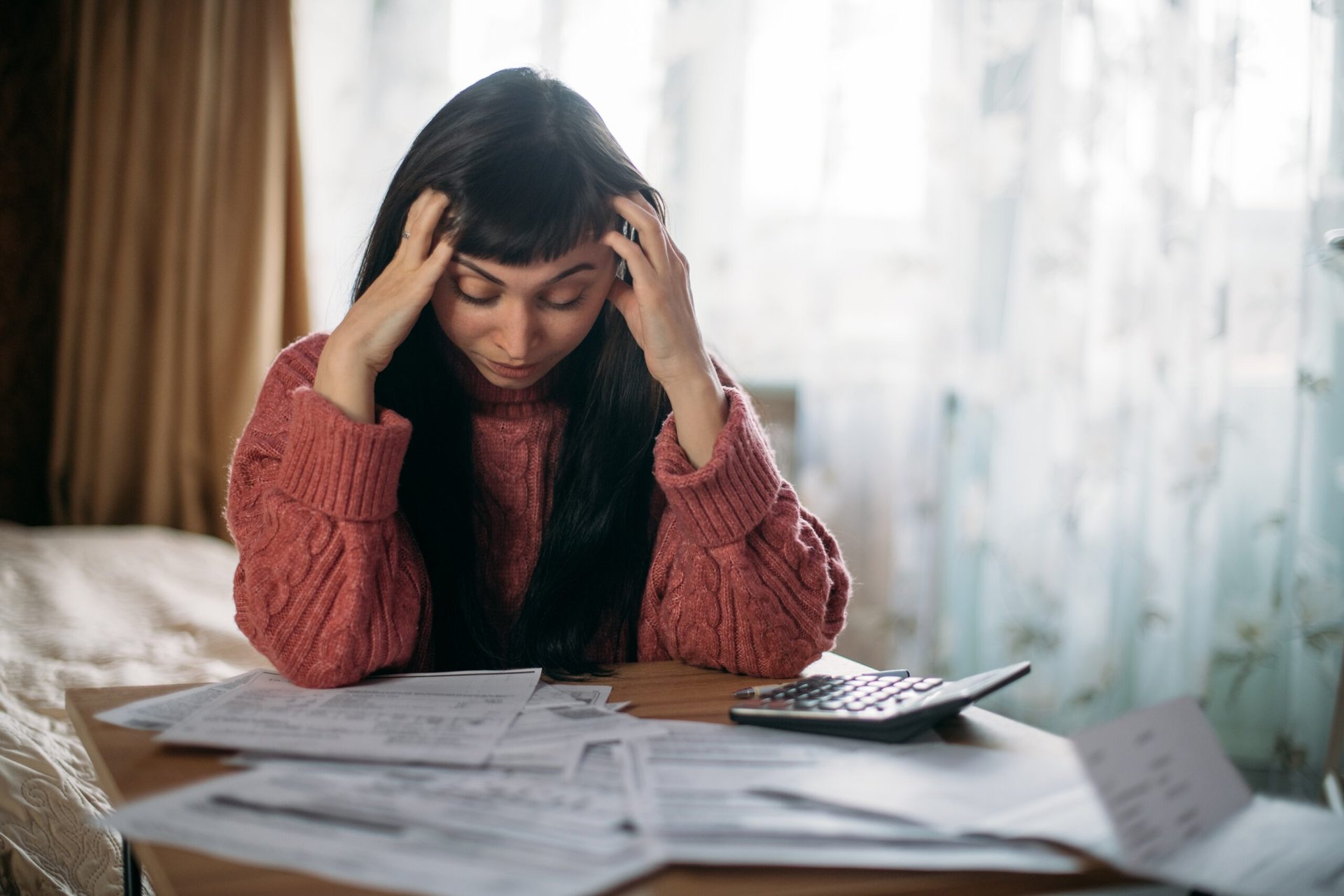

An emergency fund is your financial safety net. It’s the money you set aside before disaster strikes…not after. Whether it’s a job loss, medical emergency, car breakdown, or unexpected home repair, having accessible savings can prevent you from spiraling into high-interest debt or financial panic. Too often, emergencies become catastrophes not because of the event itself but because of the lack of funds to handle it.

Even if your job feels secure and your bills are current, unexpected expenses are inevitable. Life doesn’t give warnings before it derails your plans. An emergency fund won’t eliminate stress, but it gives you breathing room to think clearly and make smart decisions when life throws you a curveball. In today’s economy, having one isn’t just smart. It’s essential.

How Much Should You Really Have Saved?

The standard advice is three to six months’ worth of living expenses, but that’s not one-size-fits-all. Your ideal emergency fund depends on your lifestyle, job stability, income sources, and number of dependents. A single freelancer may need more savings than a dual-income household with steady government jobs. Think realistically: how long would it take you to replace your income if it suddenly disappeared?

Start by calculating your bare-bones monthly expenses—housing, food, transportation, insurance, and minimum debt payments. Multiply that by three, then by six. That gives you your emergency fund range. If that number feels overwhelming, don’t panic. You don’t have to hit it overnight. Even $500 to $1,000 in emergency cash can stop a surprise bill from derailing your budget.

Why “Emergency” Means Emergency

It might sound obvious, but your emergency fund should only be used for true emergencies. That means no tapping into it for concert tickets, vacations, or new furniture, no matter how tempting. The point of this fund is to create financial distance between you and your next crisis. Diluting it for non-urgent wants undermines its entire purpose.

The more often you dip into your emergency fund for non-essential expenses, the harder it is to trust it’ll be there when you actually need it. Over time, that trust is crucial. Treat your emergency fund like a sacred vault: access it only when there are no better options and only when the alternative is worse (like credit card debt or eviction). Boundaries are what make it work.

Where to Keep Your Emergency Fund

Your emergency fund should be liquid, safe, and easily accessible, but not too accessible. A high-yield savings account is often the best place. It earns some interest while remaining separate from your everyday checking account. Keeping it out of immediate reach (but not locked in an investment account or tied to the market) helps reduce the temptation to use it for non-emergencies.

Avoid putting your emergency fund in stocks, retirement accounts, or even CDs. Emergencies often require instant access, and you don’t want to be penalized or risk losses if you need your money quickly. Online savings accounts usually offer the best combination of access and interest, making them a practical choice for your safety net.

How to Start Saving, Even If You’re Broke

If you’re living paycheck to paycheck, saving money might feel like a fantasy. But you don’t need to wait for a windfall to get started. Begin with a small, specific goal—like saving $10 a week or stashing your tax refund. The key is consistency, not perfection. Tiny deposits add up faster than you think when you automate them and stop waiting for the “perfect” time to start.

You can also look for low-effort ways to cut expenses temporarily—pausing subscriptions, meal planning, or selling unused items—to funnel extra cash into your fund. Even rounding up your debit card purchases into savings is a way to build momentum. The important thing is proving to yourself that saving is possible, even if it’s just in small doses at first.

Automate It: The Lazy Way to Build a Safety Net

One of the easiest ways to build your emergency fund is to automate your savings. Set up a recurring transfer—weekly, bi-weekly, or monthly—so a set amount moves from checking to savings without you having to think about it. This “pay yourself first” model treats your savings like a bill, not a bonus.

Automation removes emotion and excuses from the equation. When the decision is made ahead of time, it’s easier to stay on track—even when you’re busy, stressed, or tempted to spend. Think of it as setting a financial autopilot that steadily builds your cushion. And the best part? You’ll barely notice the money leaving until you actually need it.

How to Rebuild After You Use It

Using your emergency fund isn’t a failure. It means it worked exactly as intended. Still, it’s normal to feel vulnerable once you’ve dipped into your safety net. The important thing is to replenish it as soon as you’re able. Treat the rebuild as your new financial priority, even if you can only contribute a little at a time.

Sometimes, using your funds can reveal gaps in your insurance, income streams, or budget. Let it be a learning opportunity, not a setback. Rebuilding might require some temporary cutbacks, but the peace of mind that comes from having that cushion again is worth the short-term sacrifice. Remember, you’re not starting over. You’re reinforcing your foundation.

Your Emergency Fund Is the First Step Toward Financial Freedom

An emergency fund isn’t just about covering surprise bills. It’s about gaining control over your financial life. It gives you options, reduces panic, and prevents small problems from turning into major crises. More importantly, it’s the cornerstone of financial independence. Before you invest, before you tackle debt aggressively, before you take major risks, this is the fund that protects you.

Whether you’re starting from zero or rebuilding after a hit, don’t underestimate the power of having even a few hundred dollars saved. It’s not just about survival. It’s about dignity, confidence, and breathing room. No matter how small your first step is, taking it means you’re moving forward.

What helped you finally start your emergency fund, or what’s still holding you back?

Read More:

5 Items That Are the Smartest Investments for Your Emergency Budget

Emergency Loans vs. Saving Funds: What You Need to Know for Financial Emergencies

Riley is an Arizona native with over nine years of writing experience. From personal finance to travel to digital marketing to pop culture, she’s written about everything under the sun. When she’s not writing, she’s spending her time outside, reading, or cuddling with her two corgis.