, SoftwareFounders: Dr. Maximilian Eber, Maik Taro WehmeyerFounding year: 2020Total equity funding raised: $78.7M

7. Amogy

Round: Venture – $56.0MDescription: Amogy offers carbon-free energy solutions using ammonia cracking technology. Founded by Hyunho Kim, Jongwon Choi, Seonghoon Woo, and Young Suk Jo in 2020, Amogy has now raised a total of $275.3M in total equity funding and is backed by Temasek Holdings, Amazon, Korea Zinc, Newlab, and Aramco Ventures.Investors in the round: AFW Partners, AP Ventures, Aramco Ventures, BHP Ventures, Hanwha Investment & Securities, Kibo Invest, Marunouchi Innovation Partners, MOL Switch, Quantum Ventures Korea, Samsung Heavy Industries, Seoul Investment Partners, SV Investment Corp, Temasek Holdings, Yanmar VenturesMonth of Funding: JanuaryIndustry: Clean Energy, CleanTech, Energy, Renewable Energy, SustainabilityFounders: Hyunho Kim, Jongwon Choi, Seonghoon Woo, Young Suk JoFounding year: 2020Total equity funding raised: $275.3M

7. Carbon Arc

Round: Series A – $56.0MDescription: Carbon Arc uses AI to gather and structure raw data into on-demand, consumption-based insights.Investors in the round: K5 Global, Liberty City Ventures, Raptor Group, WassermanMonth of Funding: MarchIndustry: Information Technology, SoftwareFounders: Founding year: 2021Total equity funding raised: $56.0M

6. Fundraise Up

Round: Series B – $70.0MDescription: Fundraise Up is an online donation platform that helps nonprofits engage donors and increase revenue. Founded by Anton Isaykin, Peter Byrnes, and Yuriy Smirnov in 2017, Fundraise Up has now raised a total of $82.1M in total equity funding and is backed by Telescope Partners, Begin Capital, Summit Partners, and Splash Capital.Investors in the round: Summit Partners, Telescope PartnersMonth of Funding: JanuaryIndustry: Artificial Intelligence (AI), B2B, Enterprise Software, FinTech, Non Profit, Payments, Social ImpactFounders: Anton Isaykin, Peter Byrnes, Yuriy SmirnovFounding year: 2017Total equity funding raised: $82.1MAlleyWatch’s exclusive coverage of this round: Fundraise Up Secures $70M to Transform Online Charitable Giving with AI

6. Underdog Fantasy

Round: Series C – $70.0MDescription: Underdog Fantasy is an online daily fantasy sports platform that allows users to participate in Pick’em games and esports projections.Investors in the round: Spark CapitalMonth of Funding: MarchIndustry: eSports, Fantasy Sports, GamingFounders: Brandon Stakenborg, Jeremy LevineFounding year: 2020Total equity funding raised: $115.0M

Did you know? AlleyWatch reaches over 90% of NYC’s tech decision-makers monthly. Our engaged audience of founders, investors, and industry leaders offers unparalleled advertising potential for brands seeking to make an impact in the technology and entrepreneurship space. Learn how to leverage our platform for your marketing goals.

5. Augury

Round: Series F – $75.0MDescription: Augury develops AI-driven solutions for monitoring machine health and process efficiency in industrial operations. Founded by Gal Shaul and Saar Yoskovitz in 2011, Augury has now raised a total of $369.0M in total equity funding and is backed by Insight Partners, Eclipse Ventures, Lightrock, Qualcomm Ventures, and First Round Capital.Investors in the round: Eclipse Ventures, Insight Partners, Lerer Hippeau, Lightrock, Munich Re, Qualcomm Ventures, Qumra Capital, SE VenturesMonth of Funding: FebruaryIndustry: Analytics, Artificial Intelligence (AI), Industrial Automation, Machine LearningFounders: Gal Shaul, Saar YoskovitzFounding year: 2011Total equity funding raised: $369.0M

4. Aescape

Round: Venture – $83.0MDescription: Aescape is a technology company that builds data-driven massage therapy and wellness experiences.Investors in the round: Alumni Ventures, Fifth Wall, Kevin Love, Valor Equity PartnersMonth of Funding: MarchIndustry: Artificial Intelligence (AI), Fitness, Health Care, Robotics, WellnessFounders: Eric LitmanFounding year: 2017Total equity funding raised: $113.0MAlleyWatch’s exclusive coverage of this round: Aescape Secures $83M to Scale AI-Powered Robotic Massage Technology

3. Dataminr

Round: Venture – $85.0MDescription: Dataminr develops an artificial intelligence platform designed for real-time event and risk detection.Investors in the round: HSBC, NightDragonMonth of Funding: MarchIndustry: Analytics, Artificial Intelligence (AI), Information Technology, Public Safety, Risk Management, SoftwareFounders: Jeffrey Kinsey, Sam Hendel, Theodore BaileyFounding year: 2009Total equity funding raised: $1.1B

2. Odeko

Round: Series E – $96.0MDescription: Odeko provides software for coffee shops, streamlining inventory, ordering, and delivery to enhance efficiency and reduce operational costs.Investors in the round: B CapitalMonth of Funding: MarchIndustry: Apps, Business Development, SoftwareFounders: Dane AtkinsonFounding year: 2019Total equity funding raised: $473.0MAlleyWatch’s exclusive coverage of this round: Odeko Raises $96M to Help Independent Food Businesses, Cafes, and Coffee Shops Compete With Global Chains With Technology

1. Chestnut Carbon

Round: Series B – $160.0MDescription: Chestnut Carbon develops nature-based projects to generate carbon removal credits and support net-zero initiatives. Founded by Ben Dell in 2022, Chestnut Carbon has now raised a total of $360.0M in total equity funding and is backed by Kimmeridge, DBL Partners, CPP Investments, and Cloverlay.Investors in the round: Cloverlay, CPP Investments, DBL Partners, KimmeridgeMonth of Funding: FebruaryIndustry: Carbon Capture, CleanTech, Environmental Engineering, ForestryFounders: Ben DellFounding year: 2022Total equity funding raised: $360.0M

📈 Amplify Your Brand with AlleyWatch — connecting you to NYC’s most innovative minds and companies. Our platform offers premium opportunities to showcase your brand to key technology and business leaders throughout New York. Explore our advertising solutions today.