If you find value in these articles, please share them with your inner circle and encourage them to Sign Up for my Rich Habits Daily Tips/Articles. No one succeeds on their own. Thank [email protected]

Entrepreneurship is often hailed as the quickest path to wealth, offering the potential to bypass the slow grind of traditional saving and investing. Tom Corley, a CPA and author of Rich Habits: The Daily Success Habits of Wealthy Individuals, studied 233 wealthy individuals, including 177 self-made millionaires, and 128 people living in poverty over five years. His Rich Habits research, along with insights from his articles, reveals that entrepreneurship accelerates wealth-building when paired with specific habits. This article explores why entrepreneurship is the fast track to wealth and how Corley’s findings can guide aspiring entrepreneurs to success, condensed to focus on the essentials.

The Entrepreneurial Advantage

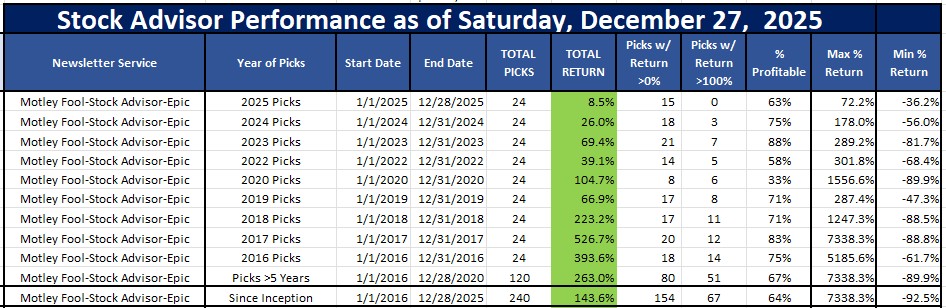

Corley’s research shows that self-made millionaires who pursued entrepreneurship, built wealth faster than those who relied on saving and investing as employees. “Saver-Investors” took an average of 32 years to accumulate $3.3 million, while entrepreneurs reached $7.4 million in just 12 years. This gap highlights entrepreneurship’s potential to compress the wealth-building timeline.

Entrepreneurs can create multiple income streams, scale businesses, and directly influence financial outcomes, unlike employees tied to fixed salaries. However, Corley emphasizes that success depends on adopting “Rich Habits”—daily practices that set successful entrepreneurs apart. Below are the key habits from his research, tailored for aspiring entrepreneurs.

Rich Habits for Entrepreneurial Success

1. Set Clear, Actionable Goals

Corley found that 80% of self-made millionaires set specific, long-term goals and focused on them daily. For entrepreneurs, this means defining a clear vision—whether launching a product or hitting revenue targets—and breaking it into daily tasks. Corley’s “DO IT NOW” mindset encourages immediate action to maintain momentum.

Actionable Tip: Write one major business goal for the next year and break it into monthly and daily tasks. Review progress daily to stay on track.

2. Commit to Continuous Learning

Successful entrepreneurs are lifelong learners. Corley’s study shows that 88% of millionaires dedicate at least 30 minutes daily to self-education, reading books on personal development or industry trends. In contrast, 77% of poor individuals spent over an hour on entertainment like TV. Knowledge keeps entrepreneurs competitive.

Actionable Tip: Replace 30 minutes of social media with reading a business book or listening to an industry podcast, such as Think and Grow Rich or relevant journals.

3. Live Frugally to Reinvest

Financial discipline is critical. Corley’s wealthy individuals saved at least 20% of their net income, living on the rest to avoid lifestyle inflation. Entrepreneurs reinvest profits into their businesses—marketing, product development, or hiring—rather than personal luxuries. Corley suggests budgeting no more than 25% of net income on housing, 15% on food, 10% on entertainment, and 5% on vacations.

Actionable Tip: Automate 20% of your income into a business savings account to fund growth or provide a buffer.

4. Build Power Relationships

Networking is a cornerstone of success. Corley found that 93% of millionaires with mentors credited them for their achievements. Mentors offer guidance, prevent mistakes, and open opportunities. Wealthy entrepreneurs also cultivate “Power Relationships” with optimistic, success-minded peers and mentor others to strengthen their networks.

Actionable Tip: Seek a mentor in your industry and ask for specific advice. Mentor someone else to build your network and refine your strategies.

5. Take Calculated Risks

Entrepreneurship involves risk, but successful entrepreneurs make informed decisions. Corley’s study notes that 27% of millionaires failed at least once in business but learned from setbacks. They avoid reckless moves, relying on research, mentorship, and market analysis to seize opportunities others miss.

Actionable Tip: Before launching a venture, conduct market research and test ideas with a small-scale pilot to minimize risk.

6. Prioritize Positivity and Health

A positive mindset and physical health sustain entrepreneurial stamina. Corley’s millionaires practiced “rich thinking,” controlling negative emotions and staying optimistic. Additionally, 76% exercised regularly to maintain energy and focus, enhancing decision-making and resilience.

Actionable Tip: Spend 30 minutes daily on exercise like walking or yoga and practice gratitude to maintain positivity.

The Power of Passion and Persistence

Corley emphasizes that passion fuels entrepreneurial success. “Passion makes work fun. Passion gives you the energy, persistence, and focus needed to overcome failures, mistakes, and rejection,” he writes. Passionate entrepreneurs endure long hours and challenges, while disciplined habits create a compounding effect. However, Corley notes that even the entrepreneurial fast track requires time—12 years on average to reach multimillion-dollar wealth. Consistency in applying Rich Habits is key.

Addressing Challenges

Critics of Corley’s work argue that systemic factors or demographic biases may influence wealth beyond habits. While barriers exist, Corley’s blind study focused on controllable behaviors. Entrepreneurs can’t eliminate external challenges but can control daily actions, relationships, and decisions to navigate them effectively.

Conclusion

Entrepreneurship offers the fastest path to wealth. By setting goals, prioritizing learning, living frugally, building networks, taking calculated risks, and maintaining positivity and health, aspiring entrepreneurs can emulate self-made millionaires. Wealth-building is a two-step process: #1 creating wealth and #2 keeping the wealth you created.

Entrepreneurs who forge the right habits put success on autopilot. Start small, stay consistent, never quit on your dream.