That approach, however, comes with trade-offs. Higher fees are a real issue, as many alternative strategies rely on active management. Complexity is another. Finding ETFs that genuinely diversify returns rather than just repackage familiar risks is not easy. And even when you get the construction right, one major gap remains. The portfolio is not designed to protect against a true market crash. When I say crash, I mean sudden, deep, double-digit drawdowns like those seen during the 2008 financial crisis or the sudden collapse in March 2020 at the onset of the COVID-19 pandemic.

Source: Testfolio.io

In the sections that follow, I will walk through two ETF approaches that retail investors have access to, highlighting Canadian-listed options where available. It is worth noting up front that the Canadian market is far more limited than the U.S. in this area, but you still have a few options.

And while these strategies can offer protection in specific scenarios, there is no free lunch. As you will see, the costs, complexity, and implementation challenges often make crash-hedging ETFs difficult to use effectively, even for experienced investors.

Option 1: Inverse ETFs

Inverse ETFs are designed to be short-term trading tools that aim to deliver the opposite return of a benchmark over a single trading day. Most track broad market indexes, though some focus on specific sectors or even individual stocks. The key point is that their objective resets daily. They are not built to provide long-term protection.

A well-known U.S. example is the ProShares Short S&P 500 ETF (NYSEArca:SH). On any given trading day, SH targets a return equal to negative one times the daily price return of the S&P 500. If the index rises 1%, SH should fall about 1%. If the index drops 1%, SH should rise about 1%. In practice, it does a reasonable job of delivering that daily inverse exposure.

For investors seeking stronger downside protection, leveraged inverse ETFs are also available. These apply leverage to magnify the inverse relationship. An example is Direxion Daily S&P 500 Bear 3X Shares (NYSEArca:SPXS), which targets negative three times the daily return of the S&P 500. If the index falls 1% in a day, SPXS aims to rise roughly 3%. If the index rises 1%, SPXS should fall about 3%.

Canadian investors have access to similar products now. Instead of using U.S.-listed ETFs, investors can look at options such as the BetaPro -3x S&P 500 Daily Leveraged Bear Alternative ETF (TSX:SSPX).

X

During sharp selloffs, these ETFs can do exactly what they are designed to do. During the March 2020 COVID-related market panic, as the S&P 500 plunged, inverse ETFs like SH and leveraged versions such as SPXS rose sharply, with the leveraged funds moving by a much larger magnitude.

Source: Testfolio.io

As the chart above shows, the problem with these ETFs turns up once the panic passes. As markets recovered after March 2020, both unleveraged and leveraged inverse ETFs began to fall steadily. This highlights the core limitation of these products: you cannot buy and hold inverse ETFs if you accept that, over time, equity markets tend to rise. A permanent short position against the broad U.S. stock market is structurally a losing bet, which is why issuers are careful to emphasize that these products are intended for day trading only.

That creates another challenge. Using inverse ETFs effectively requires anticipating the crash and positioning just before it happens, then exiting before the recovery begins. That is market timing, and it’s not only an active strategy; it requires being right twice. Even professional investors struggle with this consistently, and retail investors tend to fare worse.

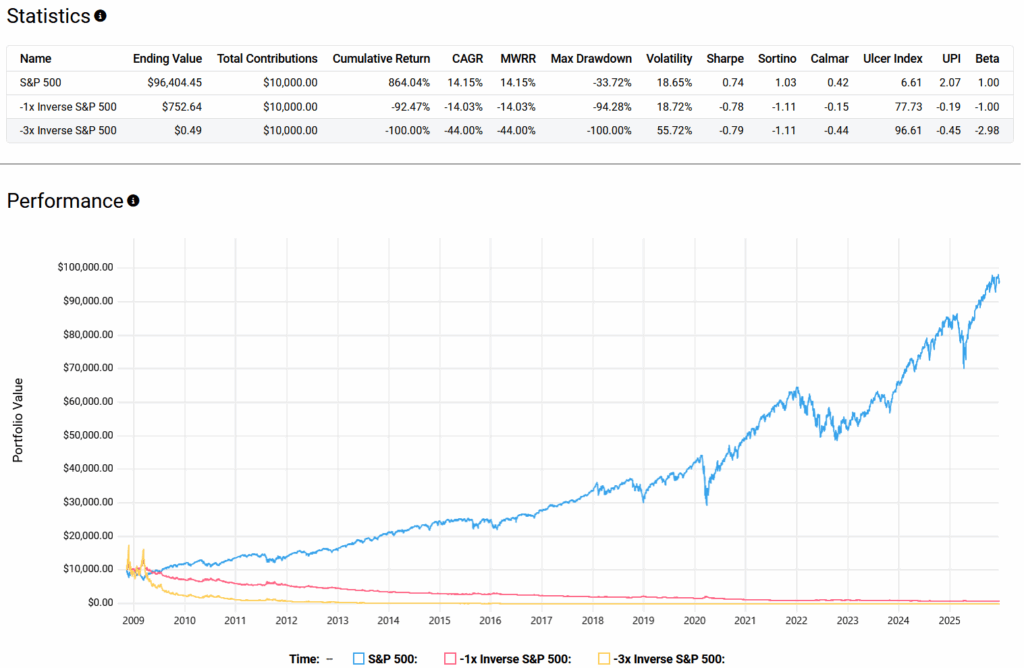

The long-term outcomes reflect those headwinds. Over a roughly 17.1-year period from November 5, 2008, to December 18, 2025, a buy-and-hold investment in inverse ETFs like SH and SPXS would have effectively gone to zero after many reverse splits.

Source: Testfolio.io

That outcome is driven by several factors. First, the underlying benchmark generally trends upward over long periods. Second, inverse ETFs carry relatively high fees, with expense ratios of 0.89% for SH and 1.02% for SPXS. Third, daily compounding works against investors in volatile markets. When prices swing up and down, the daily reset causes losses to compound faster than gains, creating volatility drag.

In short, inverse ETFs can provide short-term protection during sudden market declines, but using them as crash insurance requires precise timing. That makes them difficult to implement effectively and risky to hold for longer than a few days.