In today’s fast-fashion world, consumers struggle to keep up with rapidly changing trends while managing both budget constraints and environmental impact. True to the Pareto principle, the average person wears only 20% of their wardrobe 80% of the time, leaving billions of dollars in fashion assets sitting idle in closets across America. Pickle connects users directly with each other’s closets through its peer-to-peer fashion rental marketplace. Users can rent coveted pieces from their neighbors—whether it’s a designer dress for a wedding or a luxury handbag for a special occasion—making high-end fashion accessible while simultaneously allowing closet owners to earn money from their wardrobes during downtime. With a community-driven model that has grown to over 200,000 items from more than 2,000 brands, Pickle creates a circular economy that changes how people access, share, and monetize fashion in real-time.

AlleyWatch sat down with Pickle CEO and Cofounder Brian McMahon to learn more about the business, its mission to connect closets much like Airbnb connects homes, its future plans, and the founding story that includes taking over 4,000 subway rides to hand-deliver items during the company’s earliest stage.

Who were your investors and how much did you raise?

Series A $12M, which would bring total capital to $20M. FirstMark and Craft Ventures are co-leading a $12M Series A funding round with participation from Burst Capital and FJ Labs, investors known for backing leading marketplaces and consumer brands like Airbnb, Uber, Pinterest, Alibaba, and Yelp.

FirstMark – Led by Rick Heitzmann, early investor in Airbnb, Pinterest, and other leading consumer tech brands.

Craft Ventures – Led by Jeff Fluhr, founder of StubHub.

Burst Capital – Led by former Yelp executives (COO and CFO).

FJ Labs – Led by Fabrice Grinda, investors behind Alibaba, Uber, and Airbnb.

Tell us about the product or service that Pickle offers.

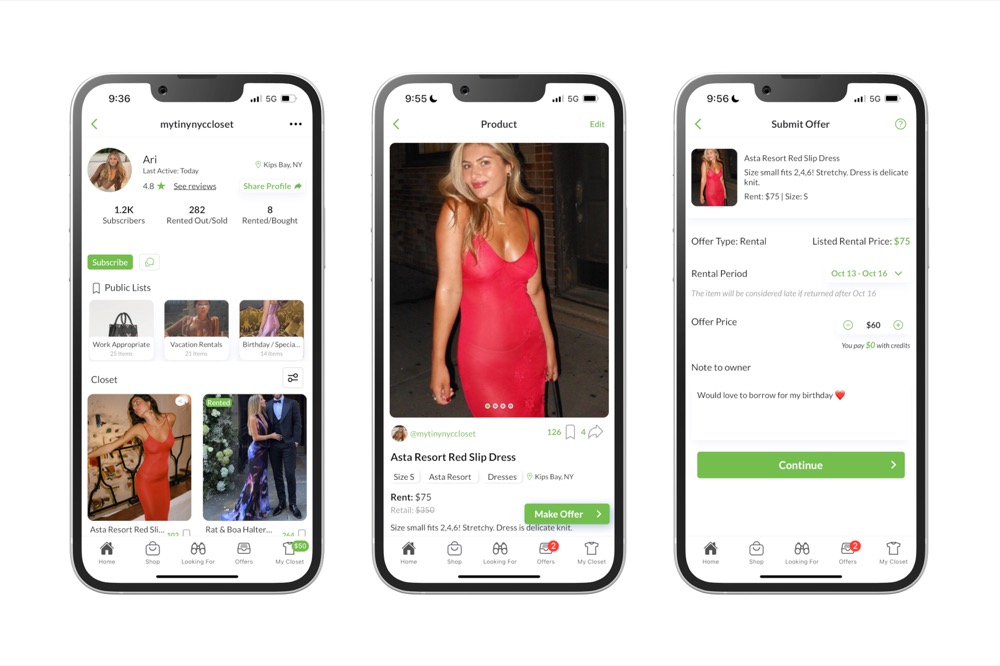

Pickle’s solution starts with the closet. By connecting hundreds of thousands of closets within a community and making items available for rent same-day with door-to-door delivery, Pickle makes it easy and enjoyable for anyone to keep items in circulation. To list: earn passive income between wears by simply uploading a photograph and description of the item, setting the price and availability, and selecting your preferred shipping method (integrated courier service, self-delivery, or standard shipping for non-local rentals). To rent: sustainably keep pace with microtrends, experiment with personal style, and access luxury items for less by shopping Pickle’s vast selection of apparel online, in-app, or in-store. Search based on location, occasion, style, curated closets, and more. Select when you want the item and pay only for the time you use it. At the end of the rental, schedule a courier pick-up, meet up with the owner to return in person, or drop off with the lister for local rentals, or mail back using our pre-paid label and box

What inspired the start of Pickle?

In 2021, Julia (Julia O’Mara -Cofounder) and I left our analyst roles at Blackstone, both driven by a curiosity about how people make purchasing decisions — and how to help them make better ones. We launched the first version of Pickle (what we now call Pickle 1.0) as a way to crowdsource opinions on each other’s potential purchases.

A pattern quickly emerged: people kept recommending items they already owned. We’d hear things like, “This is my favorite dress — I just wore it to a wedding,” or “This brand is my go-to; it looks good on everyone.” That was the lightbulb moment. We needed to connect a community of shareable closets — and do it in a way that was as dynamic and easy as borrowing from a friend.

So we taught ourselves to code, built the experience we knew people wanted, and spent months hand-delivering items across NYC — 4,000+ subway rides later, Pickle relaunched as the peer-to-peer fashion rental marketplace it is today.

How is Pickle different?

Unlike traditional fashion rental companies that buy, own, and manage inventory, Pickle is a peer-to-peer marketplace. We don’t manage warehouses or attempt to predict trends a year in advance while pre-ordering inventory. Our supply is dynamic because it comes straight from real people’s closets — which means we can keep up with fashion in real time.

When a new brand or item goes viral online, it’s often already in someone’s closet and instantly rentable on Pickle. That kind of speed and flexibility lets us meet demand without the overhead, dry cleaning, or inventory management.

We also don’t lock people into subscriptions. We’ve found that customers value the freedom and ease of renting on their own terms — no monthly fees, no commitment. It’s all designed to feel as natural and seamless as sharing clothes with friends.

Another key difference: Pickle is a true two-sided marketplace. Many of our users rent and lend. They earn money by sharing their wardrobes, then put it right back into the ecosystem. It keeps fashion in circulation and fuels a community-led, ever-evolving experience.

At the end of the day, we’re building a marketplace that’s better, faster, more accessible — and more affordable — than anything else out there.

What market does Pickle target and how big is it?

Pickle is available nationwide for anyone looking to rent high-quality fashion in a way that’s more affordable, convenient, and circular — and for anyone looking to earn passive income by lending out the pieces sitting in their closet.

Right now, we’re focused on women’s clothing and accessories, with a core demographic of Gen Z and millennial women. But this is just the beginning. We have plans to expand into new categories, including areas outside of fashion.

Today, Pickle has tens of thousands of renters and lenders across the U.S., and the opportunity ahead is massive. Most people wear just 20% of what’s in their closet 80% of the time. That means billions of dollars in underutilized items — and Pickle is helping unlock that value by turning idle items into earning, shareable assets.

What’s your business model?

Pickle is a peer-to-peer rental platform where users can rent and lend items from each other’s wardrobes, paying only for the time they need — think Airbnb, but for closets.

We charge a service fee on each transaction, and in select markets, we offer on-demand, same-day delivery through our courier network — similar to how Uber Eats or DoorDash operates. It’s a seamless experience designed to match the pace of how people actually live and dress, whether they need a last-minute outfit or want to earn passive income from pieces they already own.

How are you preparing for a potential economic slowdown?

Pickle is built for value — which makes it naturally resilient in any economic climate. Renters get access to high-quality fashion for a fraction of the retail price, often 80–90% off. Lenders earn passive income from items they already own.

Whether people are looking to save or earn, Pickle offers a practical, affordable solution. In a slowdown, that combination becomes even more compelling.

What was the funding process like?

We’re really excited about this round. Since mid-2023 (when we raised initial capital), we’ve had strong partnerships with FirstMark, Craft, and Burst Capital. As we started preparing to raise, we asked ourselves: who do we really want in the room? And the answer was clear — we already had a great thing going. Instead of going out widely, we doubled down on the relationships we’d already built.

Our goal for this round was to bring in even more marketplace expertise. Marketplaces are a unique business model, especially on the consumer side, and there aren’t many investors with deep experience in this space. That’s why we also brought FJ Labs on board — they’ve backed some of the most successful marketplaces out there, and their expertise in consumer-facing platforms is invaluable.

What are the biggest challenges that you faced while raising capital?

One of the early challenges came after we pivoted and launched Pickle as a peer-to-peer rental marketplace in May 2022. We’d originally launched Pickle in 2021 as a platform to crowdsource opinions on purchases, but the consistent theme we saw — people recommending items already in their closet — led us to rethink the model and build what Pickle is today.

We didn’t raise significant outside capital until over a year later, in June 2023. That first stretch post-pivot was all about proving that this new version of Pickle — the marketplace — was something people would actually use and return to often. We needed time to show traction: repeat renters, growing supply, strong retention, and organic word-of-mouth.

By the time we raised again, the story had changed significantly. Word of mouth had picked up, and we were getting more inbound interest from investors. There’s clearly growing excitement around circular fashion, but we still had to differentiate ourselves from more traditional resale or subscription-based rental models. We’re asset-light, fast-moving, and don’t carry the overhead of storage or cleaning — and that took some explaining in a space where many investors default to comparing us to older, inventory-heavy, asset-heavy models.

Another major focus during this round was engagement. Pickle is a marketplace, but much of our user behavior mirrors a social platform. Nearly 50% of our monthly active users are also weekly active users. That level of stickiness, combined with a community-driven model, really stood out. People use Pickle not just to rent, but to browse, discover new brands, and explore personal style through other closets — and that mix of utility and inspiration was something our investors got excited about.

What factors about your business led your investors to write the check?

Our investors were drawn to a combination of rapid growth, strong engagement, and organic network effects that are rare to see this early. Over the past year, we’ve more than quadrupled net revenue and tripled our monthly active users. Half of those monthly active users are also weekly active, and much of that growth has been organic — driven by word-of-mouth and deep brand affinity.Here’s what some of our investors had to say:

“At FirstMark, we rarely double down this early, but Pickle is proving to be one of those rare marketplaces where virality, organic growth, and deep consumer love are creating extraordinary network effects—it reminds us of the early days of Instagram, when a community-first approach and simple yet sticky product drove explosive engagement. The retention, engagement, and community-driven expansion we’ve seen are signals of a truly category-defining business. Pickle isn’t just building a fashion rental marketplace—it’s pioneering a new way for consumers to access and monetize high-quality goods at scale. We couldn’t be more excited to continue supporting Brian, Julia, and the Pickle team as they redefine the future of commerce.” — Rick Heitzmann, Cofounder and Partner, FirstMark

“Pickle is redefining how young consumers engage with fashion—not just as consumers, but as trendsetters and entrepreneurs. The engagement metrics are off the charts thanks to an engaged community of users who scroll the app multiple times a day to check out the hottest trends. As new trends emerge, Pickle’s community instantly responds by listing, renting, and shaping what’s next. Pickle has what everybody wants: the engagement metrics of a social app with the monetization power and scalability of a marketplace. Brian and Julia deeply understand what makes marketplaces thrive, and we’re thrilled to continue supporting them as they scale Pickle into a category-defining business.” — Jeff Fluhr, General Partner, Craft Ventures

What are the milestones you plan to achieve in the next six months?

We’re focused on three key areas: team, product, and market expansion.

We’re building out the team across engineering, logistics, marketing, and growth to support our next stage. On the product side, we’re rolling out a sleek new web platform along with features that make closet management and product discovery easier — plus upgrades that make the entire Pickle experience more fun and rewarding.

We’re also expanding markets. While Pickle is available nationwide, a large portion of our inventory is in NYC and LA.. Over the next six months, we’re ramping up efforts to bring more supply to additional cities, including Miami, Chicago, Dallas, and San Francisco.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Focus on your core value prop and the customer you serve best. Companies that solve real problems — and solve them well — will win.

New York is an incredible place to build, especially for consumer startups, because of the sheer volume and diversity of people. Use that to your advantage.

And above all, be scrappy. Every dollar — whether spent or earned — counts.Where do you see the company going now in the near term?

We’re focused on growing the team and expanding into new markets, while continuing to go deep in cities where we’re already seeing strong, organic momentum — including New York, LA, Miami, San Francisco, Chicago, and Dallas.

What’s your favorite spring destination in and around the city?

A walk along the West Side Highway — and ideally ending up at a restaurant with outdoor seating.