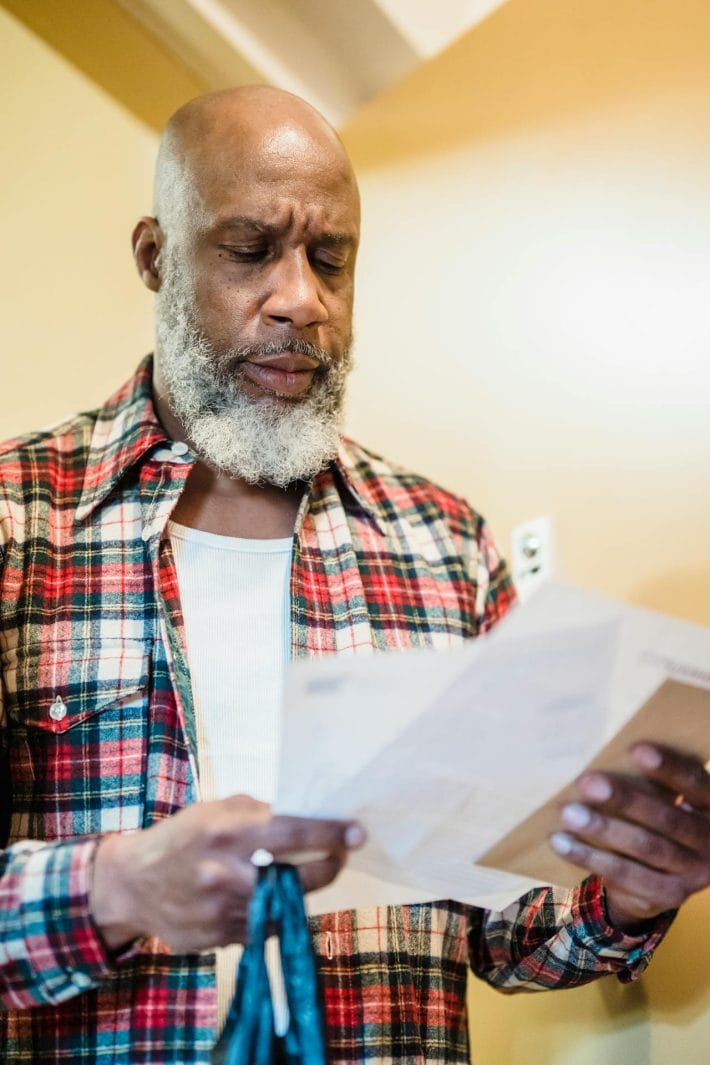

Retirement is often sold as the golden reward for a life of hard work: travel, discounts, flexible schedules, and decades of well-earned relaxation. And while many benefits do come with retirement, some of the “perks” we expect or rely on quietly fade or vanish completely as we age.

From tax breaks and healthcare coverage to eligibility rules and financial flexibility, there are surprising age cutoffs built into many programs that can catch older retirees off guard. You may think a benefit lasts forever just because you earned it, but in reality, the fine print often says otherwise.

Understanding when these changes happen can help you make better decisions before they cost you money or security in your later years. Let’s take a closer look at nine retirement perks that don’t actually last forever.

1. The Ability to Contribute to Retirement Accounts

Many retirees continue to work part-time or consult in their later years, but that doesn’t always mean you can keep stashing money away in retirement accounts. While there’s no age limit to contribute to a Roth IRA or traditional IRA (as long as you have earned income), not everyone realizes that required minimum distributions (RMDs) kick in at age 73.

Once RMDs begin, you can no longer skip distributions to delay taxes. And while you can still contribute to an IRA if you’re earning money, doing so might not make sense if you’re already forced to withdraw from those same accounts.

For workplace plans like 401(k)s, if you’re no longer employed, your ability to contribute stops altogether—even if you’d still like to save.

2. Social Security Strategies Get Locked Out at Age 70

Delaying Social Security past your full retirement age increases your benefits by about 8% per year. But that growth caps out at age 70, no matter what.

If you wait past 70 to claim, you’re essentially leaving money on the table. There’s no additional financial reward for delaying further, and any missed months of unclaimed benefits are gone for good.

Many retirees mistakenly think they’re still accumulating extra value by waiting. They’re not, and that delay could cost them thousands over time.

3. Student Loan Forgiveness for Seniors Ends at Death

This may sound unrelated to retirement perks, but many older Americans carry federal student loans—either for their own education or as Parent PLUS loans for children. Income-driven repayment (IDR) plans offer forgiveness after 20–25 years.

But here’s the catch: if you pass away before completing the forgiveness term, the loan is discharged, but the cancellation is not a tax-free event in all cases. And private loans don’t offer this option at all.

The idea of dying before reaching loan forgiveness isn’t just morbid. It’s a real issue for retirees who think this debt will just go away. In many cases, it doesn’t.

4. Early Withdrawal Penalties Don’t Disappear for All Accounts

While most people know about the 10% penalty for early withdrawals before age 59½, fewer understand that not all accounts are treated the same.

For instance, annuities held outside retirement accounts still carry early withdrawal penalties, and structured settlements or insurance products often have their own age thresholds—some up to age 85—for penalties or surrender fees. Even in retirement, certain actions can still trigger fees if you’re not paying attention to contract terms.

5. The Saver’s Credit Goes Away with Age and Income

The Saver’s Credit is a valuable tax credit that rewards low- and moderate-income earners who contribute to retirement accounts. But it’s only available if you’re under age 65 and meet income limits.

Once you pass that age or your income rises due to Social Security, pensions, or RMDs, you could lose eligibility, sometimes without even realizing you crossed a line. This perk quietly vanishes just as some retirees are most interested in making catch-up contributions.

6. Medicare Enrollment Penalty Windows Expire

If you don’t enroll in Medicare at the right time—typically around age 65—you could be hit with permanent penalties. Some people delay because they’re still working and have employer coverage, which can be fine. But if you don’t follow Medicare’s specific rules for enrollment, you’ll pay the price.

The Part B penalty increases your premiums by 10% for every 12-month period you were eligible but didn’t sign up. And once the window closes, it’s not easy or quick to get coverage back. You might assume healthcare options improve with age. But in this case, the longer you wait, the more you pay.

7. Tax-Free Withdrawals from Roth IRAs Require a 5-Year Rule

Roth IRAs are often touted as “tax-free forever.” But the 5-year rule is critical, especially for those who start Roth accounts later in life.

Even if you’re over 59½, you can’t withdraw earnings from a Roth IRA without taxes unless the account has been open for at least five years. That means someone who opens a Roth at age 67 won’t enjoy fully tax-free withdrawals until age 72.

Many retirees assume that being over 59½ is all that matters, but that second rule can catch you off guard if you’re relying on those funds too soon.

8. Some Senior Discounts Disappear After 75

It’s not just government programs—some private-sector perks for seniors also vanish with age. Airlines, car rental companies, insurance carriers, and even hotel chains sometimes cap their senior discounts at ages 70, 75, or even lower.

For instance, certain travel insurers stop offering new policies to travelers over 75. And while AARP offers discounts for advanced age, some affiliated companies impose their own restrictions based on “maximum benefit age.” Assuming you’ll always qualify for a 10% discount or special rate just because you’re over 65? Think again.

9. Long-Term Care Insurance May Be Unavailable After Age 75

If you’ve put off buying long-term care insurance, be warned: most providers stop accepting new applicants between the ages of 70 and 75. Even if you’re still healthy, you may be automatically disqualified by age alone.

And if you already have a policy, you may face rising premiums or shrinking benefits as you age, especially if your insurer changes its underwriting or payout terms.

Many retirees consider long-term care planning “a problem for later.” But when it comes later, the doors may be closed.

Retirement Isn’t One Long Perk. It’s a Series of Expiring Windows

While there are still plenty of benefits to enjoy in retirement, the idea that every advantage lasts forever is a myth. From hidden penalties and policy cutoffs to tax surprises and expired discounts, time limits are everywhere.

The earlier you recognize these expiration dates, the more control you’ll have. Strategic planning in your 60s and early 70s can make a dramatic difference in how long your money lasts and how many of those “perks” you actually get to enjoy.

Have you discovered a benefit that didn’t last as long as you expected? Or experienced a frustrating cutoff you weren’t warned about?

Read More:

10 Signs Your Retirement Fund Is Being Quietly Eaten Away

5 Emotional Purchases That Are Wrecking Retirement Budgets

Riley Jones is an Arizona native with over nine years of writing experience. From personal finance to travel to digital marketing to pop culture, she’s written about everything under the sun. When she’s not writing, she’s spending her time outside, reading, or cuddling with her two corgis.