In the complex and costly world of pharmaceutical development, the process of drug discovery remains one of the most significant bottlenecks, with scientists often describing compound optimization as a frustrating “whack-a-mole” game where fixing one molecular issue creates multiple new problems. Traditional approaches require making thousands of molecules over years, consuming millions of dollars with no guarantee of success. Inductive Bio has developed a collaborative AI platform that dramatically accelerates compound optimization by predicting how molecules will behave in the human body before they’re synthesized in a lab. Through their pre-competitive data consortium, multiple pharmaceutical companies share anonymized data in a secure environment, creating a foundation that allows AI models to learn from thousands of real-world drug programs rather than limited datasets from individual companies. AlleyWatch sat down with Inductive Bio CEO and Founder Josh Haimson to learn more about the business, its future plans, and recent funding round that brings the company’s total funding raised to $29.3M.

Who were your investors and how much did you raise?

We raised $25M in Series A financing led by Obvious Ventures with participation from Andreessen Horowitz (a16z) Bio + Health, Lux Capital, Section 32, Character, and Amino Collective, alongside several angel investors.

Tell us about the product or service that Inductive Bio offers.

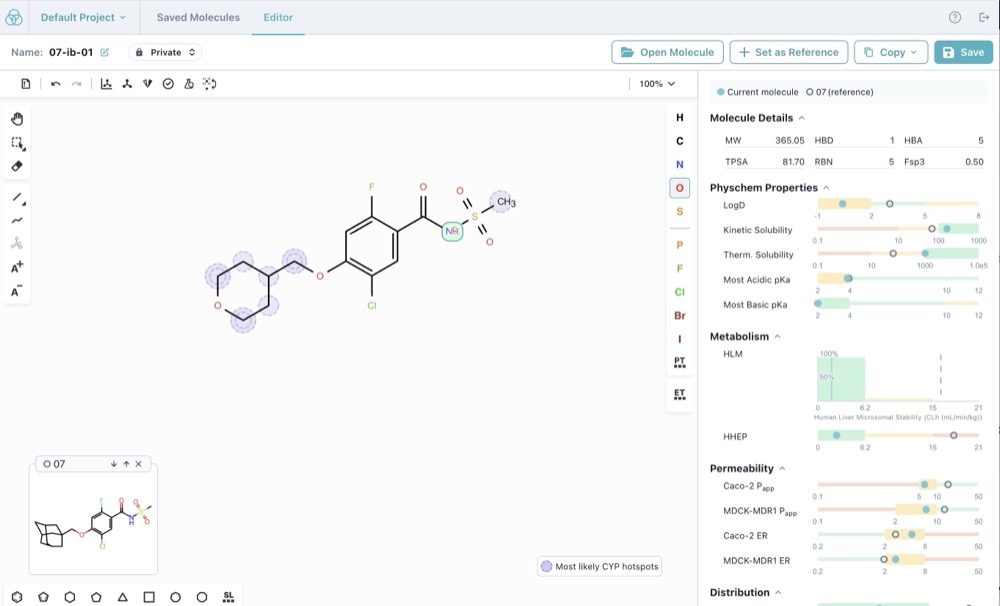

Inductive Bio has developed a collaborative AI platform that dramatically accelerates compound optimization, a critical and time-consuming step in developing new therapeutics. Our platform combines purpose-built machine learning models with intuitive design software to help scientists efficiently navigate chemical space and design higher-quality drug candidates. These tools predict small-molecule ADMET properties (Absorption, Distribution, Metabolism, Excretion, and Toxicity) — the critical factors that determine whether a drug will work in the human body.

In simple terms, our platform allows chemists to design molecules and get immediate AI predictions about how they would behave in the human body, rather than spending a month and thousands of dollars making each molecule in a lab. This helps scientists focus their resources on the most promising compounds, significantly speeding up the development of potentially life-saving medicines.

What inspired the start of Inductive Bio?

After our experience at Flatiron Health analyzing cancer patient data, my cofounder Ben Birnbaum and I wanted to address challenges earlier in the drug development process. We discovered that finding the right drug molecule is often a major bottleneck.

Chemists described their process as a frustrating game of “whack-a-mole” — when they fix one issue with a molecule, two other issues pop up. This traditional approach requires making thousands of molecules over years, costing millions of dollars. We saw an opportunity to use AI to make this process faster and to help scientists design higher quality drug candidates by predicting which molecules would work best before making them in the lab.

How is Inductive Bio different?

What makes us unique is that collaborative approach. We’ve created a “pre-competitive data consortium” where multiple pharmaceutical and biotech companies share certain anonymized data in a secure environment. This allows our AI to learn from thousands of real-world drug programs rather than just a limited dataset from one company.

Think of it like Waze for drug discovery — everyone contributes data about traffic conditions, and in return, everyone gets better navigation. Our approach was validated in the recent Polaris ADMET competition, where our model placed first among 39 participants from leading drug discovery companies and academic groups.

What market does Inductive Bio target and how big is it?

We work with biotech and pharmaceutical companies developing small-molecule drugs — typically the kind that can be taken as pills — across many disease areas, including brain disorders, cancer, and inflammatory conditions.

Small molecules represent the majority of drugs in development today. We focused here because there was a significant opportunity to improve efficiency in an area that affects many patients and represents billions in R&D spending annually.

What’s your business model?

As mentioned, we operate on a collaborative pre-competitive consortium model. What this means for our business is that we generate revenue through software licensing and scientific collaboration agreements. Partners pay to access our AI-powered platform that helps them design better drugs faster, while also contributing anonymized data that strengthens the system for everyone.

Unlike many AI drug discovery companies, we don’t develop our own drugs. Instead, we focus exclusively on being a technology partner that accelerates drug discovery across the entire industry. This approach has proven successful — our revenue increased significantly last year as we’ve expanded to support dozens of active drug programs across many therapeutic areas.

How are you preparing for a potential economic slowdown?

Interestingly, economic uncertainty often increases demand for our services, as companies face pressure to develop drugs more efficiently with fewer resources.

Our technology reduces risk in the drug development process — if companies can make fewer unsuccessful molecules and focus on compounds more likely to succeed, they save both time and money. This value proposition becomes even more compelling in challenging economic times.

What was the funding process like?

It came together faster than expected. I had braced myself for a long, challenging market, but I think the problem we’re tackling of optimizing chemistry before you get into the clinic and really accelerating those timelines, combined with the traction we’ve been seeing in the market, really convinced investors and it came together very quickly.

What are the biggest challenges that you faced while raising capital?

While our Series A came together relatively quickly, we faced the challenge of differentiating ourselves in a landscape where AI drug discovery has seen its share of hype. We needed to demonstrate that our approach wasn’t just another AI platform making ambitious claims, but one that delivers measurable value to partners today.

Another challenge was explaining our business model to investors more familiar with either traditional biotech or enterprise SaaS. We had to clearly articulate how our approach creates significant value for our partners and in turn allows us to build a high-growth business. Ultimately, these challenges pushed us to refine our story and focus on showing real results and revenue generation.

What factors about your business led your investors to write the check?

Our investors were impressed that we’ve moved beyond the hype often surrounding AI in healthcare to deliver measurable results. They recognized our approach is already changing how drugs are developed, with the potential to fundamentally transform the economics and pace of drug development.

Our technology meaningfully reduces the number of unsuccessful molecules that need to be made and helps companies reach key milestones faster. This creates both time and cost savings for our partners while helping design a better drug at the end of the day. This results in a sustainable business model with clear return on investment. The fact that we’ve demonstrated this value across dozens of active drug programs, rather than just promising future potential, was particularly compelling to investors.

What are the milestones you plan to achieve in the next six months?

We’re focused on growing our team (currently 10 people, soon to be 12), expanding our platform to more pharmaceutical companies, advancing our AI capabilities, and bringing academic research groups into our consortium. The more diverse our data becomes, the more powerful our predictions will be for all partners.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Focus relentlessly on solving a real problem that customers are willing to pay for. Through conversations with potential customers and small consulting engagements, we validated that there was genuine demand for our solution before building our platform.

At the earliest stages, make sure you’re solving the right problem for the right person in the right way. Everything else — including fundraising — becomes easier once you’ve proven you can deliver real value.

Where do you see the company going in the near term?

Our goal is to make our platform the industry standard that scientists use to design better drugs. We’re talking to multiple potential clients weekly and hiring rapidly. Long-term, we’d like to grow into a public company that accelerates drug discovery across the entire industry, ultimately helping patients get better treatments sooner.

What’s your favorite spring destination in and around the city?

Prospect Park! I live just around the corner, and it’s amazing to watch it come alive — flowers blooming, people picnicking, dancing, biking, and dogs and kids running wild across the fields. I always check the Celebrate Brooklyn concert lineup and try to catch as many shows as I can.Daily Funding Report /need a newsletter block for alleywatch

I’ll create a newsletter block for AlleyWatch that matches the provided style guide. Based on the documentation, the newsletter block should follow a specific structure with the correct URLs for AlleyWatch.

AlleyWatch Newsletter Signup BlockInteractive artifactHere’s the newsletter signup block for AlleyWatch that matches the style guide from your documentation. The HTML includes:

The correct URL for AlleyWatch’s email signup (https://email.alleywatch.com)The proper image URL from the AlleyWatch websiteThe specified styling with centered text, proper margins and paddingThe “NYC Tech” branding in t