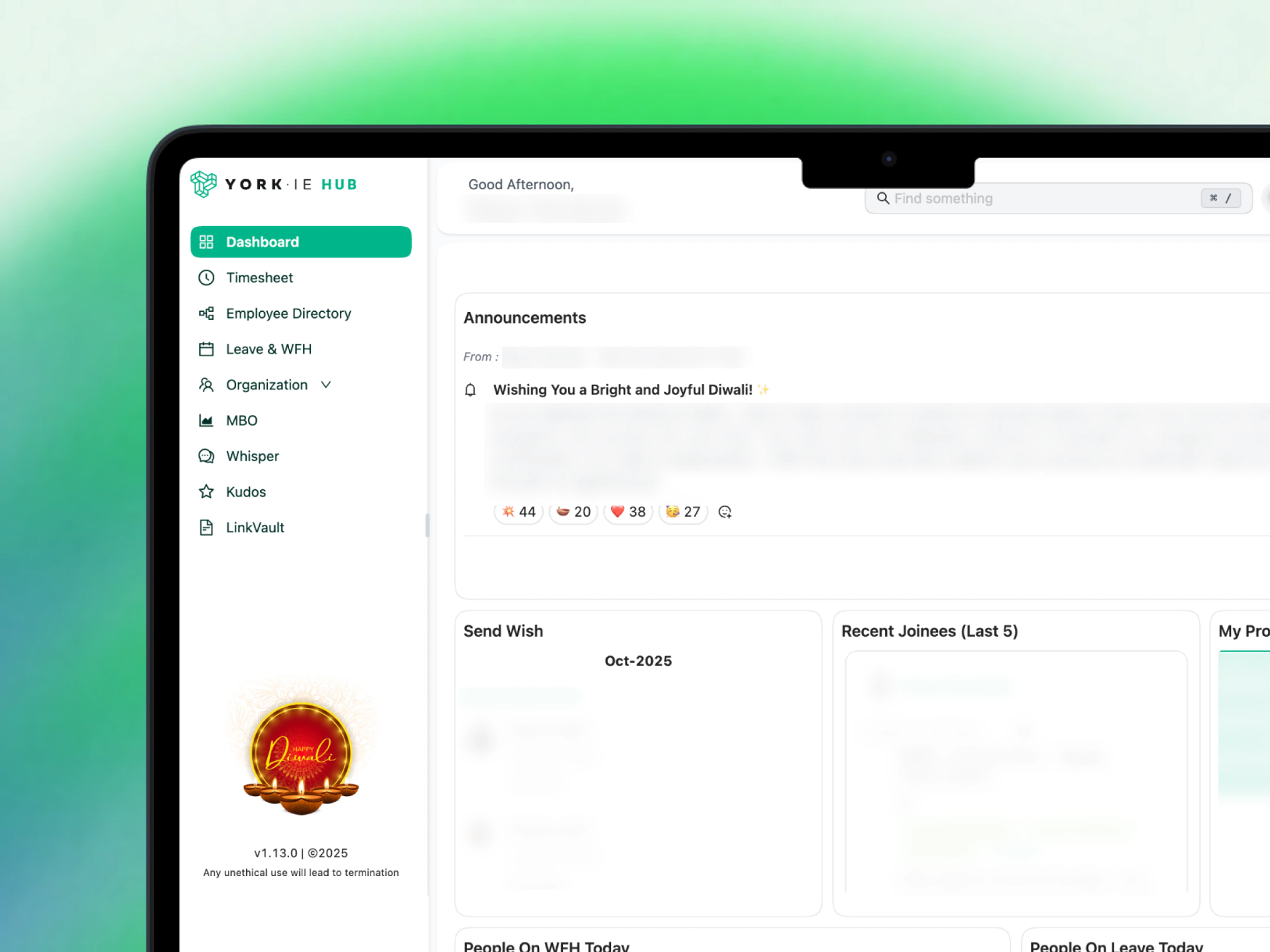

In an industry where 80% of real estate professionals still rely on spreadsheets for critical decision-making, the need for sophisticated revenue optimization solutions has never been more pressing. Despite being one of the most data-rich sectors, multifamily property management continues to struggle with inefficient processes and outdated technology that wastes valuable time and resources. Rentana delivers an AI-driven revenue intelligence platform built specifically for multifamily owners and operators. Through real-time pricing insights, automated public market analysis, and an intuitive user experience, Rentana empowers real estate professionals to make smarter, faster decisions that drive growth and efficiency in an increasingly competitive market. Founded by a team with experience at Stripe, Airtable, and Airbnb, the company reimagines real estate pricing with intelligent automation that saves customers up to 10 hours of manual pricing per property each week by modernizing workflows.

AlleyWatch sat down with Rentana CEO and Cofounder Julie Blanc to learn more about the business, its future plans, and recent seed round.

Who were your investors and how much did you raise?

We’re excited to have just closed a nearly $5M Seed round led by Zigg Capital and Benchstrength. They understood from the getgo how transformative Rentana’s technology will be for real estate, and I am so grateful to have them as our true strategic partners. Zigg and Benchstrength both back some of the most innovative companies in tech and real estate, they have an incredible track record of helping founders scale with thoughtfulness and speed, and they go above and beyond capital support to offer their expertise, network, and mentorship to our team everyday.

Tell us about the product or service that Rentana offers.

Rentana is an AI-driven revenue intelligence platform built for multifamily owners and operators. We deliver real-time pricing insights, automated public market analysis, and a fast, intuitive user experience — giving real estate professionals the intelligence and speed they need to stay ahead in today’s market.

What inspired the start of Rentana?

My cofounding team has a history of modernizing outdated workflows — whether it was reimagining payments at Stripe and databases at Airtable, or building proptech that now helps to power Airbnb and Appfolio.

We saw firsthand how revenue optimization transformed airlines, hotels, and e-commerce — but in real estate, pricing strategies were still stuck in the past, and we built Rentana to change that.

We’re here to help real estate leaders future-proof their revenue, maximize efficiency, and scale with confidence using AI as a true competitive advantage.

How is Rentana different?

One of our customers, Robert Waz, VP of Revenue & Strategic Initiatives at 29th Street Capital, articulated our point of differentiation best: “Other platforms feel like Windows 95. Rentana feels like 2025.”

His quote really sums up everything from our backend technology to our front-end user experience. Rentana transforms pricing and portfolio strategy with customized, real-time intelligence in record speed.

Unlike the legacy systems, Rentana is powerful, smart and easy to use: onboarding takes minutes, recommendations update in under a second, and it helps customers save up to 10 hours a week per property on data analysis and price planning. Our AI also doesn’t just recycle public data — it blends each customer’s private rental data with real-time market trends to generate insights that are uniquely theirs. We never share competitively sensitive data across customers. Your data stays your data — always.

What market does Rentana target and how big is it?

We’re helping multifamily owners and operators in the U.S., which according to a Freddie Mac report, represents more than a $300B market. It’s one of the largest and most valuable asset classes in the country — and it’s been relying on outdated revenue management software for far too long.

What’s your business model?

We’re a B2B SaaS platform, offering monthly subscriptions tailored to our customers’ portfolios.

How are you preparing for a potential economic slowdown?

We’re doubling down on supporting customers with our cutting-edge tech.

Real estate is a dynamic market — and in any cycle, especially during a potential economic slowdown, speed and precision are critical. Rentana gives owners and operators the real-time insights and intelligence they need to stay ahead.

We track live supply and demand signals down to the submarket and unit level. Our AI doesn’t just generate reports — it delivers actionable recommendations, helping owners optimize timing, anticipate market shifts, and minimize vacancies.

By providing full visibility into live market conditions — including concession trends, lease durations, and competitor specials — Rentana empowers customers to stay proactive, not reactive.

What was the funding process like?

Honestly, it was really personal for me. I started my career on the VC side, and then went on to help founders at early-stage startups raise capital. I’ve seen firsthand how grueling and high-stakes the process can be — and how critical it is to bring on investors who not only believe in your vision but are committed to standing by your team through the inevitable highs and lows of building a company.

I’ve known our investors for over a decade: Our Zigg Capital investor, Dave Eisenberg, from my early days at Two Sigma, where I actually backed Dave’s first startup, Floored, and John Monagle from Benchstrength – we started at Insight Venture partners together (Full circle over here!)

I bootstrapped Rentana for the first year because I wanted to prove we could build a product customers would pay for and find truly impactful to their business. Once we saw that traction, it was about bringing on the right strategic partners to help us accelerate our growth – and I’m so thrilled to have Zigg Capital and Benchstrength championing Rentana through this next phase.

What are the biggest challenges that you faced while raising capital?

One of the biggest challenges was simply the reality of being a small, fast-moving team breaking into a very established, traditional industry.

As a founder-led company, we were doing it all — strategizing, coding, designing, selling, onboarding customers, hiring, managing, and raising capital all at the same time. There’s no shortcut: it’s a lot of late nights and as the new player, we faced added hurdles… we were going up against entrenched incumbents, led by executives who had spent decades in real estate.

While our team has a track record of building powerful proptech solutions, our background is really in technology and B2B enterprise and not real estate.

While some investors found that as too high of a risk, others, including Zigg and Benchstrength, saw that as our competitive edge: by delivering advanced AI-driven intelligence, real-time market insights, and a user experience built for today’s operators, Rentana empowers customers to make smarter, faster, and more strategic decisions.

What factors about your business led your investors to write the check?

Our investors saw the same opportunity we did: real estate leaders frustrated by outdated revenue software, and a rising demand for technology designed for today’s digital era that actually drives growth, saves time, and helps anticipate market shifts.

Our investors saw the same opportunity we did: real estate leaders frustrated by outdated revenue software, and a rising demand for technology designed for today’s digital era that actually drives growth, saves time, and helps anticipate market shifts.

What are the milestones you plan to achieve in the next six months?

Agentic AI is the future, and Rentana will lead the way.

You’ll see us building out the premier AI copilot for real estate owners and operators, integrating our customers’ goals, budget, marketing data, and ancillary revenue streams like parking and storage to position Rentana as your go-to revenue partner. We’ll also expand into conversational AI, where teams can interact and literally talk to their data to get feedback on market trends, insights, forecasts — and get answers instantly.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

New York is one of the best places in the world to build a company. There’s a thriving startup and VC ecosystem here with organizations like Founders.nyc, Techstars, and countless pre-Series A events that help founders sharpen their strategies, build stronger networks, and navigate their path to fundraising.

Where do you see the company going in the near term?

We’re scaling Rentana into a holistic revenue optimization platform that functions like a digital teammate. The platform will help you build out and enhance your entire portfolio strategy in real-time through individualized insights, predictive analytics, and conversational AI.

What’s your favorite spring destination in and around the city?

I grew up by the beach in Southern California, and now that I live in Tribeca, I’m always finding my way back to the water. When it’s nice out, I love walking along the Hudson in Rockefeller Park. There’s just something about the boats, the breeze, and the river views that makes me feel recharged.