In This Article

Property taxes have been rising in many cities, cutting off the oxygen supply for real estate investors, stymying cash flow, and putting landlords and homeowners in financial jeopardy. Now the states are fighting back.

Despite the importance of property taxes in generating funds for schools, roads, and essential services such as fire prevention for local governments, a tipping point of unaffordability for residents has tilted the scales, causing states to take action.

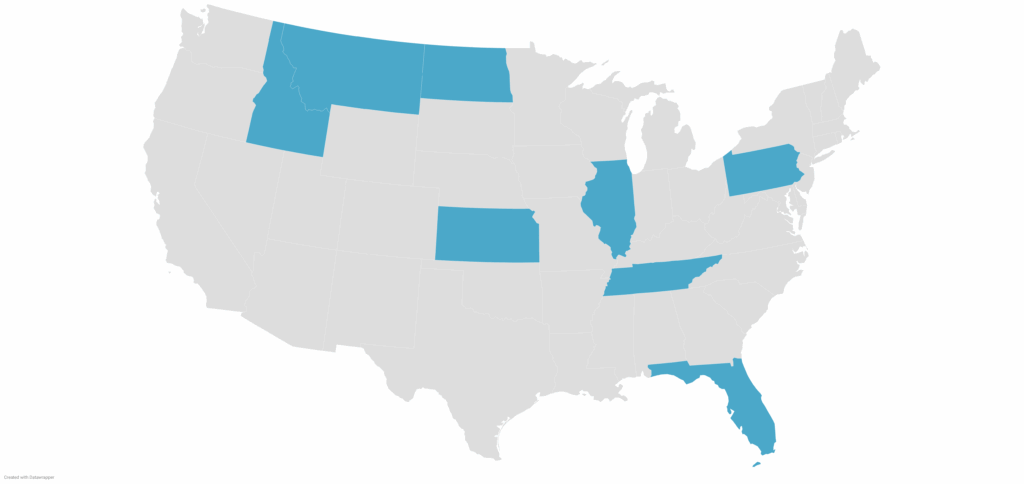

It follows five years of consistent real estate tax increases of almost 30% nationwide, according to brokerage Redfin, to a monthly median of $250. Now, Realtor.com reports that Florida, Illinois, Kansas, Montana, North Dakota, Pennsylvania, and Tennessee are some of the states considering repeals and reforms.

A Fine Line

Trimming taxes while ensuring local governments are adequately funded is a fine line.

“The affordability benefits to homeowners of reducing property tax rates as property tax values increase are great,” Susan Wachter, Albert Sussman Professor of Real Estate and Finance, and co-director of the Penn Institute for Urban Research, told Newsweek. “This can be done while keeping tax revenues needed for local expenses constant. Cutting more than this imposes real costs, either in lost community services or in the need to raise other taxes.”

A State-by-State Breakdown

Here’s a look at what’s going on in these places.

Florida

Florida, which recently approved a bill to help lower homeowners association (HOA) costs for condo owners, has made headlines for being the first state to propose eliminating property taxes altogether, replacing them with a sales tax, The Wall Street Journal reported. Governor DeSantis first brought up the topic in February, writing on his X account:

“Property taxes are local, not state. So we’d need to do a constitutional amendment (requires 60% of voters to approve) to eliminate them (which I would support) or even to reform/lower them… We should put the boldest amendment on the ballot that has a chance of getting that 60%… I agree that taxing land/property is the more oppressive and ineffective form of taxation.”

Idaho

Property tax relief is a reality in Idaho after a March vote from the Idaho Senate. Following the signing of a bill, which directs $100 million in relief to property taxpayers, Governor Brad Little said in a press release:

“America wants what Idaho has: safe communities, strong schools, and a bustling economy that offers tremendous opportunities for our people to prosper. I am proud to join the dedicated leaders of the Idaho House and Senate for the signing of this important bill today.”

Illinois

Bill 1862, currently being considered in the Illinois Senate, proposes a tax cut for homeowners who have lived in their property for 30 years or more.

Kansas

A proposed bill includes a citizens’ board to evaluate property tax exemptions. However, this bill is currently stalled after lawmakers were unable to reach an agreement in April.

Montana

House Bill 231 and Senate Bill 542 passed property tax relief for homeowners, shifting the burden to second homeowners with high-value vacation homes.

North Dakota

North Dakota’s primary residence tax credit has been tripled thanks to the reform and relief package passed in May. Governor Kelly Armstrong, who passed the bill, has grander ambitions: seeking to end property taxes entirely through funding from oil revenue.

Pennsylvania

Property taxes could also potentially be on the chopping block in Pennsylvania in 2030 after Republican Representative Russ Diamond proposed House Bill 900.

Tennessee

Voters will get to decide in the forthcoming November election whether Tennessee should ban property taxes after the House of Representatives passed a resolution proposing an amendment to the Constitution to prohibit the legislature from enacting taxes on property.

You might also like

Cities With Property Tax Issues

These states are not the only ones where property taxes could be in play. In Boston, the collapse in commercial real estate values is projected to push a $1 billion tax burden onto homeowners, according to The Wall Street Journal. To make up for the offset, homeowners have received larger tax bills, which have been incurred in conjunction with the rapid rise in home property values, further increasing taxes.

The Journal reports that Boston has been particularly impacted because more than a third of Boston’s tax revenue comes from commercial property taxes, which is the highest in the country. Attempts to reform property taxes last year failed.

In New York City, where taxes are assessed based on neighborhood appreciation, rather than the metrics of individual buildings, the NYC Advisory Commission has proposed a sweeping reform that reorganizes property classes, ends assessment caps, and introduces more equitable valuation methods. The proposals are specifically designed to alleviate the financial burden on individual homeowners.

Final Thoughts: How Reforms Could Affect Real Estate Investors

Lower property taxes translate into higher cash flow for real estate investors. However, investors should look at any potential tax savings, or not, holistically, in conjunction with potential savings, such as those included in the recent One Big Beautiful Bill.

Additionally, although many of the potential tax reforms are aimed at owner-occupants, not investors, landlords who partially rent out their residences through short-term rentals, or who live in one unit of a small multifamily building, may also be eligible for savings.

Landlords should also routinely challenge the tax assessments on their buildings, whether they live in them or not. According to the National Taxpayers Union Foundation, between 30% and 60% of taxable property in the United States is overassessed; however, fewer than 5% of taxpayers challenge their assessments. Taxpayers often win a partial victory.

A Real Estate Conference Built Differently

October 5-7, 2025 | Caesars Palace, Las Vegas For three powerful days, engage with elite real estate investors actively building wealth now. No theory. No outdated advice. No empty promises—just proven tactics from investors closing deals today. Every speaker delivers actionable strategies you can implement immediately.