Shares of Snap Inc. (NYSE: SNAP) were down over 1% on Thursday. The stock has dropped 28% year-to-date. The company delivered second quarter 2025 earnings results that were a bit of a disappointment as losses widened versus the year-ago period. It has also been seeing slow engagement trends in its largest market, which is a cause for concern.

Q2 numbers

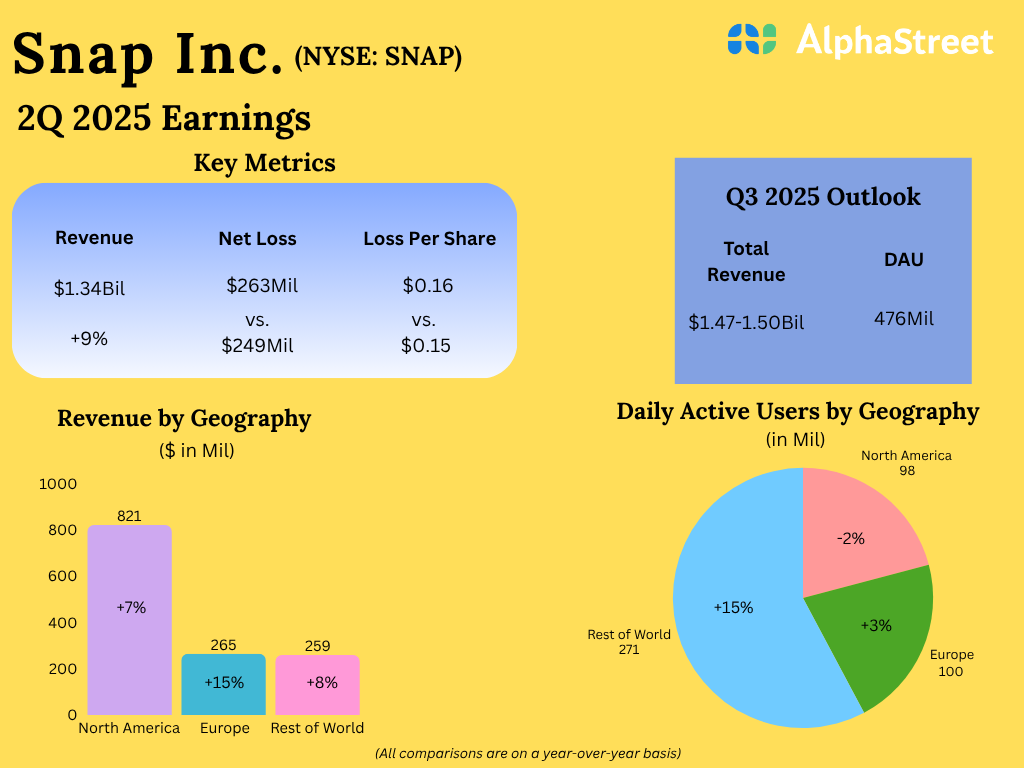

In the second quarter of 2025, Snap’s total revenue increased 9% year-over-year to $1.34 billion. Net loss widened to $263 million, or $0.16 per share, from $249 million, or $0.15 per share, in the year-ago period.

Revenue and engagement trends

Snap recorded revenue growth globally and across all its geographies on a year-over-year basis in Q2. North America saw revenues increase 7% YoY while Europe and Rest of World saw revenue growth of 15% and 8% respectively.

However, on a sequential basis, Snap’s revenue has decreased globally and in the North America region over the past two quarters. The Rest of World region saw revenue decrease in Q2 from Q1. Revenues from Europe have fluctuated sequentially.

Snap’s average monthly active users (MAU) and average daily active users (DAU) have grown consistently over the past five quarters. Global MAU grew 7% and DAU grew 9% YoY in Q2. However, the company has been seeing a decline in users in North America, its largest market.

In Q2, DAU in North America fell 2% YoY to 98 million. DAU in this region has also declined sequentially over the past two quarters. At the same time, DAUs in Europe and Rest of World have increased compared to the prior year and quarter.

In Q2, the company’s global average revenue per user (ARPU) remained relatively unchanged from the year-ago period at $2.87. The North America market, which generates the highest ARPU, saw a 9% growth in this metric YoY. On the other hand, ARPU in this region has declined sequentially over the past two quarters. Europe saw ARPU grow both sequentially and on a YoY basis in the quarter while Rest of World witnessed a decline in ARPU both from the prior-year period and the previous quarter.

Outlook

Snap expects total revenue to range between $1.47-1.50 billion in the third quarter of 2025. The company expects DAU to reach approx. 476 million in Q3.