You’d think that after decades of paying into the system, Baby Boomers would get every break possible during retirement. But when it comes to taxes, that’s rarely the case. Each year, millions of Boomers leave money on the table simply because they don’t know which tax credits they’re eligible for or how to claim them correctly.

Whether you’re fully retired or still working part-time, the tax code has several built-in advantages for older Americans. Yet many of them go underutilized, either because the rules are buried in IRS jargon or because older taxpayers rely on outdated advice. And with the tax landscape changing frequently, credits that were once unavailable might now apply, if you know where to look.

If you’re over 60 and want to stop overpaying Uncle Sam, here are six often-missed tax credits that could put money right back in your pocket.

1. The Credit for the Elderly or the Disabled

Let’s start with one of the most frequently overlooked: the Credit for the Elderly or the Disabled. This tax break is specifically designed for individuals who are either 65 and older or permanently disabled, and whose income falls below certain thresholds.

Here’s the catch: the credit isn’t automatically applied. You have to actively file Schedule R with your tax return, and the income limits are strict. For many Boomers living on modest pensions or Social Security, it’s an ideal fit—but because it doesn’t show up automatically in most tax software, it’s often skipped entirely.

If your adjusted gross income is relatively low and you meet the age or disability criteria, this credit could be worth anywhere from $375 to $1,125. It may not sound like a fortune, but for someone on a fixed income, it can make a real difference, especially if you’ve been missing it for years.

2. The Saver’s Credit (Yes, Even in Retirement)

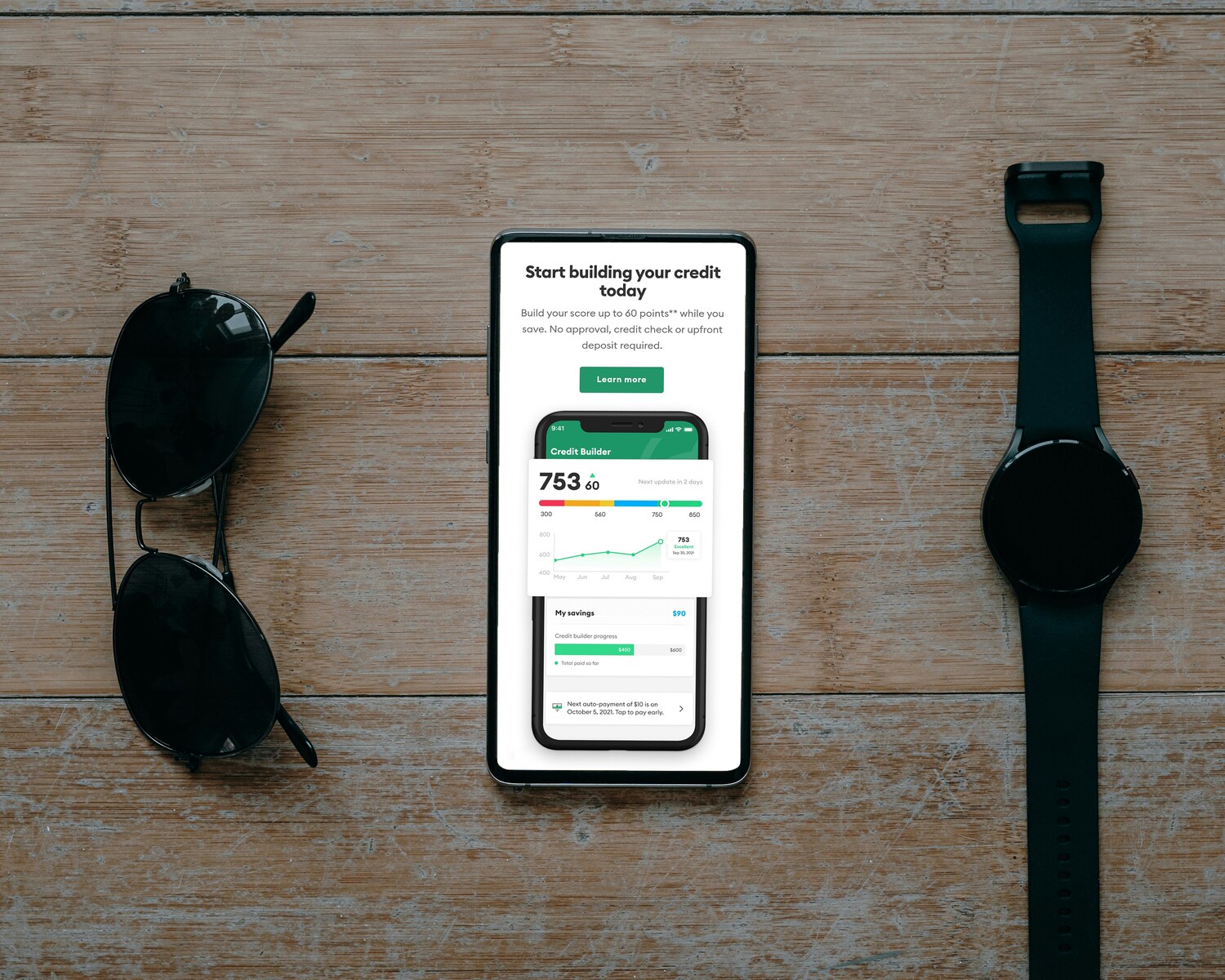

You might assume that tax breaks for saving money only apply to younger workers, but that’s not entirely true. The Saver’s Credit, officially called the Retirement Savings Contributions Credit, is available to anyone contributing to a qualified retirement account, including traditional or Roth IRAs, even after age 60.

If you’re still contributing to an IRA or 401(k), and your income is under certain limits (for 2025, it’s $36,500 for single filers and $73,000 for joint filers), you may be able to claim a credit worth up to $1,000 ($2,000 for married couples). That’s a direct reduction in your tax bill, not just a deduction.

This credit is especially valuable for part-time working retirees or late savers trying to catch up. Unfortunately, many Boomers stop contributing to retirement accounts after they retire, missing out on both the long-term compounding and the immediate tax savings.

3. The Energy Efficient Home Improvement Credit

Boomers make up a large share of homeowners, and many are investing in energy-efficient upgrades like new windows, HVAC systems, solar panels, or insulation. But far too many don’t realize these upgrades come with generous tax incentives.

The Energy Efficient Home Improvement Credit and the Residential Clean Energy Credit (which covers solar) offer substantial savings—sometimes up to 30% of the project cost—yet are frequently missed because the rules have changed over the years.

If you’ve made any upgrades since 2023, you could qualify for credits worth hundreds or even thousands of dollars. The key is keeping your receipts and ensuring the improvements meet the IRS’s standards. Even small upgrades, like installing a certified heat pump or energy-efficient doors, can trigger eligibility.

4. The Dependent Care Credit (For Grandkids or Adult Children)

Many Boomers are playing an active role in caregiving, whether it’s helping raise grandkids or supporting an adult child with special needs. In these cases, some are eligible for the Dependent Care Credit, which offsets expenses related to caregiving.

The IRS doesn’t limit this credit to parents of young children. Suppose you’re providing significant support to someone in your household (and they qualify as a dependent), and you’re paying for things like daycare, after-school programs, or adult care services. In that case, you may be eligible to claim a portion of those expenses back at tax time.

This is especially relevant for “grandfamilies”—Boomers raising grandchildren due to family circumstances. Many don’t realize they can claim both the child as a dependent and claim credits related to their care. Failing to do so could mean losing out on thousands.

5. The American Opportunity and Lifetime Learning Credits

Yes, you read that right: education credits. More Boomers than ever are returning to school, taking classes, or enrolling in continuing education for personal development or career transitions. And some are helping fund college for their children or grandchildren.

The American Opportunity Credit is geared toward undergraduate expenses, while the Lifetime Learning Credit applies more broadly, including non-degree programs and part-time studies. If you or a dependent is enrolled in an eligible institution, and you’re footing the bill, these credits could save you up to $2,500.

Even retirees taking courses to stay active or re-enter the workforce may qualify, especially through accredited community colleges or online programs. Yet few think to claim them, assuming education credits are only for 20-somethings. Not so.

6. The Property Tax Credit (State-Specific)

While not a federal credit, many states offer senior-specific property tax relief programs, and Boomers are missing out in droves. Whether it’s a direct credit, an exemption, or a “circuit breaker” refund tied to income, these programs can lower your state tax burden or refund hundreds of dollars each year.

The problem? They vary widely by state, and few are advertised clearly. In some cases, you have to apply directly with your local tax assessor’s office. Others require proof of income, age, or disability. And almost none of them are automatically applied when you file your taxes.

If you own your home and are over 65, it’s absolutely worth checking your state’s Department of Revenue or contacting a local tax assistance program. You may be entitled to help that no one has told you about, and that your accountant may not even mention unless asked.

Why Are So Many Boomers Missing These Credits?

The reasons vary, but they mostly boil down to:

Outdated assumptions. Many Boomers believe certain credits “don’t apply” to retirees, when they absolutely do.

Overreliance on software. Tax software doesn’t always prompt users about special credits unless you know to search for them.

Lack of professional guidance. Not all tax preparers are proactive about seeking credits unless they specialize in senior finances.

Complicated rules. Some credits, like the Credit for the Elderly, have multiple income tests and require additional forms, creating a barrier to entry.

How to Make Sure You’re Not Leaving Money on the Table

If you’re a Boomer or helping one with taxes, here are a few proactive steps you can take:

Review past returns. Many tax credits can be claimed retroactively if you file an amended return within three years.

Ask your tax preparer directly. Don’t assume they’re checking every credit. Ask specifically about the six mentioned here.

Use IRS Form 1040 instructions. It may be dense, but it contains lists of credits and deductions based on age and income.

Seek out AARP Tax-Aide or local senior services. Many offer free tax prep for older adults and are trained to catch these often-missed credits.

Document everything. Keep receipts, contribution records, and dependent care forms—even if you’re not sure you’ll need them.

A Few Extra Steps Could Save You Thousands

Tax season doesn’t have to be a financial loss, especially for older Americans who qualify for credits that go well beyond basic deductions. Boomers are often cautious, responsible, and conservative with money, but those same habits can lead to missing out on tax breaks designed just for them.

If you’re over 60, it’s time to start thinking not just about what you owe, but what you’re owed. The IRS might not go out of its way to tell you, but these six credits could be the difference between a stressful spring and a surprisingly profitable one.

Which of these tax credits surprised you the most? Have you ever realized you missed one in a previous year?

Read More:

8 Ways Boomers Can Continuously Save Money On Their Taxes

9 Reasons Why Baby Boomers Aren’t Leaving Much Wealth for the Next Generation