Armed with data from our friends at CrunchBase, I’ve analyzed the largest global startup funding rounds for February 2025. This month’s rankings reveal several notable trends, particularly the strong resurgence of US-based startups dominating the top positions—a shift from recent months where we’ve seen more geographic diversity.

What’s particularly striking is that 9 out of the top 11 funded companies are headquartered in the United States. The AI sector continues its funding momentum, with six companies directly involved in artificial intelligence technologies.

The manufacturing and security sectors also made notable appearances, with substantial capital flowing to companies building physical technology solutions alongside software innovations.

Below, I’ve included comprehensive details for each company: industry classifications, round types, company descriptions, participating investors, founding information, headquarters location, and total equity funding to date.

February’s funding landscape reveals a pronounced dominance of US-based startups, with 9 of the 11 largest rounds going to American companies. This represents a significant shift from recent months when we observed greater international diversity in major funding events. Only two non-US companies made the list—StackAdapt from Toronto and Krutrim from Bangalore—highlighting the exceptional concentration of capital in the American tech ecosystem this month.

Artificial intelligence remains the dominant investment theme, with AI-focused startups representing over half the companies on the list and capturing approximately 60% of the total funding. Companies like Harvey, Together AI, and Abridge are leveraging generative AI across diverse applications from legal services to healthcare, confirming that investors continue to bet heavily on AI’s transformative potential.

Particularly noteworthy is the resurgence of interest in hardware and physical technology solutions. Companies like Lambda (AI infrastructure), Apptronik (robotics), and Saronic (unmanned surface vehicles) indicate that investors are looking beyond pure software plays to companies building tangible products that interface with the physical world.

The rapid trajectory of certain startups is remarkable, with companies like Saronic (founded 2022) securing massive funding rounds despite their relative youth. In just three years, Saronic has raised a total of $845M and reached Series C funding.

Finally, the diversity of industries represented—from legal tech and healthcare to quantum computing and maritime security—demonstrates how technological innovation continues to transform multiple sectors simultaneously. This cross-industry impact suggests we’re witnessing not just isolated breakthroughs but a broader technological transformation reshaping the global economy.

Interested in the top NYC Startup Fundings? – The Largest NYC Startup Funding Rounds of February 2025Interested in the top LA Startup Fundings? – The Largest LA Startup Funding Rounds for February 2025Interested in the top London Startup Funding? – The Largest London Startups Funding Rounds of February 2025Interested in the top US Startup Funding? – The Largest US Startups Funding Rounds of February 2025

The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties (New York Tech, London Tech, LA Tech) TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including strategic brand placement in a high-visibility piece like this, which will be read by the vast majority of key decision-makers in the global business community and beyond. Learn more about how a digital campaign will return your investment here.

11. Verkada $200.0M

Round: Series EDescription: San Mateo-based Verkada is a cloud-based physical security platform that specializes in security cameras and security solutions for enterprises. Founded by Benjamin Bercovitz, Filip Kaliszan, Hans Robertson, and James Ren in 2016, Verkada has now raised a total of $643.9M in total equity funding and is backed by General Catalyst, Sequoia Capital, Lightspeed Venture Partners, Eclipse Ventures, and First Round Capital.Investors in the round: Eclipse Ventures, General CatalystIndustry: Enterprise Software, Internet of Things, Physical Security, Smart BuildingFounders: Benjamin Bercovitz, Filip Kaliszan, Hans Robertson, James RenFounding year: 2016Location: San MateoTotal equity funding raised: $643.9M

10. Krutrim $229.7M

Round: VentureDescription: Bangalore-based Krutrim is a technology company that provides an AI-based platform to develop and support the operations of the mobility industry. Founded by Bhavish Aggarwal in 2023, Krutrim has now raised a total of $279.7M in total equity funding and is backed by Z47 and Bhavish Aggarwal.Investors in the round: Bhavish AggarwalIndustry: Artificial Intelligence (AI), Cloud Data Services, Cloud InfrastructureFounders: Bhavish AggarwalFounding year: 2023Location: BangaloreTotal equity funding raised: $279.7M

9. QuEra Computing $230.0M

Round: VentureDescription: Boston-based QuEra Computing is a neutral-atoms-based quantum computing startup, located in Boston, near Harvard University. Founded by Dirk Englund, John Pena, Markus Greiner, Mikhail Lukin, Nathan Gemelke, and Vladan Vuletic in 2018, QuEra Computing has now raised a total of $17.0M in total equity funding and is backed by Valor Equity Partners, Google, SoftBank Vision Fund, Safar Partners, and Day One Ventures.Investors in the round: Alphabet, Google, QVT Financial, Safar Partners, SoftBank Vision Fund, Valor Equity PartnersIndustry: Computer, Consumer Research, Quantum ComputingFounders: Dirk Englund, John Pena, Markus Greiner, Mikhail Lukin, Nathan Gemelke, Vladan VuleticFounding year: 2018Location: BostonTotal equity funding raised: $17.0M

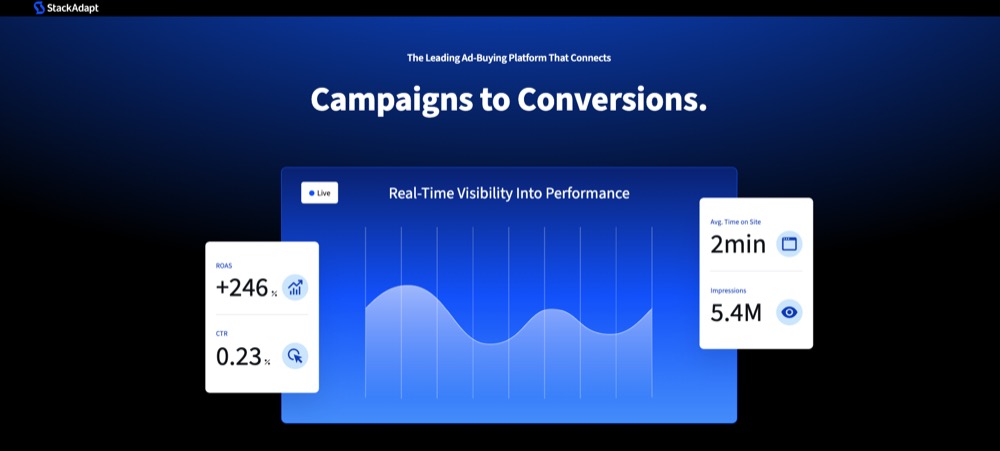

8. StackAdapt $235.0M

Round: VentureDescription: Toronto-based StackAdapt is a multi-channel programmatic advertising platform that helps maximize digital marketing efforts through data-driven solutions. Founded by Ildar Shar, Vitaly Pecherskiy, and Yang Han in 2014, StackAdapt has now raised a total of $536.6M in total equity funding and is backed by Summit Partners, Teachers’ Venture Growth, Plaza Ventures, MaRS Investment Accelerator Fund, and Intrepid Growth Partners.Investors in the round: Intrepid Growth Partners, Teachers’ Venture GrowthIndustry: Ad Retargeting, Ad Targeting, Advertising, Advertising Platforms, Digital Marketing, Machine Learning, Marketing, Mobile Advertising, Video AdvertisingFounders: Ildar Shar, Vitaly Pecherskiy, Yang HanFounding year: 2014Location: TorontoTotal equity funding raised: $536.6M

7. Abridge $250.0M

Round: Series DDescription: Pittsburgh-based Abridge is an AI-driven platform that transforms patient-clinician conversations into structured clinical notes for healthcare industries. Founded by Florian Metze, Sandeep Konam, and Shivdev Rao in 2018, Abridge has now raised a total of $457.5M in total equity funding and is backed by Union Square Ventures, Lightspeed Venture Partners, Bessemer Venture Partners, IVP, and Pillar VC.Investors in the round: Bessemer Venture Partners, California HealthCare Foundation, CapitalG, CVS Health Ventures, Elad Gil, IVP, K. Ventures, Lightspeed Venture Partners, NVentures, Redpoint, Spark Capital, SV AngelIndustry: Artificial Intelligence (AI), Electronic Health Record (EHR), Enterprise Software, Generative AI, Health Care, Intelligent Systems, Machine Learning, Medical, Natural Language Processing, SaaSFounders: Florian Metze, Sandeep Konam, Shivdev RaoFounding year: 2018Location: PittsburghTotal equity funding raised: $457.5M

The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties (New York Tech, London Tech, LA Tech) TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including strategic brand placement in a high-visibility piece like this, which will be read by the vast majority of key decision-makers in the global business community and beyond. Learn more about how a digital campaign will return your investment here.

6. Harvey $300.0M

Round: Series DDescription: San Francisco-based Harvey provides AI-driven tools to assist legal professionals with research, document review, and contract analysis. Founded by Gabe Pereyra and Winston Weinberg in 2022, Harvey has now raised a total of $506.0M in total equity funding and is backed by OpenAI, Sequoia Capital, Kleiner Perkins, Coatue, and Conviction Partners.Investors in the round: Coatue, Conviction Partners, Elad Gil, Google Ventures, Kleiner Perkins, OpenAI Startup Fund, REV, Sequoia CapitalIndustry: Artificial Intelligence (AI), Information Technology, Legal, Legal TechFounders: Gabe Pereyra, Winston WeinbergFounding year: 2022Location: San FranciscoTotal equity funding raised: $506.0M

5. Together AI $305.0M

Round: Series BDescription: San Francisco-based Together AI is a cloud-based platform designed for constructing open-source generative AI and infrastructure for developing AI models. Founded by Ce Zhang, Chris Re, Percy Liang, and Vipul Ved Prakash in 2022, Together AI has now raised a total of $533.5M in total equity funding and is backed by General Catalyst, NVIDIA, First Round Capital, Emergence Capital, and New Enterprise Associates.Investors in the round: Brave Capital, Cadenza Ventures, Coatue, DAMAC Capital, Definition, Emergence Capital, General Catalyst, Greycroft, John J. Chambers, Kleiner Perkins, Long Journey Ventures, Lux Capital, March Capital, NVIDIA, Prosperity7 Ventures, Salesforce Ventures, Scott Banister, SE VenturesIndustry: Artificial Intelligence (AI), Generative AI, Internet, IT Infrastructure, Open SourceFounders: Ce Zhang, Chris Re, Percy Liang, Vipul Ved PrakashFounding year: 2022Location: San FranciscoTotal equity funding raised: $533.5M

4. Apptronik $403.0M

Round: Series ADescription: Austin-based Apptronik designs and builds human-centered robotics systems. Founded by Bill Helmsing, Jeffrey Cardenas, and Nicholas Paine in 2016, Apptronik has now raised a total of $431.5M in total equity funding and is backed by B Capital, Google, Scrum Ventures, Capital Factory, and ARK Investment Management.Investors in the round: ARK Investment Management, B Capital, Capital Factory, Ethos Family Office, Google, Japan Post Capital, Mercedes-Benz Group AG, RyderVentures, Scrum Ventures, Trajectory VenturesIndustry: Artificial Intelligence (AI), Industrial Automation, Machinery Manufacturing, RoboticsFounders: Bill Helmsing, Jeffrey Cardenas, Nicholas PaineFounding year: 2016Location: AustinTotal equity funding raised: $431.5M

3. Lambda $480.0M

Round: Series DDescription: San Francisco-based Lambda provides infrastructure, cloud services, and software for the training and inferencing of AI models. Founded by Michael Balaban and Stephen Balaban in 2012, Lambda has now raised a total of $902.7M in total equity funding and is backed by B Capital, NVIDIA, Alumni Ventures, US Innovative Technology Fund, and Bossa Invest.Investors in the round: 1517 Fund, Andra Capital, Andrej Karpathy, ARK Investment Management, Crescent Cove Advisors, Fincadia Advisors, G Squared, IQT, KHK & Partners, NVIDIA, Pegatron, SGW, Supermicro, US Innovative Technology Fund, Wistron Corporation, WiwynnIndustry: Artificial Intelligence (AI), Cloud Computing, GPU, Machine LearningFounders: Michael Balaban, Stephen BalabanFounding year: 2012Location: San FranciscoTotal equity funding raised: $902.7M

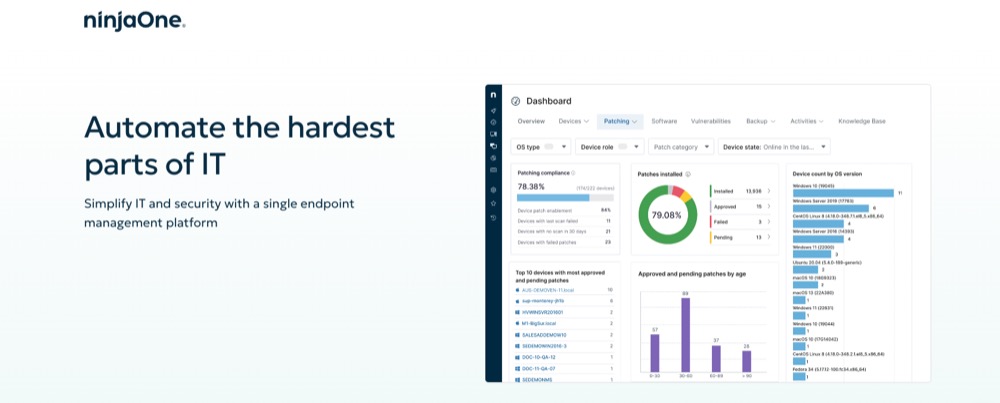

2. NinjaOne $500.0M

Round: Series CDescription: Austin-based NinjaOne serves as an IT platform for endpoint management that enhances productivity, minimizes risks, and lowers overall IT expenses. Founded by Christopher Matarese, Eric Herrera, and Sal Sferlazza in 2013, NinjaOne has now raised a total of $761.5M in total equity funding and is backed by ICONIQ Growth, Summit Partners, CapitalG, Amit Agarwal, and Frank Slootman.Investors in the round: CapitalG, ICONIQ GrowthIndustry: Cyber Security, Document Management, Information Services, Software, Software EngineeringFounders: Christopher Matarese, Eric Herrera, Sal SferlazzaFounding year: 2013Location: AustinTotal equity funding raised: $761.5M

1. Saronic $600.0M

Round: Series CDescription: Austin-based Saronic designs and manufactures unmanned surface vehicles for maritime security and domain awareness. Founded by Dino Mavrookas, Doug Lambert, Rob Lehman, and Vibhav Altekar in 2022, Saronic has now raised a total of $845.0M in total equity funding and is backed by General Catalyst, Andreessen Horowitz, Lightspeed Venture Partners, 8VC, and US Innovative Technology Fund.Investors in the round: 8VC, Andreessen Horowitz, Caffeinated Capital, Elad Gil, General Catalyst, Lightspeed Venture Partners, Silent VenturesIndustry: Artificial Intelligence (AI), Manufacturing, Marine Technology, Military, SecurityFounders: Dino Mavrookas, Doug Lambert, Rob Lehman, Vibhav AltekarFounding year: 2022Location: AustinTotal equity funding raised: $845.0M

The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties (New York Tech, London Tech, LA Tech) TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including strategic brand placement in a high-visibility piece like this, which will be read by the vast majority of key decision-makers in the global business community and beyond. Learn more about how a digital campaign will return your investment here.