In July 2025, Canada’s unemployment rate hovered around 6.9%, with youth unemployment reaching 14.6%. Two in five Canadians say they’re worried someone in their household could lose their job, the highest level of job loss anxiety ever reported, according to MNP. At the same time, 42% of Canadians say money has been their biggest source of stress this year, and nearly half are losing sleep over it.

If you’re in between jobs and worried about how to cover your bills, protect your credit, or figure out what kind of help is available, you’ve come to the right place. In this article, we’ll walk you through how to prioritize payments, negotiate with creditors, and access unemployment relief programs so you can keep things manageable while you search for your next opportunity.

The first 48 hours: Triage your finances

The first few days after losing your job can feel overwhelming, but taking a few simple steps can help you regain a sense of control.

Start by adjusting your current budget or making a bare-bones budget that covers only essentials: housing, utilities, groceries, phone, internet, transportation, and minimum debt payments. Factor in any income you expect to have during this time, such as severance, emergency savings, or Employment Insurance (EI). This gives you a clear picture of what you need and where you might need to cut back.

Then, you’ll want to prioritize your expenses. Make housing your top priority, which includes rent or mortgage and utilities, then add in basic food costs and health needs. Secured debts (loans tied to assets, such as a vehicle) come next, followed by unsecured ones like credit cards.

Once you’ve got the essentials covered, you can look at any non-essential costs that you can trim. “Prioritize housing, utilities, food and transportation. If money is tight, try your best to keep secured debts current, as it is easier to negotiate with unsecured ones,” suggests Mike Bergeron, Credit Counselling Manager at Credit Canada.

It may be tempting to rely on payday loans or high-interest credit, but these can trap you in a cycle of debt. Safer alternatives might include taking an installment loan from a bank or credit union, talking to a non-profit credit counsellor about debt consolidation, or exploring hardship options with your lenders. While not all debts carry the same risk, be aware that missing payments can lead to added fees, damage to your credit score or collections.

Read more: How to consolidate your debt

X

Invest your money or pay off debt?

A comprehensive guide for Canadians

Speaking to creditors: When to reach out and what to say

If you’re struggling to make payments, contact your creditors as soon as possible. It may feel uncomfortable, but reaching out early can open the door to options that help lower your payments and protect your credit. Many lenders offer hardship programs like reduced interest, lower minimums, or payment deferrals—but they won’t offer them unless you ask.

“One of the most common mistakes I see people make is avoiding their creditors when they lose their job,” says Bergeron. “The earlier you communicate your situation, the more options you’ll have. Most creditors would rather work with you than send your account to collections.”

When you get in touch, be direct and honest. You could say, “I’ve had a loss of income and want to keep my account in good standing. What hardship options are available?” Before agreeing to anything, ask: “Can you confirm how this will affect interest, fees, and my credit report?” If you’re offered a deferral or payment plan, clarify how long it lasts, whether interest continues, and when regular payments resume. Always get the full agreement in writing. This helps avoid surprises and gives you something to refer back to later.

If your account has already gone to collections, know your rights. Collectors must follow provincial laws and cannot harass or threaten you. You can ask them for details about the debt and any payment options, just like you would with a creditor. Stay calm, ask for everything in writing, and don’t feel pressured to agree to anything on the spot. Consult a credit counsellor if you need help dealing with collections.

Available support: Accessing government and non-profit resources

If you’re between jobs, there are programs across Canada that can help. Start by applying for EI as soon as you stop working, even if you haven’t received your Record of Employment yet (processing can take a few weeks). “Ensure that you have enough income coming in to support your expenses around the house, keep a roof over your head, and keep food on the table,” says Randolph Taylor, a certified Credit Counsellor with Credit Canada. Each province also offers its own emergency or income assistance programs that may help with urgent needs like rent, utilities, or basic living costs, depending on your situation.

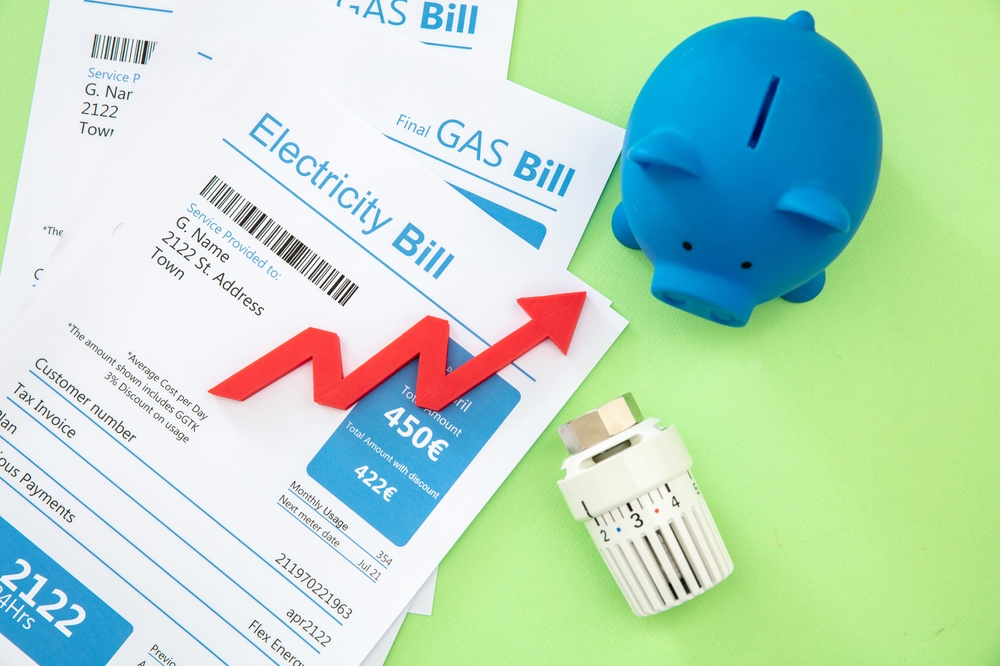

You may also be eligible for utility relief programs, offered by many hydro and gas providers across the country, which can include bill deferrals, payment plans, or seasonal discounts. For help with day-to-day essentials, food banks, and community organizations can provide groceries and supplies with no cost or judgment. These resources are designed to support Canadians through temporary hardships like job loss.

If you’re struggling to manage debt while unemployed, consider reaching out to a non-profit credit counselling agency like Credit Canada for free one-on-one financial coaching and review your income, expenses, and debts to help build a realistic plan for your situation. Credit counsellors can walk you through options like debt consolidation, contact creditors on your behalf, and provide educational and budgeting resources.

Prioritizing payments: Which debts to handle first

When money is tight, it’s important to focus on the debts that carry the most risk. Start with secured debts, like your mortgage, rent, or car loan. Since secured debts are tied to an asset, missing these could lead to eviction, foreclosure, or losing your vehicle. If you’re falling behind, contact your landlord or lender early to ask about deferrals, rent relief programs, or adjusting your repayment plan.