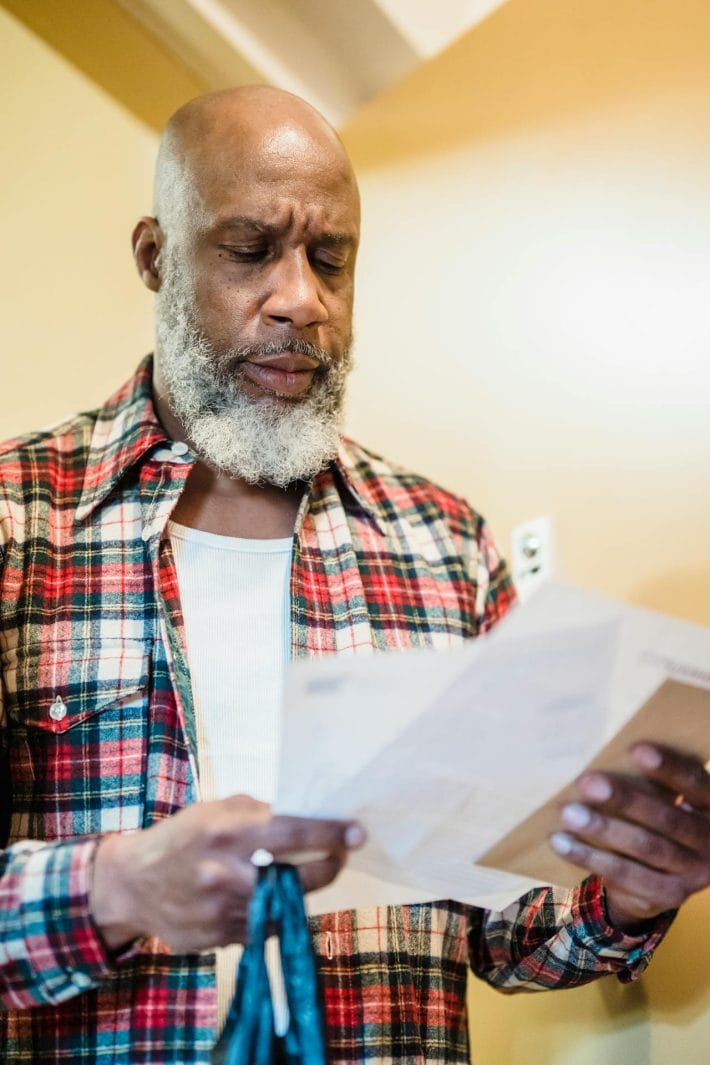

For decades, senior discounts have been a perk many older adults rely on to stretch their budgets. From retail stores to restaurants, flashing an ID often meant saving a few extra dollars. But in recent years, these discounts have started to quietly disappear, leaving retirees frustrated and surprised. Rising costs, corporate cutbacks, and changing marketing strategies have all played a role. Here are 10 elder discounts that quietly vanished this year and what it means for those living on fixed incomes.

1. Airline Ticket Discounts

Airlines once offered seniors reduced fares as a loyalty gesture, but those programs are increasingly rare. Many carriers now emphasize dynamic pricing instead, meaning ticket costs fluctuate based on demand. For retirees who love to travel, this change has made it harder to find affordable flights. Loyalty points or credit card perks have replaced traditional senior discounts. Unfortunately, that requires more spending up front rather than guaranteed savings.

2. Hotel Senior Rates

Hotels used to advertise senior rates as a standard option, especially at major chains. This year, several properties quietly phased them out, replacing them with seasonal promotions open to all guests. While discounts still exist in some locations, they are harder to find and less generous. Retirees may notice their travel budgets stretched thinner than before. The once-reliable hotel senior discount is no longer guaranteed.

3. Grocery Store Perks

Some grocery chains offered dedicated senior discount days, but many have ended those programs. Rising food costs and thin profit margins have forced stores to cut back. Instead, loyalty apps and digital coupons have taken their place—tools that can be challenging for less tech-savvy shoppers. Retirees now pay the same as everyone else, even when shopping on tight budgets. This change is especially noticeable in local and regional grocery stores.

4. Retail Clothing Discounts

Department stores and specialty retailers once proudly advertised senior shopping days. This year, many quietly dropped them in favor of general promotions tied to credit cards or memberships. For seniors on fixed incomes, losing these savings means paying more for essentials like clothing and shoes. Some retirees may not even realize the discounts disappeared until they check their receipts. What used to feel like a courtesy now feels like a cutback.

5. Prescription Savings Programs

Certain pharmacy chains offered additional senior-specific discounts beyond Medicare coverage. Many of those programs have been folded into broader customer reward systems. While the change is subtle, seniors no longer get unique perks just for their age. Instead, savings now require digital enrollment or loyalty app tracking. The shift has made medication costs less predictable for older adults.

6. Movie Theater Discounts

Matinee pricing is still around, but specific senior tickets are vanishing in some chains. Rising operating costs and a focus on subscription services have replaced traditional age-based discounts. Seniors who enjoyed affordable outings to the theater are finding tickets pricier than expected. While membership programs exist, they often come with monthly fees. The simple senior ticket deal is becoming a thing of the past.

7. Public Transportation Discounts

In some cities, public transit agencies have scaled back or eliminated discounted fares for seniors. Budget shortfalls and rising operational costs are the primary reasons cited. Seniors who rely on buses or trains for daily errands now face higher transportation expenses. These changes disproportionately impact those living on fixed incomes. Affordable transit access is no longer guaranteed in every community.

8. Utility Bill Breaks

A number of local utility companies once offered senior discounts on electricity or water bills. This year, many have phased them out, citing the need for uniform pricing across all households. Instead, assistance programs are often income-based rather than age-based. While this helps some low-income seniors, others just above the threshold lose out. What was once an automatic discount is now dependent on paperwork and eligibility checks.

9. Restaurant Senior Menus

Many diners and casual restaurants used to feature smaller-portion, lower-priced senior menus. These have quietly disappeared in favor of standard pricing for everyone. While restaurants argue that rising food costs make special pricing unsustainable, seniors notice the difference. For retirees who enjoyed affordable meals out, the cost of dining has crept upward. Loyalty apps have replaced what used to be simple in-person savings.

10. Cell Phone Carrier Deals

Major carriers once competed for senior business with special low-cost plans. This year, several discontinued them, folding seniors into broader “value” plans that aren’t always cheaper. The change requires retirees to carefully compare complex plan options. Seniors who aren’t tech-savvy may end up paying more than before. The loss of these discounts has quietly increased monthly expenses for many households.

The New Reality of Senior Discounts

Elder discounts were once a steady way for retirees to stretch their budgets, but this year proved how quickly they can disappear. From airlines to utilities, the benefits older adults relied on are being replaced by loyalty programs, apps, or income-based assistance. While some seniors can adapt, others find themselves paying more for everyday essentials. The hidden cost of these disappearing perks is a greater strain on fixed incomes. Staying aware of which programs remain can help retirees make the most of every dollar.

Have you noticed a favorite senior discount vanish this year? Share your experiences in the comments.

You May Also Like…

Are Religious Donations Now Taxed Differently in Retirement?

Why Are Some Pharmacies No Longer Honoring Medicare Discount Cards?

6 Senior Discounts That Disappear Without Warning

What Are the Downsides of Retiring With Too Much in Assets?

10 Things That Sound Smart in Retirement—But End in Regret