Looking at the largest NYC startup funding rounds from January 2026, leveraging data from CrunchBase, we’ve analyzed the most significant venture capital deals that kicked off the new year in New York’s tech ecosystem. This month’s analysis provides comprehensive insights into each company’s industry focus, founding team, business model, investor relationships, and total funding history, offering deeper context about the NYC-based ventures that attracted the largest investments as we enter 2026.

🚀 REACH NYC TECH LEADERS

AlleyWatch is NYC’s leading source of tech and startup news, reaching the city’s most active founders, investors, and tech leaders. Learn More →

Round: Series ADescription: Protege is the AI training data platform enabling seamless and compliant data exchange. Founded by Bobby Samuels and Aman Khan in 2024, Protege has now raised a total of $65.0M in total equity funding and is backed by Andreessen Horowitz, SV Angel, Flex Capital, Liquid 2 Ventures, and Footwork.Investors in the round: Andreessen Horowitz, Bloomberg Beta, CRV, Flex Capital, Footwork, Shaper CapitalIndustry: Analytics, Artificial Intelligence (AI), Data ManagementFounders: Bobby Samuels, Aman KhanFounding year: 2024Total equity funding raised: $65.0MAlleyWatch broke news of this round in an exclusive: Protege Raises $30M to Solve AI Development’s Biggest Bottleneck Through Licensed Real-World Data

Round: Series BDescription: Sixfold AI is an insurtech company that uses AI to automate underwriting processes and support more informed risk evaluation. Founded by Alex Schmelkin, Brian Moseley, and Jane Tran in 2023, Sixfold AI has now raised a total of $51.5M in total equity funding and is backed by Bessemer Venture Partners, Salesforce Ventures, Guidewire Software, Scale Venture Partners, and Crystal Venture Partners.Investors in the round: Bessemer Venture Partners, Brewer Lane Ventures, Guidewire Software, Salesforce VenturesIndustry: Artificial Intelligence (AI), Generative AI, InsurTech, Productivity ToolsFounders: Alex Schmelkin, Brian Moseley, Jane TranFounding year: 2023Total equity funding raised: $51.5M

Round: Series BDescription: Outtake is a digital trust platform automating threat classification, detection, and response to enhance enterprise cybersecurity measures. Founded by Alex Dhillon in 2023, Outtake has now raised a total of $56.5M in total equity funding and is backed by S32, CRV, ICONIQ Capital, Cleveland Avenue, and Guillermo Rauch.Investors in the round: Bob McGrew, Cleveland Avenue, CRV, Guillermo Rauch, ICONIQ Capital, John Donovan, Nikesh Arora, S32, Satya Nadella, Shyam Sankar, Trae Stephens, William AckmanIndustry: Artificial Intelligence (AI), Cyber Security, Machine LearningFounders: Alex DhillonFounding year: 2023Total equity funding raised: $56.5M

Round: Series BDescription: Benepass is a benefits administration platform that helps companies manage and distribute employee perks and benefits. Founded by Jaclyn Chen, Kabir Soorya, and Mark Fischer in 2019, Benepass has now raised a total of $74.7M in total equity funding and is backed by Alumni Ventures, Y Combinator, Amino Capital, Portage Ventures, and Operator Partners.Investors in the round: Centana Growth Partners, FoW Partners, Portage Ventures, ThresholdIndustry: Employee Benefits, Enterprise Software, FinTech, Human ResourcesFounders: Jaclyn Chen, Kabir Soorya, Mark FischerFounding year: 2019Total equity funding raised: $74.7MAlleyWatch broke news of this round in an exclusive: Benepass Raises $40M to Help Employers Control Surging Healthcare Costs Through Consolidated Benefits Platform

10. FLORA $42.0M

Round: Series ADescription: FLORA is an applied AI HCI company building creative tools. Founded by Weber Wong and Alex Li in 2024, FLORA has now raised a total of $48.5M in total equity funding and is backed by Menlo Ventures, Alumni Ventures, Long Journey Ventures, Redpoint, and Company Ventures.Investors in the round: A16Z GAMES Speedrun, Alumni Ventures, Batuhan Taskaya, Burkay Gur, Company Ventures, Cyan Banister, Emery Wells, Gabe Whaley, Gorkem Yurtseven, Guillermo Rauch, Justin Kan, Long Journey Ventures, Matthew Hartman, Menlo Ventures, Mike Volpi, RedpointIndustry: Artificial Intelligence (AI), Information Technology, SoftwareFounders: Weber Wong, Alex LiFounding year: 2024Total equity funding raised: $48.5M

Round: Series BDescription: WithCoverage operates as a modern risk management and insurance broking platform targeting fast-growing businesses. Founded by JD Ross and Max Brenner in 2023, WithCoverage has now raised a total of $42.0M in total equity funding and is backed by Sequoia Capital, 8VC, Khosla Ventures, and Crystal Venture Partners.Investors in the round: 8VC, Crystal Venture Partners, Khosla Ventures, Sequoia CapitalIndustry: Business Development, Insurance, InsurTechFounders: JD Ross, Max BrennerFounding year: 2023Total equity funding raised: $42.0M

Round: Series BDescription: Talos is an end-to-end crypto trading platform that provides digital asset trading technology for lenders, brokers, and investors. Founded by Anton Katz and Ethan Feldman in 2018, Talos has now raised a total of $190.0M in total equity funding and is backed by Andreessen Horowitz, General Atlantic, Robinhood, Citi, and Fin Capital.Investors in the round: a16z crypto, BNY, Fidelity, IMC Trading, Karatage, QCP, Robinhood, Sony Innovation FundIndustry: Cryptocurrency, Financial Services, FinTech, Trading PlatformFounders: Anton Katz, Ethan FeldmanFounding year: 2018Total equity funding raised: $190.0M

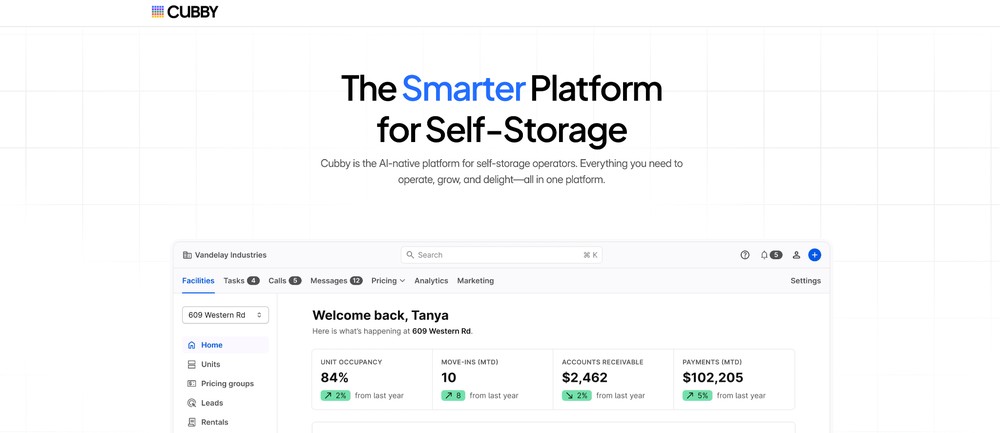

Round: Series ADescription: Cubby Storage supports self storage owners and operators. Founded by Adam Fleming in 2021, Cubby Storage has now raised a total of $63.0M in total equity funding and is backed by Goldman Sachs Alternatives.Investors in the round: Goldman Sachs AlternativesIndustry: Commercial Real Estate, Real Estate, Self-StorageFounders: Adam FlemingFounding year: 2021Total equity funding raised: $63.0M

Round: VentureDescription: Semafor is a news and media company that offers widely covered news content across the globe. Founded by Ben Smith and Justin B. Smith in 2022, Semafor has now raised a total of $107.6M in total equity funding and is backed by Gallup, Jerry Yang, Antenna Group, Henry Kravis, and PSP Capital Partners.Investors in the round: Antenna Group, David Rubenstein, Henry Kravis, PSP Capital Partners, Thomas LeysenIndustry: Internet, Media and Entertainment, NewsFounders: Ben Smith, Justin B. SmithFounding year: 2022Total equity funding raised: $107.6M

Round: Series CDescription: Datarails is an FP&A platform that automates consolidation, reporting, planning, and forecasting while supporting existing Excel models. Founded by Didi Gurfinkel, Eyal Cohen, and Oded Har-Tal in 2015, Datarails has now raised a total of $173.5M in total equity funding and is backed by Vertex Ventures, Zeev Ventures, One Peak, Innovation Endeavors, and Vintage Investment Partners.Investors in the round: ClalTech, Innovation Endeavors, Joey Low, One Peak, Qumra Capital, Vertex Growth Fund, Vintage Investment Partners, Zeev VenturesIndustry: Financial Services, FinTech, Information Technology, SaaS, SoftwareFounders: Didi Gurfinkel, Eyal Cohen, Oded Har-TalFounding year: 2015Total equity funding raised: $173.5M

5. Rogo $75.0M

Round: Series CDescription: Rogo provides an enterprise AI platform for automating research, workflows, and document creation in finance. Founded by Gabriel Stengel, John Willett, and Tumas Rackaitis in 2021, Rogo has now raised a total of $154.0M in total equity funding and is backed by Stonecroft Management, Sequoia Capital, BoxGroup, Khosla Ventures, and Thrive Capital.Investors in the round: Alt Capital, BoxGroup, Henry Kravis, JP Morgan, Khosla Ventures, MANTIS Venture Capital, Positive Sum, Sequoia Capital, Stonecroft Management, Thrive Capital, Tiger Global Management, Truist Ventures, Wells FargoIndustry: Analytics, Artificial Intelligence (AI), Business Intelligence, Financial Services, FinTech, Generative AIFounders: Gabriel Stengel, John Willett, Tumas RackaitisFounding year: 2021Total equity funding raised: $154.0M

Round: SeedDescription: Proxima Bio develops programmable medicines that modulate protein interactions to address disease processes. Founded by Jason Brouwer, Luca Naef, and Zachary Carpenter in 2019, Proxima has now raised a total of $86.3M in total equity funding and is backed by AIX Ventures, Modi Ventures, DCVC, Roivant Sciences, and Yosemite.Investors in the round: AIX Ventures, Alexandria Venture Investments, Braidwell, DCVC, Magnetic Ventures, Modi Ventures, NVentures, Roivant Sciences, YosemiteIndustry: Alternative Medicine, Artificial Intelligence (AI), Biotechnology, Clinical Trials, Life Science, Machine LearningFounders: Jason Brouwer, Luca Naef, Zachary CarpenterFounding year: 2019Total equity funding raised: $86.3M

Round: Series CDescription: Pomelo Care is a health technology company that develops evidence-based healthcare solutions for women and children. Founded by Marta Bralic in 2021, Pomelo Care has now raised a total of $179.0M in total equity funding and is backed by Andreessen Horowitz, BoxGroup, Atomico, SV Angel, and Operator Partners.Investors in the round: Andreessen Horowitz, Atomico, BoxGroup, Plus Capital, Stripes, SV AngelIndustry: Children, Health Care, Mobile Apps, Women’sFounders: Marta BralicFounding year: 2021Total equity funding raised: $179.0M

💡 CONNECT WITH NYC INNOVATORS

Join NYC’s top tech companies in reaching AlleyWatch’s engaged audience of founders, investors, and decision-makers. Learn More →

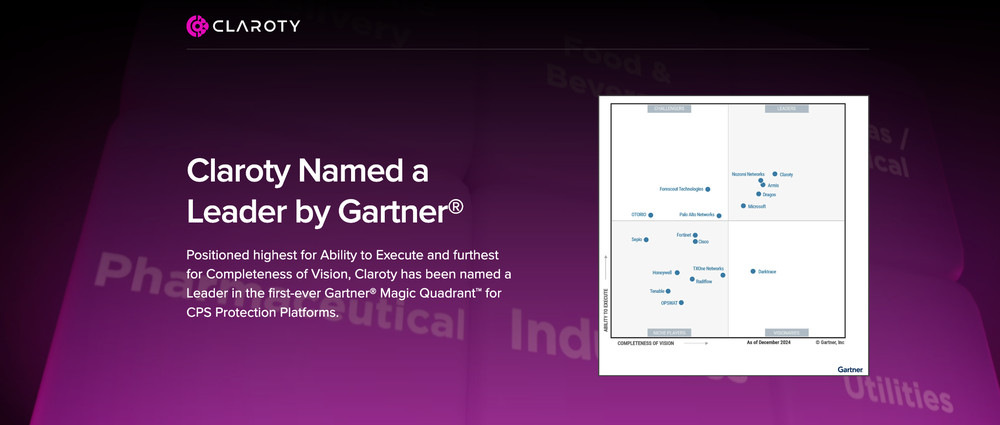

Round: Series FDescription: Claroty is a cybersecurity company that protects XIoT and cyber-physical systems from cyber threats. Founded by Amir Zilberstein, Benny Porat, and Galina Antova in 2015, Claroty has now raised a total of $890.0M in total equity funding and is backed by Temasek Holdings, Bessemer Venture Partners, Siemens, Team8, and SoftBank Vision Fund.Investors in the round: Golub GrowthIndustry: Cyber Security, Internet of Things, Network Security, SecurityFounders: Amir Zilberstein, Benny Porat, Galina AntovaFounding year: 2015Total equity funding raised: $890.0M

1. Rain $250.0M

Round: Series CDescription: Rain is a fintech company that builds stablecoin-powered payment infrastructure, allowing businesses and individuals to use tokenized money. Founded by Charles Yoo-Naut and Farooq Malik in 2021, Rain has now raised a total of $332.5M in total equity funding and is backed by Lightspeed Venture Partners, Norwest, Bessemer Venture Partners, Endeavor Catalyst, and Sapphire Ventures.Investors in the round: Bessemer Venture Partners, Dragonfly, Endeavor Catalyst, FirstMark, Galaxy Ventures, ICONIQ Capital, Lightspeed Venture Partners, Norwest, Sapphire VenturesIndustry: Blockchain, Cryptocurrency, Decentralized Finance (DeFi), FinTech, Web3Founders: Charles Yoo-Naut, Farooq MalikFounding year: 2021Total equity funding raised: $332.5M

📈 ENGAGE NYC DECISION MAKERS

Connect with NYC’s tech ecosystem through AlleyWatch, the most trusted voice in local tech and startups. Learn More →