On January 3, 2009, the global financial system was still reeling from the greatest collapse since the Great Depression.

The previous year, the S&P 500 had plunged 38%. It was its worst annual drop in 77 years.

Lehman Brothers, a 158-year-old Wall Street institution, had filed for bankruptcy with more than $600 billion in debts. It was the largest failure in U.S. history.

In Washington, the Treasury had already authorized $700 billion in emergency bailout funds through the Troubled Asset Relief Program (TARP). Meanwhile, the Federal Reserve had funneled more than $1.2 trillion in loans to rescue dozens of banks and financial firms.

Trust in our financial system had been shattered.

And in the middle of all this chaos, a pseudonymous programmer named Satoshi Nakamoto pressed “enter.”

It was the keystroke that launched bitcoin.

But what he created that day held more than a new kind of currency…

It held a secret hidden in its core.

The Secret of the Genesis Block

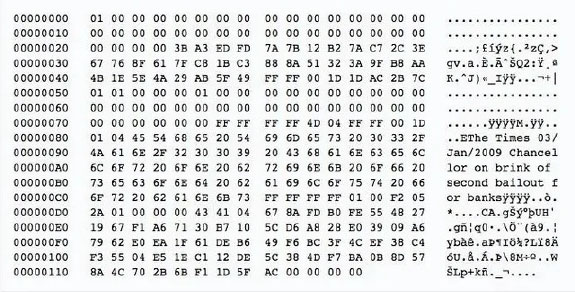

Buried in bitcoin’s very first block — known as the Genesis Block — is a line of text that has puzzled and fascinated people ever since.

It’s a newspaper headline from The Times of London that reads: “Chancellor on brink of second bailout for banks.”

This might seem like an odd choice. After all, Satoshi could have inserted anything else: a cryptic line of code, a mathematical proof or even his own name.

Instead, he chose to etch a bailout headline into the permanent foundation of bitcoin.

To me, it was a clear message that the old system had reached its breaking point and a new one had to be built.

And because bitcoin’s blocks are immutable, that headline is there forever as a permanent reminder of what happens when public trust in money is shattered.

Every transaction ever made in bitcoin — trillions of dollars’ worth today — ultimately points back to that very first message.

Yet, sixteen years later, Satoshi’s hidden clue feels less like a warning and more like a map…

A map pointing to a world where money itself is no longer bound by banks, governments or ideologies.

And it’s even more relevant today because we’re living through a period of technological convergence unlike anything in history.

Bitcoin was a spark. But what Satoshi could not have known is how quickly other technologies would rise to reinforce the system he started.

Take artificial intelligence.

AI systems today can already read legal contracts, generate code and make trading decisions in milliseconds.

But for AI to truly operate at scale, it needs financial rails that don’t close at 5 p.m. or wait two days for settlement.

Blockchain provides those rails.

Look at semiconductors. The same chips powering AI models are also accelerating blockchain validation, making decentralized systems faster and more secure.

Nvidia, AMD and Intel aren’t just helping to build data centers. They’re helping to build the backbone of a new, modern financial system.

Add in the rollout of 5G and low-orbit satellites, and billions of devices — from smartphones to industrial sensors — can now transact directly, machine to machine. That requires programmable money.

Again, blockchain is the only infrastructure that fits.

And then there’s tokenization.

We’ve talked about how assets from real estate to Treasury bills are already being moved onto the blockchain.

BlackRock CEO Larry Fink, head of the largest asset management firm in the world, has called tokenization “the next generation for markets.”

And the numbers involved are staggering.

Tether, the company behind the U.S.-dollar-backed stablecoin known as USDT, is now exploring a deal that would value it at nearly $500 billion.

If that happens, its co-founder and CFO, Giancarlo Devasini, would instantly become one of the wealthiest people on the planet, with a net worth of $224 billion.

That would put him ahead of Warren Buffett, and only a few steps behind Elon Musk, Jeff Bezos and Mark Zuckerberg.

In other words, a man who is virtually unknown outside of crypto circles could eclipse Buffett’s wealth by controlling the rails of digital money in the 21st century.

That’s why it’s so important to understand Satoshi’s secret map.

Because it points to incredible wealth building opportunities, especially during the convergence of so many incredible technologies.

Artificial intelligence, blockchain, advanced semiconductors and high-speed networks are all maturing at once.

Each is powerful on its own. But together, they’re rewriting the rules of the global economy.

And now, with this convergence accelerating, that next financial system is coming into focus.

In this new system, money moves at the speed of software. Settlement happens in mere seconds instead of days, while fees collapse as middlemen are cut out of the picture.

And entire markets are about to be open to anyone with an internet connection.

Which means there will be no need for bailouts.

Here’s My Take

Satoshi Nakamoto didn’t just create Bitcoin.

He left a map showing us where to invest in the future.

That map points to a world where money, AI, microchips and networks converge into a system that no government needs to bail out.

Follow it, and you won’t just survive the next financial crisis…

You can profit from the new order being built.

Regards,

Ian KingChief Strategist, Banyan Hill Publishing

Ian KingChief Strategist, Banyan Hill Publishing

Editor’s Note: We’d love to hear from you!

If you want to share your thoughts or suggestions about the Daily Disruptor, or if there are any specific topics you’d like us to cover, just send an email to [email protected].

Don’t worry, we won’t reveal your full name in the event we publish a response. So feel free to comment away!