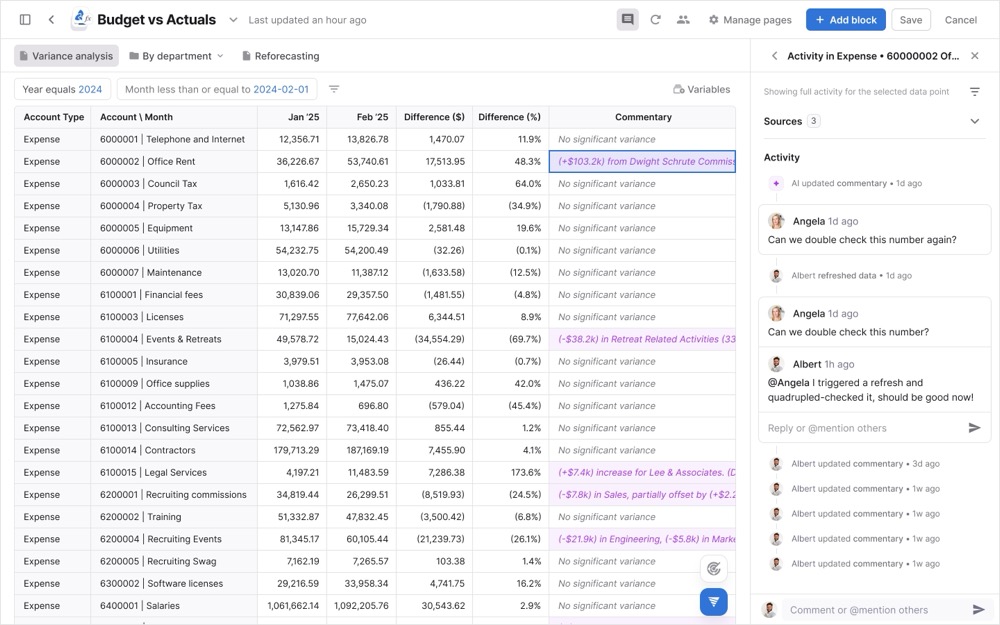

Finance teams across corporate America face mounting pressure to deliver strategic insights while drowning in manual, time-consuming busywork that prevents them from focusing on high-value analysis. Legacy FP&A tools force finance professionals into rigid systems that require months of implementation, depend heavily on IT resources, and pull teams away from the spreadsheets they know and trust. Aleph addresses these challenges with an AI-native FP&A platform that connects finance teams directly to their data through familiar Excel and Google Sheets interfaces, eliminating 90% of manual reporting tasks while maintaining the flexibility and control that finance teams demand. The platform combines 150+ no-code data connectors, enterprise-grade data transformation tools, and observable AI features like variance analysis to help lean finance teams achieve the output of much larger departments. Since its Series A, Aleph has grown 10X and now powers FP&A workflows for industry-leading companies including Zapier, Turo, and hundreds more.

AlleyWatch sat down with Aleph CEO and Cofounder Albert Gozzi to learn more about the business, its future plans, and recent $29M Series B round that brings the company’s total funding to $46M.

Who were your investors and how much did you raise?

We raised a $29M Series B, led by Khosla Ventures, with continued participation from Picus Capital, Bain Capital Ventures, and Y Combinator.

Tell us about the product or service that Aleph offers.

Aleph is the AI-native FP&A platform that is transforming how finance teams access and work with their financial data by combining the power of a web-based platform, the flexibility of spreadsheets, and the magic of AI. From annual budgeting to monthly reporting, Aleph’s no-code tools eliminate 90% of the time-consuming, error-prone busywork, empowering finance teams to make better, faster decisions and focus on the strategic work they were hired to do.

What inspired the start of Aleph?

I began my career in the finance department of Procter & Gamble and then later a consultant at Bain before eventually landing in the CFO seat at an early-stage startup. Throughout my career, I grew increasingly frustrated with the tools available to finance professionals. Everything was either super old school and clunky, or tried to pull you out of Excel and learn a new, arbitrary syntax. Additionally, the data I needed for my models was scattered across various source systems. I saw a gap in the market and set out to fill it, starting Aleph in 2020 as a one-man passion project. I built the MVP myself in my NYC apartment in the depths of the pandemic.

How is Aleph different?

Fastest to value: Legacy tools require months of painful onboarding before you can even generate your first report, and removing that barrier was a goal from day one. Aleph is the fastest to implement FP&A solutions, enabling finance teams to connect their source systems and generate their first report in hours, not weeks or months.

Comprehensive: Everyone claims to be a source of truth, but we aimed to set the bar with no-code transformation tools that put finance in complete control to sync, structure, and access cross-system data without engineering or data science resources.

Flexible and easy to use: Finance teams can continue to use their familiar and beloved spreadsheets with bi-directional Excel and Google Sheet add-ins, which enable seamless connection and collaboration on their reporting packages and models.

Observable AI: We’re layering in AI in ways that finance leaders can verify and trust the outputs, which is mission-critical in a world where one wrong number in a report or suggestion could get you fired or cost a company millions.

What market does Aleph target and how big is it?

Aleph was initially built with a focus on traditional mid-market companies, particularly those backed by private equity and venture capital. These organizations often have ambitious growth goals but lean finance teams, making them an ideal fit for the kind of leverage Aleph provides.

As we’ve grown, so have our use cases and customer segments. Today, we support a growing number of early enterprise customers—companies preparing for IPO or that have already gone public—who rely on Aleph to bring clarity and speed to their financial planning and decision-making.

Beyond operating companies, we’ve also seen strong adoption among financial advisory and consulting firms. Many of these organizations utilize Aleph to enhance reporting and offer more strategic guidance to their clients. Similarly, private equity funds are now leveraging Aleph at the fund level to standardize reporting, consolidate insights, and align decision-making across their portfolios.

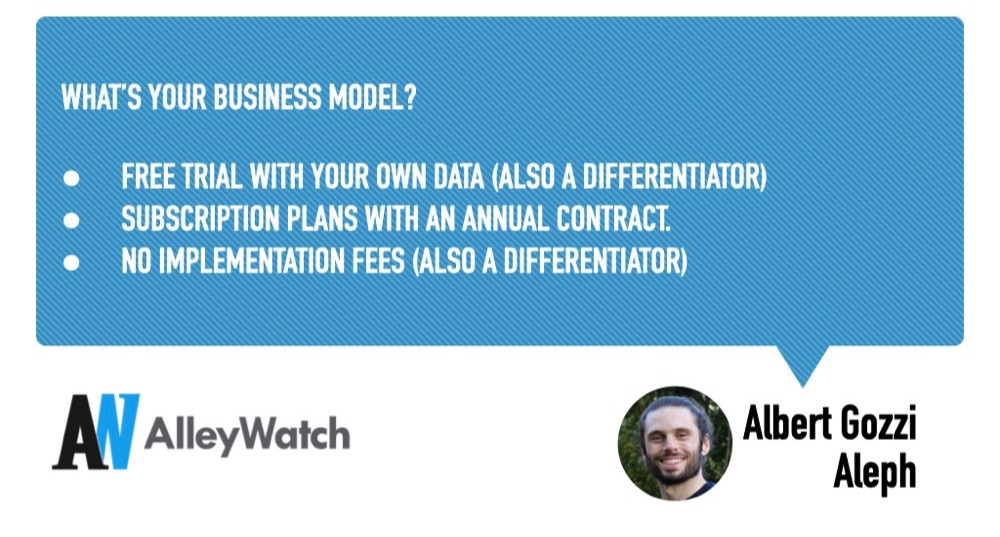

What’s your business model?

Free trial with your own data (also a differentiator)

Subscription plans with an annual contract.

No implementation fees (also a differentiator)

How are you preparing for a potential economic slowdown?

As an FP&A platform, we’re fortunate to have a team full of talented FP&A professionals. We eat our own dog food by using Aleph in the same way our customers do—building and maintaining models that pressure-test multiple scenarios and assumptions, which allows us to be well-prepared for whatever challenges or opportunities may arise.

This Series B provides more flexibility and options, but it also comes with a responsibility to be disciplined. If the economy slows, we can adjust and pace ourselves without halting progress. That said, our base plan is to stay aggressive, accelerate execution, and continue pursuing ambitious bets. The recent funding provides us with added runway and padding to tackle those big goals with greater confidence and less short-term risks.

What was the funding process like?

We’re fortunate to have long-term, supportive investors who know our market, vision, and progress. When we floated the idea of raising, the round came together quickly with our existing investors leaning in. While there is always work to agree on terms and legal details, keeping the round internal avoided the extended sourcing and due diligence that bringing new investors in would have created.

What are the biggest challenges that you faced while raising capital?

We were lucky that this round didn’t present major challenges, especially given the support from our existing investors. That said, raising capital is never without its complexities. The hardest part for me is the back-and-forth between investors, key stakeholders, and legal teams—it can be a surprisingly messy process, and one I sometimes think deserves its own dedicated startup to make it more efficient.

Another challenge is more emotional: holding back from sharing the news with the team. When you’re excited about what’s ahead, it’s tough to stay quiet until the ink is dry. It’s a process that should feel celebratory, but the legal and logistical details can add friction to what should otherwise be an energizing milestone.

What factors about your business led your investors to write the check?

I’d like to think our investors are drawn to the way we’re building—innovating thoughtfully and layering AI into Aleph in a way that’s observable and trusted, not a black box. That combination of innovation and execution certainly matters.

But the reality is the most powerful signal comes from our customers. The advocacy and outcomes they generate with Aleph are what truly drive investor conviction. We’re fortunate to have incredible customers who not only provide feedback that helps us raise the bar but also champion Aleph as promoters and advocates in the market. That passion and validation speaks louder than anything we could put in a pitch deck.

What are the milestones you plan to achieve in the next six months?

The next six months are about acceleration. We’ve made meaningful progress against our roadmap even before this round, but our execution has been largely linear—choosing where to focus and moving step by step. This capital allows us to change that.

By ramping up hiring and adding resources, we’ll be able to run more projects in parallel while also placing some bigger strategic bets. That shift will enable us to execute faster, test more ideas simultaneously, and ultimately deliver more value to our customers in a shorter timeframe.

We’re hiring and will be posting more roles in the coming weeks.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

My advice is to take full advantage of what makes New York such a unique ecosystem. The city is overflowing with opportunities—potential customers to validate and sell to, experienced professionals who are willing to mentor or help shape early-stage companies, and a vibrant community of investors, funds, and angels.

Whatever resource you might be missing—customers, talent, or capital—there’s someone in this city who can help. The key is being proactive, putting yourself out there, and tapping into the network. If you need it, New York has it. Go find it.

Where do you see the company going now over the near term?

In the near term, our focus overlaps with the milestones we’ve set for the next six months—specifically around resourcing and hiring. But those are means to an end. The real outcome is our ability to place bigger bets, move faster, and scale in a responsible way while pushing the boundaries of what’s possible in our space.

We’re still in the early innings of shaping what the future of AI-native FP&A looks like. We’ve already seen promising early wins, and this new capital allows us to bring in top talent, expand execution, and continue to innovate. Ultimately, our goal is to lead the way in showing how AI can drive real productivity gains and more confident decision-making for finance teams, whose number one priority is ensuring the numbers they report—and the strategic recommendations they make—can be trusted.

What’s your favorite fall destination in and around the city?

I love to run year-round, but there’s something special about fall in New York. The crisp air makes it the perfect season to be outside. Since I live in Williamsburg, some of my favorite runs are along the waterfront at Domino Park—it’s a great way to start the day and take in the city. On weekends, I also enjoy stopping by local markets like Smorgasburg in Williamsburg to explore new vendors and support small businesses.