The US healthcare system’s capacity crisis has reached a breaking point in neurology, where 145 million Americans with chronic neurological conditions face average wait times of 4-6 months to see a specialist, if they can find one at all. This shortage isn’t just an inconvenience; it’s forcing millions to cycle through emergency departments, endure preventable suffering, and watch treatable conditions worsen while they wait. Neura Health tackles this crisis head-on with a comprehensive virtual neurology platform that delivers appointments within seven days, combining board-certified specialists with AI-powered workflows and continuous care coordination. The company has already served over 43,000 patients nationwide, achieving a 73% reduction in ER visits and a 66% increase in patients’ global impression of improvement – outcomes that caught the attention of the American Heart Association’s Go Red for Women Venture Fund, which made Neura its first-ever investment. With their recent expansion into memory care addressing the critical shortage of cognitive neurologists (just one per million dementia patients), Neura is building the infrastructure layer that health systems need to manage neurological care at scale.

AlleyWatch sat down with Neura Health CEO and Founder Elizabeth Burstein to learn more about the business, its future plans, recent $11.4M Series A round that brings total funding to $21.7M, and much, much more…

Who were your investors and how much did you raise?

We raised a $11.4M Series A led by the American Heart Association’s Go Red for Women Venture Fund, marking the fund’s first-ever investment. Additional participants include Norwest Venture Partners, Koch Disruptive Technologies, Esplanade Ventures, Pear VC, Correlation Ventures, and E12 Ventures.

Tell us about the product or service that Neura Health offers.

Neura is addressing an urgent unmet need for sub-specialty, patient-focused neurological support. 145 million Americans live with a neurological condition, yet the average wait time for an appointment with a neurologist is at least 4–6 months due to a nationwide provider shortage (American Academy of Neurology). Neura is closing the access gap with a first-of-its-kind, comprehensive platform that combines virtual visits with top neurologists and neurological sub-specialists, alongside AI-powered workflows, an intuitive app with integrated symptom tracking, streamlined care navigation, and personalized education and coaching.

What inspired the start of Neura Health?

Prior to founding Neura, I led product development at LinkedIn, Maven Clinic, and Zocdoc, all of which exposed me to the promise of technology to do right by patients. In March 2020, I became patient myself – I developed a complicated nerve entrapment issue. Despite having had 7 radiology exams, 3 rounds of physical therapy, and 10 nerve blocks and epidural steroid injections, I have not found any effective relief. The experience has exposed me to the fragmented system, challenges with specialist access, and lack of integration with health trackers. After diligently documenting my pain patterns on a Google sheet, I could not find a specialist to regularly engage with me on this data to improve treatment. I realized how badly things needed to change for patients and for the system at large.

How is Neura Health different?

Unlike point solutions focused on just one condition or that offer text-only care, Neura’s care model delivers accessible, comprehensive neurological care built for both high-quality outcomes and high-touch support, regardless of the condition. Neura is the only tech-enabled care model to support the full spectrum of neurology conditions, including eight major condition categories: headache and migraine, epilepsy, chronic pain, concussion, stroke recovery, dementia, and undiagnosed neurological symptoms.

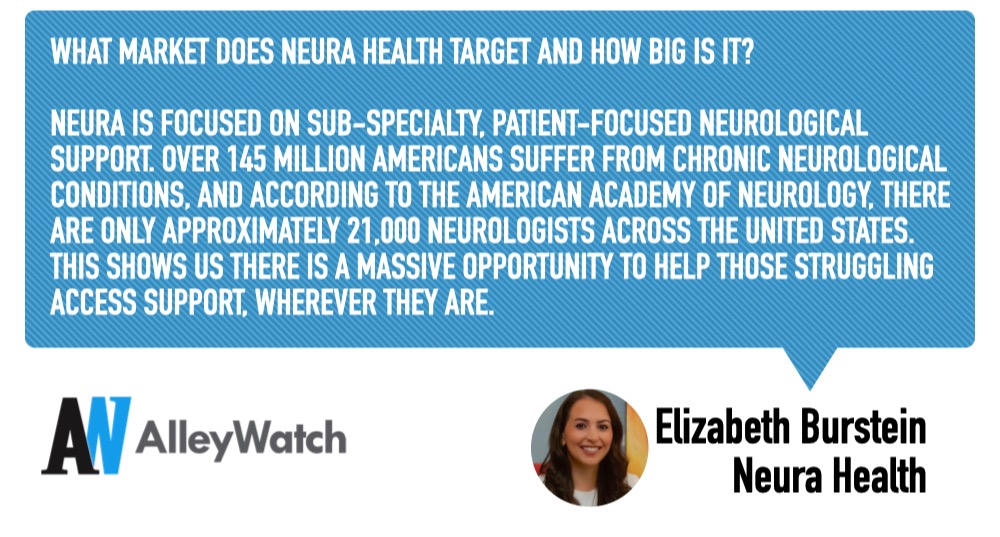

What market does Neura Health target and how big is it?

Neura is focused on sub-specialty, patient-focused neurological support. Over 145 million Americans suffer from chronic neurological conditions, and according to the American Academy of Neurology, there are only approximately 21,000 neurologists across the United States. This shows us there is a massive opportunity to help those struggling access support, wherever they are.

What’s your business model?

Neura has forged partnerships with more than 40 health plans, including Aetna, Blue Shield of California, Cigna, Sana, Anthem Blue Cross, TriWest, and Medicare, allowing us to integrate seamlessly into the medical system and offer in-network treatment to patients. For others, we offer performance guarantees or more value-based care agreements.

We’ve also partnered with leading health systems like Sentara Health to extend their bandwidth and treat the widest array of neurological conditions, and have referral partnerships with life sciences leaders such as Theranica and Otolith Labs. These are primarily fee for service agreements.

How are you preparing for a potential economic slowdown?

We’re taking necessary precautions for our business, including minimizing unnecessary costs and maximizing our revenue. That said, we believe that, because we offer such an essential piece of healthcare, health plans will continue to recognize and invest in our offering.

What was the funding process like?

We were really energized and excited by the strategic synergies between Neura and the American Heart Association’s Go Red for Women Venture Fund. The Go Red for Women Venture Fund is focused on conditions that affect women distinctively, differently, or disproportionately, so Neura’s focus on many of these conditions (migraine, stroke recovery, dementia, chronic pain) ties in well.

What are the biggest challenges that you faced while raising capital?

One of the biggest challenges in raising capital has been helping investors really understand our go-to-market. It’s not a simple, single-channel model — we have a multi-pronged approach that touches patients, providers, and payers. That’s intentional, because healthcare doesn’t move through one clean distribution path. But it also means our story takes a little more time to explain.

A lot of investors tend to bucket companies into familiar patterns — pure B2B, or D2C, or payer-focused — and we don’t fit neatly into any one of those. The challenge was showing how the different parts of our model reinforce each other, and why that complexity actually creates durability and scale over time. Once we found investors who really got that, the conversations clicked — they could see the bigger picture we were building toward.

One of the biggest challenges in raising capital has been helping investors really understand our go-to-market. It’s not a simple, single-channel model — we have a multi-pronged approach that touches patients, providers, and payers. That’s intentional, because healthcare doesn’t move through one clean distribution path. But it also means our story takes a little more time to explain.

A lot of investors tend to bucket companies into familiar patterns — pure B2B, or D2C, or payer-focused — and we don’t fit neatly into any one of those. The challenge was showing how the different parts of our model reinforce each other, and why that complexity actually creates durability and scale over time. Once we found investors who really got that, the conversations clicked — they could see the bigger picture we were building toward.

What factors about your business led your investors to write the check?

Our investors were drawn to a few key factors that make our business uniquely positioned to lead in neurological care delivery. First, we’ve developed proprietary technology that enables scalable bandwidth extension for clinicians — allowing health systems to expand access to high-quality neurological care without adding staff. This technology isn’t just a workflow tool; it’s a deeply integrated platform that supports diagnosis, monitoring, and management across the full spectrum of neurological conditions.

Second, we’re the only solution in the market designed to serve as a true bandwidth extender for an entire neurology department, not just for one or two niche conditions. That breadth is critical for large health systems, where neurological patients present with a wide variety of disorders — and where operational efficiency and clinical consistency are essential.

Ultimately, investors saw that we’re building not just a product, but the infrastructure layer that health systems will depend on to manage neurological care at scale.

What are the milestones you plan to achieve in the next six months?

For the next six months, we’re focused on forging partnerships with additional health plans, health systems, and clinics across the country and reaching more patients. We’ll also continue to invest in our clinical model and team.

Additionally, we’re building the foundation for long-term clinical breakthroughs. Neura is aggregating one of the largest real-world evidence datasets in neurology, centralizing outcomes, symptoms, and treatment data that have long been siloed across the healthcare system. This year, we’ll continue to build this dataset, pushing toward our long-term goal of finding life-changing medical solutions by learning from the experience of every neurology patient.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

If your company doesn’t currently have a new injection of capital in the bank, the best course of action is to slow your burn and focus on scaling profitably. This means carefully evaluating spending, extending your runway, and prioritizing activities that generate sustainable revenue rather than rapid, inefficient growth.

In parallel, conduct first principles user research — go back to the fundamentals of your customer needs and validate whether your business or product is truly unique among the competition. Deeply understanding your users and differentiating your offering will position you to grow more efficiently and attract capital under stronger terms later.

What’s your favorite fall destination in and around the city?

Rockefeller State Park for its beauty and stroller-friendly paths!