Most people know they should save, but willpower alone often fails. That’s because saving isn’t just a numbers game—it’s a psychology game. Our brains are wired to prefer instant gratification over long-term rewards. This makes saving feel like deprivation instead of progress. Fortunately, there are psychological tricks that rewire habits and make saving nearly automatic.

1. Labeling Money with a Purpose

Studies show people save more when money is mentally earmarked. Instead of one big pile of cash, create sub-accounts labeled “vacation,” “emergency,” or “future home.” This creates emotional buy-in, because each dollar feels tied to a goal. Spending from those accounts suddenly feels like breaking a promise to yourself. The label itself acts as a silent savings coach.

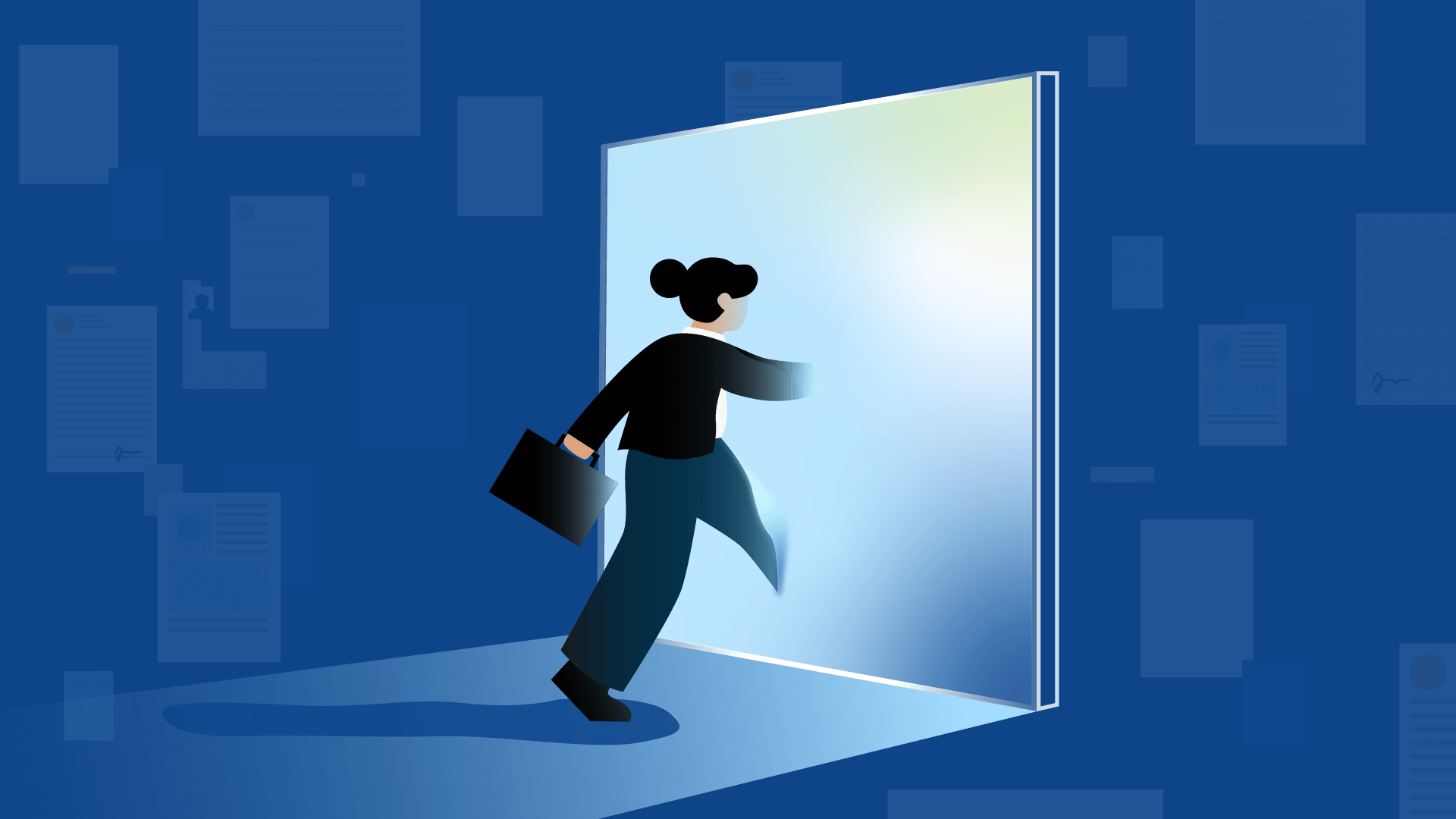

2. Automating Savings Before You See It

The most powerful trick is never letting your brain negotiate with money. Direct deposit or automatic transfers remove the temptation to spend first. When savings happen before you touch the cash, it feels invisible. Over time, you simply adjust to living on what remains. Automation turns saving from effort into a routine.

3. Using Commitment Devices

People often stick to goals when there’s a penalty for failure. Commitment apps, savings challenges, or even public promises leverage this psychology. By putting your reputation or money on the line, you’re more likely to follow through. These devices turn saving into a non-negotiable behavior. The brain resists loss more than it seeks gain, making this highly effective.

4. Playing the Rounding-Up Game

Many banks now offer “round-up” features that stash spare change. Every time you spend $9.25, an extra $0.75 is saved. It feels painless because the amounts are small and nearly invisible. But over time, these little transfers compound into meaningful balances. This trick works because it exploits the brain’s tendency to ignore small losses.

5. Framing Savings as a Reward

Instead of viewing saving as a sacrifice, flip the script. Treat each contribution as an investment in freedom or future enjoyment. For example, saving for retirement becomes “buying future weekends off.” This positive framing reduces resistance. It connects saving with pleasure rather than pain, reshaping the mental narrative.

6. Making Savings Visible

Abstract numbers in an account don’t motivate like visuals do. Charts, progress trackers, or apps that show goals growing provide dopamine hits. Watching a vacation fund climb feels like leveling up in a game. The visual feedback loop reinforces the behavior. Making progress visible keeps saving fun and engaging.

7. Linking Savings to Identity

People tend to be more consistent when their behaviors align with their self-perception. Calling yourself a “saver” or “investor” creates identity reinforcement. Each deposit then confirms that identity. Over time, saving isn’t something you do—it’s part of who you are. This trick shifts money habits from temporary to permanent.

Turning Habits Into Second Nature

Saving doesn’t have to feel like a chore or a battle of willpower. By using psychology, you bypass the brain’s resistance and make the process automatic. From automation to identity, these tricks reshape how you view money. The result is steady progress with less stress and fewer setbacks. The smartest savers aren’t more disciplined—they just use their brains differently.

Which of these psychology tricks would help you save more without even noticing? Share your thoughts in the comments.

You May Also Like…

9 High-Yield Savings Traps That Shrink Your APY Without Warning

5 Common Mistakes You Could Be Making When Saving Money

Boost Your Savings with Better Payment Choices

How to Balance Saving and Investing for a Stronger Financial Future

9 Money-Saving Habits That Are Now Considered Financially Risky