Common examples include American mortgage real estate investment trusts (mREITs) and business development companies (BDCs). Both tend to be highly leveraged and structurally complex, and the headline yield rarely tells the full story. The same applies to Master Limited Partnerships, or MLPs.

What is a master limited partnership?

MLPs occupy the midstream segment of the energy sector. This part of the industry focuses on transporting, storing, and processing oil and gas rather than producing or retailing it. Canadian investors are already familiar with midstream businesses through TSX-listed companies like TC Energy and Enbridge. The difference is that these Canadian firms are conventional corporations, not partnerships.

An MLP is a U.S.-specific pass-through structure designed to generate income from energy-related assets. By operating as a partnership rather than a corporation, an MLP avoids corporate-level tax and distributes most of its cash flow directly to unitholders. That structure is the reason for the eye-catching yields. It is also why MLPs have long been popular with income-focused investors stateside.

From a distance, it is easy for Canadians to assume these investments should translate well across the border. Capital markets are similar, the businesses are familiar, and the income looks appealing.

The sticking point is taxation. Differences between Canadian and U.S. tax rules turn MLP ownership into a complicated exercise for Canadian investors, often reducing after-tax returns and creating ongoing administrative headaches. Those frictions matter more than most investors realize.

Here is what Canadian investors need to know about U.S. MLPs, why they are usually best avoided, and which alternatives offer exposure to similar businesses without the same tax complications.

The tax headaches of MLPs for Canadian investors

For Canadian investors, the problems with U.S. master limited partnerships come down to two main issues: withholding tax and reporting requirements.

Most Canadians are already familiar with how U.S. withholding works. When you own U.S.-domiciled stocks or exchange traded funds (ETFs), 15% of dividends are typically withheld at source. That withholding can be avoided by holding those securities inside a Registered Retirement Savings Plan (RRSP), thanks to the Canada-U.S. tax treaty.

X

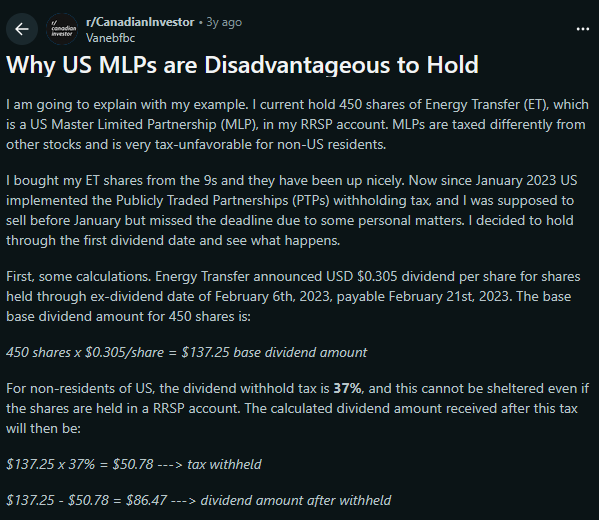

MLPs are treated very differently. They do not benefit from that treaty treatment. Distributions from MLPs are fully subject to U.S. withholding tax. Worse, the rate is not 15%. It is up to 37%. This withholding applies even inside registered accounts, including RRSPs.

Source: r/CanadianInvestor

That means more than one third of each distribution can disappear before it ever reaches your account. This is especially damaging because most of the long-term return from MLPs comes from reinvested distributions rather than price appreciation.

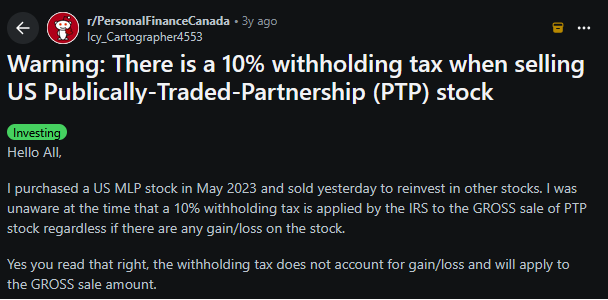

It does not stop there. When you sell an MLP, there is an additional 10% withholding tax applied to the gross proceeds by the Internal Revenue Service (IRS), because MLPs are classified as publicly traded partnerships. This is not a capital gains tax. It is withheld regardless of whether you are selling at a gain or a loss.

There are numerous real-world examples of Canadian investors discovering this the hard way. Some have bought and sold the same MLP multiple times, only to find that 10% was withheld on each transaction.

Source: r/PersonalFinanceCanada

The final complication is tax reporting requirements. When you own a typical U.S. stock, you receive a 1099-DIV form that summarizes your income. With an MLP, you are not a shareholder. You are a partner. That means you receive a Schedule K-1.

A K-1 reports your share of the partnership’s income, deductions, and credits. It is far more complex than a standard dividend slip, and it creates a U.S. tax filing obligation. In theory, you are required to file a U.S. tax return to properly report this income to the IRS.