You’ve probably heard them a hundred times—those so-called “golden rules” of investing handed down like sacred financial scripture. Hold long term. Diversify everything. Never time the market. On the surface, these tips sound smart. They offer structure and reassurance. But what if many of these investing traditions are less about helping you build wealth and more about preserving Wall Street’s influence and profits?

Behind the curtain, the financial industry thrives when individual investors stay predictable, passive, and dependent. The more you follow the rules without questioning them, the more money flows into the same old structures that pad Wall Street’s bottom line. In truth, not all traditions are timeless. The market has changed, and so should your strategies.

Let’s break down 12 investing traditions that Wall Street hopes you’ll never challenge, along with what you should do instead.

1. “Buy and Hold Forever”

The idea here is to invest in solid stocks or funds and then let them ride for decades. While long-term investing often outperforms short-term trading, “buy and hold forever” doesn’t mean “buy and ignore.” Markets evolve. Companies rise and fall. You know how that story ends if you bought Blockbuster stock in the 90s and held it forever. Periodic reevaluation of your portfolio is essential. Holding blindly in the name of tradition can be a slow bleed on your long-term gains.

2. “Diversify Across All Asset Classes”

Diversification reduces risk…until it becomes dilution. Wall Street loves to sell you on excessive diversification because it justifies more products, more accounts, and more fees. If you’re invested in everything, you’re also exposed to underperformers that drag your returns. True diversification isn’t about volume. It’s about thoughtful exposure to uncorrelated assets that serve a clear purpose in your portfolio. Quality over quantity, always.

3. “Trust the Experts”

Financial advisors often provide helpful guidance, but they’re not always unbiased. Many are incentivized by commissions or asset-based fees, meaning their advice may subtly favor products that benefit them more than you. Wall Street thrives when you defer all decisions to someone else. But informed investors don’t blindly hand over control. They ask questions, understand strategies, and stay involved. Trust is good. Transparency is better.

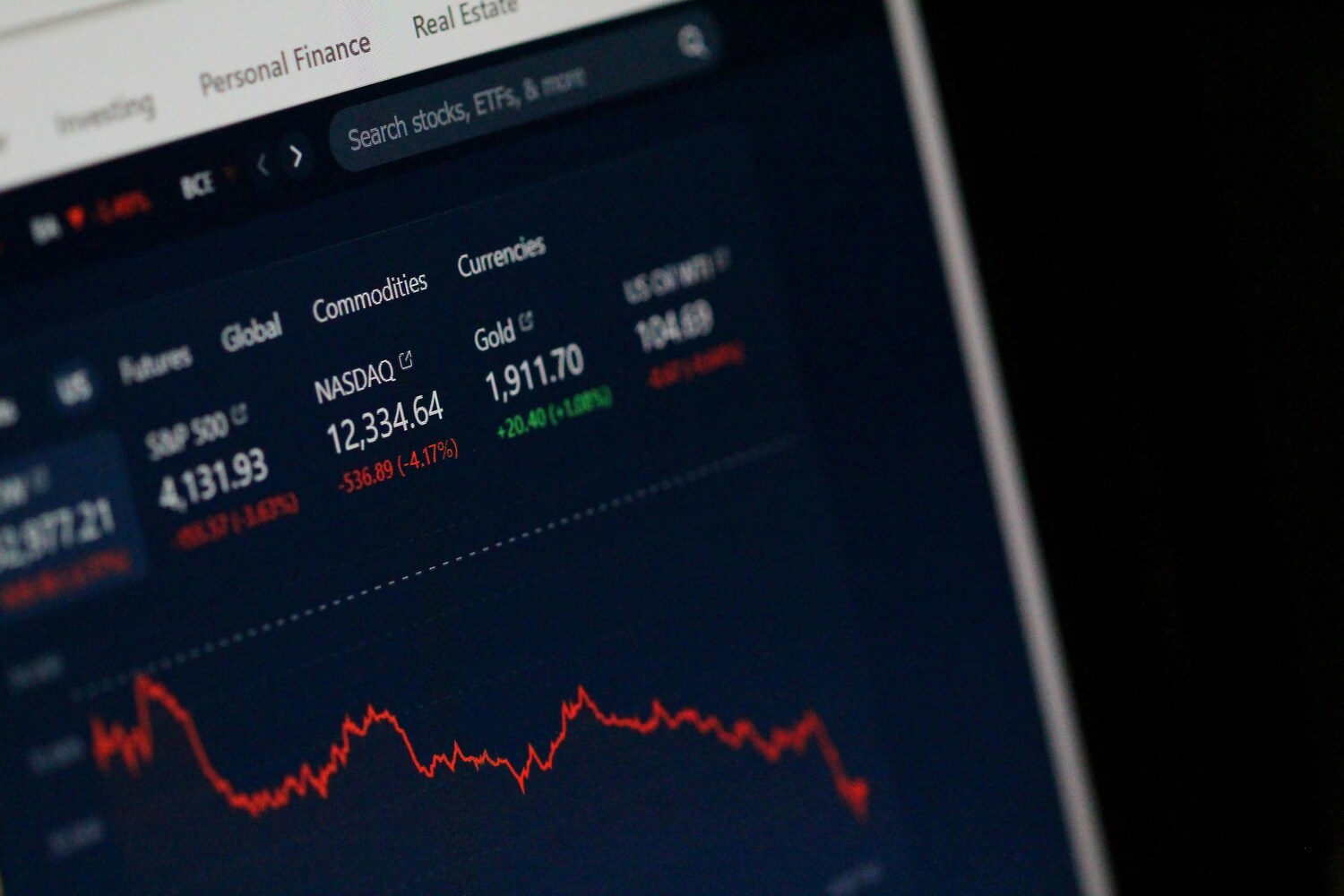

4. “The Market Always Goes Up”

This one comforts people through recessions, but it’s not entirely accurate. Markets generally trend upward over long periods, but in between, they crash, correct, and stagnate. Relying solely on historical averages can blind you to real risks. A healthy strategy anticipates volatility, uses stop-losses or rebalancing tactics, and builds in cash reserves or defensive positions. Upward momentum is great, but don’t bet your financial future on autopilot optimism.

5. “Active Trading Beats Passive Investing”

Wall Street has long promoted the illusion that you can beat the market with the right moves or, more importantly, the right broker, product, or hedge fund. Active management can work in niche situations, but most traders underperform index funds over time. Why? Trading costs, management fees, and poor timing. Passive strategies like index investing usually yield better net returns with far less stress. You don’t need to outsmart the market. You need to outlast it.

6. “High Fees Equal Better Returns”

It’s one of Wall Street’s biggest cons: convincing you that the more you pay, the more you get. In reality, many low-fee ETFs and index funds outperform high-fee mutual funds. What high fees guarantee is that someone else is making money off you. Always read the fine print. Every percentage point lost to fees is a percent taken from your future compounding. Smart investors chase efficiency, not flash.

7. “Market Timing Is a Fool’s Game”

You can’t perfectly time the market, but that doesn’t mean you should never try to be strategic. Wall Street prefers you stay fully invested through crashes because they still make money on your assets. Tactical adjustments, like moving to defensive sectors in downturns or taking profits in overheated markets, can significantly improve your outcome. You don’t have to predict every top and bottom, but ignoring macroeconomic signals altogether is just as risky.

8. “Stay Domestic. U.S. Stocks Are King”

For American investors, this idea feels comfortable. But it ignores massive global opportunities. Emerging markets and international stocks can outperform during periods of U.S. stagnation. Wall Street firms often push domestic products they control, but savvy investors look beyond borders. A well-balanced global portfolio can reduce risk and open up new returns in sectors and regions the U.S. isn’t leading.

9. “Bigger Companies Are Always Safer”

Blue-chip stocks feel secure, but large doesn’t mean immune. Companies like Enron, Lehman Brothers, and GE once seemed untouchable. Small and mid-cap stocks may carry more volatility but often outperform over long timeframes due to higher growth potential. Wall Street likes promoting big-name stocks (it’s easier to sell), but diversification across company sizes helps you capture more upside.

10. “Follow the Crowd. If Everyone’s Doing It, It Must Be Safe”

The herd is often wrong. Investment manias like the dot-com bubble or crypto surges show how quickly groupthink can lead to massive losses. When everyone rushes into a trade, ask why. What do they know or think they know that you don’t? Independent thinking, not conformity, separates successful investors from short-term speculators. If it feels too easy, it probably is.

11. “Chase Short-Term Gains for Quick Wealth”

Wall Street adores your impatience. It drives more trades, more fees, and more churn. But chasing gains often leads to gambling behavior. Long-term investors who stick to a disciplined plan almost always end up ahead. Instead of trying to triple your money overnight, focus on slow, consistent growth. That’s how wealth is built and how Wall Street really gets rich.

12. “Let Financial News Dictate Your Strategy”

Turn on CNBC, and you’ll get a firehose of headlines, market swings, and breathless analysis. But most of it is noise. Financial media thrives on urgency. It wants clicks, not your best interest. Savvy investors don’t chase stories. They build strategies based on data, not drama. Use news as context, not a compass.

Break Free From The Old Playbook

Wall Street’s traditions aren’t all bad, but many of them are outdated, overhyped, or tilted in favor of those running the show. Investing has evolved. Technology, transparency, and access to information have empowered individual investors like never before. The more you question old rules and understand why they exist, the better decisions you’ll make. It’s your money. Your future. Don’t let someone else write the rulebook for it.

What’s one old-school investing rule you’ve been told that never quite sat right with you?

Read More:

Simple Steps to Financial Independence: How Smart Investing Can Build Your Wealth

Investments You Should Be Making in 2025

Riley is an Arizona native with over nine years of writing experience. From personal finance to travel to digital marketing to pop culture, she’s written about everything under the sun. When she’s not writing, she’s spending her time outside, reading, or cuddling with her two corgis.