Over the same time, equity markets have provided returns well above historical averages, which can lead people to take more risk than they normally would by reducing their bond holdings.

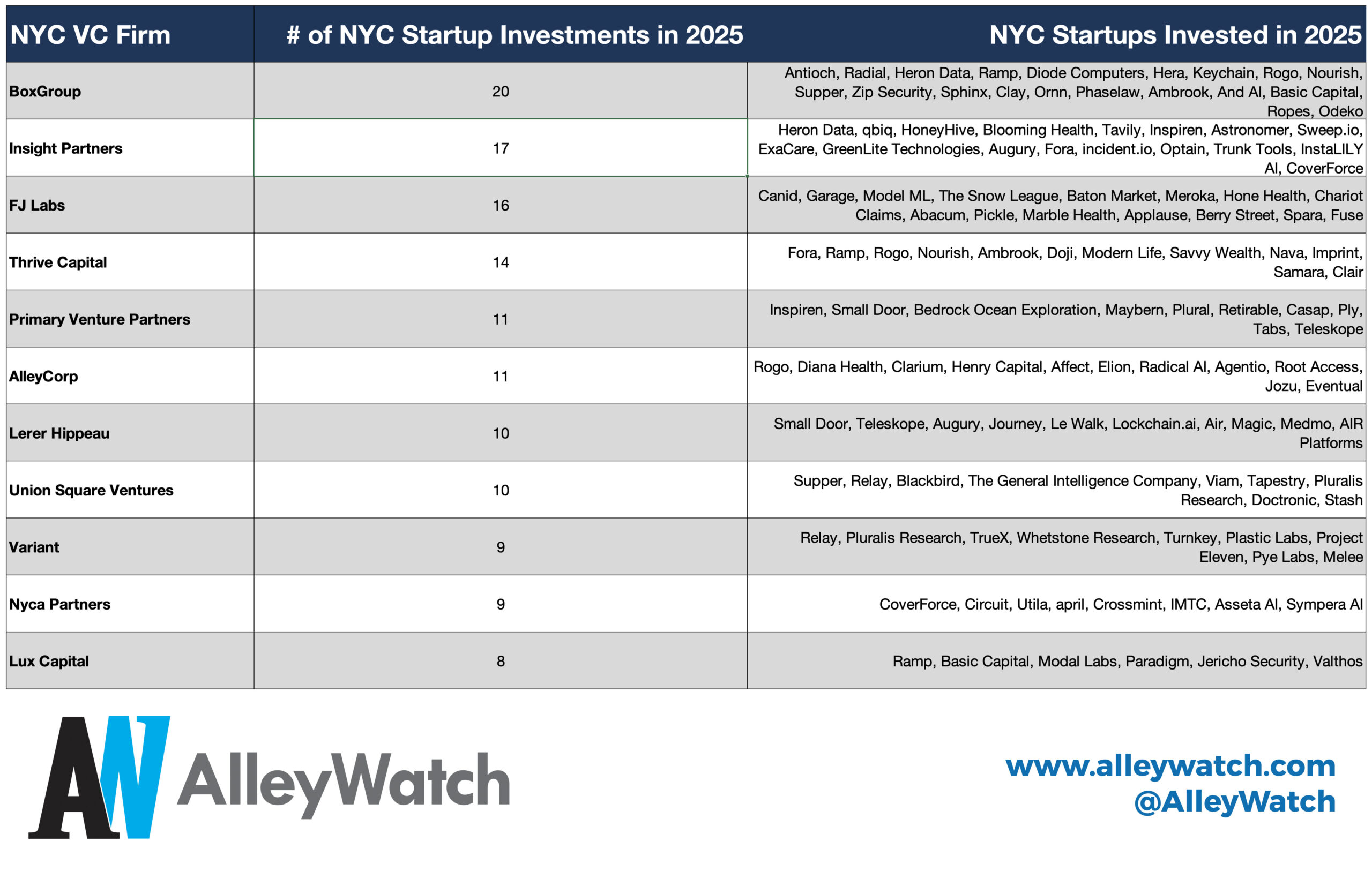

Adding to that, if you look at pre-tax historical bond returns, there have been some long stretches when returns have been really bad as you can see in the table below.

U.S. government bond returns

Given that historical context and the knowledge that from 1980 to 2020 we were in a decreasing interest rate environment, ideal for bonds, why would you invest in bonds today?

Your question reminds me of a book I read about 10 years ago, Why bother with bonds? The author, Rick Van Ness, suggests there are four reasons to consider bonds: 1. Stocks are risky, 2. Bonds make risk more palatable, 3. Bonds can be a safe bet, and 4. Bonds can be an attractive diversifier in your portfolio. I’ll walk through each of these but, as I do, consider how each of these would apply to your portfolio needs.

1. Stocks are risky

I am guessing you have read that equities become safer over time. That is true and false. Sure, if you invest $1 today in equities, the longer you hold it the more likely you are to enjoy positive returns. You can see this looking at the historical data. Great! But does that mean equities became safer? No!

If you have a $100,000 portfolio and equities drop 40%, taking your portfolio to $60,000, are you feeling good that the $1 you invested 10 or 20 years ago may still have a positive return? No, you are thinking you just lost $40,000. Will it get worse, will you get your money back, and how long will it take? What if you had a million-dollar portfolio that went to $600,000?

X

Equity markets are always at risk of dropping. What if they drop while you are drawing an income or spending money from your portfolio? The reason for holding bonds or an alternative to bonds is to protect the money you plan to spend in the short term from market declines and provide liquidity for spending needs.

2. Bonds make risk more palatable

Holding bonds may prevent you from buying high and selling low. Imagine you have a $1-million portfolio rapidly dropping to $600,000; what are you going to do? Buy, sell, or hold? Some people will panic and sell, which is the real threat to investment success. Volatility on its own is not a problem. It only becomes a problem when it is combined with a withdrawal.

What typically happens when a panic sell occurs? You wait for the right time to get back into the market, if you ever get back into the market. A scared investor doesn’t wait until things get even worse to invest so they can buy low. Instead, they wait until markets recover, things feel good, and then they buy high.

In this case the reason for holding bonds or an alternative to bonds is to anchor your portfolio so that it only drops to an amount you can tolerate before panic selling. Liquidity is not necessarily a requirement to make risk more palatable.

Have a personal finance question? Submit it here.

3. Bonds can be a safe bet

In its basic form, a bond is a simple interest-only loan. You lend money to a government or company and in return, they promise to pay you a rate of return. At the end of the term, they give you back your money. There are some risks with bonds, often associated with changes in interest rates, the length of the term, the strength of the originator, and the ability to buy and sell bonds. However, in general they are safer than equities at protecting your capital—capital you can use for spending. Equities are for protecting your long-term purchasing power, matching or beating the rate of inflation.

If you are considering an alternative to bonds, ask yourself: is the investment as safe as a bond?