Retail’s rapid embrace of private label brands has created a supply chain crisis that legacy systems can’t handle. Private label sales hit a record $271B in 2024, growing 3.9% while national brands managed just 1% growth, pushing retailers to manage increasingly complex product portfolios with outdated tools designed for simpler times. Over 90% of industry leaders plan to increase private brand investments in the next two years, yet most rely on fragmented systems that force brands to spend months navigating trade shows and email chains to find the right manufacturing partner. Keychain connects over 20,000 brands and retailers with 30,000 vetted manufacturers through AI-powered matching technology that eliminates these bottlenecks, turning product ideas into structured, searchable data that accelerates sourcing from months to days. The platform launched KeychainOS for manufacturers in February 2024, then immediately faced demand from retailers who needed the same end-to-end visibility for their private label programs- a signal that drove the company to develop Keychain360, a supply chain management platform designed specifically for retail private label operations. With eight of the top ten U.S. retailers and customers like General Mills already using the platform, Keychain has positioned itself at the center of the $2T+ consumer packaged goods industry’s digital transformation.

AlleyWatch sat down with Keychain CEO and Cofounder Oisin Hanrahan to learn more about the business, its future plans, recent funding round, and much, much more…

Who were your investors and how much did you raise?

Keychain is announcing a $10M investment from W23 Global, a global fund backed by Tesco, Ahold Delhaize, Woolworths Group, Empire Company Limited, and Shoprite Group. The investment follows our $30M Series B announcement in August, bringing the total capital raised to $78M.

Tell us about the product or service that Keychain offers.

Keychain is an AI-powered platform that connects over 20,000 brands and retailers with over 30,000 vetted manufacturers. Our core search-and-discovery product is completely unique in the market–no other platform offers instant matching between brands and manufacturers at this scale. It uses AI to bridge the gap between product ideation and physical manufacturing, making the whole process, from design to sourcing and production, clearer and more efficient.

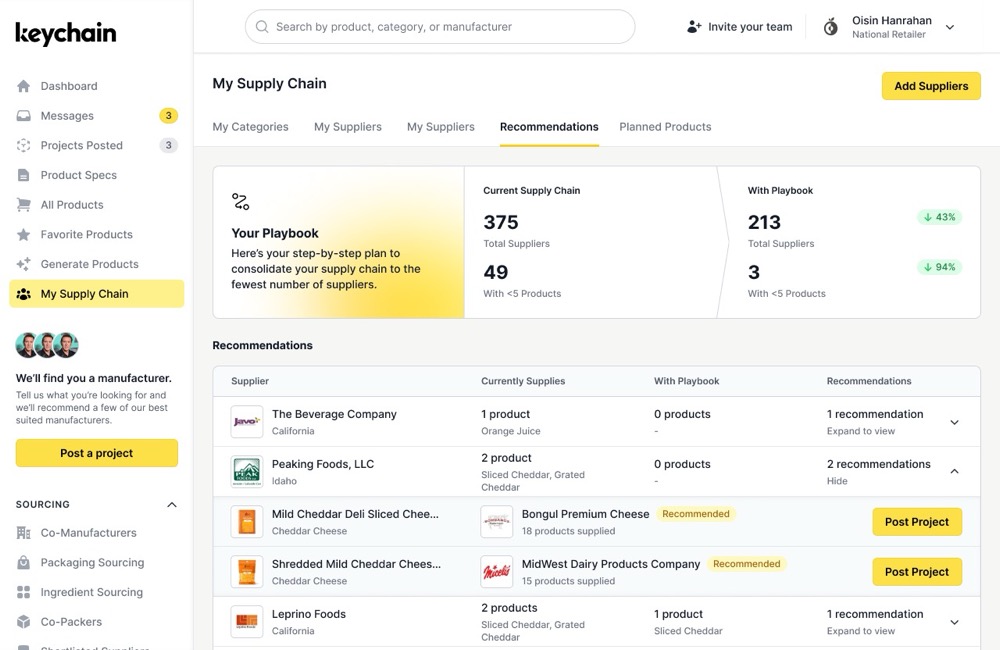

Since our launch in February 2024, we’ve introduced two operating systems that support the rest of the product lifecycle. KeychainOS is built for manufacturers, and our latest product, Keychain360, is a next-generation supply chain and product management platform designed to help retailers develop and manage their private label brands more efficiently.

What inspired the start of Keychain?

In the past, bringing a new product to market forced brands through months, sometimes even years, of manual searches, trade shows, and endless emails to secure the right manufacturing partner. Keychain was founded to eliminate these bottlenecks and bring real clarity and speed to the consumer-packaged goods (CPG) manufacturing process. By turning product ideas into structured, searchable data, we help brands and manufacturers make smarter decisions faster than ever before.

How is Keychain different?

Keychain is the first AI-native operating system that brings the entire CPG product development process into one place. Our core search-and-discovery product is one-of-a-kind–there really isn’t another product that can connect brands and retailers to vetted manufacturers at this scale.

We definitely have some competition when it comes to KeychainOS and Keychain360, but our advantage is that these tools sit on top of the only real-time, AI-powered manufacturing network. That foundation gives retailers and brands better data, better visibility, and a level of execution that others can’t match.

What market does Keychain target and how big is it?

Keychain targets the global consumer packaged goods market, specifically brands and retailers looking to bring products to market more efficiently. We also target manufacturers looking for potential customers. CPG is a $2 trillion+ industry, and Keychain currently serves categories including food and beverage, supplements, beauty, and personal care.

What’s your business model?

Keychain works with a network of over 30,000 manufacturers and 20,000 brands and retailers. Manufacturers pay based on how they use the platform and the tools and capabilities they need, while brands ranging from major CPG players to emerging startups gain access to the platform at no cost. The model is designed to make Keychain valuable and accessible to businesses of every scale, whether they’re developing a single product or managing a vast portfolio worldwide.

You just announced your Series B round in August. Why raise now, so soon?

Private label is booming, and it’s clear that retailers need the technology we’re building to keep up with demand. They’re treating private label as a core growth engine, which means more complexity, tighter timelines, and higher pressure to deliver high-quality products quickly. As soon as we launched KeychainOS for manufacturers, retailers wanted the same end-to-end visibility and control for their own programs. This funding allows us to accelerate Keychain360 and meet that demand head-on.

What was the funding process like?

The funding process came together naturally and was a smooth process. Once we started talking to W23 Global and their network of leading grocery retailers, it was clear they saw the same opportunity we did: private label is growing fast, and retailers need better tools to match the pace.

What are the biggest challenges that you faced while raising capital?

The hardest part of fundraising is the process itself. It’s time-consuming, and there’s a lot of back-and-forth. Luckily, I have two amazing co-founders who can run the business during busy times like fundraising.

What factors about your business led your investors to write the check?

Investors were drawn to a few key things about Keychain. First, the market itself is massive: private label is growing more rapidly than any other segment in retail, and retailers are under pressure to move faster and more efficiently than ever. Second, our technology is already widely used, connecting thousands of brands, retailers, and manufacturers, and helping them bring products to market months faster. And finally, our team and track record matter. Customers like General Mills and eight of the top ten U.S. retailers rely on us today, so investors see that we’re not just solving a small problem–we’re redefining how private label and product creation work globally.

What are the milestones you plan to achieve in the next six months?

Over the next six months, we’re focused on rolling out Keychain360, giving retailers full visibility and control over their supply chains. This will position us as the leading AI operating system for retailers looking to grow their private label brands. At the same time, we’re expanding our CPG manufacturing offerings with goals to cover the entire market.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Focus on customer pain points and deliver value early. In today’s climate, capital follows traction. Stay close to your users, and show how your product drives real business outcomes because investors will always want to see momentum.

Where do you see the company going now over the near term?

Over the next six months, we’re focusing on rolling out Keychain’s new product, Keychain360. It’s a huge step forward in our mission to connect the entire retail ecosystem–brands, manufacturers, and retailers–so that more innovative products consumers actually want can reach shelves.

What’s your favorite fall destination in and around the city?

The Catskills.