Editor’s Note: A once-in-a-generation event is taking place on October 21st that could unleash an unstoppable $20 trillion wave of wealth for everyday Americans.

The last time Ian King spotted a setup similar to this, one of his picks soared 18,325%. But he says what’s happening next week could be even bigger.

Ian is going LIVE tomorrow, Thursday, October 16th at 1pm ET, to help you prepare for next week’s pivotal, federally-mandated event…

And there’s still time for you to claim your seat. Click here now to auto-RSVP.

(Clicking any of the links above will instantly register you for urgent reminders and details leading up to the event on Thursday, October 16th at 1pm ET. You may unsubscribe anytime.)

Nearly a year ago, I wrote about the infinite money loop, a financial phenomenon that seems almost too good to be true.

It’s the idea of a self-feeding engine of capital that could, at least in theory, run forever.

The example I used was Michael Saylor’s MicroStrategy, which started as a software company but has since been rebranded to Strategy (Nasdaq: MSTR).

Strategy sells a special kind of stock called perpetual preferred shares. These shares never expire and are backed by well over 640,000 bitcoin (BTC), valued around $80 billion at today’s prices. The money it raises from selling these shares is then used to buy even more bitcoin.

In other words, Saylor has turned his company into a perpetual bitcoin machine, built to reward investors while growing its own pile of crypto.

This kind of financial engineering isn’t new.

In fact, it follows the same logic as stock buybacks and even parts of the Federal Reserve’s balance sheet.

When the Fed buys assets like Treasury bonds or mortgage-backed securities, it creates new money to pay for them. That money flows into the banking system. From there, it often circles back into Treasuries and other financial assets, which usually lifts their prices and makes borrowing cheaper.

In their own way, these systems were built to make money chase its own tail…

A feedback loop that keeps spinning as long as confidence in the system holds.

And now this infinite money loop has entered the world of NFTs.

Adopting the Strategy Strategy

A new project called PunkStrategy is attempting to build what it calls the Perpetual Punk Machine that runs on the same basic idea Michael Saylor used to turn Strategy into a bitcoin-backed money engine.

Except this time it’s an infinite loop built on digital art.

Here’s how it works.

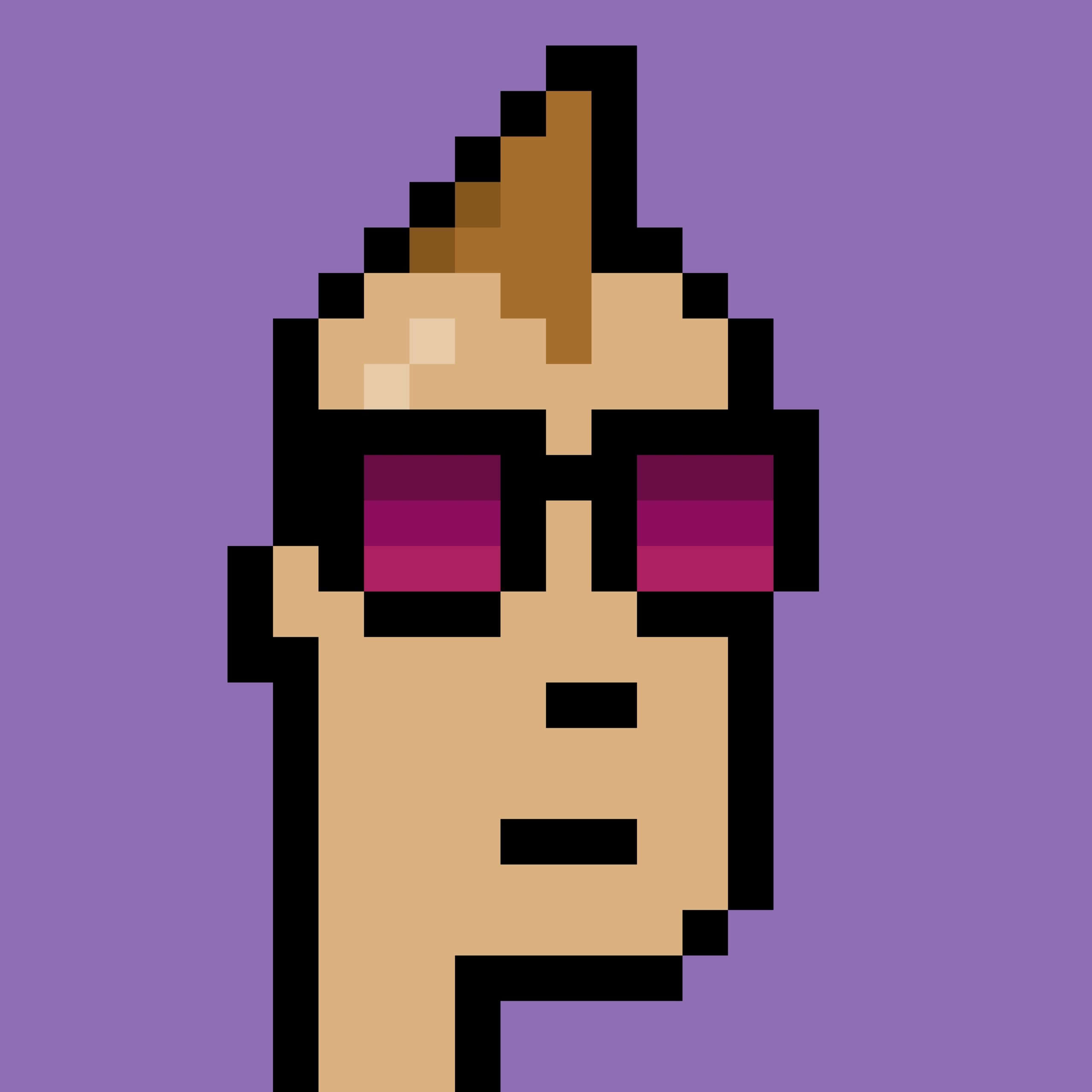

PunkStrategy uses a piece of code — known in crypto as a protocol — that automatically buys and sells CryptoPunks.

Image: Wikimedia Commons

These are some of the oldest and most valuable NFTs, each one a tiny pixelated portrait that trades for thousands, sometimes even millions, of dollars. There are only 10,000 CryptoPunks in existence, and their total market value sits near $1.5 billion.

The project also has its own cryptocurrency called $PNKSTR. Every time someone buys or sells this token, the system charges a 10% fee.

Most of that fee — about 80% — gets saved up in a pool until there’s enough money to buy the cheapest available CryptoPunk on the market.

In NFT slang, it’s called the “floor Punk.” But that doesn’t mean it’s a bargain.

The cheapest Punk still sells for more than 40 ETH, which is over $160,000 at today’s prices.

Once the system buys one of these floor Punks, it immediately puts it back up for sale at a 20% markup. And when that Punk sells, the system takes the profit and uses it to buy back and destroy some of its own $PNKSTR tokens.

By “burning” these tokens, the total supply of them shrinks, which in theory should make each remaining token a little more valuable.

That’s the cycle: Trades create fees. Fees buy Punks. Punk sales burn tokens.

According to the project’s dashboard, the protocol has already executed about a dozen of these buy-and-sell loops, generating roughly 700 ETH in volume and burning nearly 3% of the token supply.

The team calls this a “self-reinforcing system of digital scarcity.” And it’s quite similar to what Michael Saylor is doing with Strategy.

Over the past year, Strategy has issued more than $2.4 billion in perpetual preferred shares tied to its bitcoin reserves that the company is using to buy even more bitcoin.

The result is a crypto version of the Perpetual Punk Machine loop: bitcoin backs the shares, the shares fund more bitcoin, and the cycle reinforces itself.

It’s what Saylor calls a “bitcoin-backed fixed-income market.”

And so far, it’s working.

Strategy’s 640,000 BTC is more bitcoin than any other public company — even more than Tesla once held at its peak — and its preferred shares have become a benchmark for bitcoin-linked yield.

Its success proves that an infinite money loop can work when the conditions are right.

But there’s a big difference between Strategy and PunkStrategy.

You see, Saylor’s system operates in a regulated environment with audited books, deep liquidity and institutional access. But PunkStrategy is operating in a niche NFT market with maybe a few thousand active traders.

And while Strategy’s preferred shares are designed to weather market cycles, PunkStrategy’s loop depends on perfect timing and a steady stream of new buyers.

That makes it a fragile machine.

If buyers dry up or floor prices fall, the whole system could stall. We’ve seen this happen before when NFT trading volume plunged more than 80% in 2022, wiping out dozens of projects.

But that’s the risk of every infinite money loop. It works beautifully…

Until it doesn’t.

Here’s My Take

PunkStrategy is trying to do for NFTs what Saylor did for bitcoin: build a self-sustaining capital engine.

It’s a clever idea. And if the loop holds, it could point to a future where digital asset portfolios manage themselves…

Buying, selling and compounding with little human intervention.

But if it doesn’t, then it’ll be yet another reminder that money can’t run on faith alone.

Either way, it shows how far NFTs have come.

They’re not just collectibles anymore. They’re the latest proving ground for the infinite money loop.

Regards,

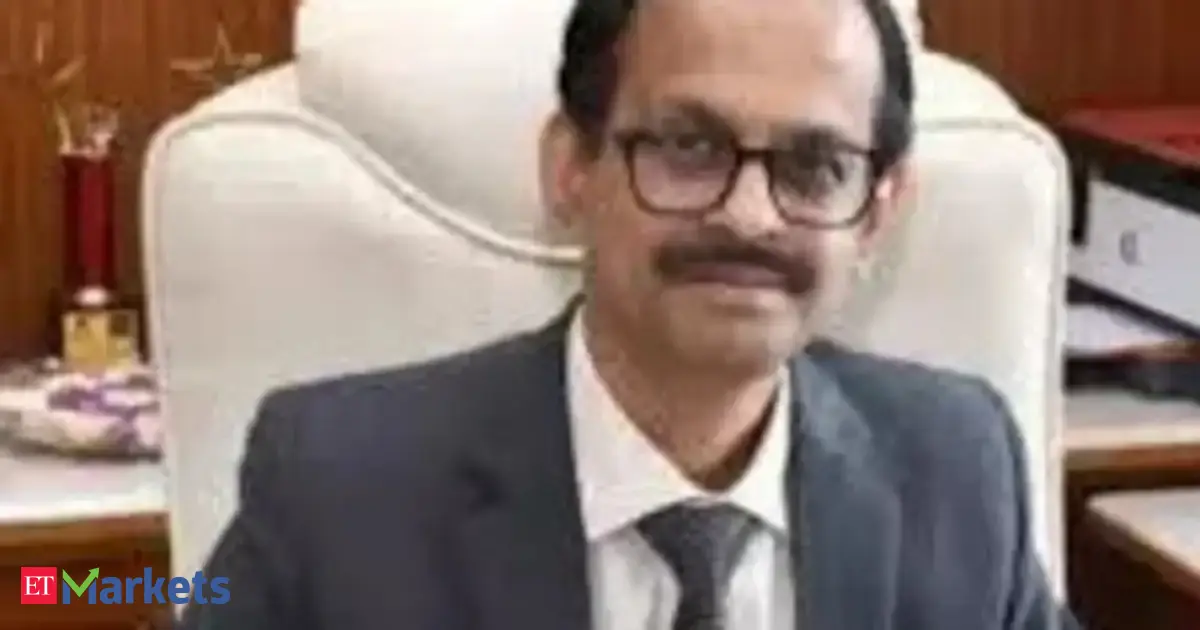

Ian KingChief Strategist, Banyan Hill Publishing

Ian KingChief Strategist, Banyan Hill Publishing

Editor’s Note: We’d love to hear from you!

If you want to share your thoughts or suggestions about the Daily Disruptor, or if there are any specific topics you’d like us to cover, just send an email to [email protected].

Don’t worry, we won’t reveal your full name in the event we publish a response. So feel free to comment away!