We’ll walk you through the current landscape of pet insurance and discuss current premium costs to help you decide if purchasing a policy makes sense for your pet and your wallet.

Watch: Is pet insurance worth it?

What pet insurance covers (and what it doesn’t)

Pet insurance is similar to health insurance, but it’s for your pet. Just like with a health insurance policy, you’ll pay a monthly fee, called a premium, to keep the policy active so your furry friend is covered.

An accident-only policy covers accident-related injuries, such as those from a motor vehicle accident, a torn ligament, food poisoning, and ingested foreign objects.

An accident and illness policy covers the accidents listed above, plus other types of emergencies, such as broken bones, surgery, hospitalization, prescription medications, digestive issues, infections, and illnesses.

If your pet needs medical care, you’ll take them to the vet as usual. As long as the reason for the visit is covered by your insurance policy, you’ll pay only your deductible and any co-pay, and the insurance provider will cover the rest (or pay up to the coverage limit).

Some conditions may be excluded—pet insurance doesn’t usually cover pre-existing conditions, older pets, specific breeds, or alternative methods of treatment. It also doesn’t typically cover preventative care and dental work unless you purchase a wellness add-on.

Pros and cons of pet insurance

Before making any decision that will impact your finances, it’s wise to consider the benefits and drawbacks.

How much does pet insurance cost?

Several factors determine how much you could pay each month for pet insurance, including your pet’s breed, location, age, and medical history. Plus, there are factors you can control, such as the deductible, annual limit on coverage, and what percentage of costs your insurer reimburses.

Keep in mind that as your pet ages, the cost of caring for and insuring it increases. Some insurance companies even set a maximum age limit on coverage, so enrolling your pet while it’s young and healthy could unlock more affordable rates.

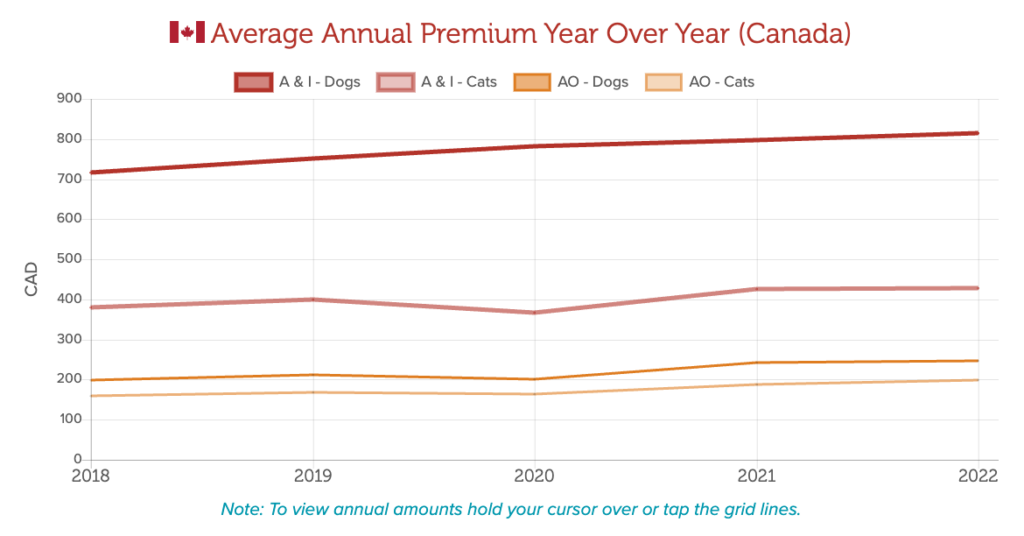

According to data from the North American Pet Health Insurance Association (NAPHIA), in 2024, the average monthly premiums in Canada were:

$22.46 for dogs and $18.47 for cats for an accident-only policy

$89.18 for dogs and $45.86 for cats for an accident and illness policy

The more coverage and benefits you get, the higher the price tag. For this reason, it’s important to consider the pros and cons to decide whether purchasing insurance is worthwhile for you.

X

Get free MoneySense financial tips, news & advice in your inbox.

Why is pet insurance getting more expensive?

The cost of pet insurance has risen steadily over the past decade or so. The average annual increase for accident and illness insurance was 6.5% for dog owners and 15.24% for cat owners.

Inflation, increased wages of veterinary staff, and higher medical costs have all contributed to the rise in pet insurance premiums since the pandemic; however, higher costs are also tied to advancements in the medical care that pets receive. Vet clinics are increasingly able to treat life-threatening conditions like cancer and other diseases, but it can be expensive.

Before deciding whether or not to get insurance, pet owners must weigh the possibility of paying thousands of dollars out-of-pocket for medical procedures vs. paying ongoing monthly premiums.

How to keep pet insurance costs down

There are several strategies you can use to keep pet insurance costs low:

Shop around and compare policies. Insurers each have unique offerings and calculate premiums differently. Get multiple quotes to find the most affordable rate, but be sure you’re comparing similar coverages.

Choose a higher deductible. The higher your deductible, the lower your premium will be. That said, be sure you choose a deductible amount that you can afford to pay at a moment’s notice if your pet requires urgent care.

Choose a lower annual limit. This is the maximum amount of money your pet insurance company will pay out to you every year. Once you’ve reached that threshold, you’ll be on the hook for any additional veterinary costs.

Ask about discounts. If you have multiple pets, it’s worth asking if you can get a discount from your provider for insuring them both (or all). Typically, you have to enroll each pet and pay separate premiums.